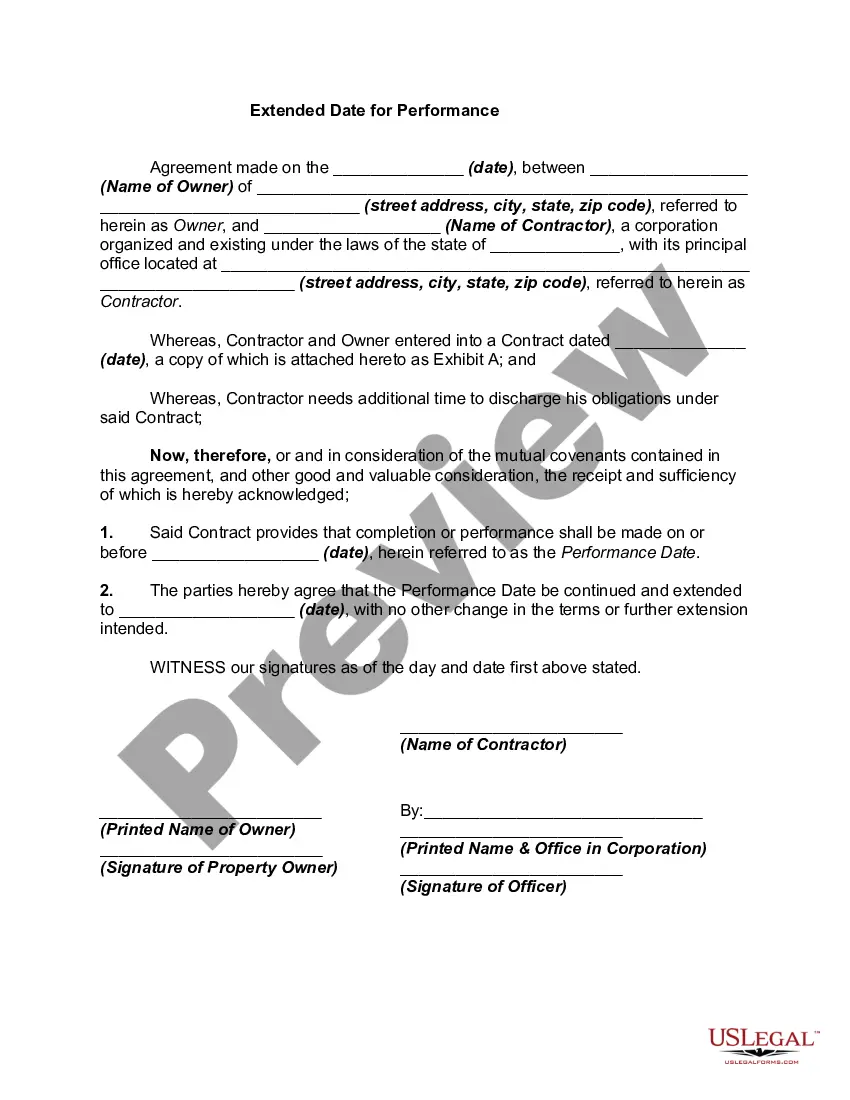

Virginia Extended Date for Performance

Description

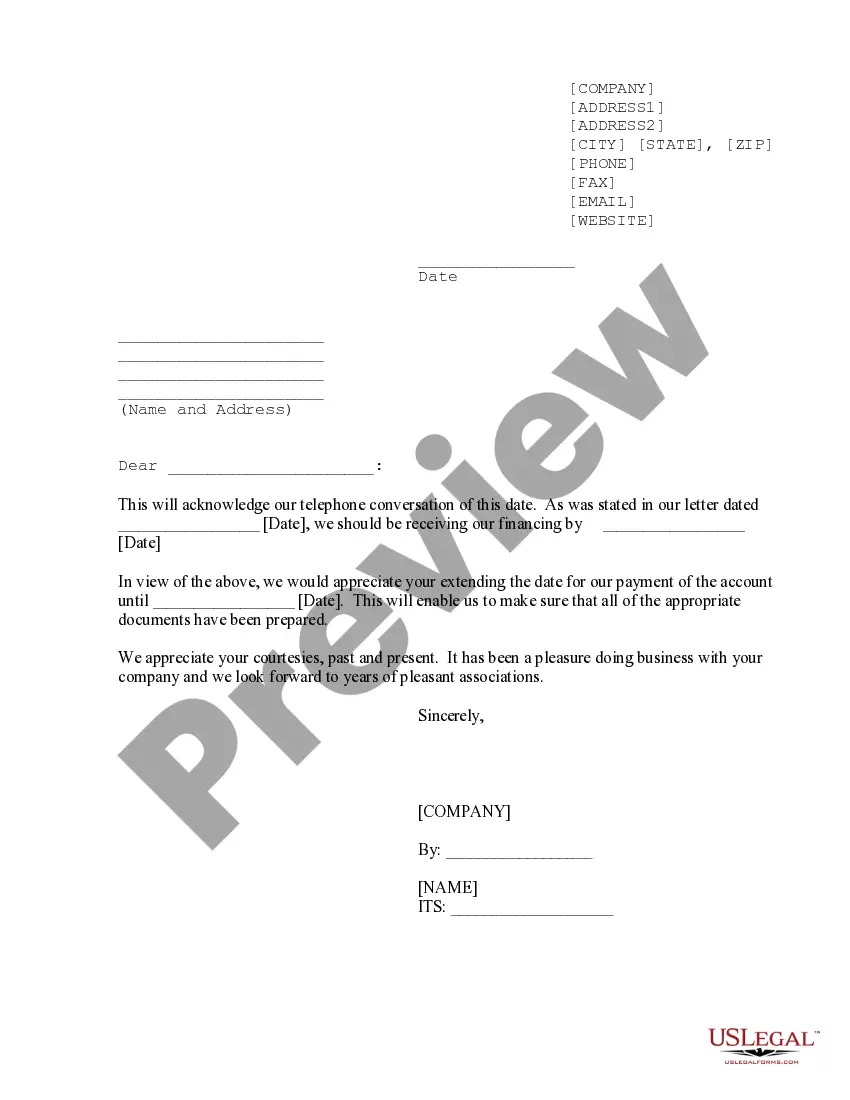

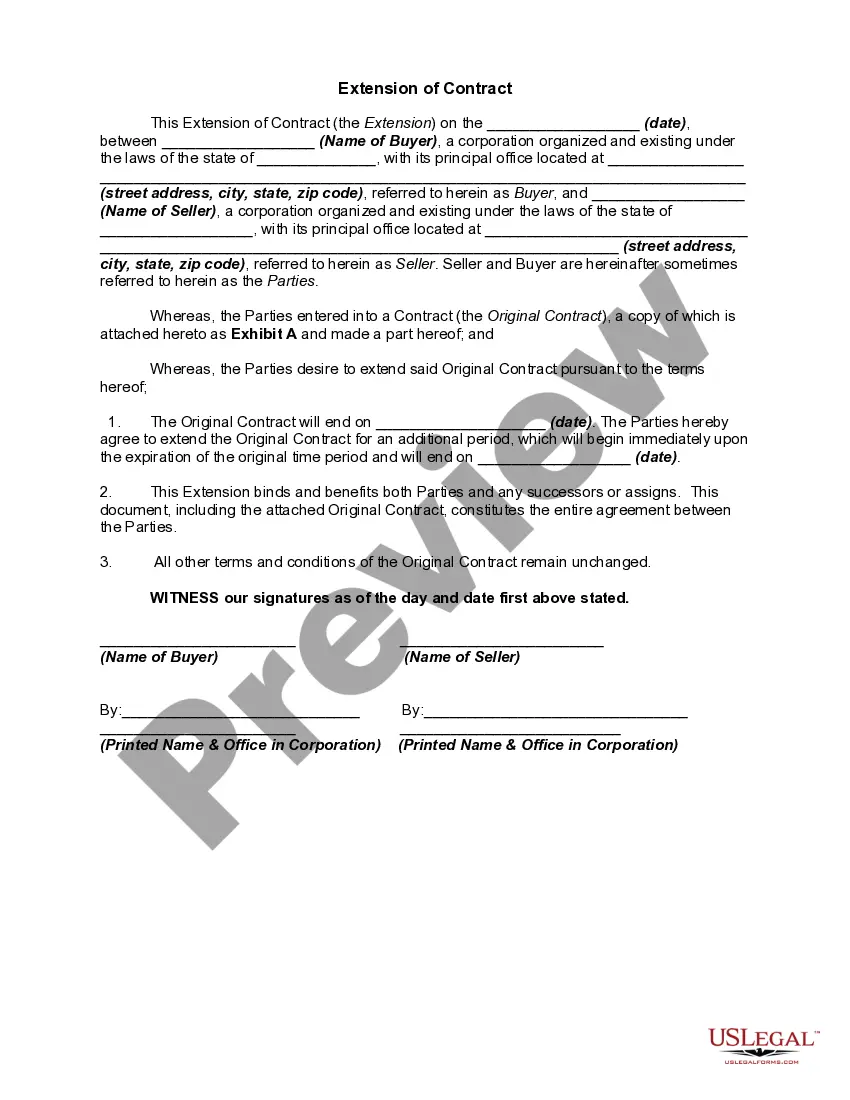

How to fill out Extended Date For Performance?

Have you ever been in a situation where you would require documentation for potentially professional or personal purposes nearly every time.

There are numerous legal document templates accessible online, but finding forms you can trust is not easy.

US Legal Forms offers a vast array of document templates, such as the Virginia Extended Date for Performance, which are designed to meet both state and federal standards.

Once you find the appropriate document, click Purchase now.

Choose the payment plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Virginia Extended Date for Performance template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

