The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Virginia Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor

Description

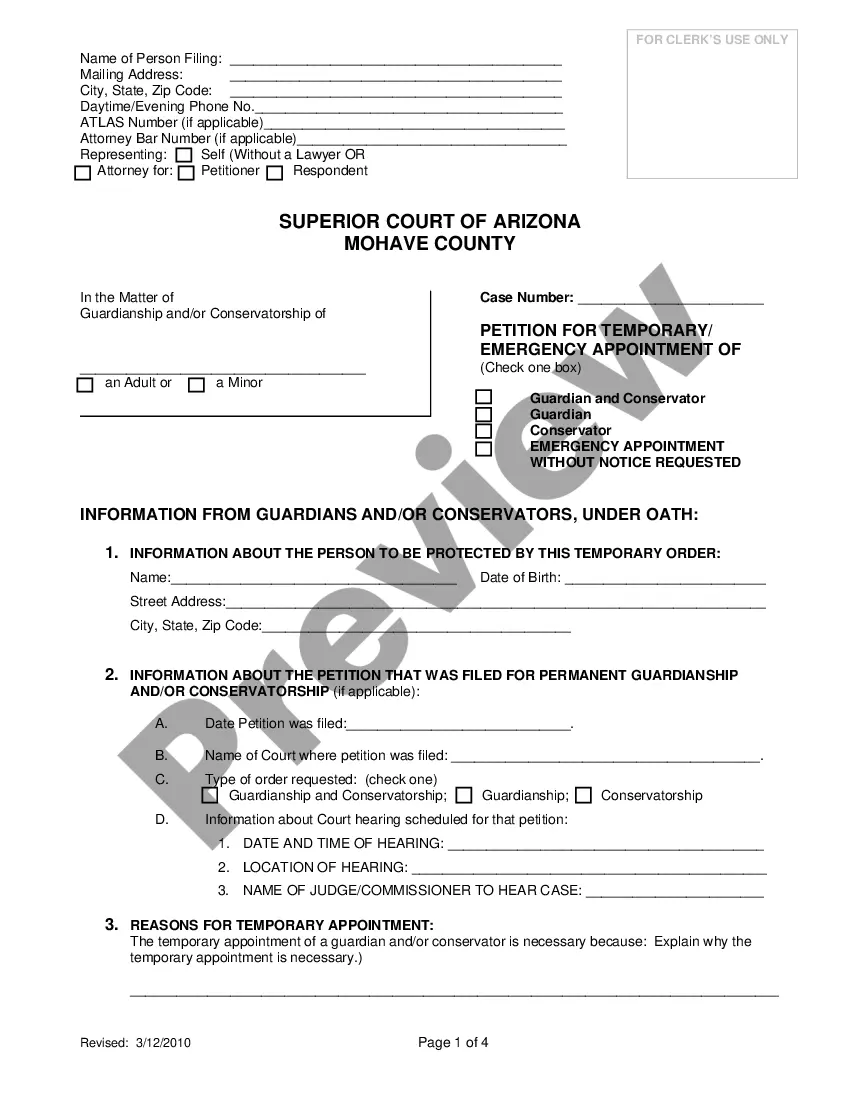

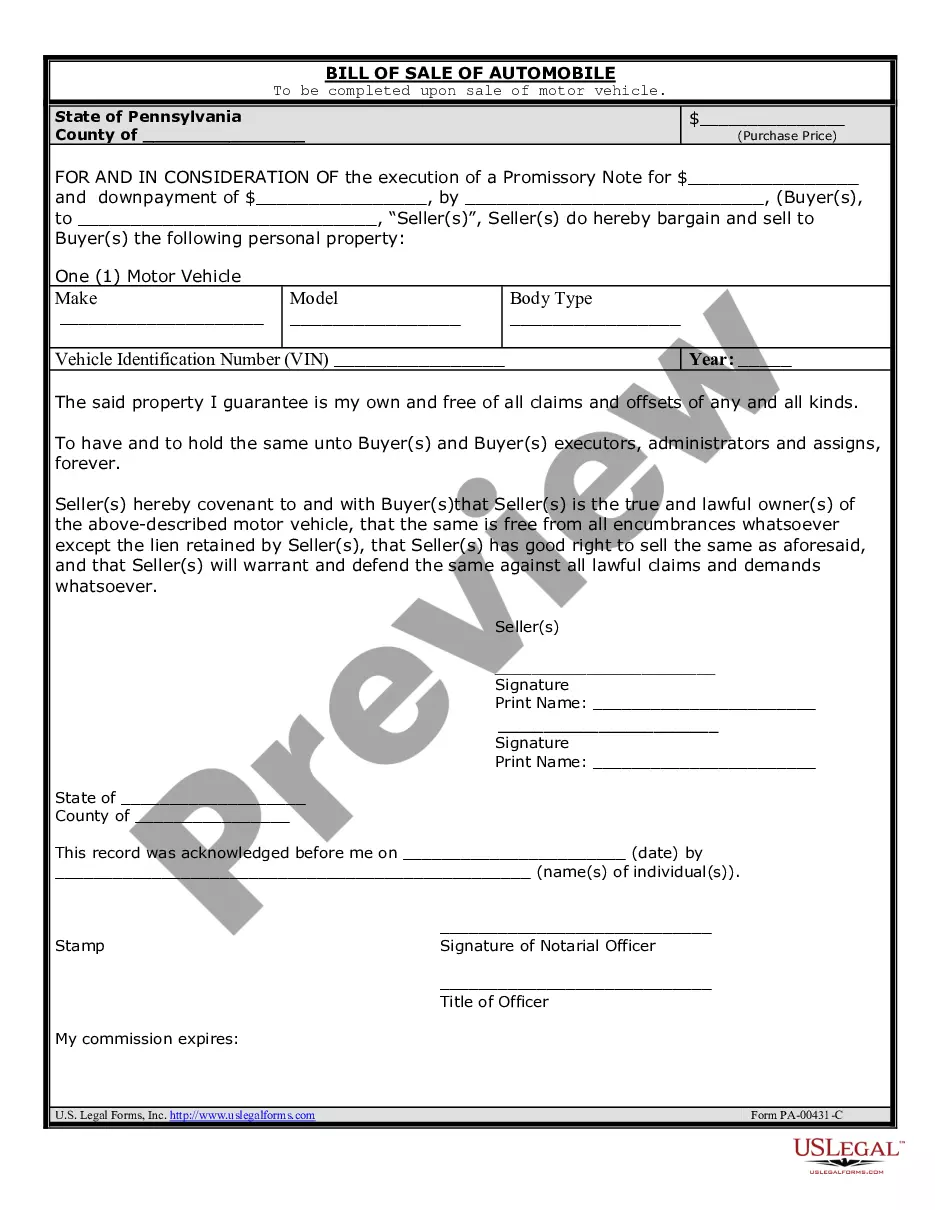

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Due To False Oath Or Account Of Debtor?

Are you currently in the position where you will need papers for either organization or individual functions virtually every time? There are plenty of legal document web templates available online, but finding types you can rely is not easy. US Legal Forms gives a huge number of kind web templates, just like the Virginia Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor, that happen to be composed in order to meet state and federal requirements.

Should you be currently familiar with US Legal Forms website and have an account, simply log in. Following that, you can obtain the Virginia Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor format.

If you do not have an account and need to begin using US Legal Forms, abide by these steps:

- Discover the kind you require and ensure it is for your proper metropolis/area.

- Make use of the Review switch to examine the form.

- Browse the outline to ensure that you have selected the right kind.

- When the kind is not what you`re searching for, utilize the Look for area to obtain the kind that meets your needs and requirements.

- When you find the proper kind, simply click Buy now.

- Pick the prices plan you desire, fill in the specified info to generate your money, and pay for your order utilizing your PayPal or Visa or Mastercard.

- Choose a handy document format and obtain your copy.

Locate every one of the document web templates you possess bought in the My Forms menus. You can obtain a additional copy of Virginia Complaint Objecting to Discharge of Debtor in Bankruptcy Due to False Oath or Account of Debtor anytime, if necessary. Just click the needed kind to obtain or print the document format.

Use US Legal Forms, the most extensive selection of legal kinds, to save time as well as prevent mistakes. The services gives expertly produced legal document web templates that you can use for an array of functions. Create an account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

