Virginia Sample Letter for Authorized Signatories for Partnerships or Corporations

Description

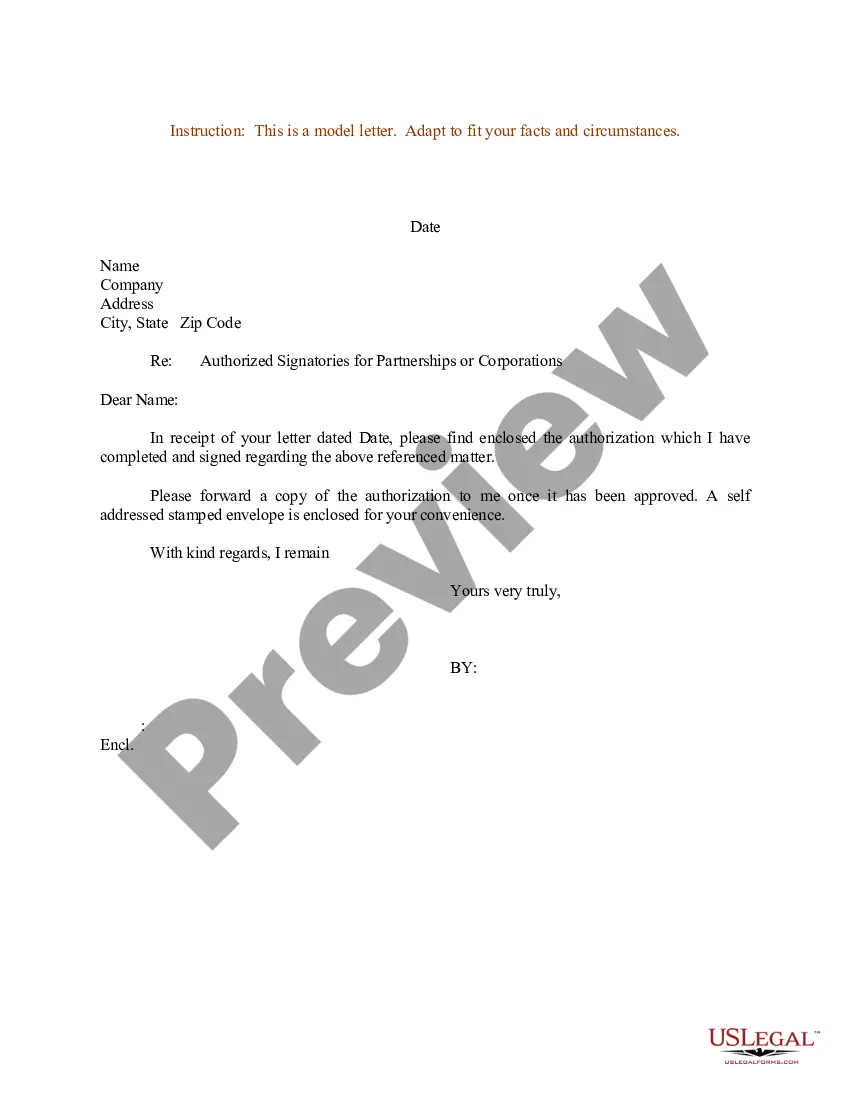

How to fill out Sample Letter For Authorized Signatories For Partnerships Or Corporations?

US Legal Forms - one of many most significant libraries of authorized types in the States - provides a wide range of authorized file themes you may acquire or print out. Using the internet site, you will get 1000s of types for enterprise and person purposes, sorted by categories, states, or key phrases.You will find the most up-to-date versions of types such as the Virginia Sample Letter for Authorized Signatories for Partnerships or Corporations within minutes.

If you already possess a membership, log in and acquire Virginia Sample Letter for Authorized Signatories for Partnerships or Corporations from your US Legal Forms collection. The Down load switch can look on each and every form you look at. You gain access to all formerly acquired types in the My Forms tab of the accounts.

If you wish to use US Legal Forms initially, listed below are easy instructions to help you began:

- Ensure you have picked the proper form for your city/county. Select the Review switch to examine the form`s articles. See the form description to ensure that you have selected the correct form.

- When the form doesn`t match your demands, take advantage of the Search industry near the top of the screen to discover the one that does.

- When you are satisfied with the shape, validate your choice by simply clicking the Buy now switch. Then, choose the pricing program you favor and offer your accreditations to register for the accounts.

- Procedure the financial transaction. Make use of your credit card or PayPal accounts to complete the financial transaction.

- Find the structure and acquire the shape on the product.

- Make changes. Fill up, edit and print out and sign the acquired Virginia Sample Letter for Authorized Signatories for Partnerships or Corporations.

Every single template you included in your money lacks an expiry day and is also your own eternally. So, if you want to acquire or print out one more copy, just proceed to the My Forms portion and then click around the form you need.

Gain access to the Virginia Sample Letter for Authorized Signatories for Partnerships or Corporations with US Legal Forms, probably the most comprehensive collection of authorized file themes. Use 1000s of skilled and condition-certain themes that fulfill your organization or person requirements and demands.

Form popularity

FAQ

If claiming a subtraction for Code 56 (Venture Capital Investment) and/or Code 57 (Virginia Real Estate Investment Trust), the 9-digit certification number that was provided must be entered.

The amount of the deduction is equal to the amount of child and dependent care expenses used to calculate the federal credit (not the federal credit amount). The maximum amount of deduction allowed is based on how many dependents you have: $3,000 for one dependent. $6,000 for two or more dependents.

Use Form PAR 101 to: Authorize a person to represent you before Virginia Tax with respect to the tax matters you specify, or ? Revoke a prior power of attorney authorization. THIS IS A LEGAL DOCUMENT: When you submit Form PAR 101, you are authorizing the person you name in Section 4 to be your representative.

Form 765 is an optional ?unified return? (henceforth referred to as a composite return) that is filed by the PTE on behalf of its qualified nonresident owners. All of the Virginia source income from the PTE that is passed through to the qualified nonresident owners who participate is reported on a single return.

Withholding Formula (Effective Pay Period 19, 2019) If the Amount of Taxable Income Is:The Amount of Virginia Tax Withholding Should Be:Over $0 but not over $3,0002.0%Over $3,000 but not over $5,000$60.00 plus 3% of excess over $3,000Over $5,000 but not over $17,000$120.00 plus 5% of excess over $5,0001 more row ?

The subtraction is equal to the amount of income received for total or permanent disability, not to exceed $20,000. You may not claim this subtraction if you claim the Age Deduction for Taxpayers Age 65 and Over.

Under HB 30, for tax year 2022 the standard deduction increases from $4,500 to $8,000 for single filers and from $9,000 to $16,000 for married filers filing jointly if the annual revenue growth is at least 5% for the six-month period of July 2022 through December 2022.

Form 502PTET will allow qualifying pass-through entities to pay Virginia tax at a rate of 5.75% on behalf of their owners at the pass-through entity level rather than the owners paying the tax at the individual level, consequently avoiding the state and local tax cap on Schedule A of Form 1040.