Virginia Monthly Retirement Planning

Description

How to fill out Monthly Retirement Planning?

If you desire to be thorough, acquire, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms that can be accessed online.

Leverage the site's straightforward and user-friendly search to find the documents you require.

A wide range of templates for business and personal purposes are organized by categories and states, or keywords.

Each legal document template you obtain is yours permanently. You have access to every form you acquired in your account. Click on the My documents section to select a form to print or download again.

Be proactive and download, then print the Virginia Monthly Retirement Planning with US Legal Forms. There are countless professional and state-specific forms available for your business or personal requirements.

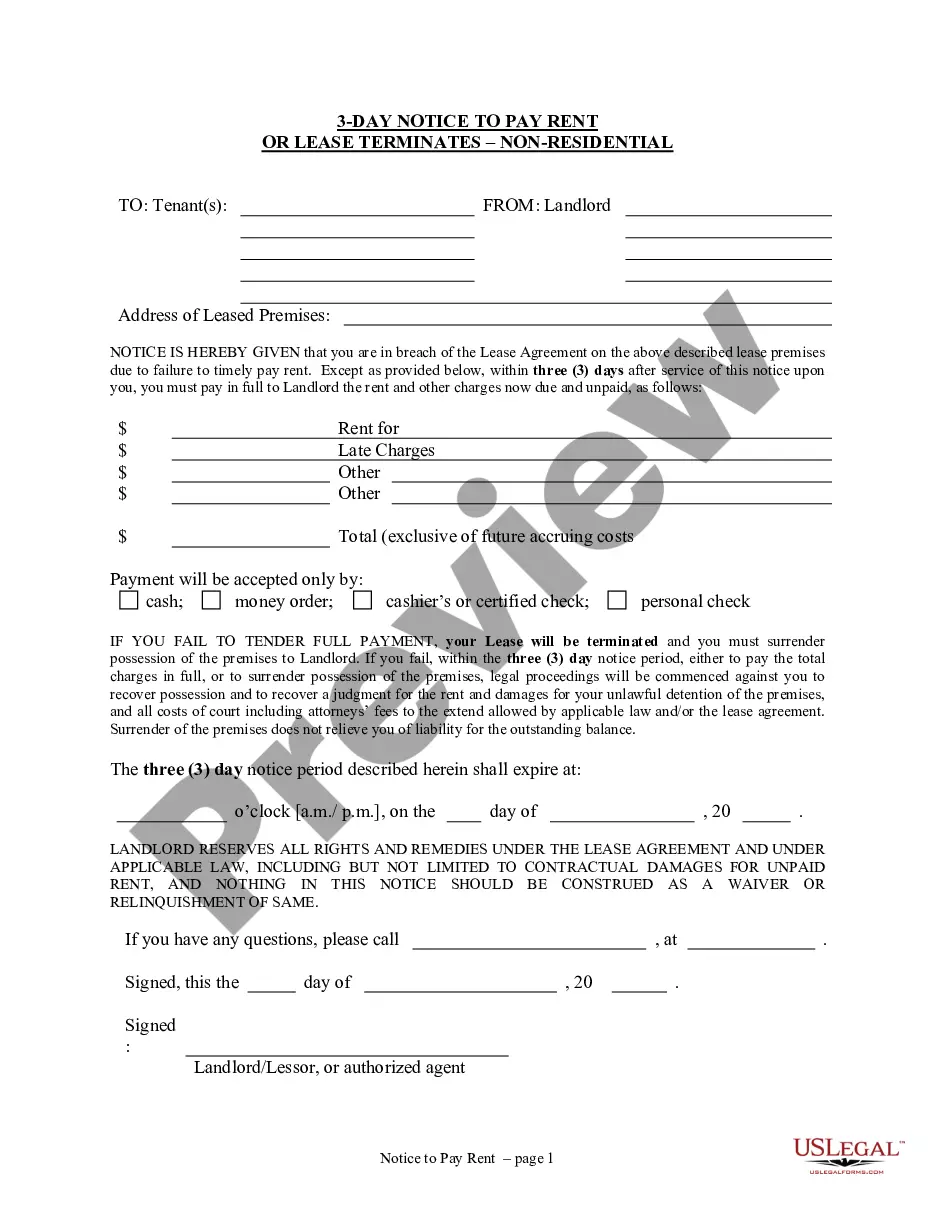

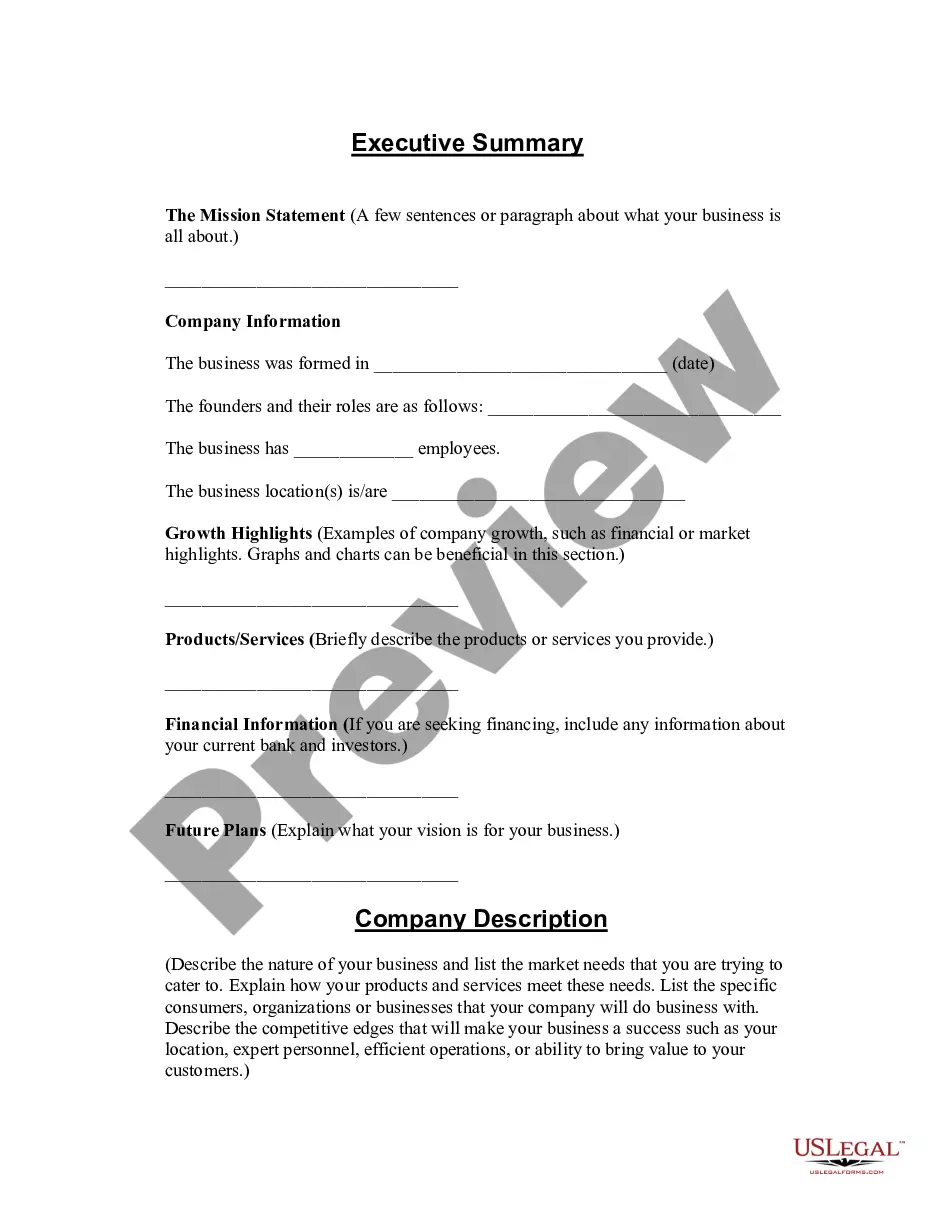

- Step 1: Confirm you have selected the form for the appropriate city/state.

- Step 2: Use the Review option to examine the contents of the form. Don't forget to check the details.

- Step 3: If you are not pleased with the form, utilize the Lookup field at the top of the screen to discover alternative versions in the legal document format.

- Step 4: Once you have located the form you want, click the Buy now option. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5: Complete the transaction. You can use your Visa, MasterCard, or PayPal account to finalize the purchase.

- Step 6: Select the format of the legal document and download it to your device.

- Step 7: Complete, modify, and print or sign the Virginia Monthly Retirement Planning.

Form popularity

FAQ

In most Southern states, a comfortable retirement costs less than $1 million. Virginia is one of the exceptions, however. With a slightly higher than average cost of living, a comfortable retirement costs $1,140,824 in Virginia, about $20,416 more than the national average.

