Virginia Security Agreement for Promissory Note

Description

How to fill out Security Agreement For Promissory Note?

Are you in a situation where you require documentation for both business or personal purposes every time.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

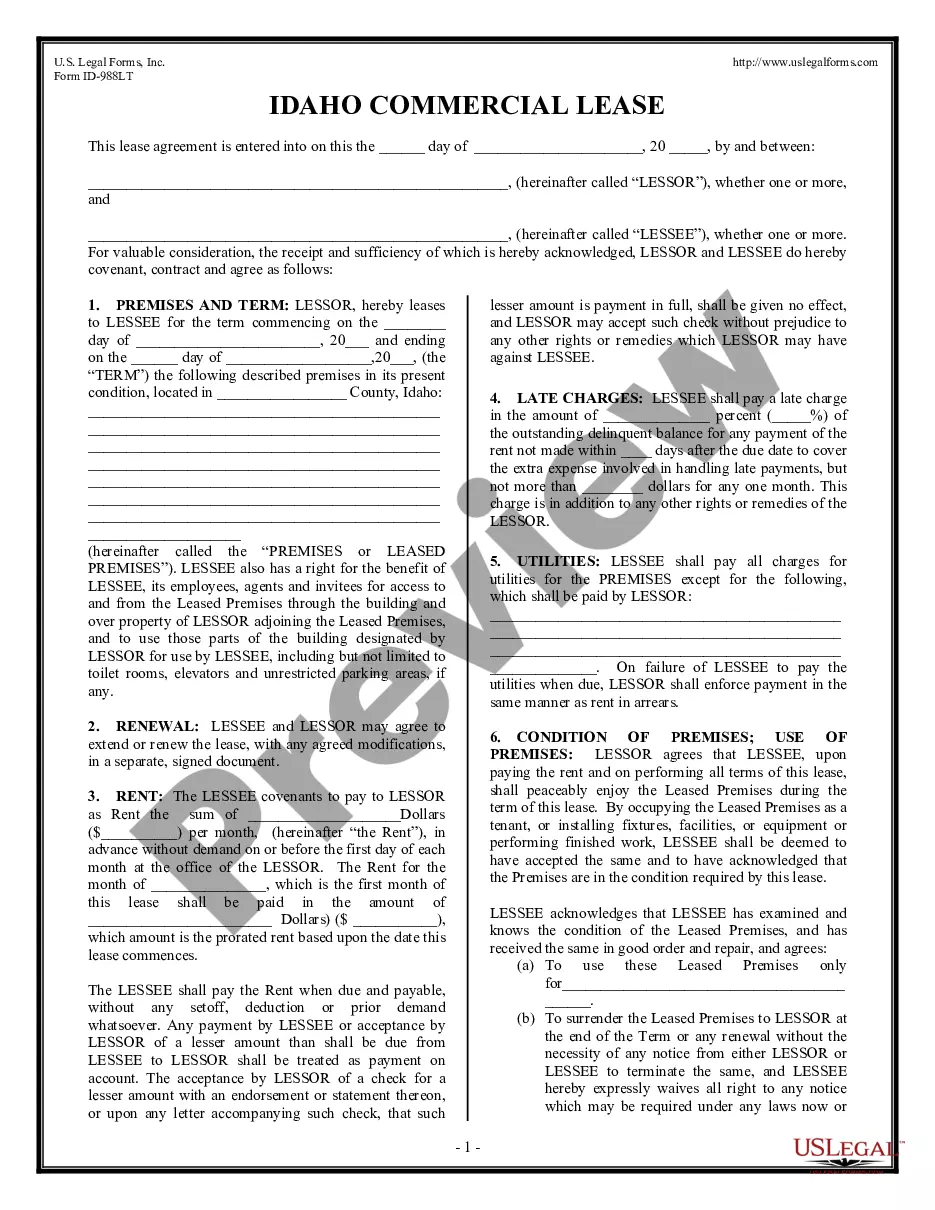

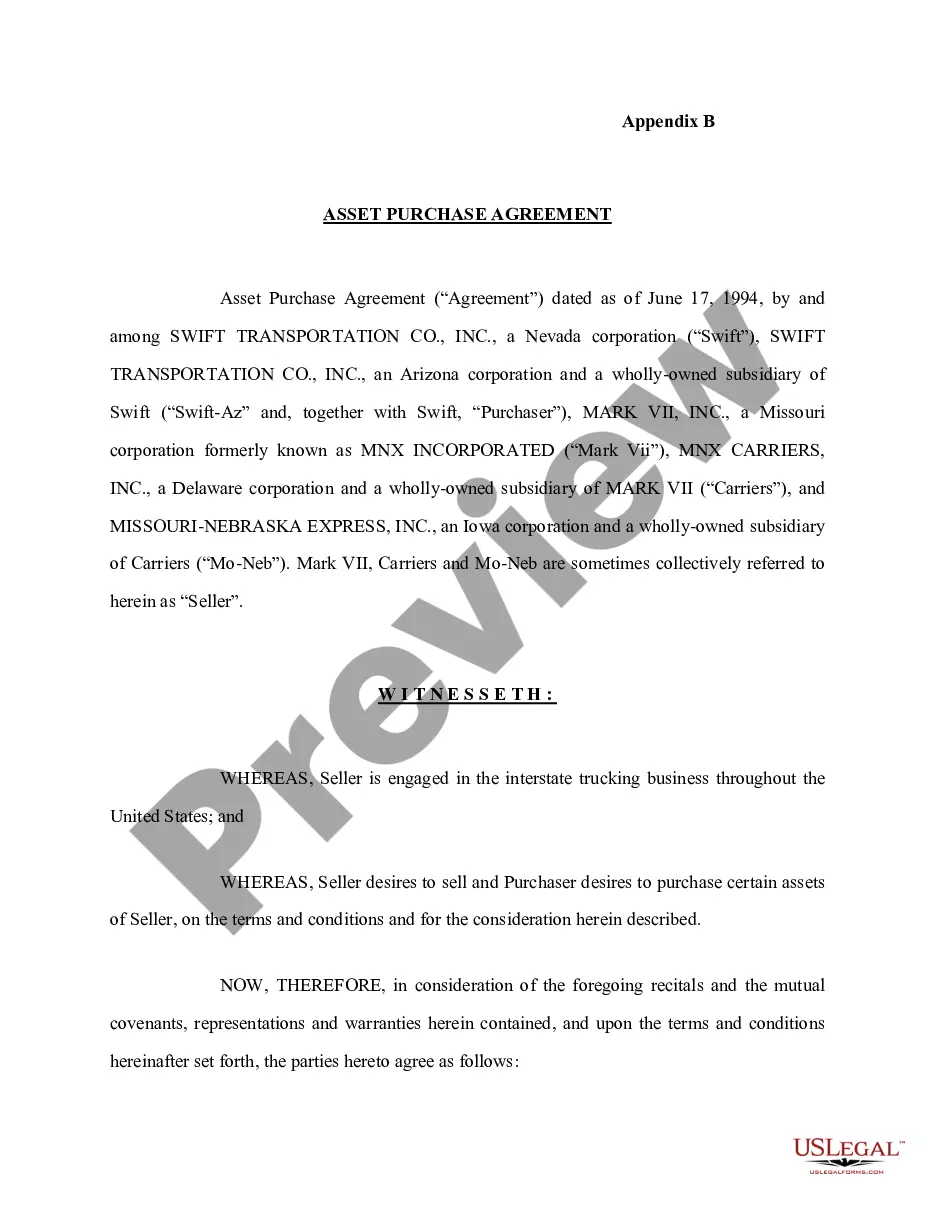

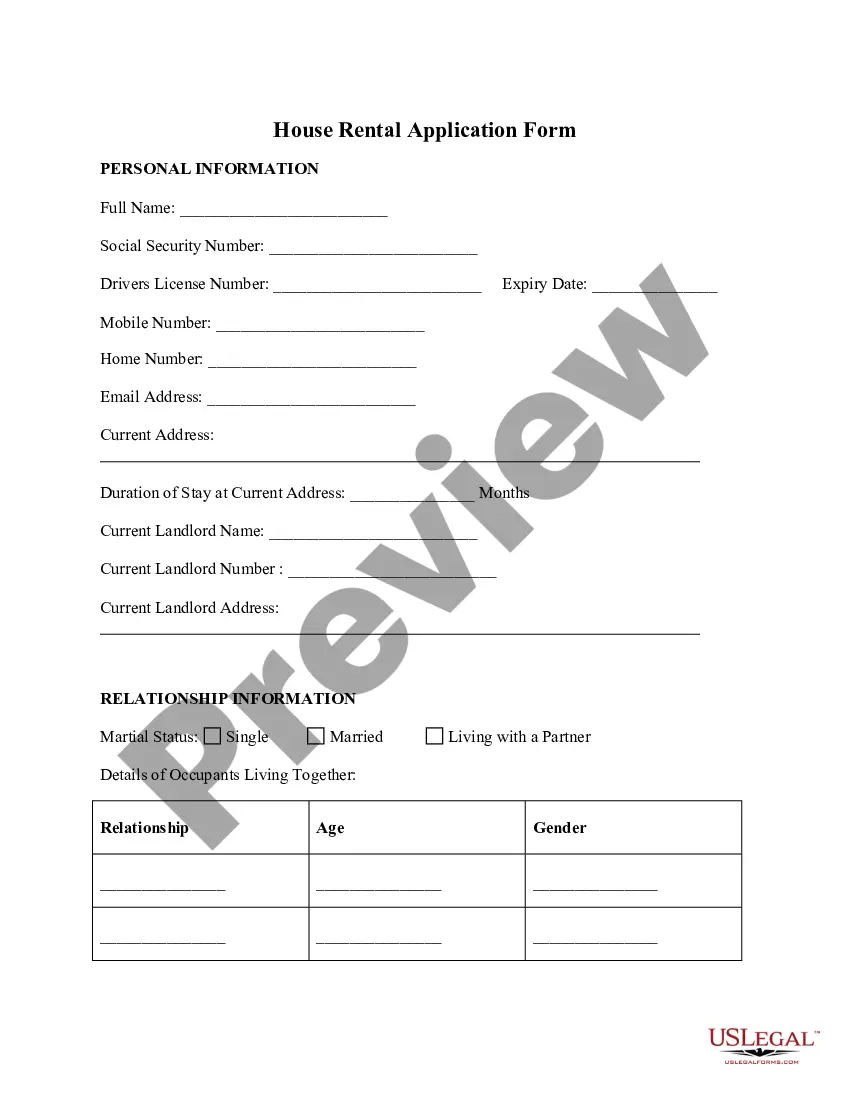

US Legal Forms offers a wide variety of form templates, such as the Virginia Security Agreement for Promissory Note, designed to meet state and federal regulations.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or a credit card.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Virginia Security Agreement for Promissory Note template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it corresponds to your specific city or region.

- Utilize the Preview feature to examine the document.

- Read the description to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find a form that suits your requirements.

- Once you locate the appropriate form, click Acquire now.

Form popularity

FAQ

Secured Promissory NotesA secured promissory note is an obligation to pay that is secured by some type of property. This means that if the payor fails to pay, the payee can seize the designated property to obtain reimbursement of the loan.

A security interest arising out of a sale of a promissory note (i.e., an instrument) is perfected automatically, without additional action, when it attaches. See Section 9-304(4) of the Uniform Commercial Code.

