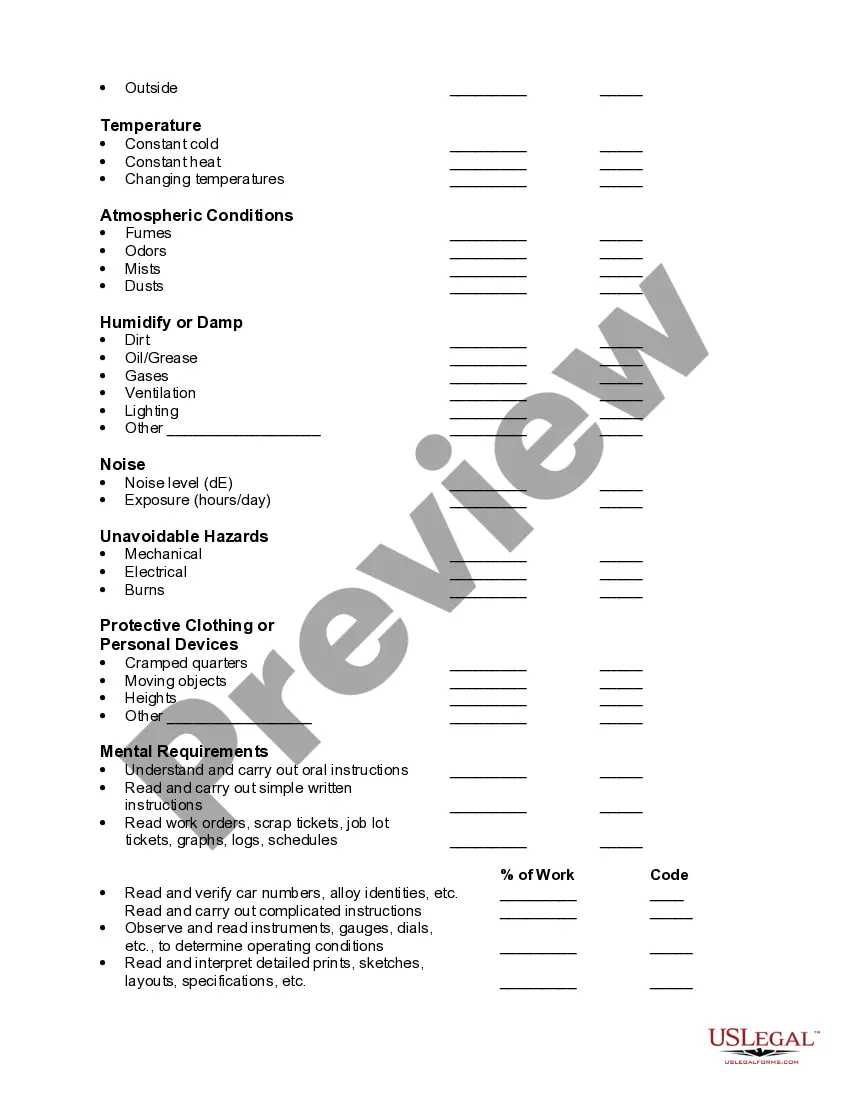

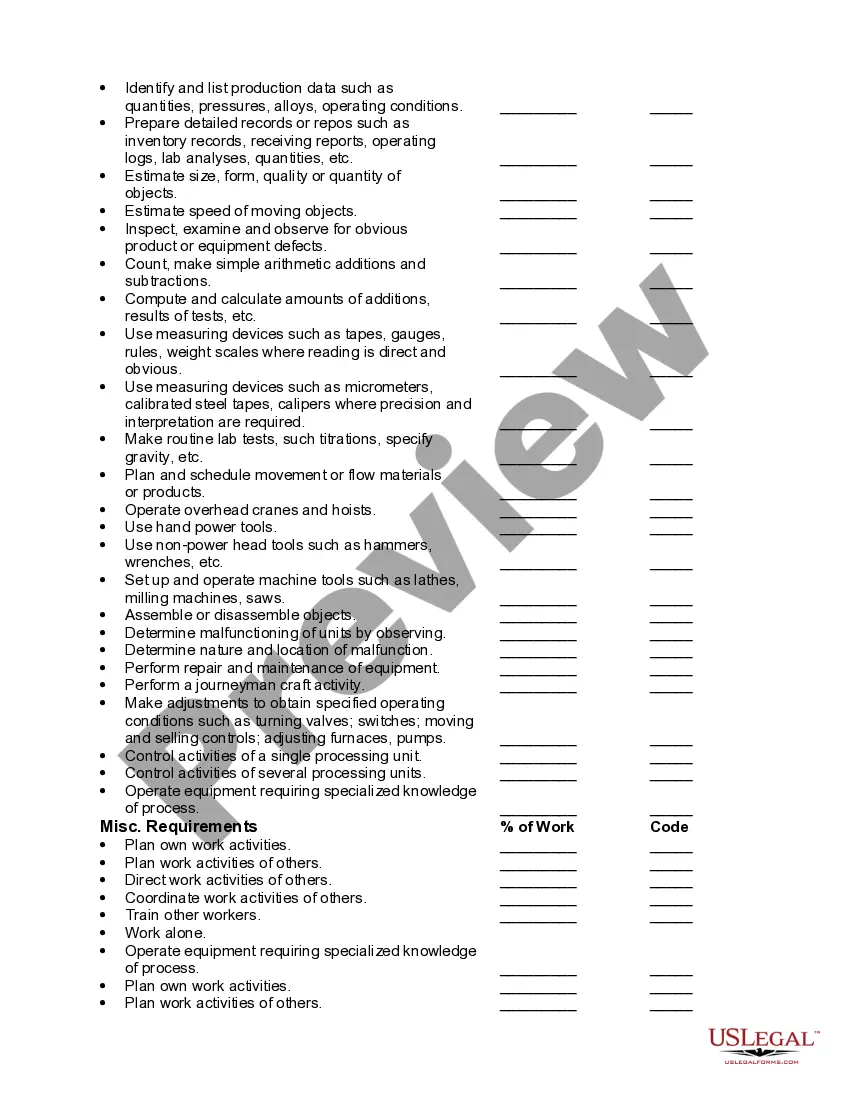

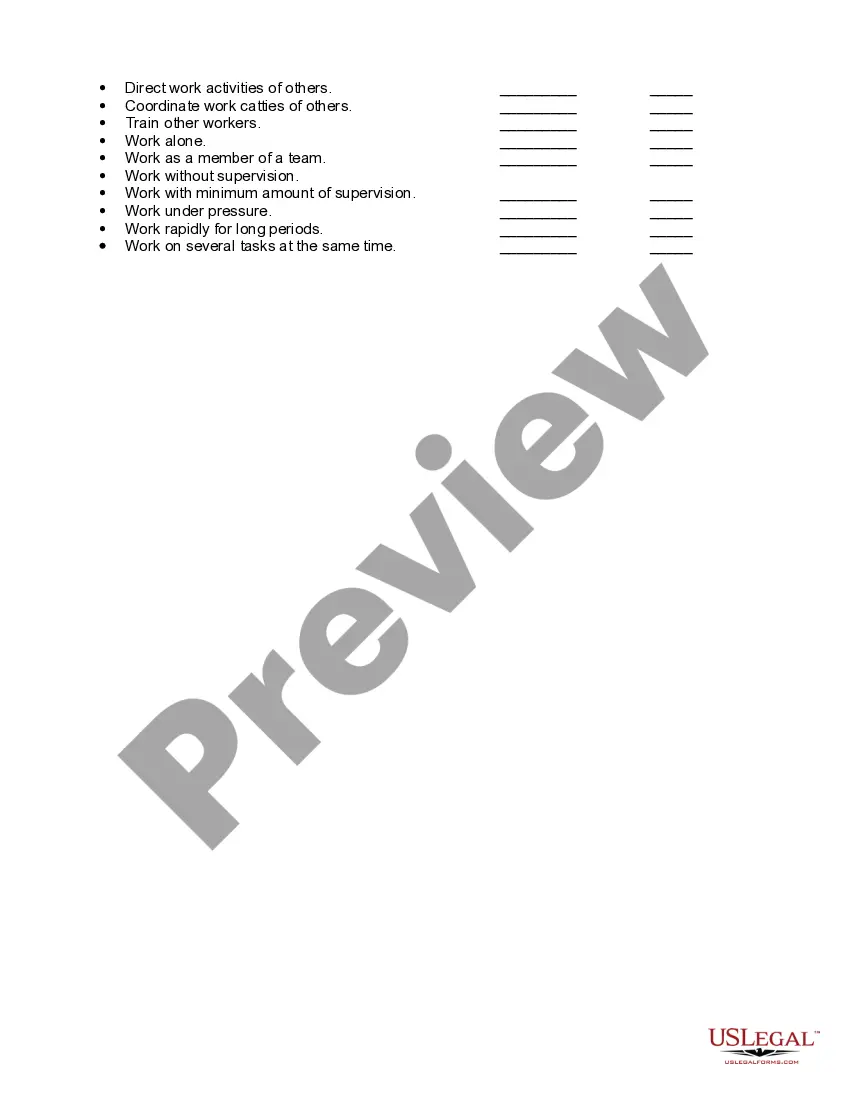

Virginia Sample Job Requirements Worksheet

Description

How to fill out Sample Job Requirements Worksheet?

It is feasible to dedicate several hours online looking for the legal documents template that meets the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that are reviewed by experts.

You can easily obtain or print the Virginia Sample Job Requirements Worksheet from our service.

If available, use the Preview option to review the document template as well. If you wish to get another copy of the form, utilize the Search field to find the template that fits your needs and requirements. Once you have found the desired template, click Get now to proceed. Choose the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the purchase. You can use your Visa, Mastercard, or PayPal account to pay for the legal form. Select the document format and download it to your device. Make edits to the document if necessary. You can complete, edit, and sign and print the Virginia Sample Job Requirements Worksheet. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you have a US Legal Forms account, you may Log In and click the Acquire option.

- Then, you can complete, modify, print, or sign the Virginia Sample Job Requirements Worksheet.

- Every legal document template you purchase belongs to you permanently.

- To obtain another copy of the acquired form, navigate to the My documents tab and select the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the area/region you choose.

- Check the form details to confirm you have selected the appropriate form.

Form popularity

FAQ

When completing the Commonwealth of Virginia Form VA-4: Line 1 On Line 1(c), please write in the number 0 or 1 (NRAs can only select a maximum of 1 as their total number of allowances Line 2 skip. Line 3 skip (NRAs cannot check this box) Line 4 (not on older form) skip.

When completing the Commonwealth of Virginia Form VA-4: Line 1 On Line 1(c), please write in the number 0 or 1 (NRAs can only select a maximum of 1 as their total number of allowances Line 2 skip. Line 3 skip (NRAs cannot check this box) Line 4 (not on older form) skip.

Generally, you can claim one personal tax exemption for yourself and one for your spouse if you are married. You can also claim one tax exemption for each person who qualifies as your dependent, your spouse is never considered your dependent.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. Line1. You may claim an exemption for yourself.

Use this form to notify your employer whether you are subject to Virginia income tax withholding and how many exemptions you are allowed to claim. You must file this form with your employer when your employment begins.

You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. Line1. You may claim an exemption for yourself.

Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.