The consequences of a Chapter 7 bankruptcy are significant: you will likely lose property, and the negative bankruptcy information will remain on your credit report for ten years after the filing date.

Not all debts are discharged. The debts discharged vary under each chapter of the Bankruptcy Code. Section 523(a) of the Code specifically excepts various categories of debts from the discharge granted to individual debtors. Therefore, the debtor must still repay those debts after bankruptcy.

Disadvantages to a Chapter 7 Bankruptcy: If you want to keep a secured asset, such as a car or home, and it is not completely covered by your bankruptcy exemptions then Chapter 7 is not an option. The automatic stay created by filing Chapter 7 Bankruptcy only serves as a temporary defense against foreclosure.

More than 95% of all Chapter 7 bankruptcy filers in the United Stateskeep all of their belongings. That's because the law protects certain property ? called exempt property ? from your lenders/creditors.

Automatic Stay -- Immediately after a bankruptcy case is filed, an injunction (called the "Automatic Stay") is generally imposed against certain creditors who want to start or continue taking action against a debtor or the debtor's property. Bankruptcy Code Section 362 discusses the Automatic Stay.

A Chapter 7 bankruptcy wipes out mortgages, car loans, and other secured debts. But if you don't continue to pay as agreed, the lender will take back the home, car, or other collateralized property using the lender's lien rights.

Examples of nonexempt assets that can be subject to liquidation: Additional home or residential property that is not your primary residence. Investments that are not part of your retirement accounts. An expensive vehicle(s) not covered by bankruptcy exemptions.

The automatic stay has a broad scope, applying to all creditors, whether secured or unsecured, and to all of the debtor's property, wherever located. It forbids creditors from pursuing both formal and informal actions and remedies against the debtor and its property.