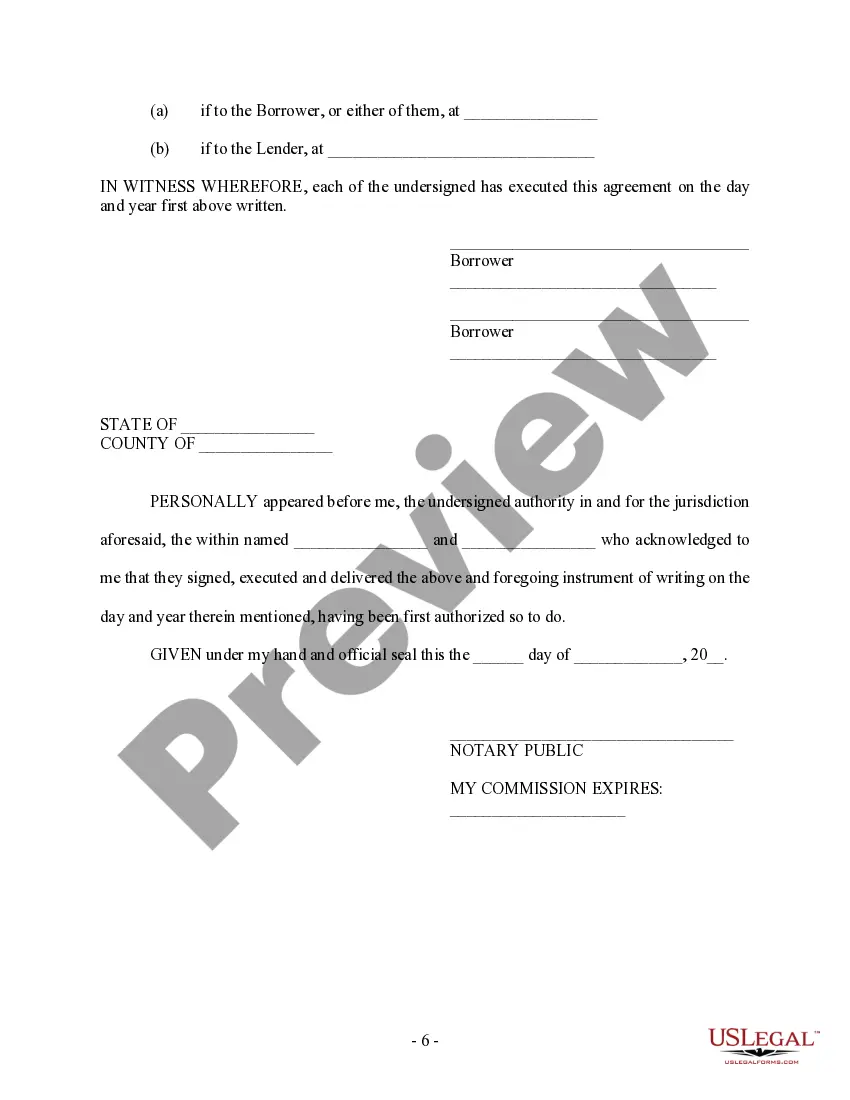

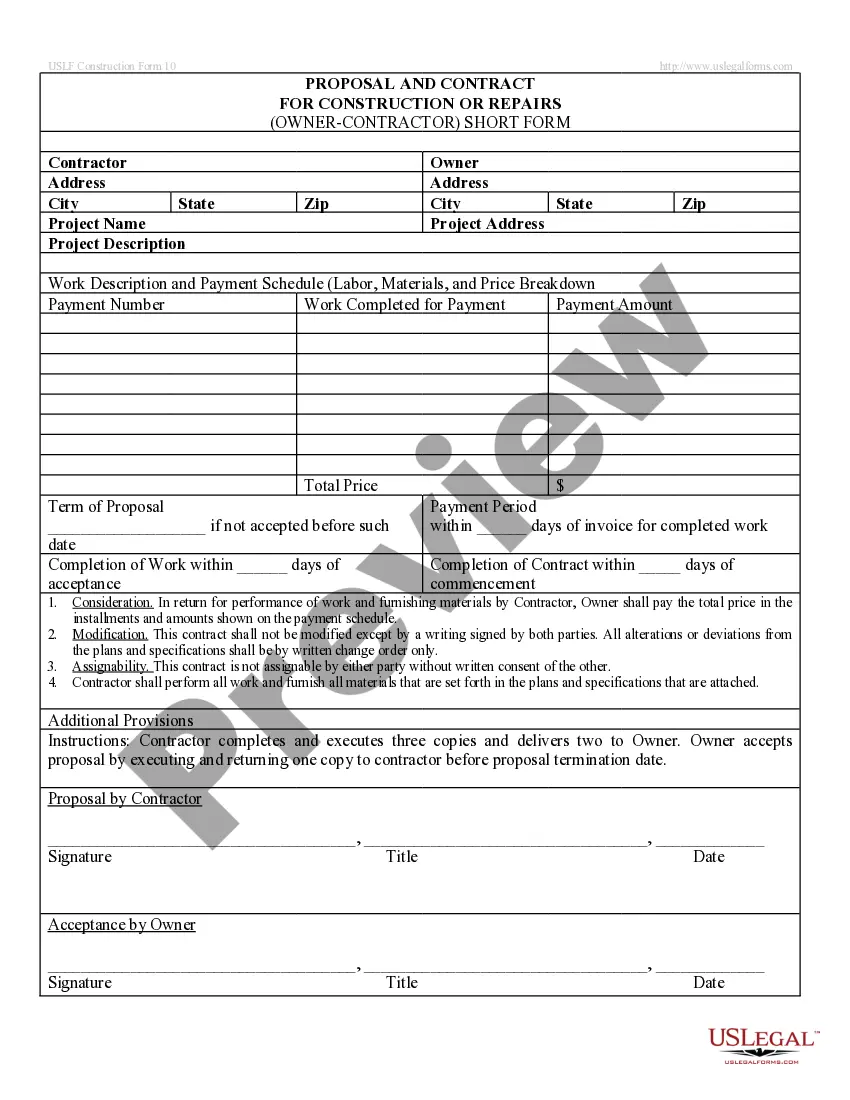

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust. If the collateral is personal property, there will be a security agreement.

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

There is no legal requirement for most promissory notes to be witnessed or notarized in Virginia (promissory notes related to real estate must be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A secured promissory note may include a security agreement as part of its terms. If a security agreement lists a business property as collateral, the lender might file a UCC-1 statement to serve as a lien on the property. A security agreement mitigates the default risk faced by the lender.