Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

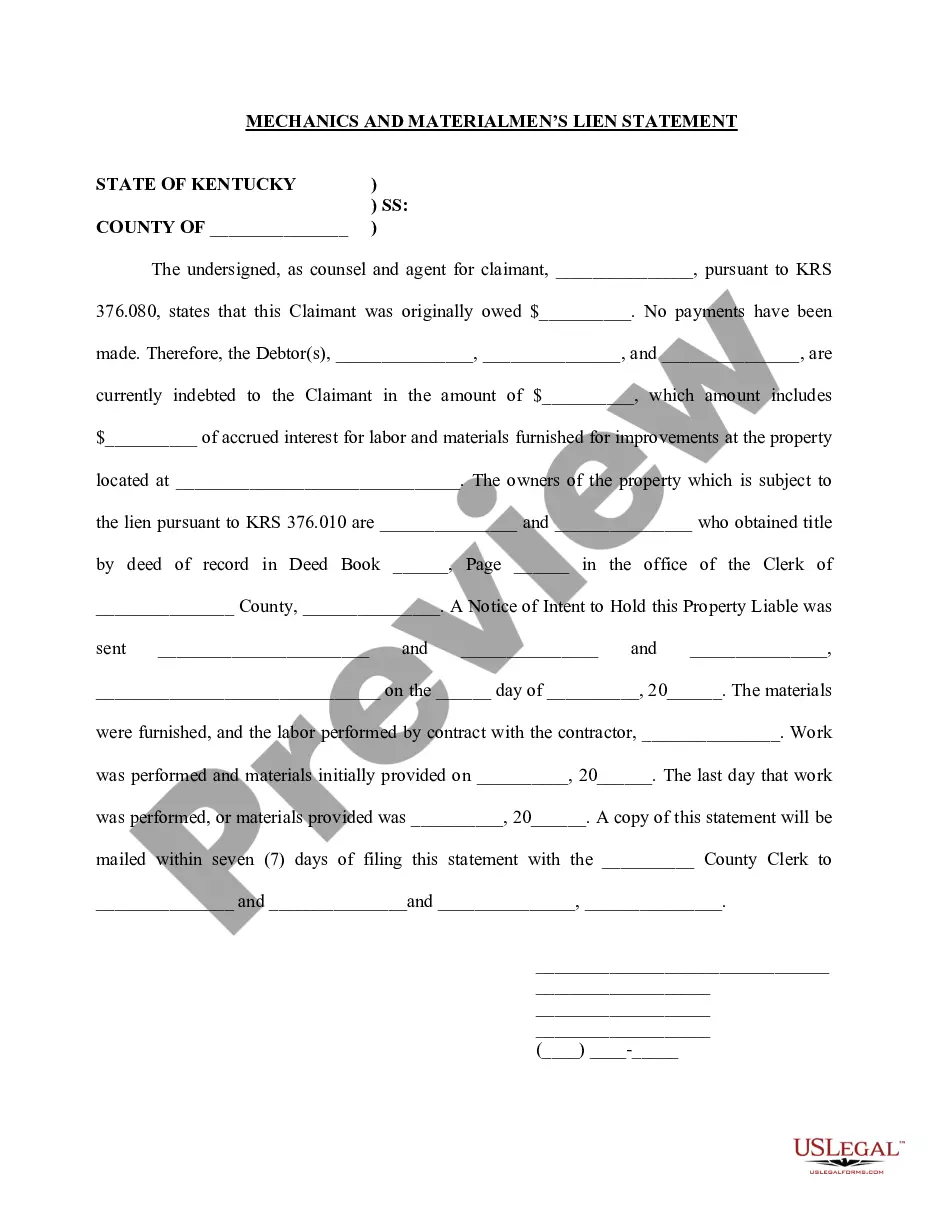

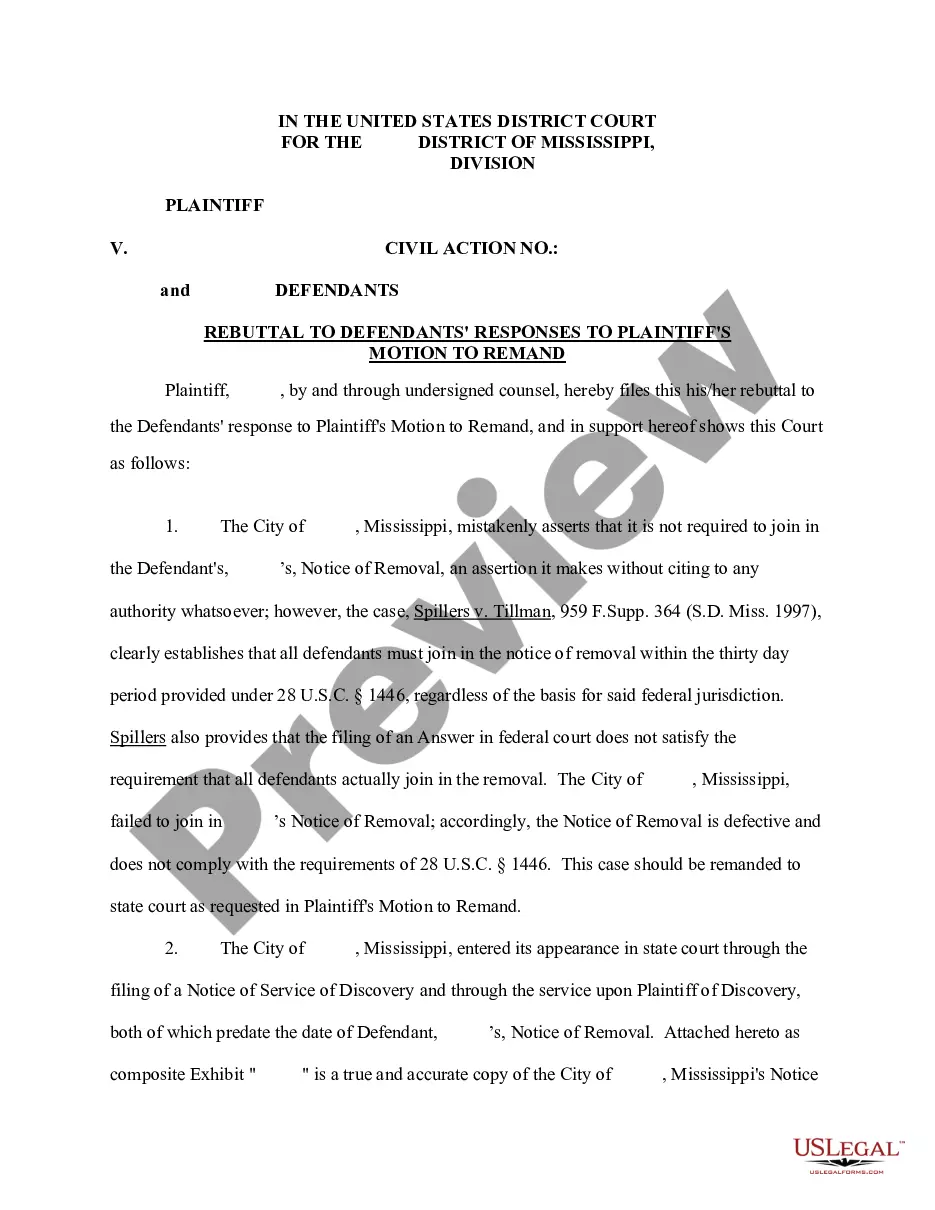

How to fill out Resolution Selecting Bank For Corporation And Account Signatories - Corporate Resolutions?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By using the website, you will find thousands of forms for business and personal needs, organized by categories, states, or keywords. You can access the latest versions of forms such as the Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions in just seconds.

If you already have a monthly membership, Log In to download the Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions from the US Legal Forms collection. The Download button will appear on each form you view. You have access to all previously obtained forms in the My documents section of your account.

Process the purchase. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the obtained Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Gain access to the Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have chosen the correct form for your city/state.

- Click the Review button to examine the content of the form.

- Check the form summary to ensure you have selected the right one.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy Now button.

- Then, select your preferred pricing plan and provide your credentials to register for the account.

Form popularity

FAQ

Corporate bank resolution refers to the documented decisions made by a company's board regarding who can access and manage corporate bank accounts. Bank signature cards are forms that list the individuals authorized to sign for account activities. Both these elements are vital for maintaining financial integrity and security in corporate transactions. Utilize US Legal Forms to simplify the creation of these important documents to streamline your banking processes.

To write a board resolution for an authorized signatory, start by stating the meeting details and the authority being granted. Clearly identify who will act as the authorized signatory and delineate the tasks they are allowed to perform on behalf of the corporation. This ensures transparency and accountability. Take advantage of resources from US Legal Forms to obtain a well-structured template.

A board resolution letter of authorization is a formal statement from the board of directors that grants specific powers to individuals within the company. This letter typically outlines the scope of authority given, whether for banking transactions or other financial matters. Ensuring proper documentation protects the corporation and clarifies responsibilities; consider using the US Legal Forms platform for support.

