This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virginia Deed of Trust Securing Obligations Pursuant to Indemnification Agreement

Description

How to fill out Deed Of Trust Securing Obligations Pursuant To Indemnification Agreement?

If you wish to complete, obtain, or printing authorized record layouts, use US Legal Forms, the largest collection of authorized forms, that can be found on the web. Use the site`s basic and practical research to discover the documents you require. A variety of layouts for business and individual functions are categorized by classes and says, or key phrases. Use US Legal Forms to discover the Virginia Deed of Trust Securing Obligations Pursuant to Indemnification Agreement in a number of click throughs.

When you are presently a US Legal Forms consumer, log in to your accounts and click on the Obtain switch to obtain the Virginia Deed of Trust Securing Obligations Pursuant to Indemnification Agreement. You can even entry forms you in the past delivered electronically within the My Forms tab of your respective accounts.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Ensure you have selected the shape for the right area/country.

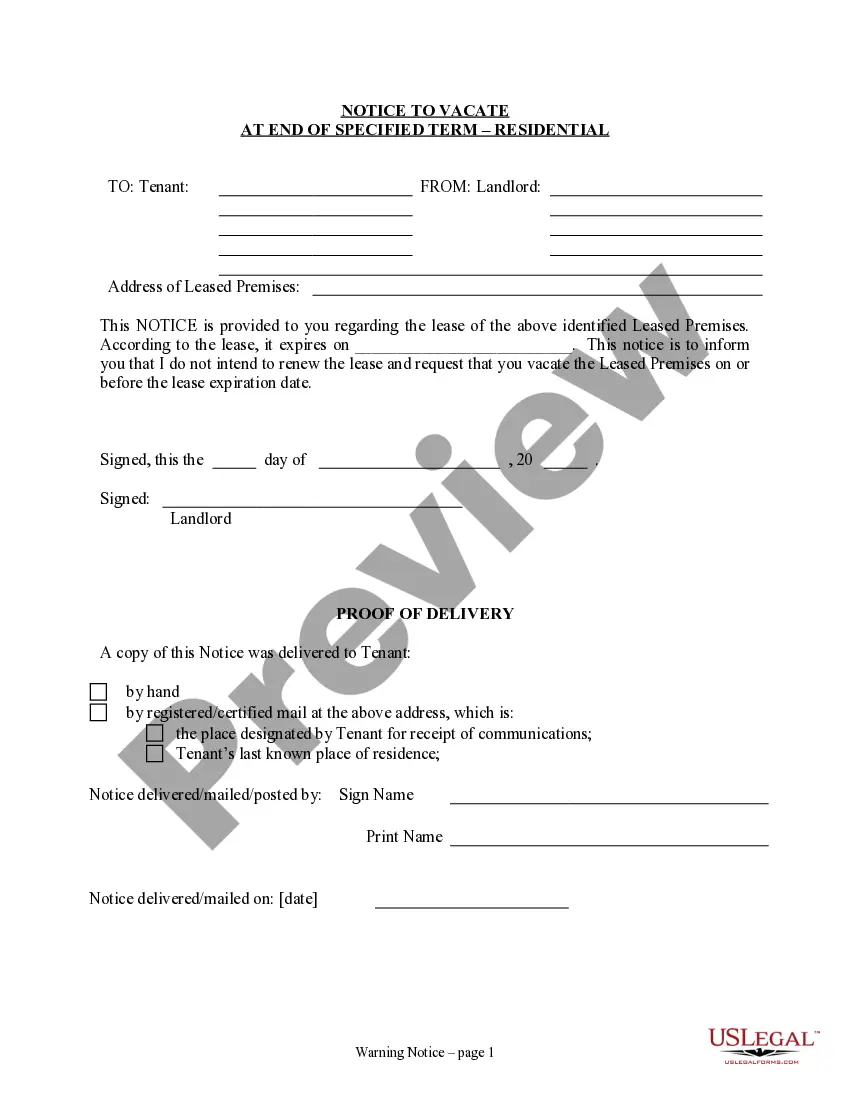

- Step 2. Make use of the Preview solution to look through the form`s information. Never neglect to read the description.

- Step 3. When you are not satisfied together with the kind, take advantage of the Search industry at the top of the display screen to get other types of the authorized kind design.

- Step 4. After you have discovered the shape you require, click on the Purchase now switch. Choose the rates prepare you choose and put your accreditations to register on an accounts.

- Step 5. Process the transaction. You may use your charge card or PayPal accounts to complete the transaction.

- Step 6. Select the format of the authorized kind and obtain it on your own gadget.

- Step 7. Comprehensive, modify and printing or indicator the Virginia Deed of Trust Securing Obligations Pursuant to Indemnification Agreement.

Every authorized record design you acquire is your own permanently. You possess acces to each and every kind you delivered electronically in your acccount. Click the My Forms area and pick a kind to printing or obtain once more.

Contend and obtain, and printing the Virginia Deed of Trust Securing Obligations Pursuant to Indemnification Agreement with US Legal Forms. There are thousands of specialist and condition-particular forms you may use for the business or individual requirements.

Form popularity

FAQ

How deed of trust construed; duties, rights, etc., of parties. Every deed of trust to secure debts or indemnify sureties is in the nature of a contract and shall be construed ing to its terms to the extent not in conflict with the requirements of law.

THIS DEED OF TRUST IS GIVEN TO SECURE: Payment and performance of the Guaranteed Obligations; advances made by Beneficiary to protect the Premises or the lien of this Deed of Trust or to pay taxes, assessments, insurance premiums, and all other amounts that Grantor has agreed to pay pursuant to the provisions hereof; ...

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

In a deed of trust, the borrower is called the trustor and the lender is the beneficiary. The trustee holds title to the property until the trustor has fully repaid the loan to the beneficiary, at which time the lender notifies the trustee, who then transfers full title of the property to the trustor.

A Virginia deed of trust transfers title of an owner's property to a trustee as security for repayment to a beneficiary who financed the real estate purchase. The trustee's role is to hold onto the title until the owner (grantor ) repays the debt, at which point they'll transfer the title back.

THIS DEED OF TRUST IS GIVEN TO SECURE: Payment and performance of the Guaranteed Obligations; advances made by Beneficiary to protect the Premises or the lien of this Deed of Trust or to pay taxes, assessments, insurance premiums, and all other amounts that Grantor has agreed to pay pursuant to the provisions hereof; ...

A deed of trust can benefit the lender because it typically allows a faster foreclosure on a home. Most deeds of trust have a ?non-judicial foreclosure? clause, which means that the lender won't have to wait for the court system to review and approve the foreclosure process.

A deed of indemnity is a type of agreement between multiple parties that specifies the consequences of a specific event or events, usually based on protecting one or more of the parties from being held responsible.