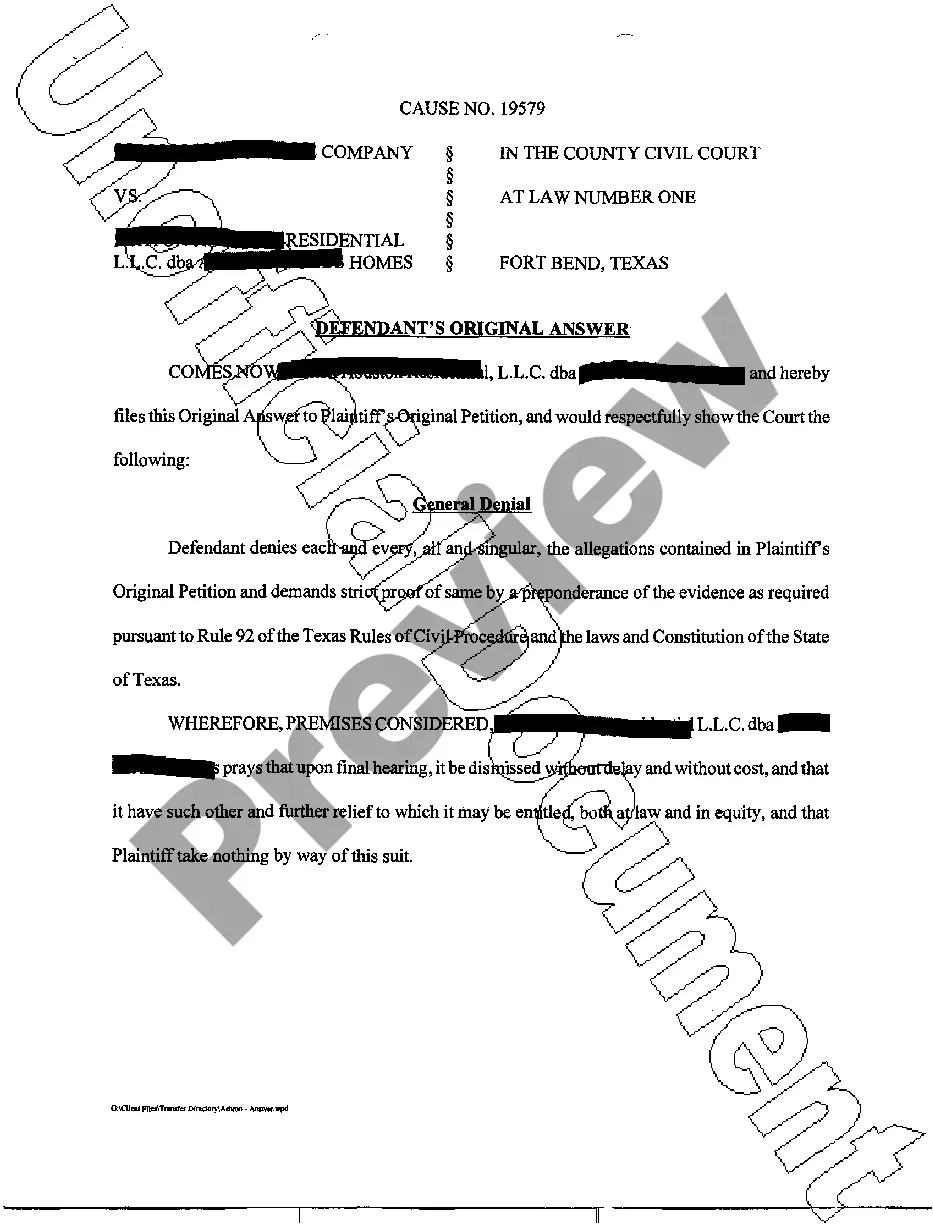

- Use the Review button to check the form.

- Examine the details to ensure that you have selected the correct template.

- If the form isn't what you're looking for, make use of the Search feature to find the template that fits your needs.

Form popularity

FAQ

If you file your taxes late without an extension, you may incur penalties and interest on the unpaid tax balance. The IRS and state tax authorities may impose fines that increase over time, making it vital to address the matter as soon as possible. Taking corrective action early can minimize consequences and help you manage your tax obligations. You can find helpful resources on US Legal Forms to aid in rectifying your situation.

Filing an extension after the deadline typically involves reaching out to the tax authority directly to explain your circumstances. You may need to provide documentation that supports your request for the Virginia Extended Date for Performance. Although this process may be challenging, platforms like US Legal Forms can assist you in completing any required forms or communications.

Filing an extension on your taxes after the deadline is generally not permitted. However, it's wise to check with the Virginia tax authority to discuss any potential options. Depending on your situation, you may be given guidance on how to address your late filing. US Legal Forms can assist you in preparing the necessary documents quickly.

If you missed the deadline to file an extension, you may still have options to mitigate penalties. Contact the Virginia Department of Taxation to explain your situation and explore possible remedies. They may offer alternatives, such as applying for an abatement of penalties under certain circumstances. Using services like US Legal Forms can help you navigate these issues more effectively.