In most Southern states, a comfortable retirement costs less than $1 million. Virginia is one of the exceptions, however. With a slightly higher than average cost of living, a comfortable retirement costs $1,140,824 in Virginia, about $20,416 more than the national average.

Most experts say your retirement income should be about 80% of your final pre-retirement annual income. 1 That means if you make $100,000 annually at retirement, you need at least $80,000 per year to have a comfortable lifestyle after leaving the workforce.

Virginia: #7 Best State for Retirement Overall living costs are above average, but high household incomes among seniors11.3% higher than the national average of $53,799, to be exactshould be able to cover the spread.

So what makes a 'comfortable' retirement income? Ultimately it depends on how you want to spend your retirement. Research suggests that a couple in the UK need an annual combined income of £47,500 to have a retirement with few or no money worries, while a single person would need A£33,000.

Virginia is tax-friendly toward retirees. Social Security income is not taxed. Withdrawals from retirement accounts are partially taxed. Wages are taxed at normal rates, and your marginal state tax rate is 5.90%.

Hey, who's complaining? Regardless of where it came from, that $10,000 a month gives you plenty of options for where you can retire, including states with higher income tax rates like New York and California. Here, we outline our top five picks.

Virginia does not tax Social Security benefits. If any portion of your Social Security benefits are taxed at the federal level, you can subtract that amount on your Virginia return.

Virginia's retirement system is among the top 50 largest public or private pension funds in the world. And because Virginia is a tax-friendly state for retirees, it would behoove you to invest in tax-advantaged savings vehicles like a 401(k) or individual retirement account (IRA).

If you work at least one year beyond the date you are eligible for an unreduced retirement benefit, you may elect to receive a one-time Partial Lump-Sum Option Payment (PLOP). This option reduces your monthly benefit. You can elect this option with the Basic Benefit or Survivor Option.