Virginia Agreement for Conditional Gifts

Description

How to fill out Agreement For Conditional Gifts?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers an extensive variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for commercial and personal needs, categorized by types, states, or keywords. You can find the most current forms like the Virginia Agreement for Conditional Gifts in just moments.

If you already possess a subscription, Log In and obtain the Virginia Agreement for Conditional Gifts from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the transaction. Use a credit card or PayPal account to complete the transaction.

Select the file format and download the form to your device. Make changes. Complete, edit, and print and sign the obtained Virginia Agreement for Conditional Gifts. Each document you added to your account has no expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Virginia Agreement for Conditional Gifts with US Legal Forms, the most comprehensive collection of legal document templates. Utilize a vast number of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some straightforward steps to get started.

- Ensure that you have selected the correct form for your area/state.

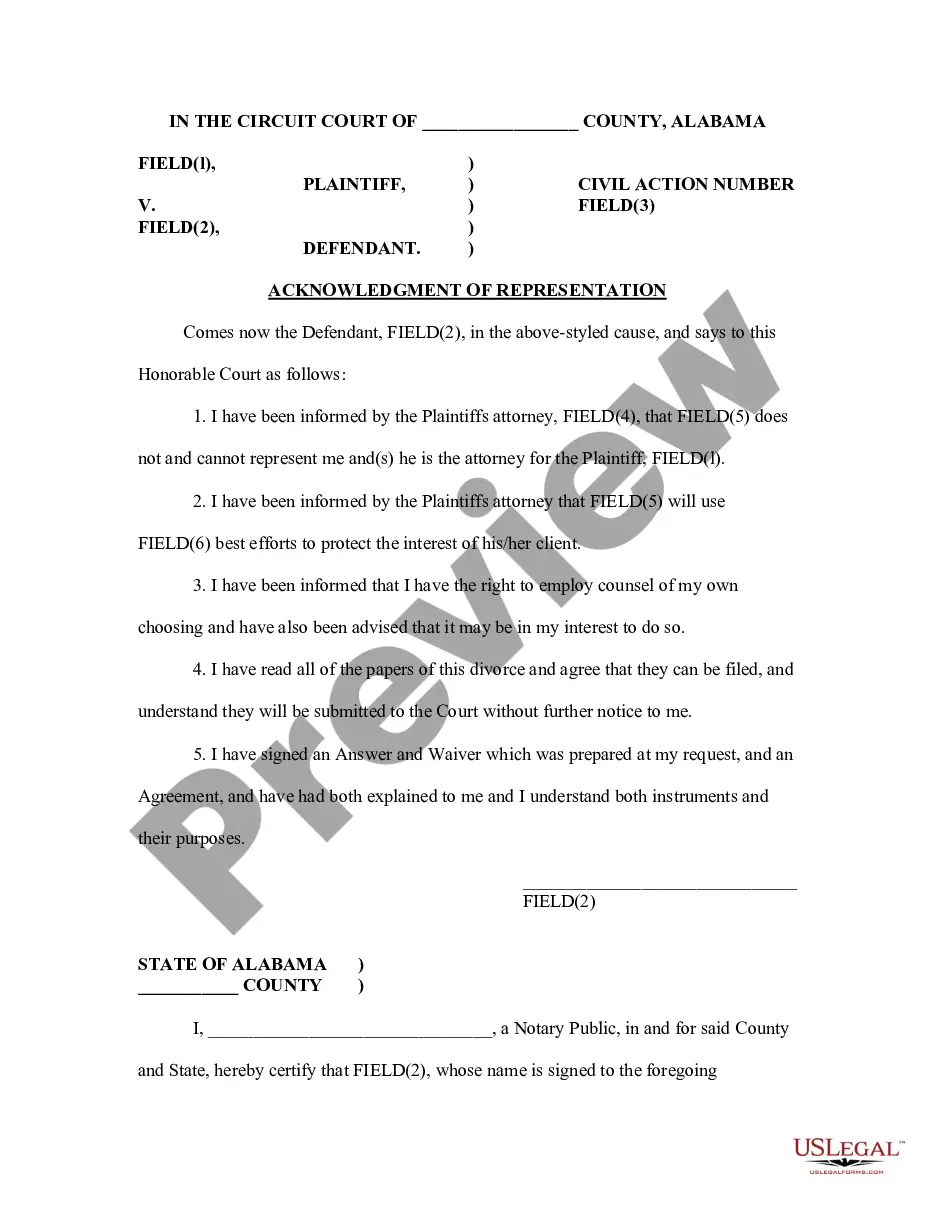

- Click the Preview button to review the content of the form.

- Examine the form description to confirm that you have selected the correct document.

- If the form does not meet your specifications, utilize the Search feature at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

The 3-month rule for rings suggests that an individual should spend around three months' salary on an engagement ring. This guideline helps set a baseline for the value of the ring, although it is not a legal requirement. Incorporating this understanding with a Virginia Agreement for Conditional Gifts ensures that both parties are aligned on the significance and expectations of the gift.

The issue of returning an engagement ring after divorce in Virginia often depends on the circumstances surrounding the marriage and the ring's classification as a gift. Generally, if the marriage does not take place, the ring should be returned. Consulting a Virginia Agreement for Conditional Gifts can provide guidance in resolving such matters.

A conditional gift refers to a gift that is granted only if certain conditions are fulfilled. On the other hand, a gift with condition may imply that the recipient must perform certain actions to validate the receipt of the gift. Understanding these terms is essential for anyone navigating a Virginia Agreement for Conditional Gifts.

A conditional gift requires specific conditions to be met for the gift to be completed, while a gratuitous promise does not involve any conditions and is given freely without expectations. In the context of a Virginia Agreement for Conditional Gifts, it is important to distinguish between these types to ensure that all parties are aware of their obligations.

In most states where engagement rings are considered conditional gifts, the recipient remains the owner of the ring only if the condition of marriage is met. In most cases, the ring goes back to the purchaser if the couple breaks up.

Engagement rings are conditional gifts. They are given with the condition or promise that the receiver will marry the giver. If they do not get married, then the engagement belongs to the giver. It does not matter if it was the giver who broke off the engagement or the receiver.

Is an Engagement Ring Considered Marital Property? Typically, an engagement ring is not considered marital property to be divisible. The Court will often look at the engagement ring as a gift that was given in anticipation of a wedding, which obviously took place or you wouldn't be going through a divorce.

In most states, including Maryland, an engagement ring is not considered just a gift from one to-be spouse to another, but a conditional gift. A conditional gift is given to the recipient with the expectation that some agreed-upon future event or action will occur.

Virginia, in general, does not require the return of an engagement ring. The Heart Balm Act, §8.01-220 of the Code of Virginia, provides that no civil action shall be maintained in Virginia for breach of promise to marry. The Act has been interpreted to not require the return of an engagement ring.

This is because one person gives the ring to the other person before you get married. Therefore it's considered a pre-marital asset. Additionally, engagement rings have been held by the courts to be conditional gifts. This means that they are gifted to the other person based upon a condition or conditions being met.