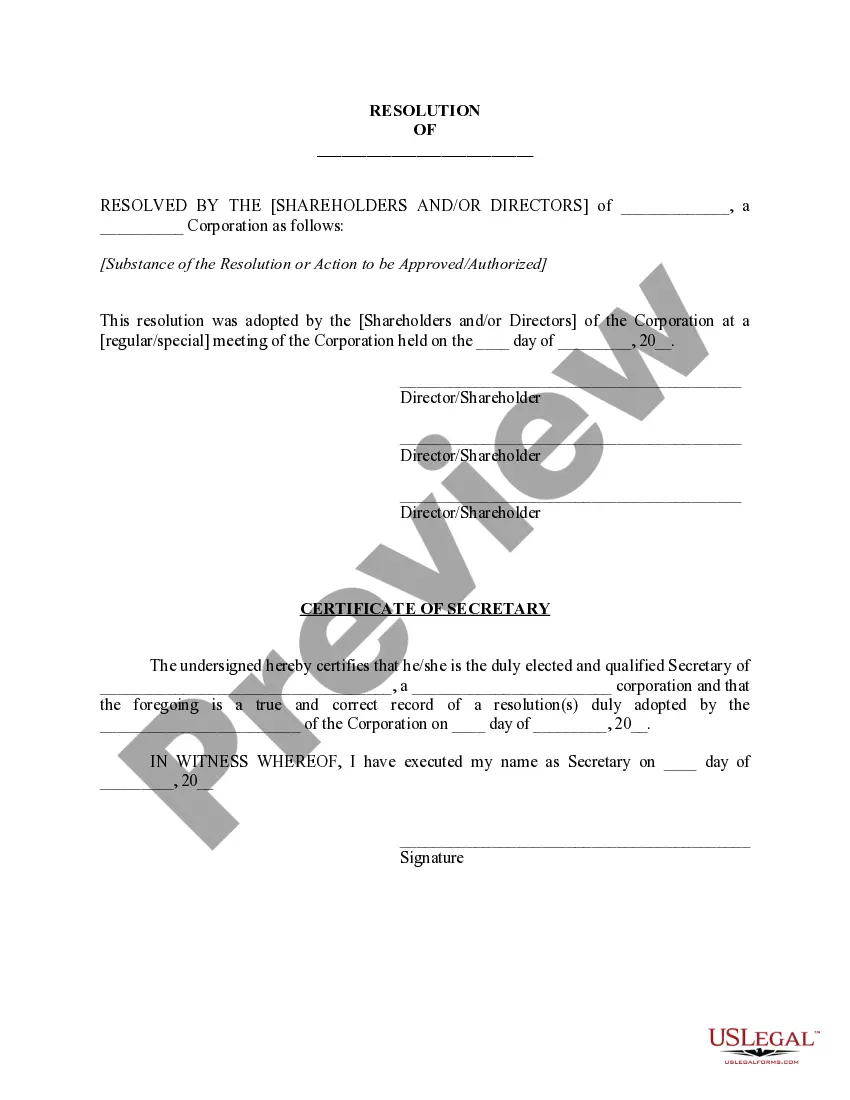

Virginia Corporate Resolution for PPP Loan

Description

How to fill out Corporate Resolution For PPP Loan?

It is feasible to spend numerous hours online trying to locate the permitted document template that meets the federal and state requirements you seek.

US Legal Forms provides thousands of legal templates that have been reviewed by experts.

You can easily download or print the Virginia Corporate Resolution for PPP Loan from our service.