The resolution for signatory authority is a formal document that designates individuals within a corporation who can execute transactions on behalf of the company. This resolution is crucial for banking and financial dealings, ensuring that only authorized personnel can make important financial decisions. Explore options available on US Legal Forms for crafting this vital document efficiently.

Filling out a banking resolution involves selecting a clear title for the document, like 'Banking Resolution for Corporate Accounts'. Then, list the corporation's details and specify who is authorized to act on behalf of the business. Be sure to include signatures from relevant officers to validate the document. This is where the US Legal Forms platform can provide useful resources for accurate completion.

To write a resolution to change a bank's signatories, draft a document that states the intention of the board to modify signatories. Include the names of current signatories and the new individuals authorized. Ensure the document is signed by the board members to validate the resolution. Utilizing the services at US Legal Forms can simplify this process with ready-made templates tailored for corporate needs.

To write an authorized signatory letter, begin by stating your company’s name, address, and date. Clearly identify the individuals who hold the signatory authority, specifying their roles within the corporation. Include a declaration of their authorization to sign on behalf of the company for banking purposes. For a smooth process, consider using a reliable platform like US Legal Forms for customized templates.

A corporate authorization resolution is a formal document that grants authority to individuals within a corporation to act on its behalf. This may include signing contracts or making significant financial decisions, such as opening bank accounts. It plays a vital role in the Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions process, ensuring that the right persons are empowered to manage corporate affairs effectively.

An example of a corporate resolution could be a document stating that the board approves a specific bank to hold the LLC’s funds and designates certain individuals as authorized signatories. This resolution outlines clear actions for the corporation and provides legal backing for banking transactions. Utilizing the Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions framework, you can ensure that your example follows best practices.

Writing a corporate resolution for an LLC involves including the LLC’s name, the date of the meeting, and the specific resolution being adopted. You should also outline the powers granted to members or managers, including banking privileges. By following this format, you help ensure compliance with the relevant guidelines, such as those within the Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.