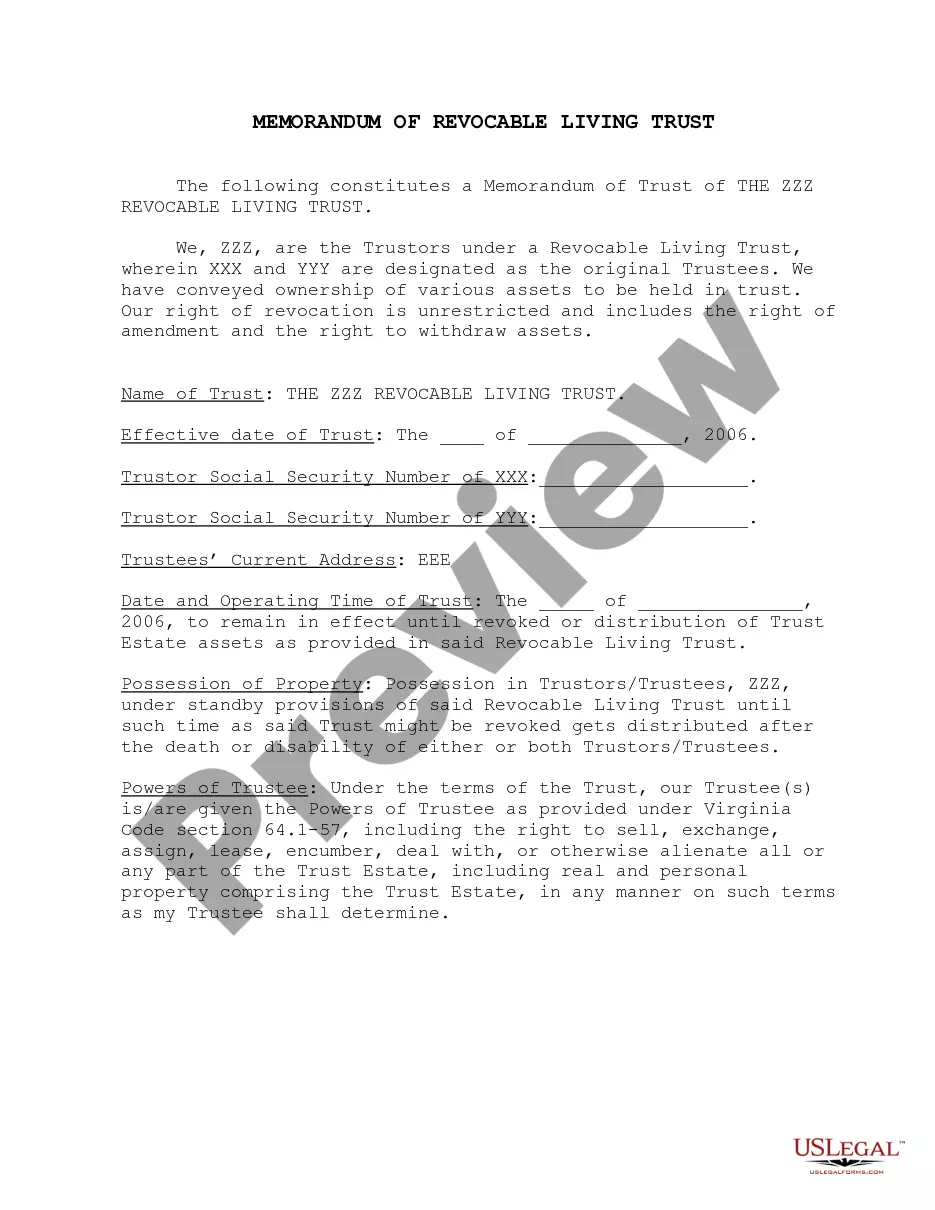

This is a form memo describing the terms of the trust and identifying the Trustor(s) and Trustee(s).

Virginia Memorandum of Revocable Living Trust

Description

Definition and meaning

A Memorandum of Revocable Living Trust is a legal document that outlines the details of a revocable living trust created by trustors, who are typically the individuals establishing the trust. This memorandum serves as a summary of the trust's fundamental features and pertinent information regarding the trustors and trustees. The purpose of this document is to provide guidance for the management and disposition of the assets held within the trust during the trustors' lifetime and after their death.

In essence, this memorandum details the rights of the trustors and the powers granted to the trustees, all while allowing the trustors the flexibility to modify or revoke the trust as their circumstances change.

How to complete a form

Completing a Virginia Memorandum of Revocable Living Trust requires careful attention to detail. Follow these steps to ensure accuracy and compliance:

- Identify the trustors: Clearly state the names of the individuals creating the trust.

- Specify trustees: List the names and identification details of the appointed trustees who will manage the trust's assets.