To ask for an extension after the deadline, you should contact the appropriate tax authority directly. Explain your situation clearly and request the Virginia Extended Date for Performance to file your taxes. It's important to provide any necessary supporting documents to strengthen your case. Using forms provided by platforms like US Legal Forms can streamline this process.

In Virginia, the deadline for filing an extension typically aligns with the original tax filing date. While you can request an extension until October for your state taxes, be mindful that this does not extend the payment date. Thus, it is crucial to ensure tax payments are made on time to avoid penalties.

To fill out the VA 4 form, start by entering your personal information, including name and social security number. Next, choose the number of allowances you wish to claim, which will influence your tax withholding. Remember to sign and date the form for validity. Accessing US Legal Forms can provide useful templates and guidance to simplify this process.

Choosing to claim 0 or 1 on the VA 4 impacts your withholding amount significantly. Claiming 0 means more tax will be withheld from your paycheck, which may lead to a refund when you file your return. On the other hand, claiming 1 indicates a lesser withholding, keeping more in your paycheck but possibly resulting in a tax bill. You can consult resources from US Legal Forms to determine what's best for your situation.

Filling out a W 4V form follows similar steps as the W-4V form. Start with your identifying information, then indicate the amount to withhold based on your payment type. Make sure to sign and date your form adequately. If you seek more guidance, check out the step-by-step instructions available on US Legal Forms.

To fill out a W4 form, begin with your name and social security number at the top. Next, follow the sections to determine your filing status and number of dependents, which help calculate your withholding. Complete the additional section if you have other adjustments, and remember to sign and date the form at the end. US Legal Forms provides resources to make this easier.