Virginia Sample Letter for Tax Exemption - Review of Applications

Description

How to fill out Sample Letter For Tax Exemption - Review Of Applications?

It is possible to devote hrs on-line searching for the legitimate papers template that suits the state and federal requirements you require. US Legal Forms supplies a large number of legitimate types which can be analyzed by specialists. You can easily obtain or printing the Virginia Sample Letter for Tax Exemption - Review of Applications from my service.

If you currently have a US Legal Forms account, you may log in and then click the Obtain key. Following that, you may comprehensive, edit, printing, or indicator the Virginia Sample Letter for Tax Exemption - Review of Applications. Every single legitimate papers template you get is your own property for a long time. To obtain another backup of the acquired type, proceed to the My Forms tab and then click the related key.

If you use the US Legal Forms internet site the first time, adhere to the easy instructions listed below:

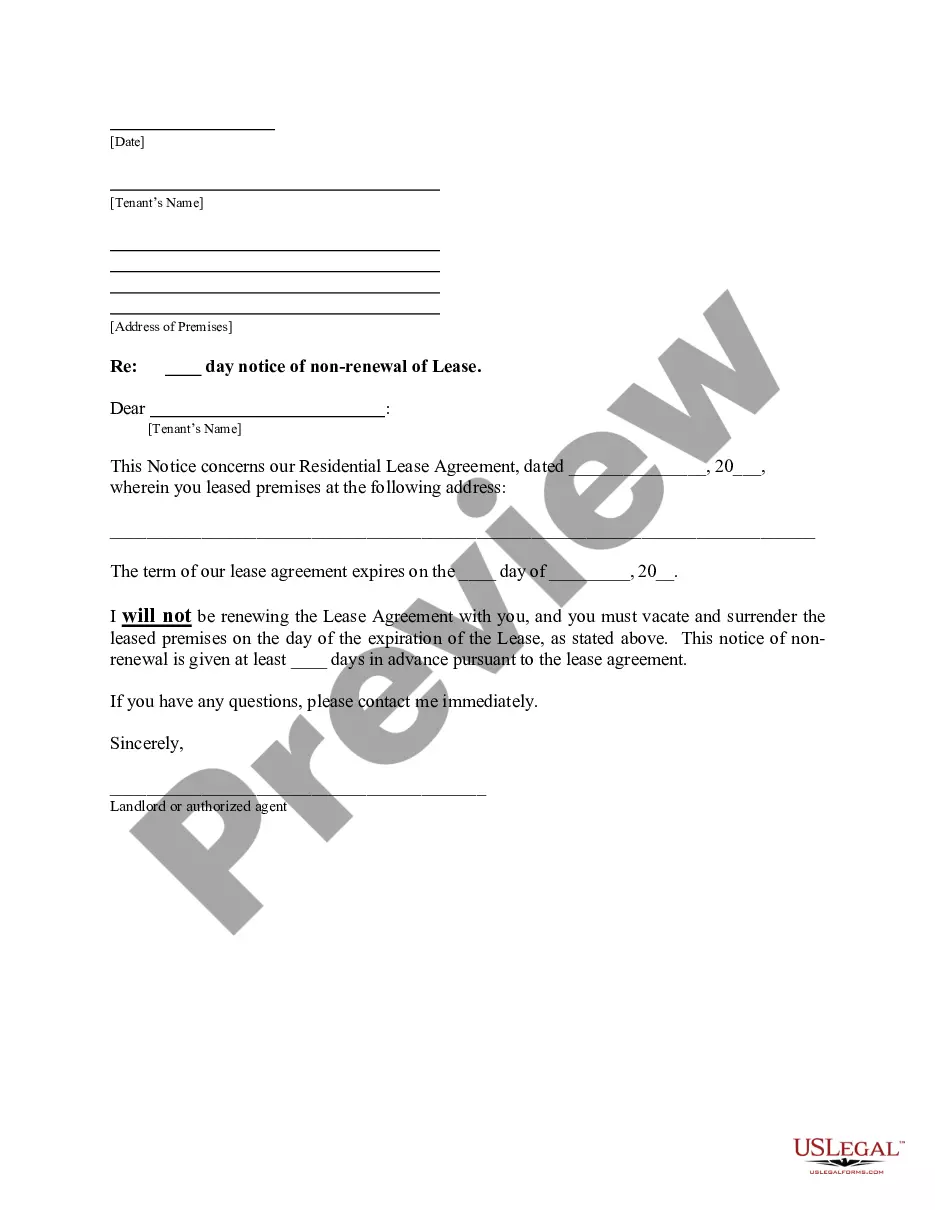

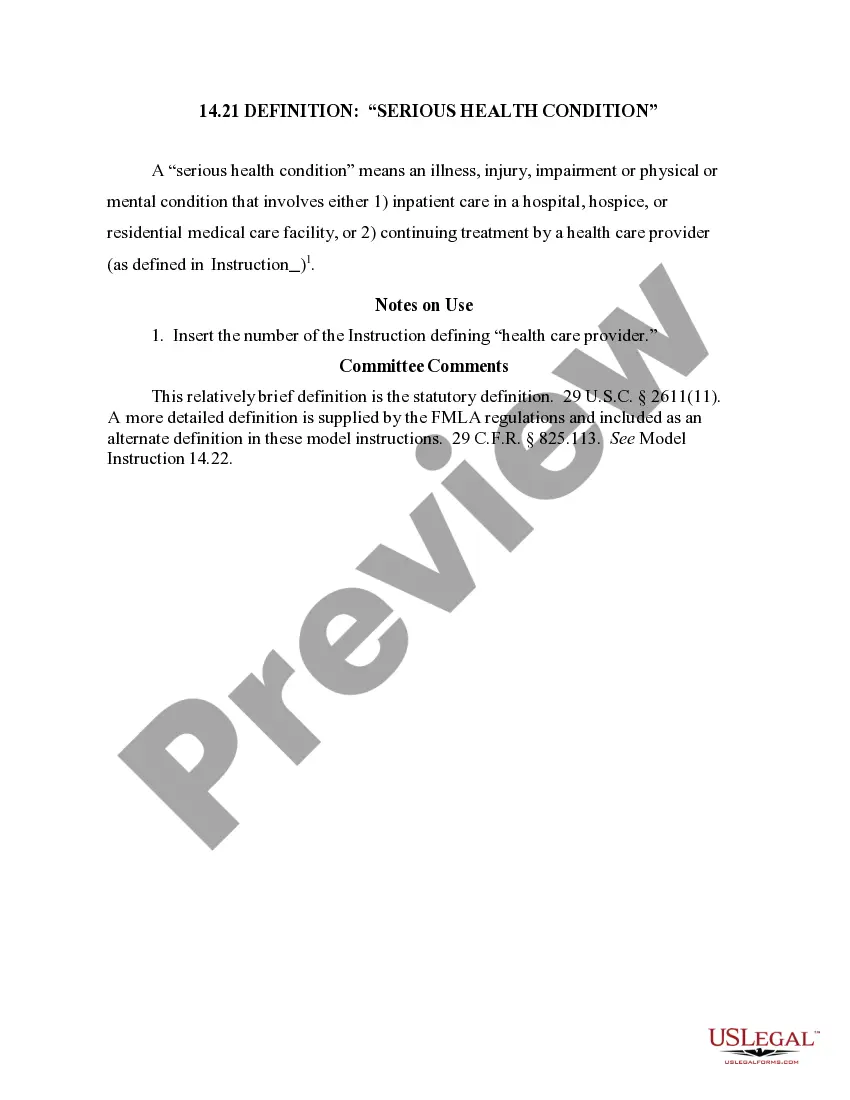

- Very first, make certain you have selected the proper papers template for the region/city that you pick. Look at the type outline to ensure you have picked the appropriate type. If accessible, take advantage of the Review key to check from the papers template at the same time.

- In order to discover another edition from the type, take advantage of the Research industry to obtain the template that suits you and requirements.

- After you have discovered the template you would like, click on Buy now to continue.

- Select the prices strategy you would like, type in your credentials, and register for an account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal account to fund the legitimate type.

- Select the formatting from the papers and obtain it in your gadget.

- Make alterations in your papers if needed. It is possible to comprehensive, edit and indicator and printing Virginia Sample Letter for Tax Exemption - Review of Applications.