- Name the trust: Provide a clear title for the trust, which should include the term 'Revocable Living Trust'.

- Fill in effective date: Include the date from which the trust shall be effective.

- Include social security numbers: Enter the social security numbers of the trustors for identification purposes.

- Detail the trust property: Specify the assets being placed into the trust.

- Review and sign: Ensure all information is accurate before the trustors sign the document in the presence of a notary public.

Key components of the form

The Virginia Memorandum of Revocable Living Trust includes several critical components that ensure the document's effectiveness and clarity:

- Names of Trustors and Trustees: Clearly identified individuals who establish and manage the trust.

- Name of Trust: A specific title that conveys the trust's purpose.

- Effective Date: The date the trust becomes legally binding.

- Social Security Numbers: Identification numbers for the trustors to help verify identity.

- Description of Trust Property: A detailed listing of the assets managed under the trust.

- Powers of Trustee: Clear delineation of the authority granted to the trustee regarding the management and distribution of the trust's assets.

Legal use and context

The Virginia Memorandum of Revocable Living Trust is legally recognized under Virginia state law as a valid mechanism for estate planning. This document ensures that the trustors' assets are managed correctly during their lifetime and specifies how these assets should be handled after their death. The legal framework surrounding revocable living trusts allows trustors to maintain control over their property while providing a means to avoid probate, which can be a lengthy and costly process.

Additionally, the memorandum acts as a summary of the full trust document, making it easier for family members and other parties to understand the essential elements of the trust without delving into complex legal language.

Who should use this form

The Virginia Memorandum of Revocable Living Trust is beneficial for individuals and families who wish to manage their assets effectively during their lives and ensure seamless transitions of ownership after death. This form is particularly suitable for:

- Individuals with significant assets: Those looking to protect their assets from probate and plan their estate efficiently.

- Married couples: Partners wanting to simplify the transfer of property to the surviving spouse.

- Parents: Those aiming to designate guardians for their minor children and secure their families' financial future.

- People with specific wishes for asset distribution: Individuals wishing to have precise control over who benefits from their assets after they pass away.

Common mistakes to avoid when using this form

When completing the Virginia Memorandum of Revocable Living Trust, users should be cautious to avoid several common mistakes that can lead to complications or improper execution:

- Leaving essential fields blank: Ensure that all required information, including names, dates, and asset descriptions, is filled out accurately.

- Using outdated information: Verify that all personal and financial details present in the document are current and correct.

- Failing to sign in front of a notary: Ensure the document is signed in the presence of a notary public to validate its authenticity.

- Inadequate asset description: Provide a clear and comprehensive list of assets to avoid ambiguity in trust management.

- Not keeping a copy: Retain a copy of the signed memorandum for personal records and future reference.

How to fill out Virginia Memorandum Of Revocable Living Trust?

Looking for a Virginia Memorandum of Revocable Living Trust online can be stressful. All too often, you find files which you think are ok to use, but find out afterwards they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Have any form you are searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll automatically be added to your My Forms section. In case you do not have an account, you should sign-up and select a subscription plan first.

Follow the step-by-step instructions listed below to download Virginia Memorandum of Revocable Living Trust from the website:

- Read the form description and press Preview (if available) to verify whether the form suits your expectations or not.

- In case the document is not what you need, find others with the help of Search engine or the provided recommendations.

- If it is right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Get access to 85,000 legal forms right from our US Legal Forms library. Besides professionally drafted templates, customers are also supported with step-by-step guidelines on how to find, download, and complete forms.

Form popularity

FAQ

The Process of Creating a Revocable Living Trust Start by taking an inventory of your assets. Then, think about who you want to inherit your assets and who you can assign as trustee. Once the document is drawn up, transfer any property you want covered into the trust.

The need for a lawyer to help with your estate has nothing to do with a Revocable Living Trust. If your executor could handle your estate alone, then there is no need for a lawyer even if you had no Revocable Living Trust.For example, with filing inheritance and estate tax returns or obtaining beneficiary releases.

Sure you can write your own revocable living trust. In fact, you can do it better than a lot of the attorneys. First you have to ascertain that you really want a trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

Select a type of trust. Inventory your assets and property. Choose a trustee. Put together your trust document. Visit a notary public and sign your living trust in front of them. Fund your trust.

Establishing a trust requires serious legal help, which is not cheap. A typical living trust can cost $2,000 or more, while a basic last will and testament can be drawn up for about $150 or so.

As far as the Internal Revenue Service is concerned, trust property belongs to the grantor. The grantor names a trustee to manage the assets, but during their lifetime, most people name themselves in this position. A successor trustee is named to carry on when the grantor dies or becomes incapacitated.

Irrevocable trusts can remain up and running indefinitely after the trustmaker dies, but most revocable trusts disperse their assets and close up shop. This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer.