Virginia Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

If you need to finalize, obtain, or produce valid document templates, utilize US Legal Forms, the premier collection of legal forms, available online.

Employ the site’s straightforward and efficient search to locate the documents you require. Various templates for businesses and personal purposes are sorted by categories and indicates, or keywords.

Utilize US Legal Forms to discover the Virginia Agreement to Settle Debt by Returning Secured Property with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you saved within your account. Click the My documents section and choose a form to print or download again.

Be proactive and acquire, and print the Virginia Agreement to Settle Debt by Returning Secured Property with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are a current US Legal Forms customer, Log In to your account and click the Download button to retrieve the Virginia Agreement to Settle Debt by Returning Secured Property.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/country.

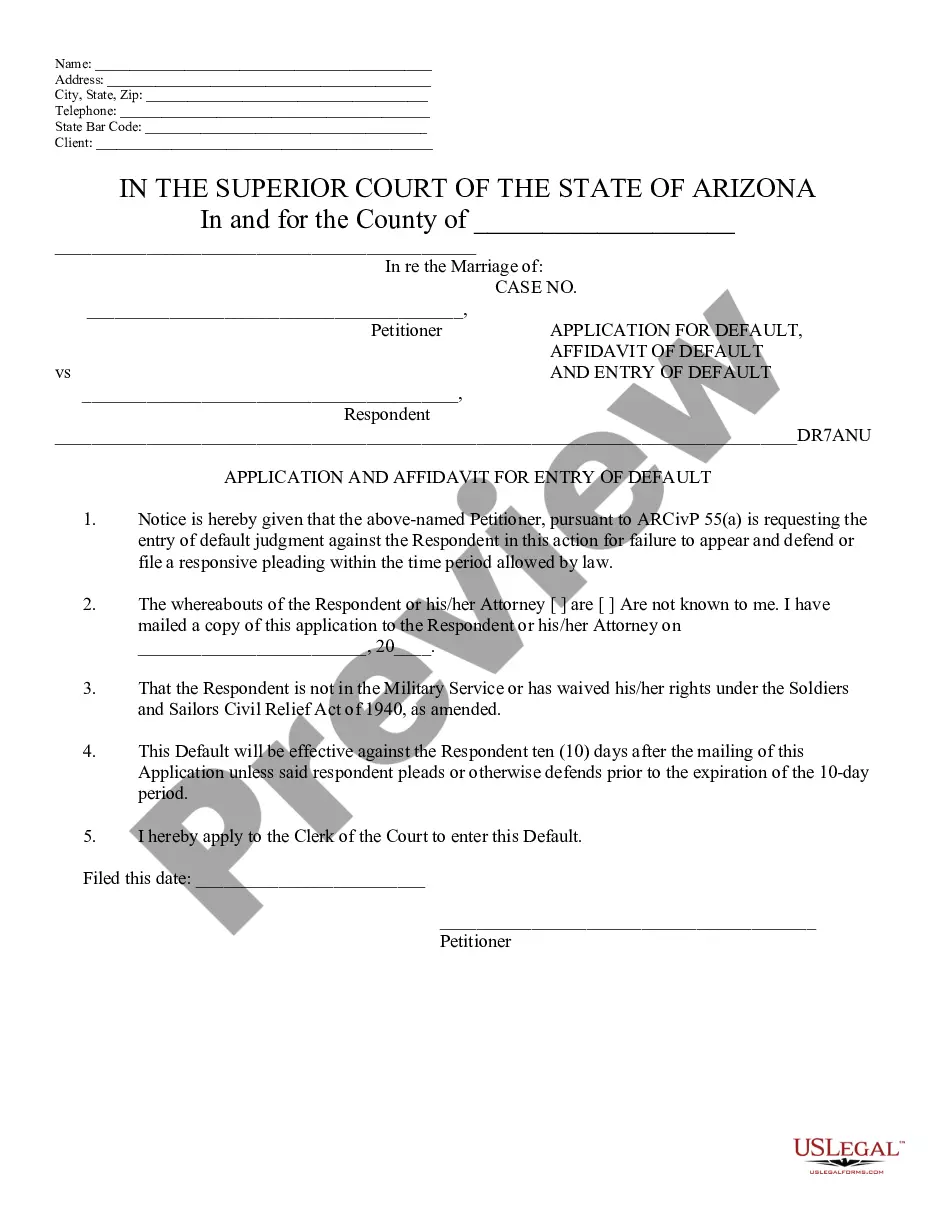

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area near the top of the screen to find alternative types of your legal form template.