Obtain and printing a large number of papers web templates making use of the US Legal Forms web site, that offers the biggest variety of legitimate types. Use expert and status-specific web templates to handle your company or specific demands.

Form popularity

FAQ

If you receive a refund verification letter from us, it doesn't mean you did anything wrong, or that there's anything wrong with your return. We're just being extra careful to rule out identity theft and other problems, and need a little help from you to make sure we send the correct refund to the right person.

You can obtain replacement copies of your 501(c)(3) form through the IRS website or by using Form 4506-A.

Getting a 501(c)(3) Determination Letter After applying with the IRS for 501(c)(3) status, it may take between 3 and 6 months to get a determination letter confirming approval. The amount of time you can expect depends on the scale of the operation; it is not unheard of for some of the largest to take 12 months.

Property considered for exemption from real estate taxation must qualify by general classification. The appropriate Application for Exemption must be completed and filed with the City Assessor no later than July 1st prior to the calendar year in which the exemption is requested.

A ruling or determination letter will be issued to your organization if its application and supporting documents establish that it meets the particular requirements of the section under which it is claiming exemption.

The IRS determination letter notifies a nonprofit organization that its application for federal tax exemption under Section 501(c)(3) has been approved. This is an exciting day for an emerging nonprofit! Having your IRS determination letter in hand affords your nonprofit organization several unique advantages.

How does an organization apply for a Virginia retail sales and use tax exemption? Go to Nonprofit Online, or complete Form NP-1 and submit it to Virginia Tax, Nonprofit Exemption Unit, P. O. Box 715, Richmond, Virginia 23218-0715.

A determination letter is a formal document issued by the Internal Revenue Service (IRS) that indicates whether or not a company's employee benefit plan has been found to meet the minimum legal requirements for special tax treatment.