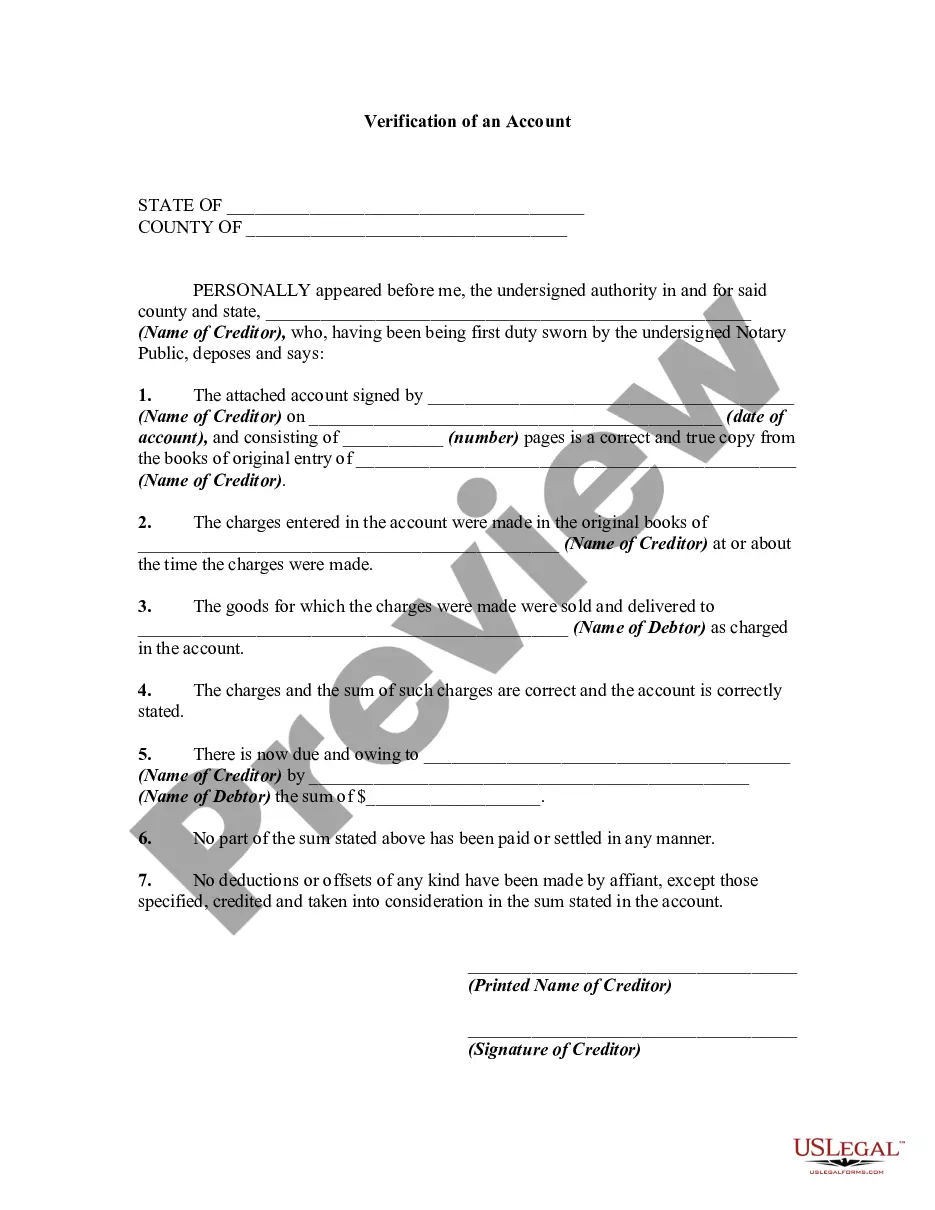

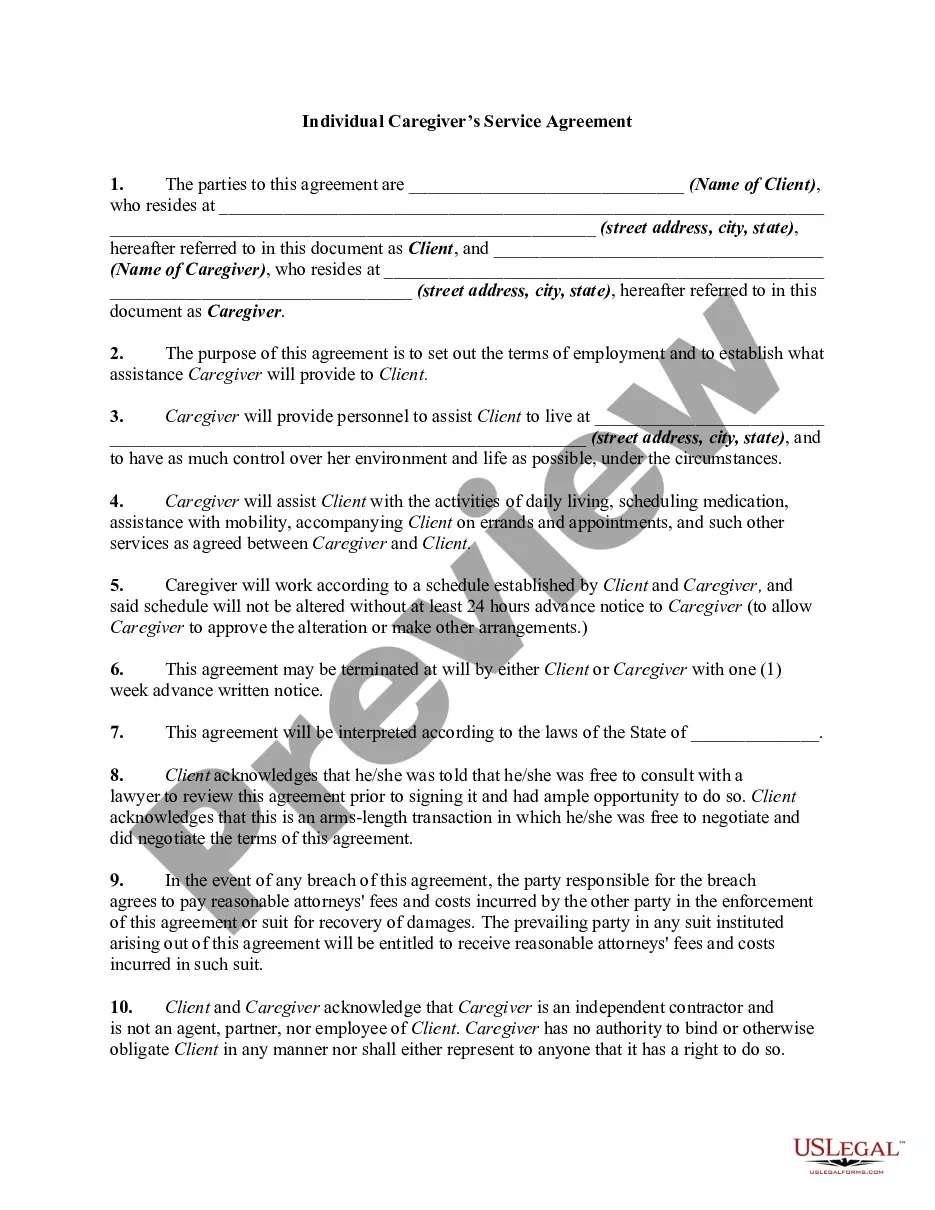

Read the form description to confirm that you have selected the right form. If available, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Virginia Corporate Resolution for PPP Loan.

- Each legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city that you choose.

Form popularity

FAQ

Instead, Virginia created a state-level deduction of up to $100,000 for business expenses funded by forgiven PPP loan proceeds that were paid or incurred during tax year 2020, and a subtraction of up to $100,000 for Rebuild Virginia grant recipients.

Businesses can apply for a PPP loan as long as they were operational on February 15, 2020, and had paid employees at that time (even if the owner is the only employee).

The maximum amount of money you can borrow as a first-time PPP borrower is 2.5 times your average monthly payroll costs, up to a maximum of $10 million.

Taxable Year 2020No changes to how Virginia treated PPP loan forgiveness and the deductibility of related expenses. Therefore, there is no relief for taxpayers whose loans were forgiven in 2020.

Owners of 5 percent or more of an S corporation who are also employees are eligible for Payroll Protection Plan (PPP) loan forgiveness of up to 20.83% of their employee cash compensation (capped at $20,833; maximum salary of $100,000 times 20.83%), with cash compensation defined as it is for all other employees (Box 1

Even if your business is set up as an S or C corporation, you may qualify for the PPP loan.

First Draw PPP Loan If You Have No Employees (If you are using 2020 to calculate payroll costs and have not yet filed a 2020 return, fill it out and compute the value.) If this amount is over $100,000, reduce it to $100,000. If both your net profit and gross income are zero or less, you are not eligible for a PPP loan.

Taxable Year 2020No changes to how Virginia treated PPP loan forgiveness and the deductibility of related expenses. Therefore, there is no relief for taxpayers whose loans were forgiven in 2020.

PPP Loan Proceeds Deduction LimitThe Virginia deduction may be claimed solely for Taxable Year 2020. If you claimed a federal deduction for business expenses funded by forgiven PPP loans on your Taxable Year 2019 return, you must add back the full amount of such deduction on your Taxable Year 2019 Virginia return.

The SBA re-opened the PPP on Jan. 11 with $284 billion appropriated through the Economic Aid Act. In Virginia so far, this round of funding has approved 6,834 PPP loans valued at over $6.5 million. The loans are still available to apply for with a deadline of March 31, 2021, or until appropriated funding runs out.