Virginia Personal Property Inventory

Description

How to fill out Personal Property Inventory?

Are you situated in a location where you frequently require documentation for either business or personal reasons almost daily.

There is a wide range of legal document templates accessible online, but finding reliable ones is quite challenging.

US Legal Forms offers a vast selection of form templates, including the Virginia Personal Property Inventory, designed to meet state and federal standards.

Once you find the appropriate form, click Buy now.

Select the payment plan you desire, complete the required information to create your account, and finalize your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Following that, you can download the Virginia Personal Property Inventory template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these guidelines.

- Locate the form you need and ensure it corresponds to the correct city/area.

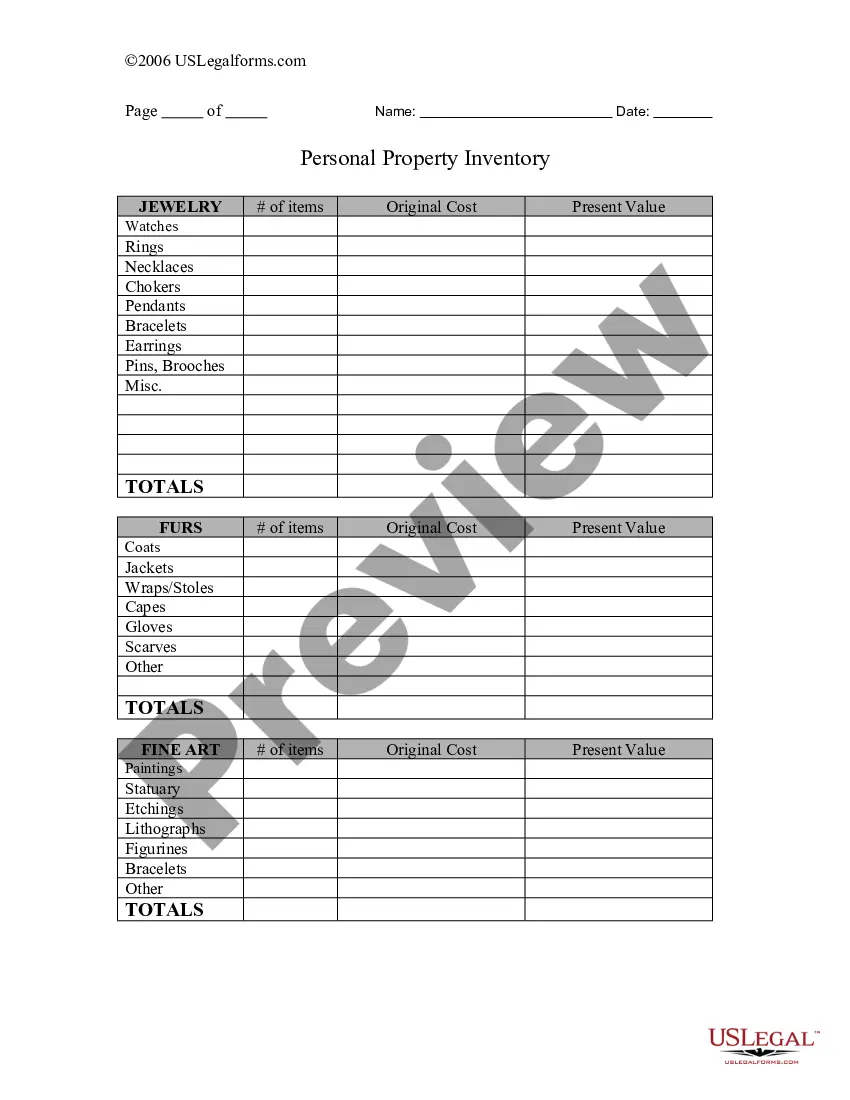

- Use the Review button to check the form.

- Read the description to confirm that you have chosen the right form.

- If the form is not what you seek, use the Search field to find the form that meets your needs.

