Virginia Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual

Description

How to fill out Oil, Gas And Mineral Deed - Individual Or Two Individuals To An Individual?

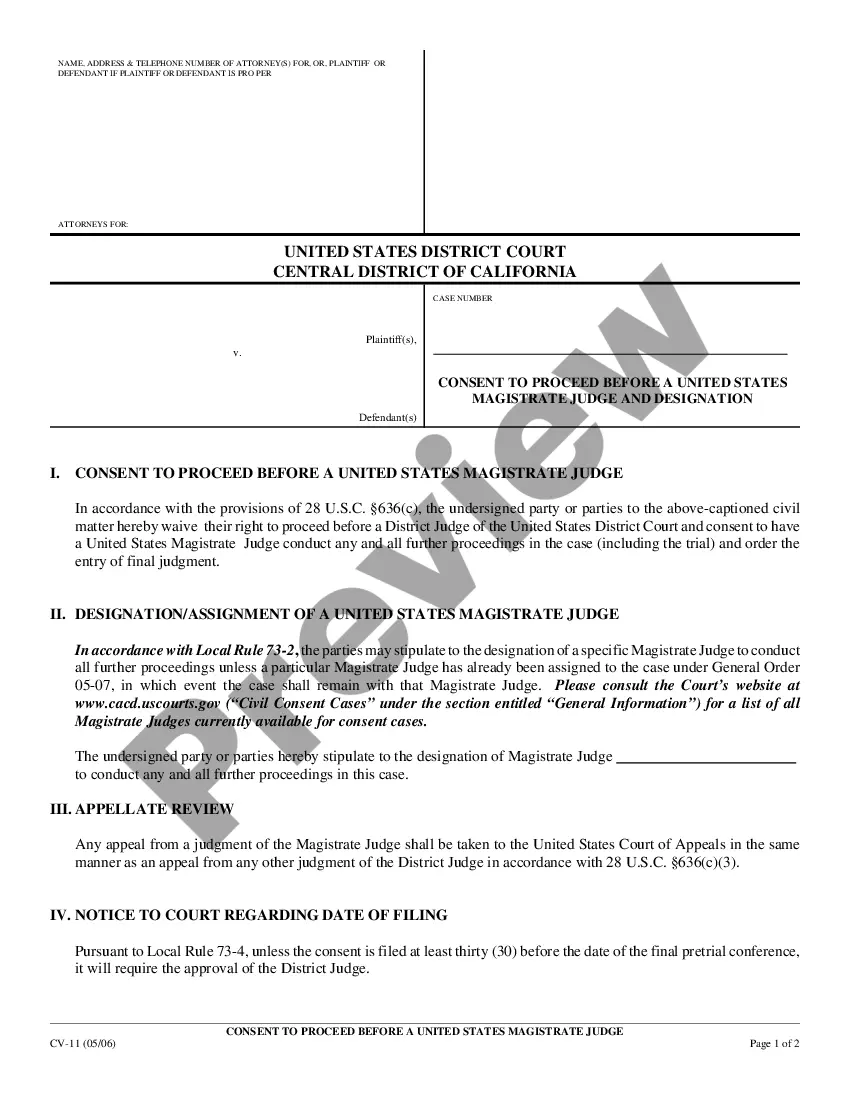

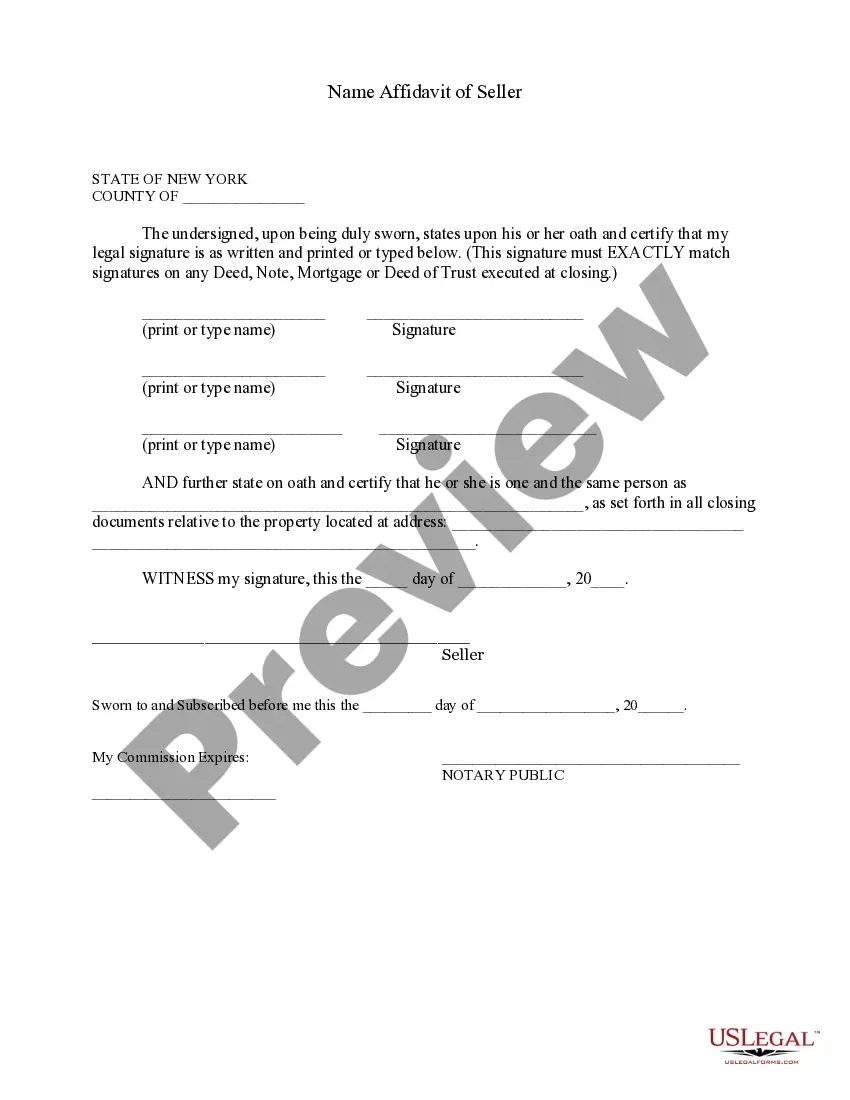

US Legal Forms - one of several most significant libraries of legal forms in the USA - provides a wide range of legal record templates you are able to acquire or print. Making use of the site, you can get a huge number of forms for organization and individual uses, categorized by classes, suggests, or keywords.You can get the most up-to-date versions of forms much like the Virginia Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual within minutes.

If you have a membership, log in and acquire Virginia Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual through the US Legal Forms local library. The Download option will appear on each type you look at. You have access to all earlier acquired forms from the My Forms tab of your account.

If you would like use US Legal Forms the first time, listed here are basic guidelines to obtain started out:

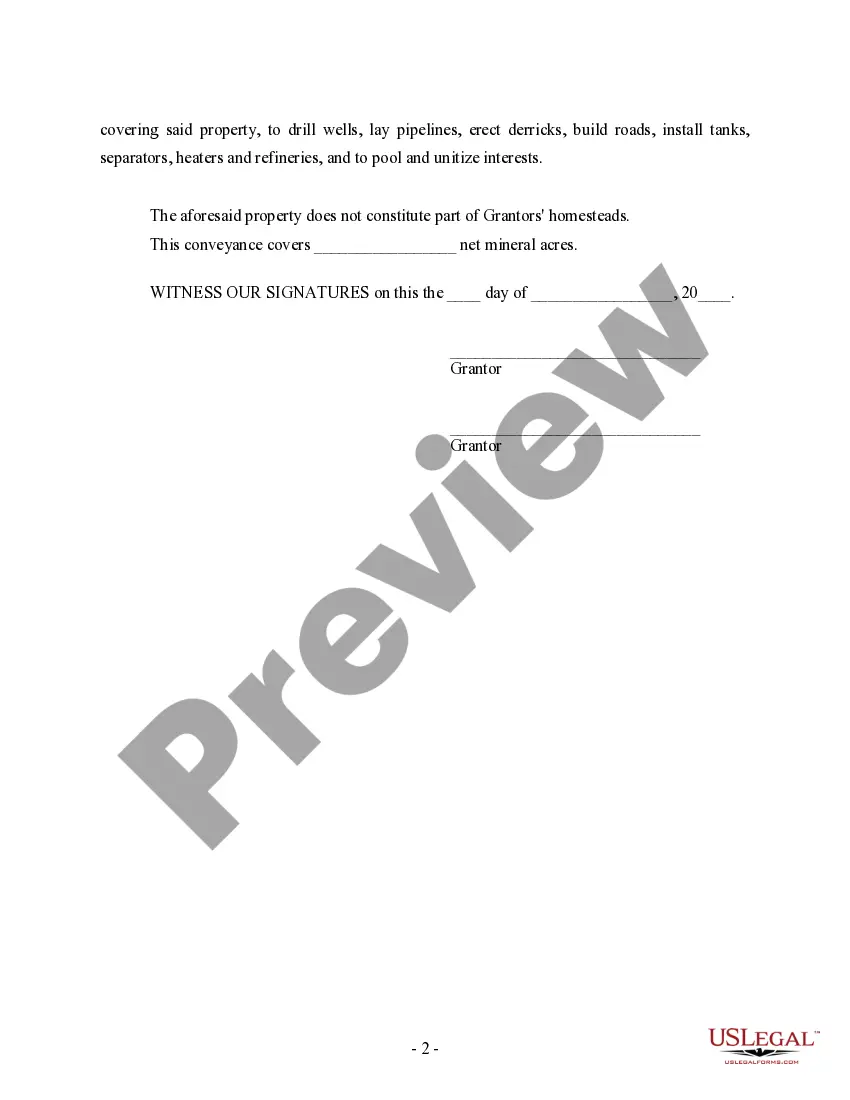

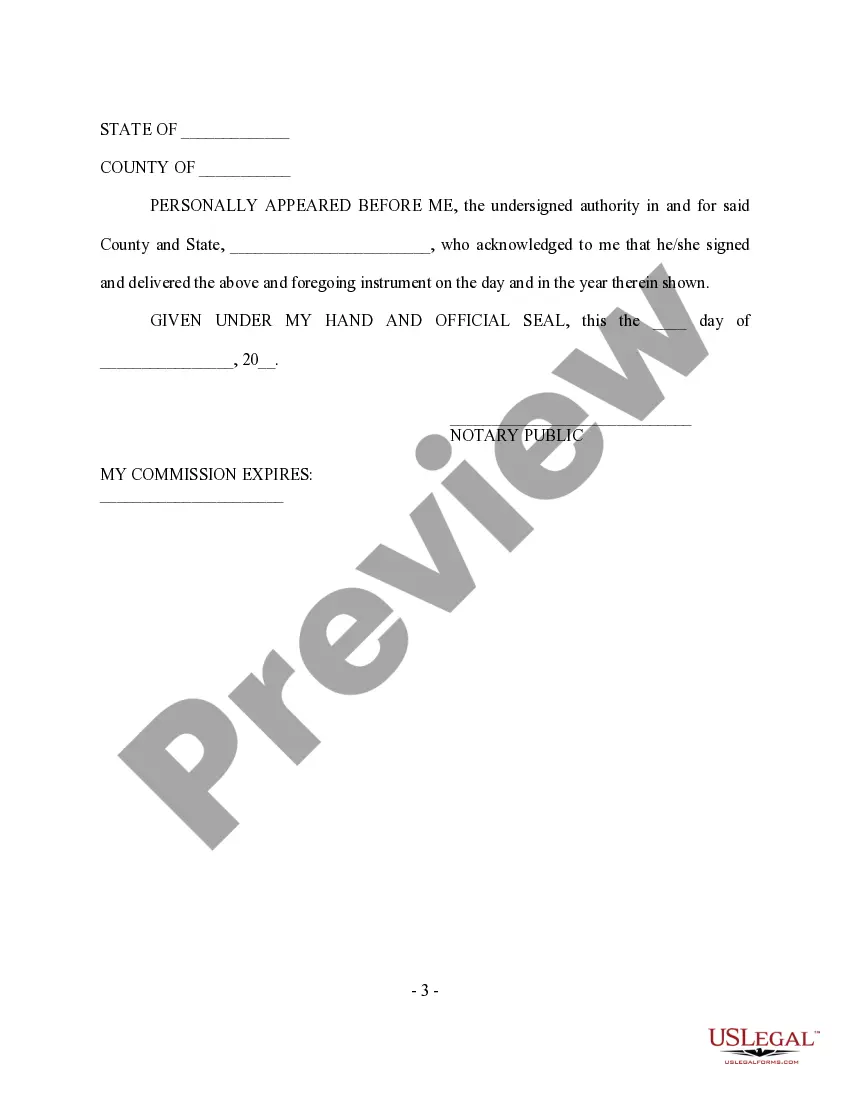

- Be sure to have picked the proper type for the town/county. Select the Preview option to review the form`s content. Read the type information to actually have selected the appropriate type.

- When the type does not suit your specifications, make use of the Research field on top of the display to get the one that does.

- Should you be happy with the form, verify your option by simply clicking the Get now option. Then, choose the costs plan you like and provide your credentials to register to have an account.

- Method the transaction. Make use of your credit card or PayPal account to finish the transaction.

- Choose the file format and acquire the form on your device.

- Make changes. Fill up, edit and print and signal the acquired Virginia Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual.

Each template you included with your money does not have an expiration date and it is yours eternally. So, if you wish to acquire or print one more duplicate, just visit the My Forms segment and then click on the type you want.

Obtain access to the Virginia Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual with US Legal Forms, the most extensive local library of legal record templates. Use a huge number of skilled and condition-particular templates that satisfy your business or individual requires and specifications.

Form popularity

FAQ

The default is that the rights to minerals ? including diamonds (like the 23-carat diamond found in Richmond in 1855!)* ? that exist under a piece of property convey with the land itself. In Virginia, owners can separate mineral rights from other property rights.

What are Outstanding and Reserved mineral rights? Outstanding mineral rights are owned by a party other than the surface owner at the time the surface was conveyed to the United States. Reserved mineral rights are those rights held by the surface owner at the time the surface was conveyed to the United States.

After confirming your legal ownership with an attorney at law, you need to draw up a deed of transfer form in your name and register it with the county records office as the mineral owner. The land transaction, leasing transaction, and royalty compliance go through the county office.

Also known as a mineral estate, mineral rights are just what their name implies: The right of the owner to utilize minerals found below the surface of property. Besides minerals, these rights can apply to oil and gas. Interestingly, mineral rights can be separate from actual land ownership.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.

Some of the major advantages of owning mineral rights include; Mineral owners do not take any drilling liability and pay no expenses. There are no environmental risks. It is an investment into ?real? property.