Virginia Lien Notice

Description

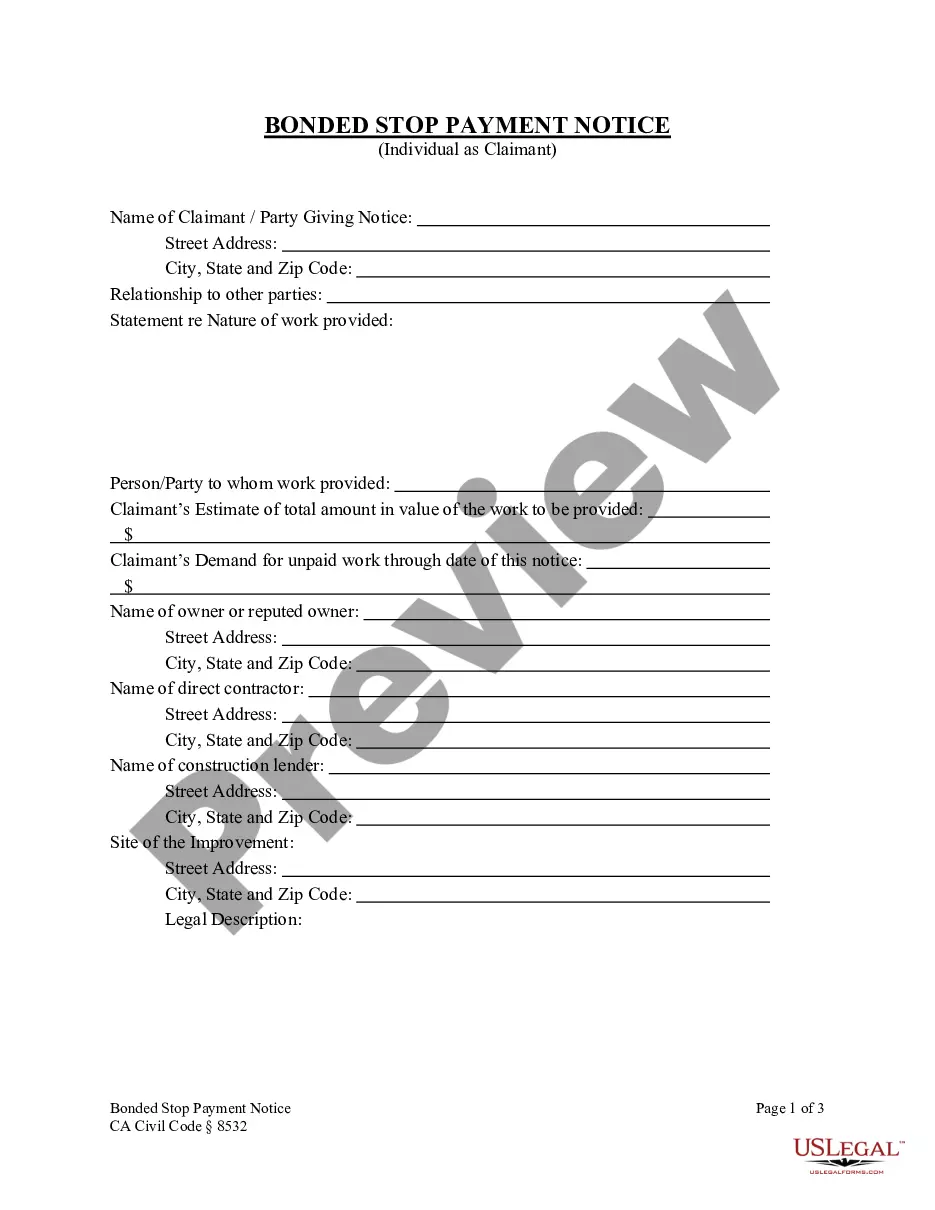

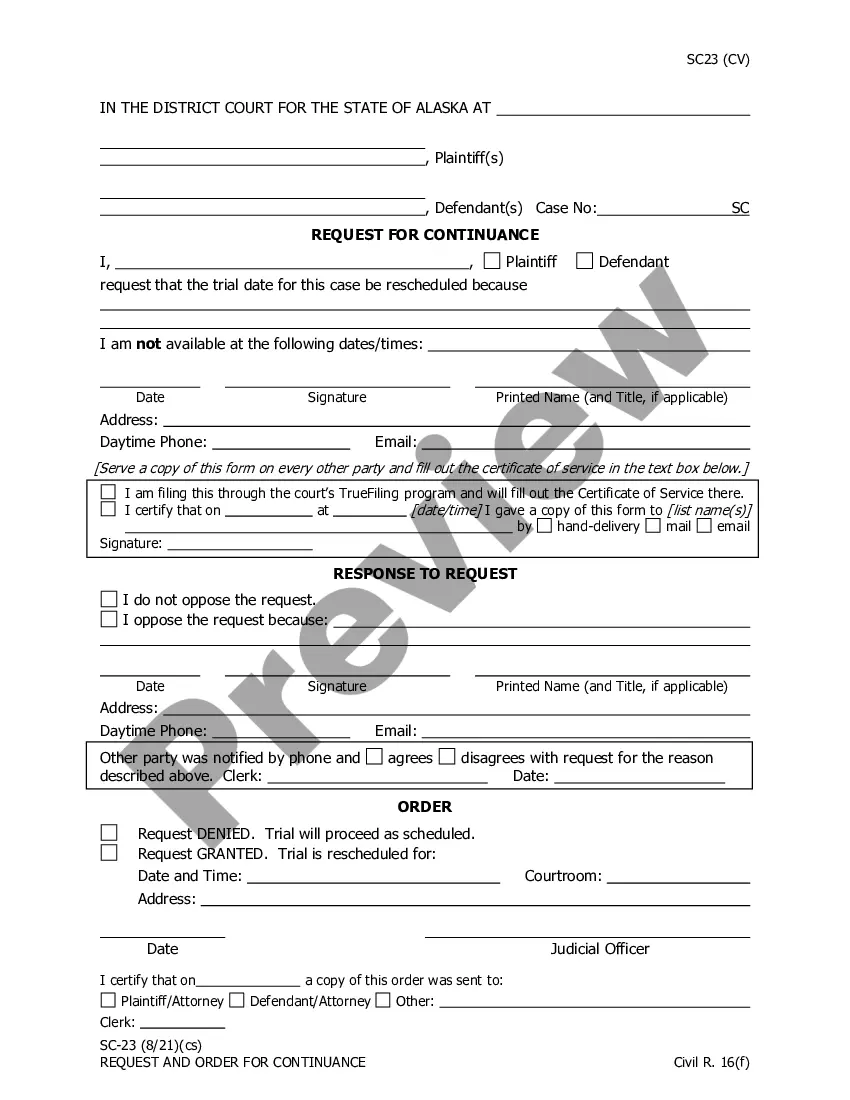

How to fill out Lien Notice?

Have you ever been in a situation where you need documents for either professional or personal purposes nearly every day.

There are numerous authentic document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms provides a vast collection of form templates, such as the Virginia Lien Notice, designed to comply with federal and state regulations.

Once you find the right form, click Acquire now.

Select the payment plan you prefer, fill in the necessary details to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Virginia Lien Notice template.

- If you do not have an account and want to start using US Legal Forms, follow these guidelines.

- Find the template you need and ensure it matches the correct city/county.

- Use the Preview feature to review the document.

- Check the description to confirm that you have chosen the correct template.

- If the template is not what you need, use the Lookup field to find the one that suits your requirements.

Form popularity

FAQ

You have up to 150 days to file a lien in Virginia from the last date of labor or materials provided. This time limit is crucial and dictates when you can legally stake your claim for payment. It is advisable to keep detailed records of your project timeline to ensure you meet this filing deadline. Utilizing resources from platforms like US Legal Forms can help you stay on track with the necessary documentation.

Yes, Virginia provides statutory lien waivers that help ensure payment is made for services rendered in construction projects. These waivers can protect both contractors and property owners and can facilitate smoother transactions. Using these waivers properly is essential to maintaining good relationships in the construction industry. Ensure you understand how to implement these waivers to fully benefit from them.

In Virginia, a contractor has a maximum of 150 days from the last day of work or delivery of materials to file a lien. This timeframe is crucial for contractors aiming to secure payment. If you wait longer than this period, you may lose the right to file a lien entirely. It's essential to stay organized and act promptly to protect your rights.

Filing a lien in Virginia involves several steps. First, gather necessary information about the debt and the property, including the property owner’s details and the amount owed. Next, complete the proper forms to create your Virginia Lien Notice and file it with the local circuit court. Platforms like US Legal Forms can provide the required documents and help you navigate the filing process effectively.