Form popularity

FAQ

The merchandise tax in Virginia applies to the retail sale of tangible personal property. Generally, the rate is 5.3%, but it may vary based on specific items or local taxes. Understanding this tax is important when managing your Virginia Personal Property Inventory, as it affects the valuation and potential resale of your items.

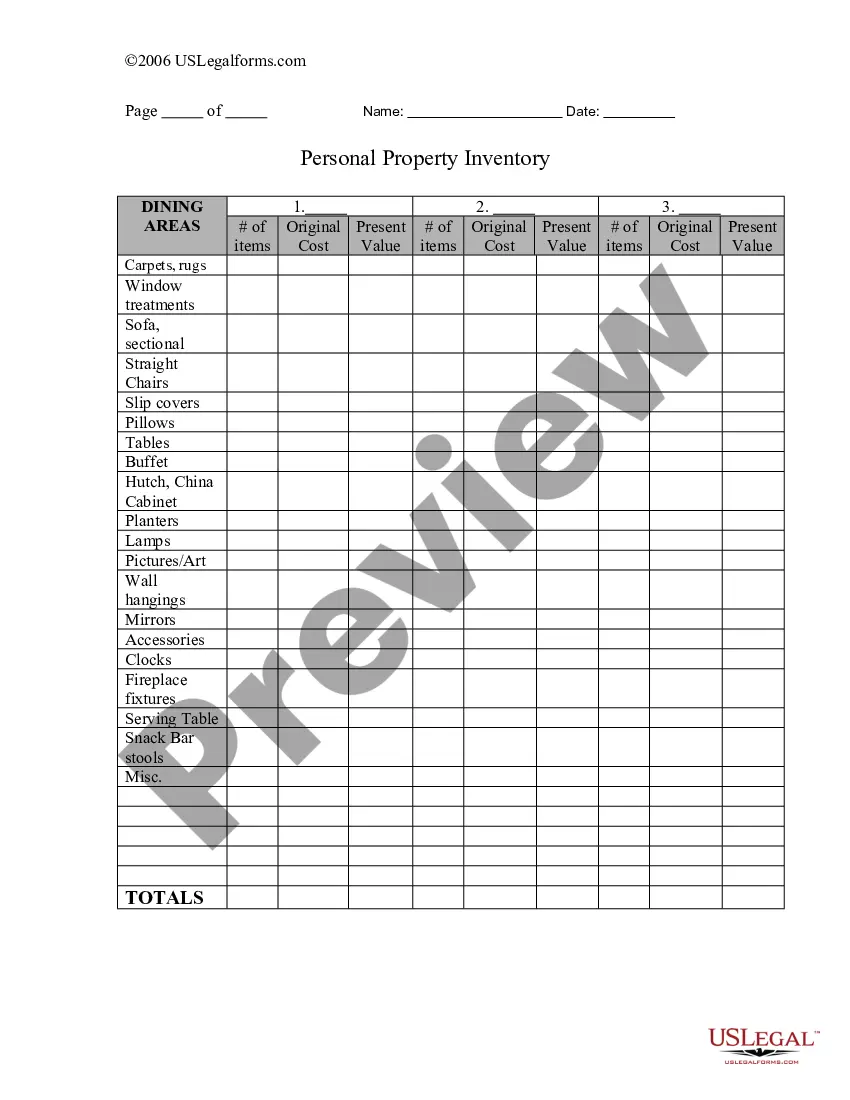

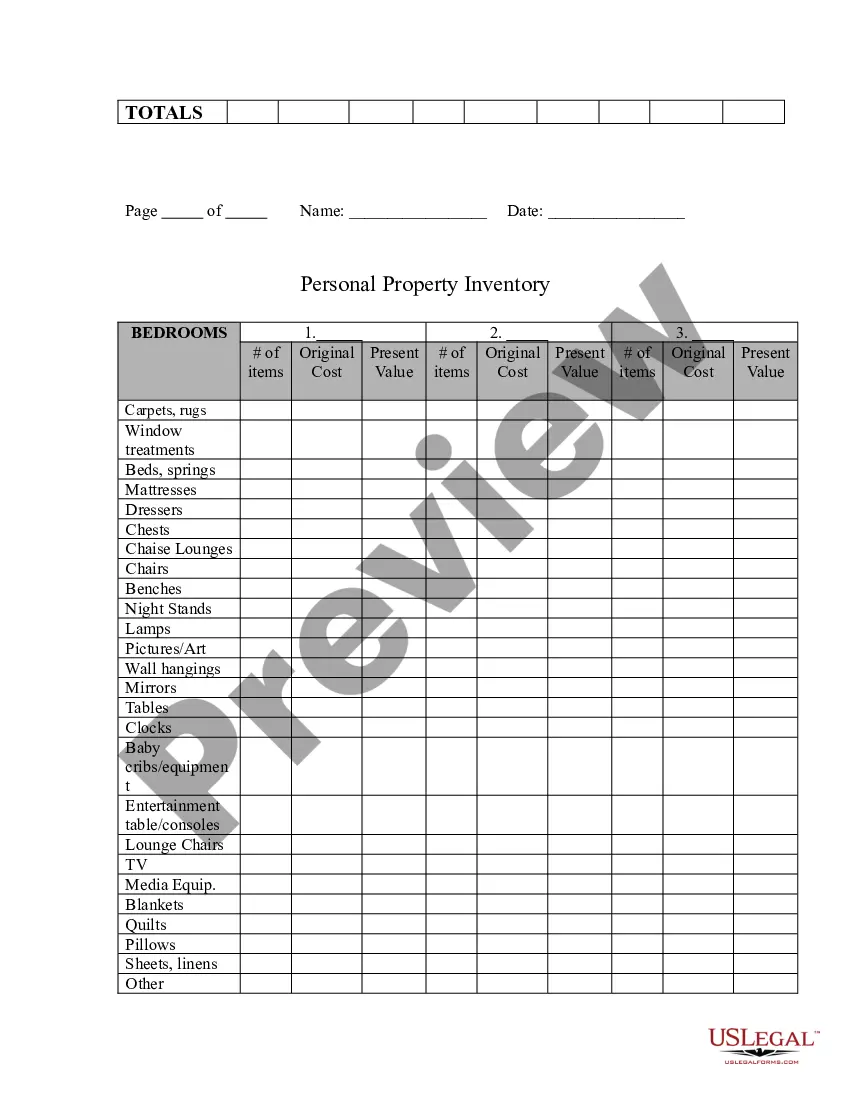

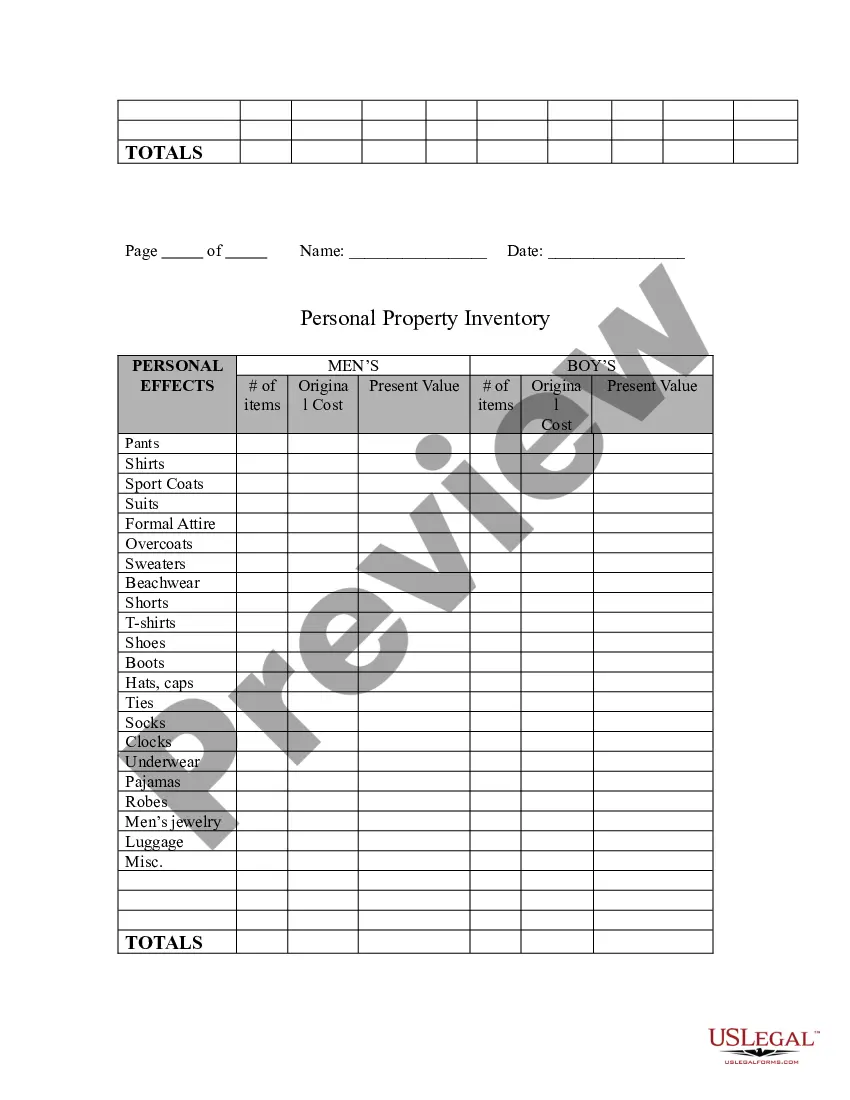

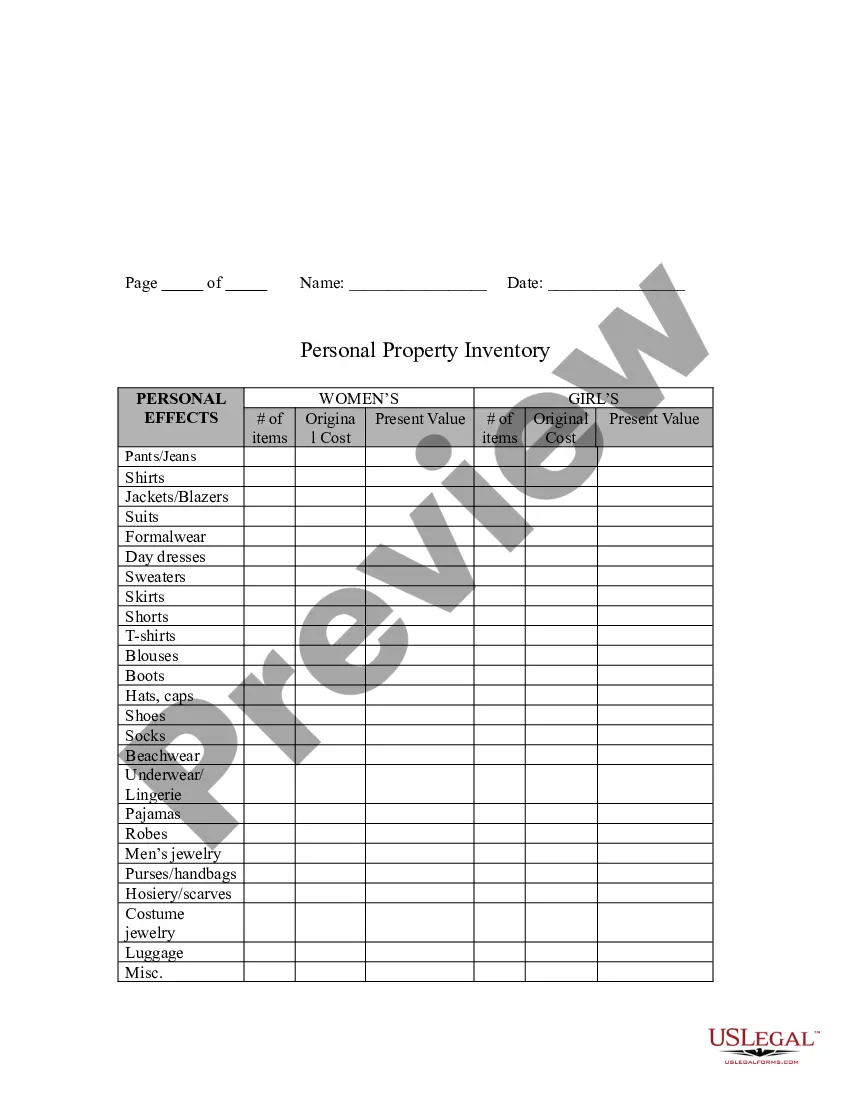

