Virginia Invoice Template for SEO Expert

Description

How to fill out Invoice Template For SEO Expert?

It is feasible to spend numerous hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are reviewed by professionals.

It is easy to download or print the Virginia Invoice Template for SEO Expert from my service.

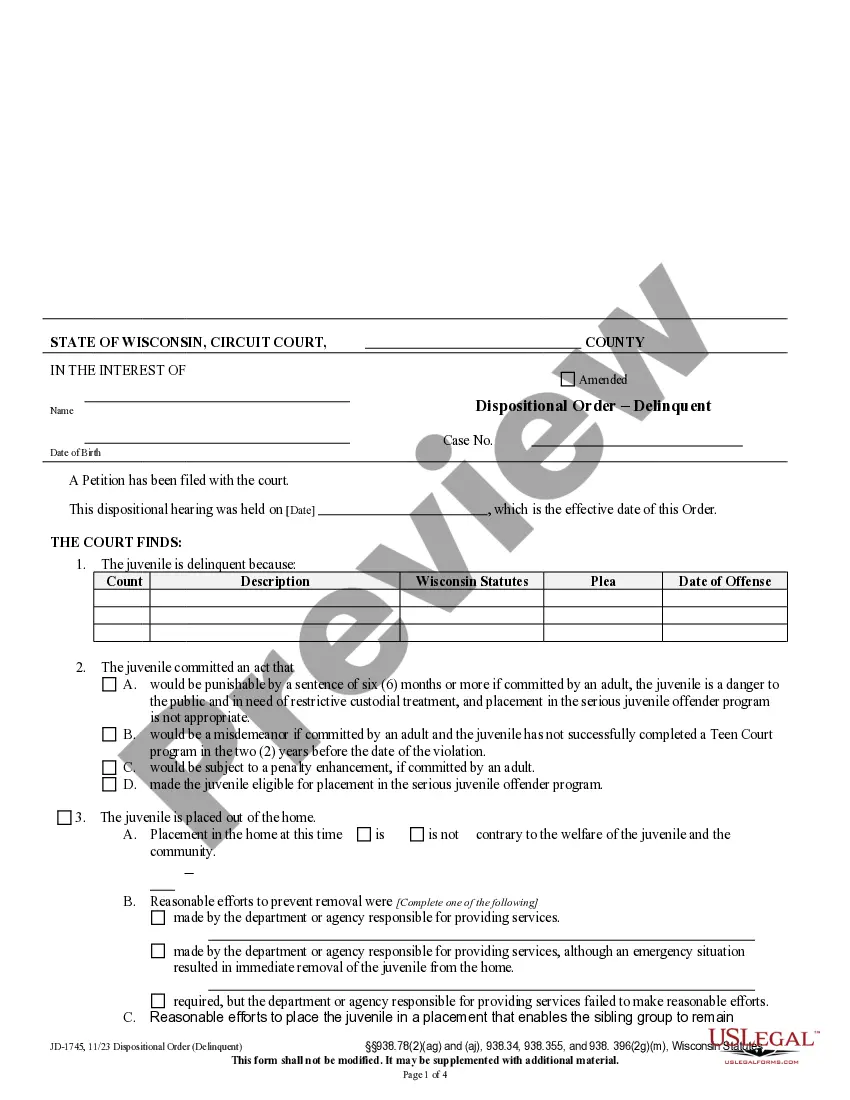

If available, use the Review button to go through the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and hit the Obtain button.

- Then, you can complete, modify, print, or sign the Virginia Invoice Template for SEO Expert.

- Every legal document template you buy is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure that you have selected the correct document template for your area/city of choice.

- Read the document description to ensure you have selected the appropriate form.

Form popularity

FAQ

To submit an invoice for a service, ensure you have completed the invoice with accurate details about the work performed, payment terms, and due date. You can send it via email or postal service, depending on client preference. The Virginia Invoice Template for SEO Expert can assist you in creating a clear and professional invoice that makes submission straightforward.

Creating an invoice for VA services involves using a specific format that meets state requirements. You should include your business information, the client's details, and all relevant services rendered. Utilizing the Virginia Invoice Template for SEO Expert can help you adhere to local guidelines and present a professional invoice to your clients.

As a consultant, generating an invoice begins with detailing your services clearly along with their respective costs. You can use a professional format that includes your contact details, client information, and a breakdown of services. The Virginia Invoice Template for SEO Expert equips you with a polished structure to make this process efficient and professional.

To fill out an invoice template, start by placing your business details at the top, followed by the client's information. Add a unique invoice number and date to keep track of the transaction. Use the Virginia Invoice Template for SEO Expert to streamline this process, ensuring that you provide clear descriptions and totals that make it easy for your client to understand.

For beginners, invoicing can start with understanding the key components of an invoice like listing your services, adding rates, and calculating totals. Begin with a simple structure by using the Virginia Invoice Template for SEO Expert, which provides guidance on formatting and essential elements. Remember to provide clear payment terms and include your business details to make the process smoother.

The correct format for an invoice typically includes a header with your business name and contact information, the client's details, the invoice number, and the date. You should also include a detailed item list with descriptions, quantities, rates, and the total amount due. Using the Virginia Invoice Template for SEO Expert can help ensure you cover all these essential components.

Creating an invoice for professional services is simple with the Virginia Invoice Template for SEO Expert. First, gather all relevant information, such as your business name, client details, and the services provided. Next, clearly list the services, their rates, and any applicable taxes. Finally, use the template to present this information professionally, ensuring it aligns with your branding to enhance trust and clarity.

To write a tax invoice statement, utilize a Virginia Invoice Template for SEO Expert tailored for tax invoices. Start by listing your business name and contact details, followed by the buyer’s information. Accurately detail the products or services with prices and applicable tax rates, clearly outlining the total amount due to facilitate easy understanding for the recipient.

An example of a tax invoice includes all critical elements like the seller's details, buyer's information, product or service descriptions, prices, and tax amounts displayed clearly. Using a Virginia Invoice Template for SEO Expert can help you structure these elements efficiently. Furthermore, the tax invoice should specify whether tax is included in the total amount or added separately, ensuring compliance with tax regulations.

To fill out an invoice statement, start with a Virginia Invoice Template for SEO Expert for clear guidance. Include your business and client information, a detailed list of services or products, their costs, and the total amount due. It’s crucial to specify payment terms, such as due dates or accepted payment methods, which helps in prompt payment and reduces confusion.