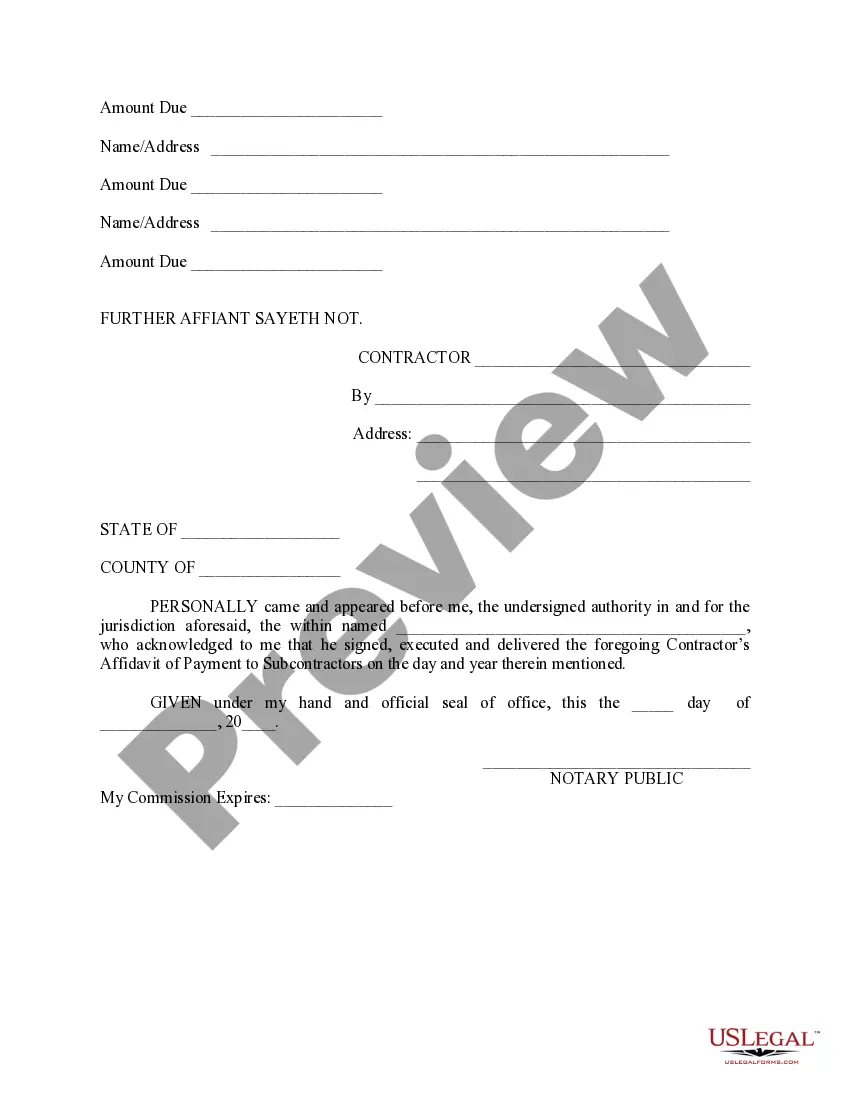

Virginia Contractor's Affidavit of Payment to Subs

Description

How to fill out Contractor's Affidavit Of Payment To Subs?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, organized by types, states, or keywords. You can find the latest editions of forms such as the Virginia Contractor's Affidavit of Payment to Subs in just a few moments.

If you already have a membership, Log In and download the Virginia Contractor's Affidavit of Payment to Subs from the US Legal Forms library. The Download button will appear on each form you view. You have access to all previously acquired forms in the My documents section of your account.

Complete the payment process. Use your Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Virginia Contractor's Affidavit of Payment to Subs. Every template saved to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you require. Access the Virginia Contractor's Affidavit of Payment to Subs with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs.

- Ensure you have selected the correct form for your locality/region.

- Click the Preview button to review the form's content.

- Check the form description to confirm that you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, validate your choice by clicking the Purchase now button.

- Next, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

The prime contractor has a direct contractual agreement with the property owner. If the contractor isn't paid, he can sue on the contract and record a mechanic's lien. But subcontractors, workers and suppliers don't have a contract with the property owner.

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

Avoid paying in cash. Contractors cannot ask for a deposit of more than 10 percent of the total cost of the job or $1,000, whichever is less. (This applies to any home improvement project, including swimming pools.) Stick to your schedule of payments and don't let payments get ahead of the completed work.

As the homeowner who is commissioning the project, it's reasonable to withhold at least 10% as your final payment. Avoid paying in full upfront, and definitely avoid paying anything before the contractor has evaluated the project in person.

Not just in California, but in any state, if you agree to pay a contractor everything up front, you've made a major mistake. Progress Payment Schedules: Contractors do not have to wait for the entire job to end before being paid.

A reputable contractor should be able to front the costs of most supplies without a large sum of money from you. A good rule of thumb is an initial deposit of no more than 10% down or $1,000, whichever is less.

Payment Schedule In Your Contract Before any work begins, a contractor will ask a homeowner to secure the job with a down payment. It shouldn't be more than 10-20 percent of the total cost of the job. Homeowners should never pay a contractor more than 10-20% before they've even stepped foot in their home.

The courts recognize the subcontractor's right to sue the owner directly for the payment of its claim to the extent that the master contract creates an express obligation on the owner's part (must) as opposed to a mere option (may) to make payment to the general contractor conditional upon the latter's having

A direct payment clause says that if you have paid the main contractor for work done by subcontractors and your money is not passed on to them, you can pay the subcontractor directly and deduct the payment from any other monies due to the main contractor.