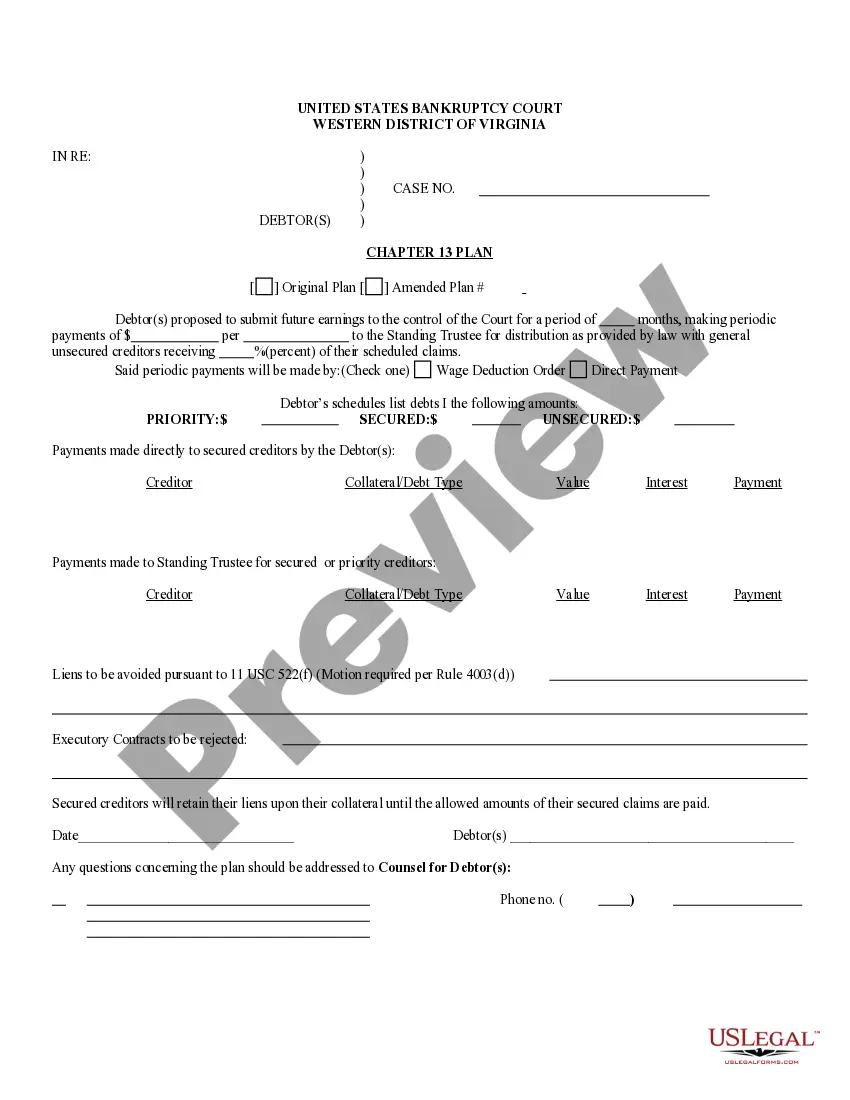

The Virginia Notice of Amendment to Debtor’s Schedules of Creditors and/or Matrix (Chapter 7) is a form used in Virginia bankruptcy proceedings. It is used to make changes to the debtor’s list of creditors, or the “matrix”, that has been filed with the court. This document must be signed by the debtor and filed with the court when there are changes to the list of creditors. The document must also be served on the creditors, the trustee, and the United States Trustee. There are two types of Virginia Notice of Amendment to Debtor’s Schedules of Creditors and/or Matrix (Chapter 7): one for amending the list of creditors, and one for amending the matrix. The Notice of Amendment for the list of creditors must include the debtor’s name, address, and Social Security number, as well as the date the schedules were filed. It must also list the name and address of each creditor to be added or removed from the list. The Notice of Amendment for the matrix must include the debtor’s name, address, and Social Security number, as well as the date the matrix was filed. It must also list the name and address of each creditor to be added or removed from the matrix, the type of debt, and the amount of the debt.

Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 7)

Description

How to fill out Virginia Notice Of Amendment To Debtor's Schedules Of Creditors And/or Matrix (Chapter 7)?

Working with legal documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 7) template from our library, you can be certain it meets federal and state regulations.

Working with our service is simple and quick. To get the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 7) within minutes:

- Remember to attentively look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 7) in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 7) you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Filers are usually hoping to get a bankruptcy discharge. That's the order that wipes out certain debts and gives you a fresh start. A dismissal is very different. It means your case has been stopped before the court granted a discharge.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

A Chapter 7 bankruptcy may stay on credit reports for 10 years from the filing date, while a Chapter 13 bankruptcy generally remains for seven years from the filing date. It's possible to rebuild credit after bankruptcy, but it will take time.

To object to the debtor's discharge, a creditor must file a complaint in the bankruptcy court before the deadline set out in the notice. Filing a complaint starts a lawsuit referred to in bankruptcy as an "adversary proceeding."

Most bankruptcy cases pass through the bankruptcy process with little objection by creditors. Because the bankruptcy system is encoded into U.S. law and companies can prepare for some debts to discharge through it, creditors usually accept discharge and generally have little standing to contest it.

A discharge releases a debtor from personal liability of certain debts known as dischargeable debts, and prevents the creditors owed those debts from taking any action against the debtor or the debtor's property to collect the debts.

The Chapter 7 Discharge. A discharge releases individual debtors from personal liability for most debts and prevents the creditors owed those debts from taking any collection actions against the debtor.

The discharge is a permanent order prohibiting the creditors of the debtor from taking any form of collection action on discharged debts, including legal action and communications with the debtor, such as telephone calls, letters, and personal contacts.