This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse

Description

How to fill out Notice Of Non-Responsibility For Debts Or Liabilities Contracted By Spouse?

If you need to finish, acquire, or create valid document templates, utilize US Legal Forms, the largest compilation of authentic forms available online.

Leverage the site’s straightforward and user-friendly search to locate the documents required.

A range of templates for business and personal needs are organized by categories and states, or keywords. Use US Legal Forms to quickly find the Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse.

Every legal document template you purchase is yours indefinitely. You will have access to every form you have purchased through your account. Click on the My documents section to select a form to print or download again.

Compete and acquire, and print the Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal requirements.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to receive the Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

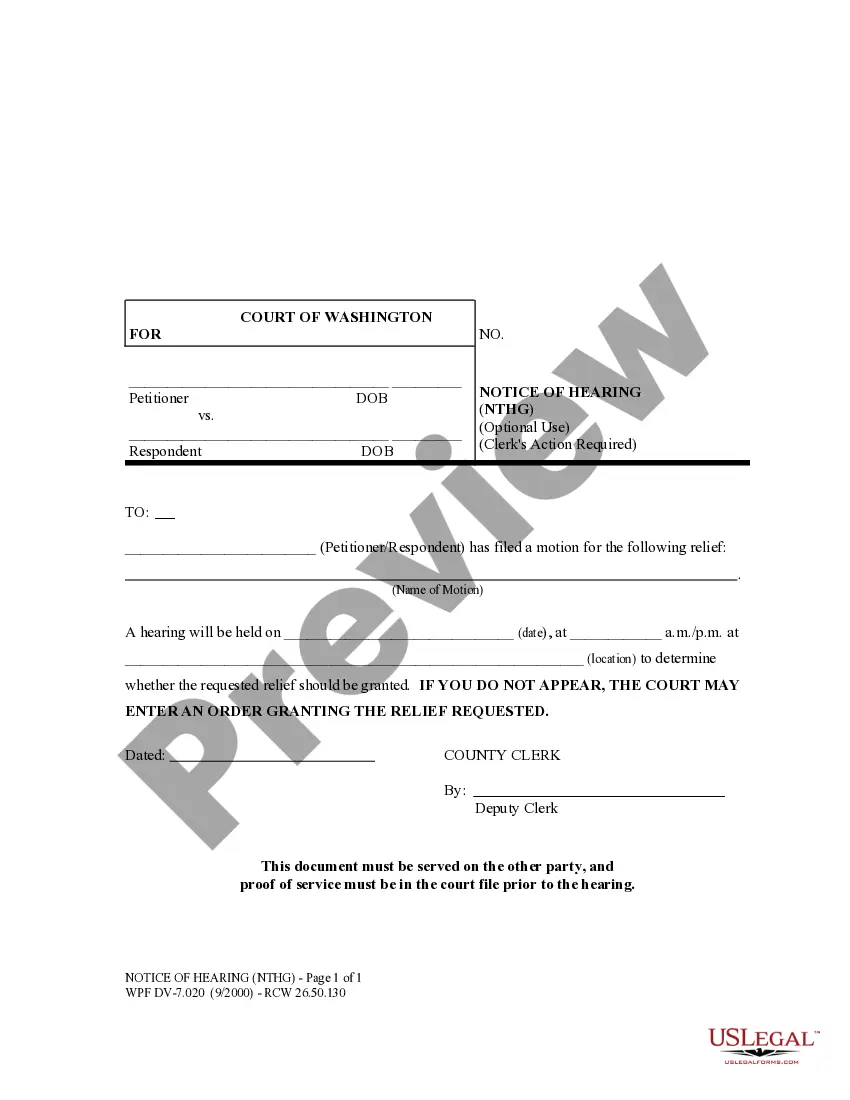

- Step 2. Utilize the Preview option to view the contents of the form. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other types of the legitimate form template.

- Step 4. Once you have found the form you want, click the Buy now button. Select your preferred pricing plan and enter your credentials to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse.

Form popularity

FAQ

In a Virginia divorce, a wife is entitled to a fair distribution of marital assets and liabilities, which can include property, savings, and other financial resources. The equitable distribution principle does not guarantee equal division but rather considers various factors like the length of the marriage and contributions made by each spouse. Utilizing a Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can protect her interests, ensuring that her share is not diminished by any debts incurred by the husband during the marriage.

A wife in Virginia typically inherits all or part of her husband's estate, depending on the presence of a will and other heirs. If there's no will, the state's intestacy laws dictate the distribution. Having a Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can further clarify her rights, preventing his debts from impacting what she inherits. This legal tool can simplify the complexities of estate management during this sensitive time.

In Virginia, when a husband passes away, the wife is entitled to a share of the estate. This can include property, personal belongings, and any financial accounts. If a Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse has been filed, it safeguards her inheritance from any debts he may have had. Thus, she can focus on mourning without the added burden of financial uncertainties.

In Virginia, property division during divorce typically follows equitable distribution, not automatic 50-50 splits. If the house is solely in your name, your wife may not have direct entitlement. However, factors like contributions made to the property can influence her claim. Understanding the Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can help protect assets during this process as well.

When a husband dies, his wife may receive several benefits. She may inherit his assets, according to Virginia's intestate succession laws if he did not leave a will. Moreover, if a Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse has been properly recorded, it can further clarify her financial standing regarding any debts. This document helps ensure that his debts do not impact her inheritance, providing peace of mind during a challenging time.

Creditors may pursue you for your wife's debt if you both share a joint account or obligation. In Virginia, debts incurred during marriage can potentially affect both partners, depending on the situation. If you want to safeguard your finances, consider utilizing a Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. This document can provide added protection and clarity.

Yes, creditors can go after your spouse for your debt if you have joint accounts or obligations. In Virginia, creditors often seek repayment from any assets owned jointly. It is important to establish clear financial boundaries to protect your spouse. You might find a Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse helpful in outlining these boundaries.

When you marry, you do not automatically take on your spouse's debts. Virginia law generally holds each spouse responsible for their own liabilities. However, during marriage, creditors may pursue joint assets for debts incurred by either spouse. To clarify your responsibilities, consider using a Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse.

In Virginia, a spouse may inherit property, assets, and possibly debts from their deceased partner. The distribution depends on the presence of a will and the property laws in Virginia. If no will exists, the Virginia intestacy laws guide how assets are allocated. Understanding the implications of a Virginia Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse is crucial, as this document can clarify responsibilities regarding debts incurred by a spouse, protecting you in unfortunate situations.

Dissipation of marital assets in Virginia refers to the wasting of marital property by one spouse for non-marital purposes, often during separation or pending divorce. This act can impact the division of property during legal proceedings. If you suspect dissipation, seek legal advice promptly to protect your interests.