Virginia Consumer Loan Agreement

Description

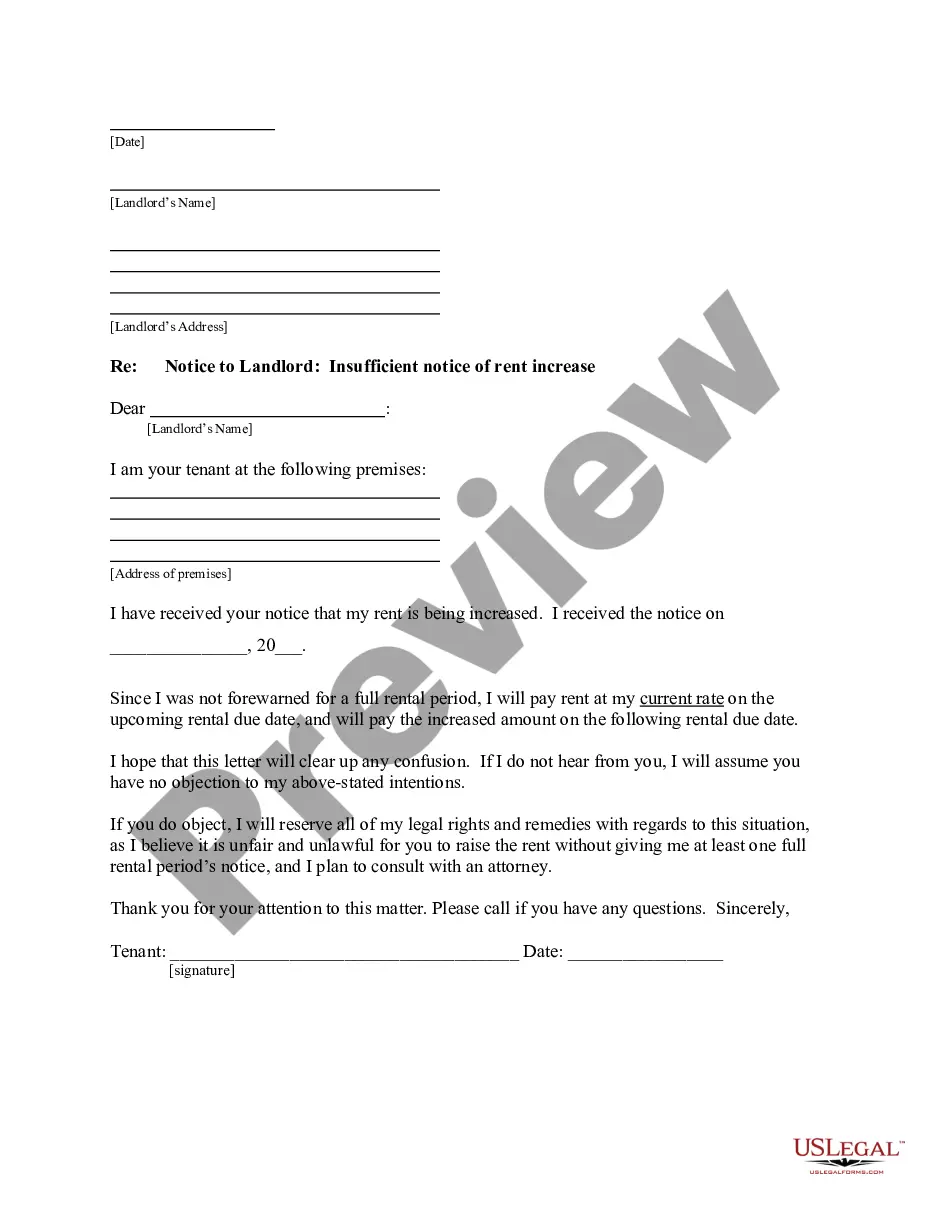

How to fill out Consumer Loan Agreement?

If you need to comprehensive, obtain, or print legitimate document templates, use US Legal Forms, the biggest variety of legitimate kinds, that can be found online. Utilize the site`s simple and practical lookup to obtain the papers you require. Different templates for organization and specific reasons are categorized by classes and states, or key phrases. Use US Legal Forms to obtain the Virginia Consumer Loan Agreement with a couple of click throughs.

If you are presently a US Legal Forms client, log in in your account and then click the Download option to find the Virginia Consumer Loan Agreement. You can also access kinds you formerly saved inside the My Forms tab of your respective account.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have chosen the form for your proper metropolis/region.

- Step 2. Take advantage of the Review choice to examine the form`s articles. Never forget about to read the description.

- Step 3. If you are unsatisfied together with the kind, take advantage of the Research field on top of the display to find other models in the legitimate kind design.

- Step 4. After you have identified the form you require, go through the Acquire now option. Opt for the costs program you favor and put your qualifications to sign up for the account.

- Step 5. Approach the financial transaction. You should use your credit card or PayPal account to finish the financial transaction.

- Step 6. Find the structure in the legitimate kind and obtain it on your gadget.

- Step 7. Complete, revise and print or indication the Virginia Consumer Loan Agreement.

Every single legitimate document design you acquire is your own for a long time. You may have acces to every kind you saved within your acccount. Go through the My Forms portion and pick a kind to print or obtain once more.

Contend and obtain, and print the Virginia Consumer Loan Agreement with US Legal Forms. There are many professional and condition-specific kinds you can use for your organization or specific needs.

Form popularity

FAQ

Unlawful contracts void; recovery of amounts paid. A. A loan contract shall be void if any act has been done in the making or collection thereof that violates § 6.2-1501.

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

Consumer loans are structured in one of two key ways: either as a fixed loan that is repaid over a set period of time or as a revolving credit account that you can use at your own discretion. Closed loans are structured with a fixed interest rate, monthly payment amount, and repayment term.

Lenders offer two types of consumer loans ? secured and unsecured ? that are based on the amount of risk both parties are willing to take.

The minimum duration of the loan is four months and the maximum duration of the loan is 24 months; however, the minimum duration of the loan may be less than four months if the total monthly payment on the loan does not exceed the greater of (i) an amount that is five percent of the borrower's verified gross monthly ...

Virginia Consumer Protection Act ? The Virginia Consumer Protection Act of 1977 was created to ?promote fair and ethical standards of dealing between suppliers and the consuming public.? Virginia Automobile Repairs Facilities Act - provides protections for consumers considering having repair work done on their vehicle.

A consumer credit contract is a formal written agreement to borrow money, or pay something off over time, for personal use. You pay interest and fees for the use of the bank or finance company's money. One or more of your assets might secure the loan. Examples include: vehicle finance to buy a car, van, or boat.

Consumer installment loans, including car loans, student loans, and home mortgage loans, are examples of consumer loans. Other examples of consumer loans include certain revolving credit products, such as consumer credit cards and personal lines of credit.