Virginia Consumer Loan Application - Personal Loan Agreement

Description

How to fill out Consumer Loan Application - Personal Loan Agreement?

You can spend hours online trying to find the official document template that meets the federal and state standards you require. US Legal Forms offers a vast selection of legal forms that are reviewed by experts.

You can easily download or print the Virginia Consumer Loan Application - Personal Loan Agreement from our service. If you already have a US Legal Forms account, you may Log In and click the Obtain button. After that, you can fill out, modify, print, or sign the Virginia Consumer Loan Application - Personal Loan Agreement.

Every legal document template you purchase is yours forever. To get another copy of the purchased form, go to the My documents tab and click the corresponding button. If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, make sure that you have selected the correct document template for the area/city you choose. Check the form description to ensure you have selected the right form.

Download and print a multitude of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

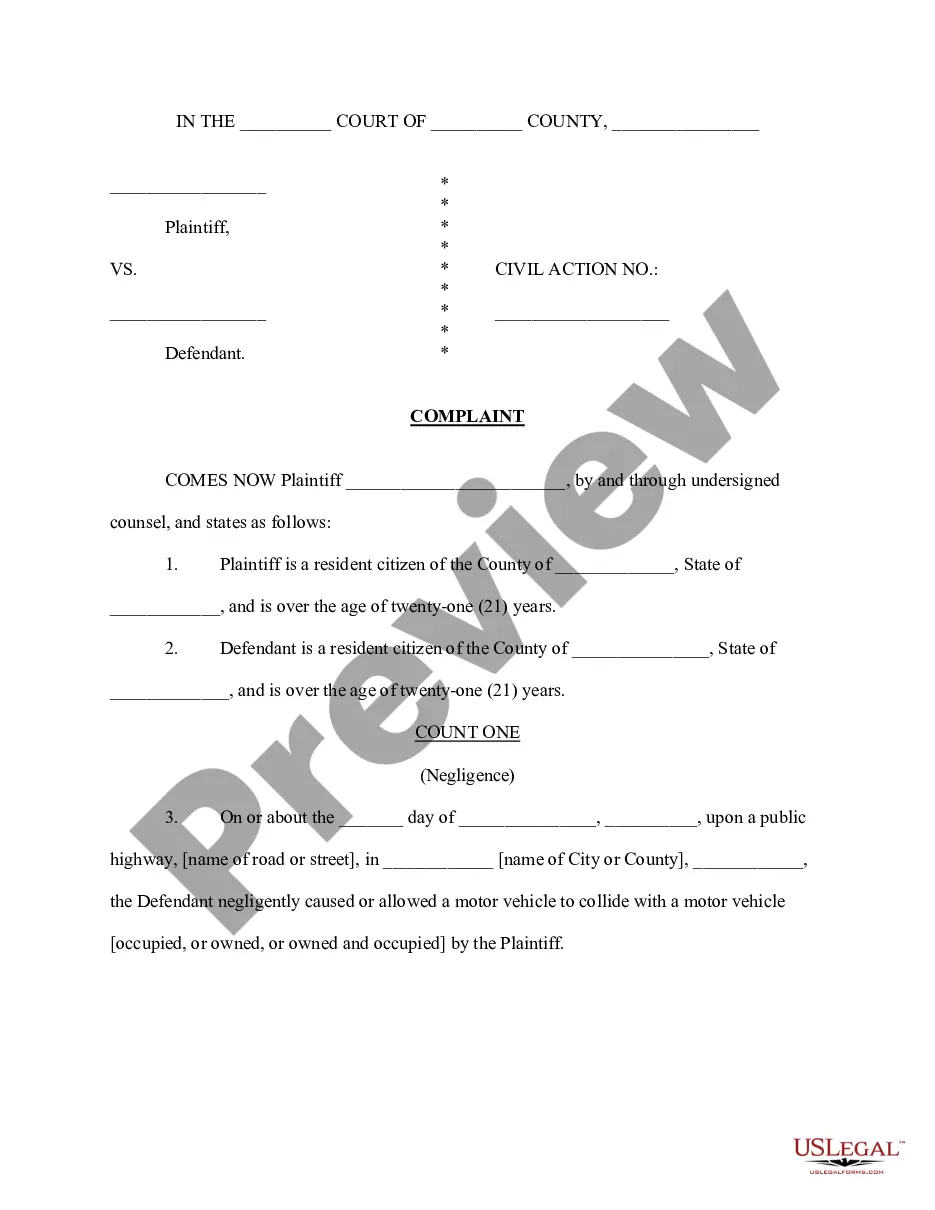

- If available, use the Preview button to review the document template as well.

- If you want to find another version of your form, use the Search section to locate the template that meets your needs.

- Once you have found the template you require, click Buy now to proceed.

- Select the pricing plan you want, enter your details, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal document.

- Choose the format of your document and download it to your device.

- Make changes to your document if necessary. You can fill out, edit, sign, and print the Virginia Consumer Loan Application - Personal Loan Agreement.

Form popularity

FAQ

The minimum duration of the loan is four months and the maximum duration of the loan is 24 months; however, the minimum duration of the loan may be less than four months if the total monthly payment on the loan does not exceed the greater of (i) an amount that is five percent of the borrower's verified gross monthly ...

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

§ 6.2-303. Except as otherwise permitted by law, no contract shall be made for the payment of interest on a loan at a rate that exceeds 12 percent per year.

Common items in personal loan agreements. The name, address, and contact information of the borrower. The name, address, and contact information of the lender. A plan for loan payment, such as a monthly payment plan with start dates and due dates. The maturity date or the date that the final payment is due on the loan.

A personal loan agreement is a legally binding contract that defines the expectations for both a borrower and a lender. It can be drawn up with an official lender, like a bank or credit union, or used in a more informal situation, such as with a friend who's lending you an amount of money.

While you have ample flexibility with how to use a personal loan, there are some restrictions. For example, lenders typically do not allow you to use a personal loan for college tuition or to repay existing student loans. Lenders also may not permit a personal loan to fund the purchase of a home.

If you do not meet a lender's specific eligibility requirements, you will not be able to get a personal loan with that lender. Lenders may deny a personal loan application if your credit score is too low, your debt load is too high, or your income is not high enough to repay the loan.

A personal loan (also known as a consumer loan) describes any situation in which an individual borrows money for personal need, including making investments in a company. All personal loans have three common elements: Evidence of the debt (promissory note)