Yes, Virginia is a tax lien state. This means that if property taxes remain unpaid, the state has the authority to place a lien against the property. These tax liens can impact property ownership and can lead to foreclosure if the taxes are not settled. Understanding tax lien procedures is essential for property owners to avoid losing their assets.

The 150-day rule for a mechanic's lien in Virginia refers to the timeframe within which a lien must be filed after the work has been completed. Specifically, this means you have 150 days from the last date of work or materials provided to file your Virginia Lien Notice. This rule ensures that claims are made timely and protects the rights of both contractors and property owners. Understanding this rule is crucial for anyone involved in construction or renovation projects.

In Virginia, a contractor must file a lien within 90 days after completing work or providing materials for a project. This time frame is crucial, as failing to file within this period can result in losing the right to claim a lien. Timely filing of a Virginia Lien Notice ensures that contractors are protected and can seek payment for their work. Utilizing platforms like USLegalForms can assist contractors in understanding their legal rights and responsibilities.

To find a lien on a property in Virginia, you can start by checking the local land records office, where liens are typically recorded. Many county offices offer online databases that allow you to search by the property owner’s name or address. You can also use third-party services to streamline this process. Accessing USLegalForms can provide you with additional guidance on how to search effectively and understand the implications of any liens you discover.

A notice of intent is an official document that informs others of your plan to file a Virginia Lien Notice. This notice is important as it establishes your intention to claim a lien on a property for unpaid debts. By sending this notification, you create a record that can protect your right to payment. It is a proactive step that can help resolve payment disputes before they escalate.

Releasing a lien in Virginia involves a straightforward process that begins with submitting a release document to the circuit court where the lien was filed. This document should include specific information such as the original lien details and a statement confirming that the debt has been satisfied. Once the release is filed, it will clear the property's title, allowing the owner to proceed without the burden of the lien. Consider using resources like uslegalforms to simplify this process.