- Step 4. Once you have found the form you desire, select the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You may utilize your credit card or PayPal account to complete the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Virginia Agreement to Settle Debt by Returning Secured Property.

Form popularity

FAQ

To file an offer in compromise, start by completing the required forms detailing your financial situation and the proposed terms of the Virginia Agreement to Compromise Debt by Returning Secured Property. Submit these forms along with any supporting documentation to the appropriate agency. It's important to follow the instructions carefully to avoid delays. Consider consulting with US Legal Forms for guidance on the paperwork process to ensure everything is done correctly.

When negotiating a debt settlement, be honest and straightforward about your financial situation. Clearly state your intention to resolve the debt and suggest the terms of a Virginia Agreement to Compromise Debt by Returning Secured Property that work for you. Listen actively to the creditor's counteroffers and be prepared to discuss alternative solutions. It's essential to communicate openly to reach a mutually beneficial agreement.

A tax lien is a serious matter as it signifies the government's claim against your property due to unpaid taxes. It can severely affect your credit score and may hinder your ability to sell or refinance the property. Ignoring this issue can lead to more extensive legal consequences. If you find yourself in this situation, the Virginia Agreement to Compromise Debt by Returning Secured Property might be essential for regaining financial control.

The downside of an offer in compromise can include a lengthy review process and the potential rejection of your offer. Additionally, accepting an offer may require you to forfeit certain rights or claims to the property involved. Even though it may settle debts, you might not receive the relief expected. The Virginia Agreement to Compromise Debt by Returning Secured Property can provide a framework for understanding these implications.

In Virginia, any partnership conducting business operations must file a partnership return. This includes both general and limited partnerships. Timely filing helps maintain compliance and avoids unexpected tax obligations that can result in liens. Should you find yourself facing partnership debt, the Virginia Agreement to Compromise Debt by Returning Secured Property may offer a viable solution.

Anyone earning income in Virginia must file a tax return if it meets the state's income thresholds. This includes full-time residents and non-residents who earn income from Virginia sources. Failing to file can lead to tax liens and legal action. The Virginia Agreement to Compromise Debt by Returning Secured Property can help mitigate any complications arising from unpaid returns.

To file an IRS offer in compromise, you must complete the application by providing your financial details, including income, expenses, and debts. You then submit your offer, along with a payment, to the IRS for consideration. This process can be intricate, requiring accurate documentation. For state tax issues, consider exploring the Virginia Agreement to Compromise Debt by Returning Secured Property as an alternative.

A notice of lien and demand for payment is a public declaration that the state has placed a lien on your property because of unpaid taxes. This notice also requests immediate payment to resolve your tax debt. It’s important to respond to avoid further complications, like property seizure. The Virginia Agreement to Compromise Debt by Returning Secured Property provides a potential solution to manage such debts.

Virginia Form 502 must be filed by partnerships that have income to report to the state. This form is critical in ensuring the state receives an accurate account of a partnership's earnings. Not filing can lead to tax liabilities and potential liens on property. If you encounter difficulties managing these filings, the Virginia Agreement to Compromise Debt by Returning Secured Property could provide relief.

In Virginia, any partnership conducting business and earning income is required to file a Virginia partnership return. This includes limited partnerships and general partnerships. It’s essential to stay compliant to avoid tax liens or other legal issues. The Virginia Agreement to Compromise Debt by Returning Secured Property could offer a way to address any debt arising from partnership returns.