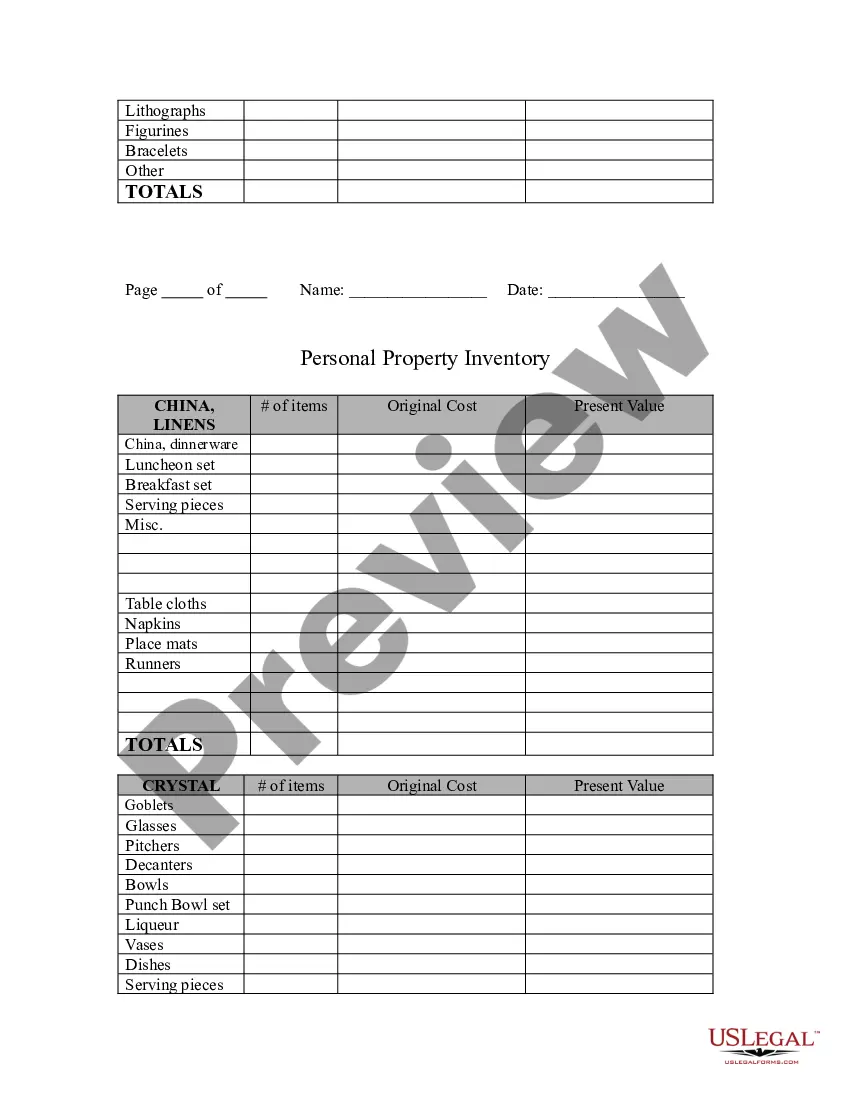

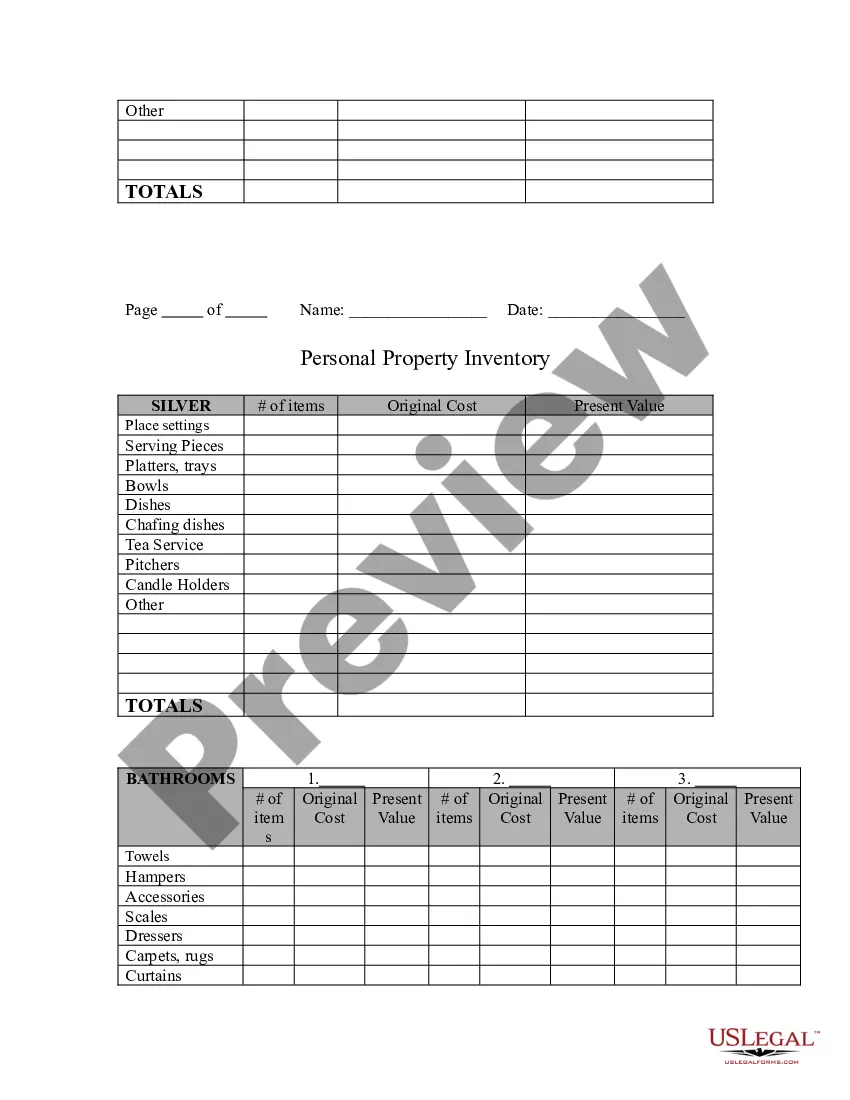

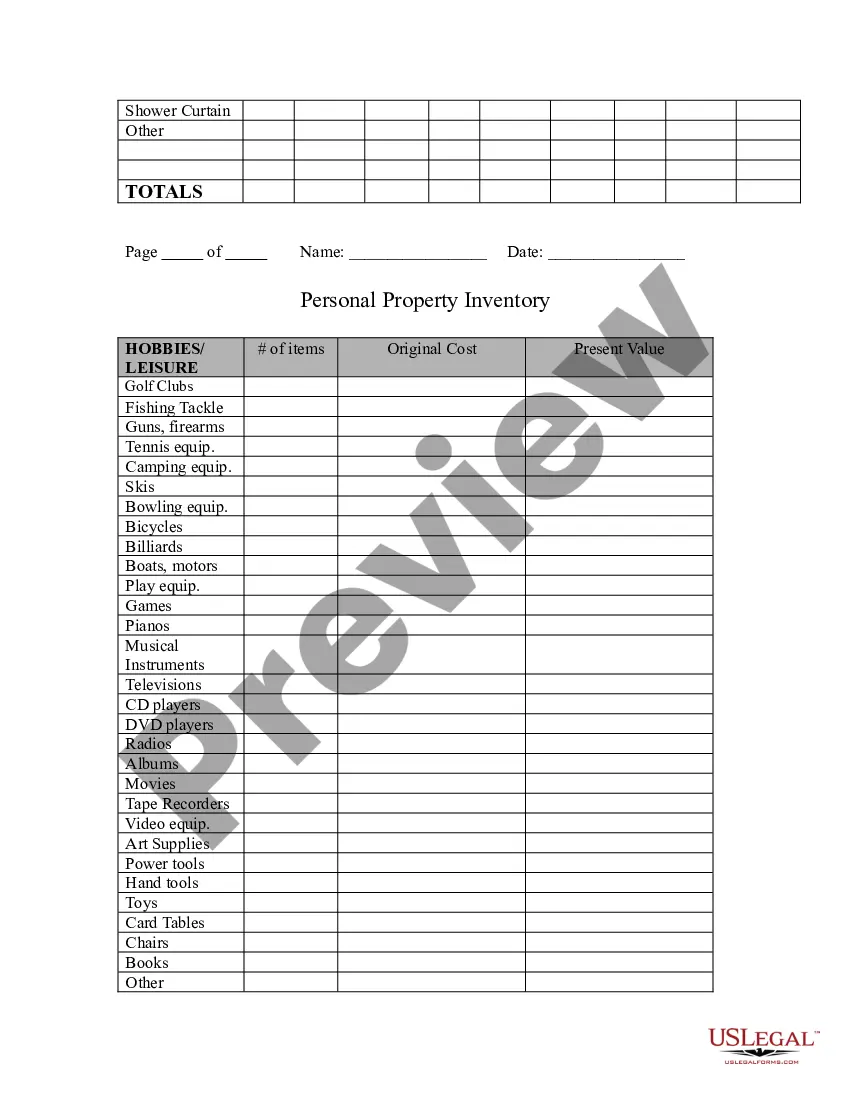

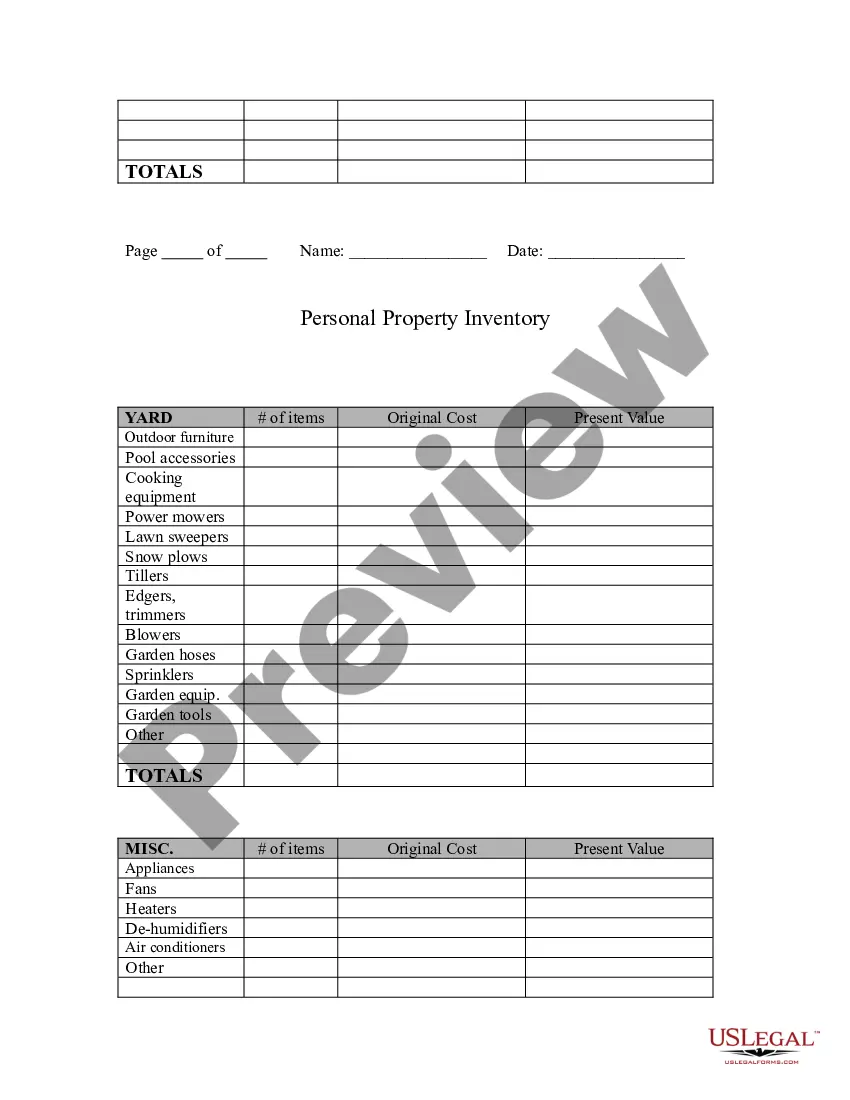

Creating a personal property inventory involves clearly listing each item you own, along with its estimated value and condition. It's wise to categorize items, such as furniture, electronics, and collectibles, to maintain organization. The US Legal platform offers templates and guidance to help you efficiently complete your Virginia Personal Property Inventory.

To fill out an inventory for a decedent's estate, you begin by compiling a comprehensive list of all personal property owned by the deceased. This includes valuing items such as real estate, vehicles, jewelry, and household goods. Utilizing tools like the US Legal platform can simplify this process, ensuring you accurately document and assess the Virginia Personal Property Inventory.

To inventory personal property, systematically list all items, noting descriptions, values, and conditions. A thorough Virginia Personal Property Inventory should include assets like furniture, electronics, and vehicles. Consider using inventory management tools or consulting uslegalforms for templates that simplify the process.

Certain individuals and organizations can be exempt from paying personal property tax in Virginia, including veterans and non-profits. To determine your eligibility, maintain an accurate Virginia Personal Property Inventory and review local laws. Consulting with local tax assessors or platforms like uslegalforms can provide clarity on available exemptions.

Reducing personal property tax in Virginia often requires a detailed review of your Virginia Personal Property Inventory. Identify and claim all eligible exemptions or deductions based on asset types. Using resources like uslegalforms can help guide you through tax reduction strategies specific to your situation.

To take inventory in a deceased estate, start by compiling a Virginia Personal Property Inventory of all assets owned by the deceased. This includes real estate, vehicles, financial accounts, and personal belongings. Engaging a professional estate administrator can streamline this process and ensure that all relevant items are accurately documented.

Virginia does not impose a separate inventory tax on personal property. However, personal property, such as vehicles or equipment, can be subject to local taxation. Maintaining a detailed Virginia Personal Property Inventory can assist you in accurately reporting your assets and managing taxes effectively.

Getting out of personal property tax in Virginia involves understanding your legal options. An accurate Virginia Personal Property Inventory can help identify assets that may be exempt or qualify for tax relief. Consult with a tax professional or use platforms like uslegalforms to find solutions tailored for your circumstances.

To avoid vehicle tax in Virginia, ensure that you efficiently manage your Virginia Personal Property Inventory. By keeping track of vehicles you own and their valuations, you might qualify for certain exemptions. Additionally, consider donating vehicles or exploring specific tax relief programs that may apply to your situation.