Virginia Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC

Description

A distributional interest in a limited liability company is personal property and may be transferred in whole or in part. The following form is a agreement whereby the sole member of the LLC transfers his 100% interest as such member to another party.

How to fill out Agreement For Sale Of All Rights, Title And Interest In Limited Liability Company LLC?

You are able to devote several hours on-line attempting to find the legal document template which fits the state and federal requirements you want. US Legal Forms provides 1000s of legal kinds that are analyzed by pros. It is possible to down load or print out the Virginia Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC from my service.

If you already possess a US Legal Forms account, it is possible to log in and click on the Down load option. Following that, it is possible to complete, revise, print out, or signal the Virginia Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC. Each and every legal document template you purchase is yours forever. To get another duplicate for any obtained develop, go to the My Forms tab and click on the related option.

If you use the US Legal Forms site the first time, follow the straightforward instructions beneath:

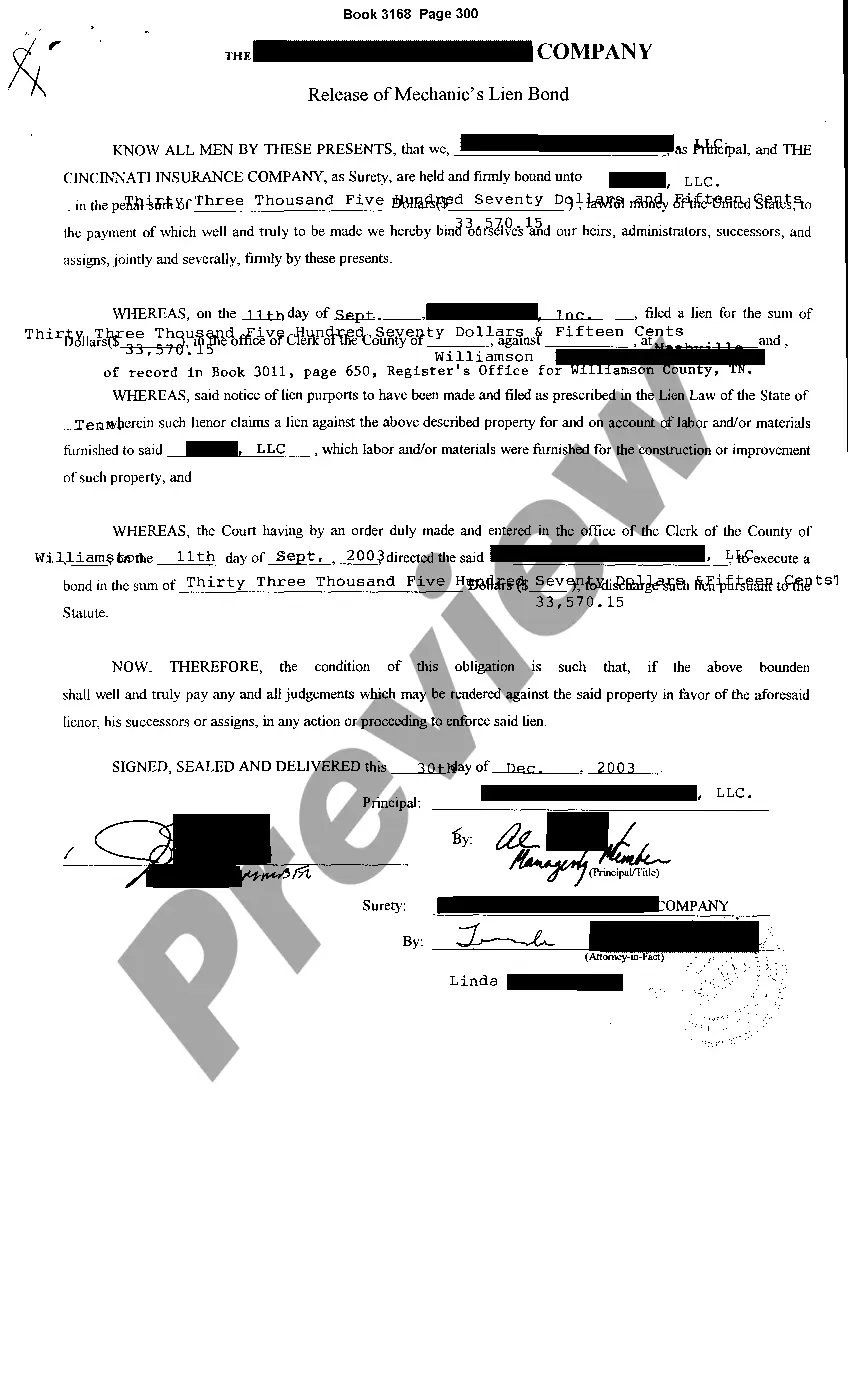

- Initial, make certain you have chosen the correct document template for that region/city of your liking. See the develop description to ensure you have picked the proper develop. If accessible, take advantage of the Review option to check from the document template also.

- If you would like find another version in the develop, take advantage of the Research industry to obtain the template that suits you and requirements.

- Upon having identified the template you want, click on Purchase now to proceed.

- Select the costs plan you want, enter your credentials, and register for a free account on US Legal Forms.

- Complete the transaction. You should use your charge card or PayPal account to cover the legal develop.

- Select the file format in the document and down load it for your product.

- Make modifications for your document if needed. You are able to complete, revise and signal and print out Virginia Agreement for Sale of all Rights, Title and Interest in Limited Liability Company LLC.

Down load and print out 1000s of document templates making use of the US Legal Forms website, which offers the largest selection of legal kinds. Use professional and condition-specific templates to deal with your small business or specific requires.

Form popularity

FAQ

Management of limited liability company. A. Except to the extent that the articles of organization or an operating agreement provides in writing for management of a limited liability company by a manager or managers, management of a limited liability company shall be vested in its members.

Requirements for the Articles of Organization The document required to form an LLC in Virginia is called the Articles of Organization. The information required in the formation document varies by state. Virginia's requirements include: Registered agent.

Stock Purchase Agreements: the stock in a corporation is sold to a new owner, often making the new owner or the sole or majority owner. Membership Interest Transfer Agreements: the membership interests in an LLC are sold or transferred, often used when a business partner or member of the LLC leaves the business.

A membership interest purchase agreement, sometimes called a MIPA, is a contract between a seller and a buyer to transfer the ownership of an LLC. A MIPA transfers the whole company with all of its assets and liabilities being transferred by the contract.

Virginia does not require an operating agreement in order to form an LLC, but executing one is highly advisable.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

Your Virginia LLC operating agreement is a legal document that establishes rules for how your LLC will handle procedures like voting, allocating profits and losses, management, and even?should it ever come to this?dissolution.