Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement

Description

How to fill out Contract For The Sale Of Motor Vehicle - Owner Financed With Provisions For Note And Security Agreement?

Are you in a situation where you regularly require documents for either business or personal purposes every day.

There are numerous legal document templates available online, but locating ones you can trust is challenging.

US Legal Forms offers a vast collection of form templates, including the Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, designed to comply with state and federal regulations.

Once you find the right form, click Acquire now.

Select the pricing plan you want, provide the necessary information to create your account, and place an order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is applicable to the correct city/county.

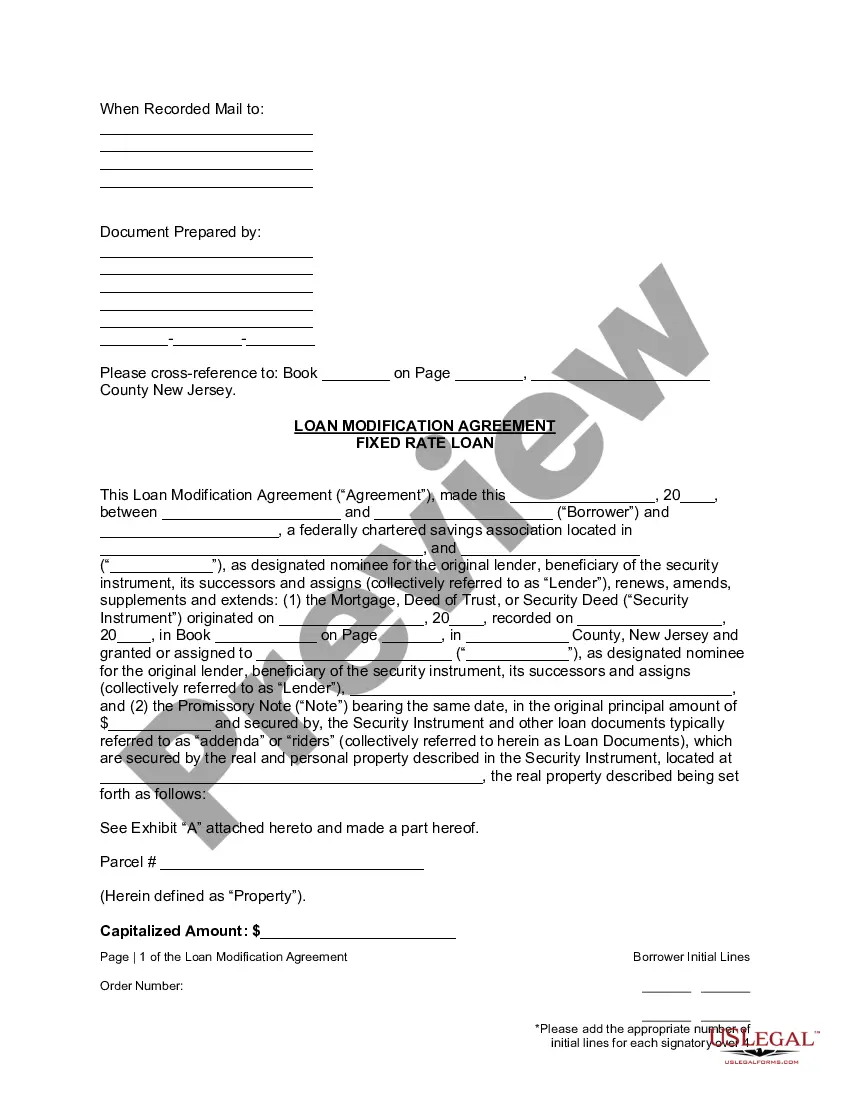

- Utilize the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Lookup field to find a form that fits your needs.

Form popularity

FAQ

Selling a car with owner financing involves creating an agreement that outlines the terms of sale, including the down payment, interest rate, and repayment schedule. You should also include provisions for a note and security agreement to protect your interests as the seller. Consider using the Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement as it encapsulates all necessary details effectively.

In Virginia, a contract requires an offer, acceptance, and consideration. This means both parties must agree on the terms of the deal with mutual benefits involved. Importantly, when discussing the Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, ensure the contract outlines the financial arrangements clearly to avoid any disputes.

A financing statement is not the same as a security agreement, but it serves to publicly record the existence of a security interest. While a security agreement establishes the terms between the lender and borrower, a financing statement lets third parties know about the lender's claim on the collateral. In transactions involving a Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, filing a financing statement can enhance protection for the lender.

A security agreement on a car is a legal document that grants a lender a security interest in the vehicle. This agreement establishes the lender's rights to the car if the borrower fails to meet the payment obligations. Within a Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, this agreement plays a crucial role in facilitating owner financing.

Yes, in Virginia, you need a bill of sale when purchasing or selling a car. This document serves as proof of the transaction between the buyer and the seller, ensuring that all parties are clear on the terms. When using a Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, it is beneficial to include a bill of sale to protect both parties and simplify the transfer process.

Yes, a dealership may take back the vehicle after you have signed a contract if you default on your payment obligations. In the context of a Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, failure to comply with the payment terms allows the dealership to initiate repossession. It’s crucial to review your responsibilities in the agreement to avoid such circumstances.

Virginia Code 46.2 618 pertains to the requirements of properly transferring ownership of a vehicle when sold. This regulation is key in the context of a Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement. It ensures that both the seller and buyer follow necessary steps to finalize the ownership legally.

A dealership can cancel a signed contract under certain circumstances, such as discovering fraudulent information or if both parties mutually agree to void the contract. However, for a standard transaction, such as a Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, cancellation by the dealer is unlikely. It's always best to fully understand your contract before signing to avoid any surprises.

Once you sign the contract, including a Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, a dealer usually cannot take the car back unless specific conditions are met. If there's a default in the payment agreements outlined, the dealer may initiate repossession. Always review the terms of your contract carefully to understand your rights and obligations.

In Virginia, there is generally no mandatory 'cooling-off' period that allows you to return a car after purchasing it. Once you sign a contract, including a Virginia Contract for the Sale of Motor Vehicle - Owner Financed with Provisions for Note and Security Agreement, the deal is typically final. However, check your specific dealership policies, as some might offer a return option.