Virginia Complaint for Impropriety Involving Loan Application

Description

How to fill out Complaint For Impropriety Involving Loan Application?

Are you currently inside a placement the place you will need papers for sometimes organization or specific reasons just about every time? There are a variety of lawful document layouts available online, but locating kinds you can depend on isn`t simple. US Legal Forms gives a huge number of kind layouts, like the Virginia Complaint for Impropriety Involving Loan Application, that happen to be created to satisfy federal and state needs.

In case you are presently knowledgeable about US Legal Forms website and also have your account, simply log in. Following that, it is possible to obtain the Virginia Complaint for Impropriety Involving Loan Application design.

If you do not have an accounts and need to start using US Legal Forms, follow these steps:

- Find the kind you need and make sure it is for your right city/area.

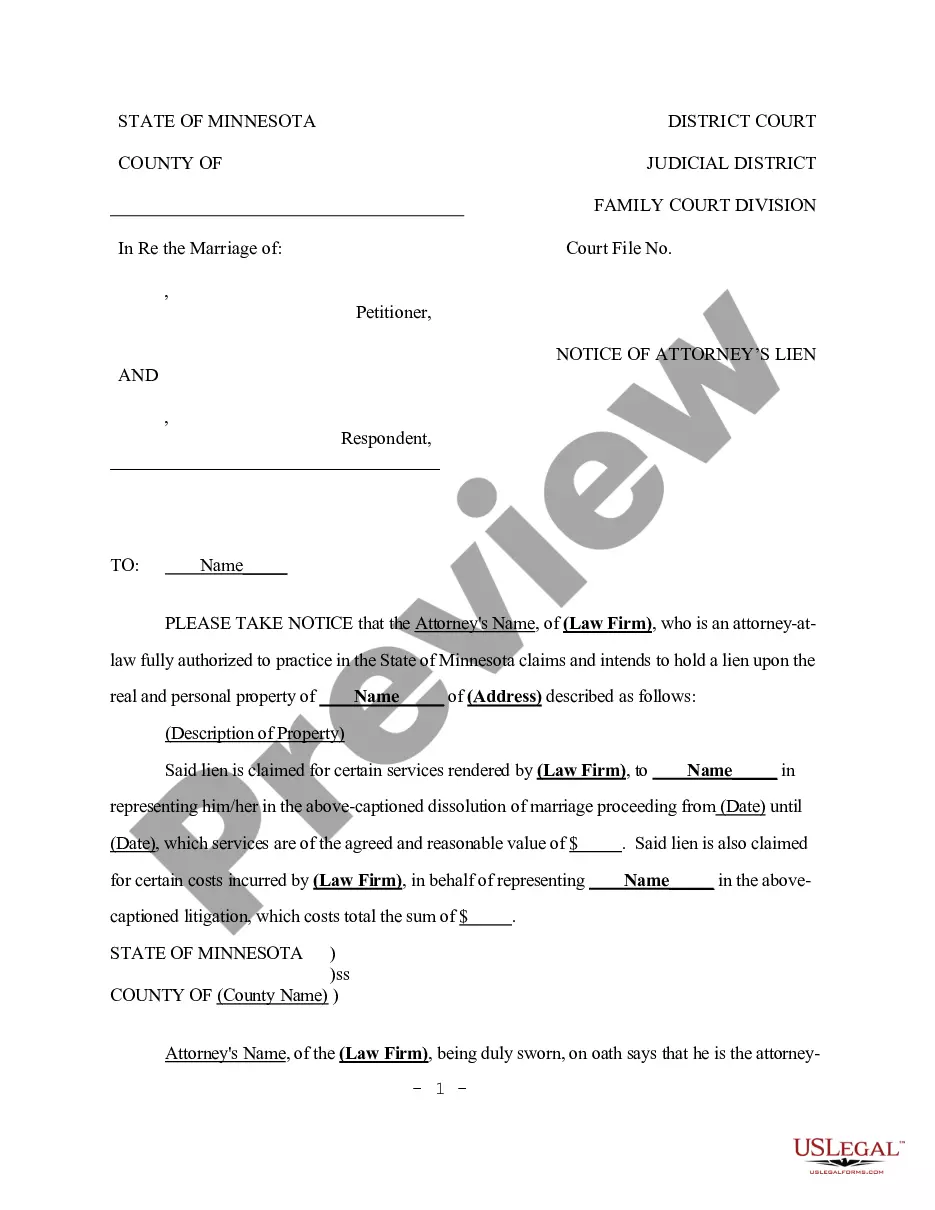

- Utilize the Review button to check the form.

- Read the information to ensure that you have chosen the correct kind.

- If the kind isn`t what you are trying to find, take advantage of the Research discipline to discover the kind that meets your needs and needs.

- If you discover the right kind, just click Acquire now.

- Pick the costs prepare you would like, fill out the desired details to generate your money, and pay for your order with your PayPal or bank card.

- Pick a handy paper format and obtain your version.

Discover every one of the document layouts you might have bought in the My Forms menus. You can get a more version of Virginia Complaint for Impropriety Involving Loan Application any time, if necessary. Just click on the necessary kind to obtain or printing the document design.

Use US Legal Forms, probably the most comprehensive collection of lawful forms, to save time and steer clear of errors. The support gives professionally produced lawful document layouts that you can use for a selection of reasons. Make your account on US Legal Forms and begin producing your way of life easier.

Form popularity

FAQ

Please call the Consumer Protection Hotline at (800) 552-9963 if calling from Virginia, or (804) 786-2042 if calling from the Richmond area or from outside Virginia.

You may also file a complaint via the FDIC's FDIC Information and Support Center. State your inquiry or complaint, making certain to include the name and street address of the bank. Provide a brief description of your complaint. Enclose copies of related documentation.

Complaints can be submitted to the Enforcement Division verbally or in writing and may be submitted anonymously. Go to the Complaint page to see detailed information about the Complaint Process. For any questions contact the Enforcement Division at (804) 367-4691 or toll free at 1-800-533-1560 (VA Only).

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

Use our online complaint form. It is the quickest way to get your complaint filed and processed. If you cannot file online, download and complete our printable complaint form to ensure prompt processing. Type if possible or submit a legible hand-written copy.

File A Complaint Toll-free number: 1-877-310-6560. Life and Health Consumer Services: 804-371-9691. AskAQuestion@scc.virginia.gov. Property and Casualty Consumers Services: 804-371-9185. AskAQuestionPC@scc.virginia.gov.

Department of Labor and Industry Emailwebmaster@doli.virginia.gov. Phone(804) 371-2327. Mailing Address Department of Labor and Industry. Main Street Center. 600 East Main Street, Suite 207. Richmond, VA 23219.

FILING OF COMPLAINTS If you have a complaint involving an entity or individual who is, or may be subject to regulation or supervision by the State Corporation Commission, please submit the Complaint Form - PDF by mail, fax or email. Email: BFIQuestions@scc.virginia.gov.