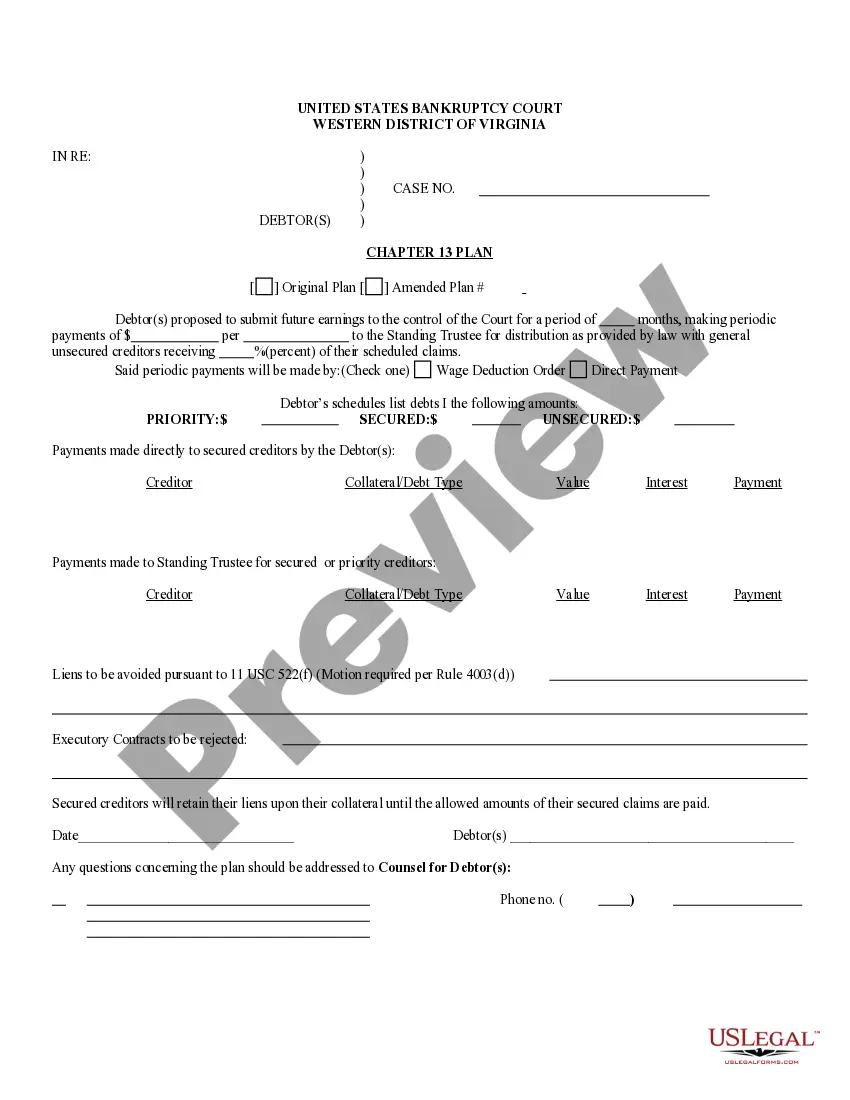

The Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 13) is an official document form, filed by a debtor in Chapter 13 Bankruptcy, in order to amend the schedules of creditors or matrix. It is typically filed in conjunction with an amended Chapter 13 plan. The notice must include information such as the debtor's name, address, case number, date of filing, the creditor's name and address, the amount owed, and a description of the amendment. The notice must also be served to creditors, the chapter 13 trustee, and the United States Trustee. There are two types of Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 13): 1) Notice of Amendment of Schedules of Creditors and/or Matrix, and 2) Notice of Amendment of Matrix Only. The Notice of Amendment of Schedules of Creditors and/or Matrix is used when the debtor wishes to amend the creditor's name, address, amount owed, and/or description of debt. The Notice of Amendment of Matrix Only is used when the debtor wishes to change the payment amounts or payment dates as set forth in the Chapter 13 matrix. In either case, the debtor must submit the notice to the court, the chapter 13 trustee, the United States Trustee, and all affected creditors. The debtor must also publish the notice in a newspaper of general circulation in the district in which the debtor is filing.

Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 13)

Description

How to fill out Virginia Notice Of Amendment To Debtor's Schedules Of Creditors And/or Matrix (Chapter 13)?

Dealing with legal paperwork requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 13) template from our library, you can be certain it meets federal and state regulations.

Dealing with our service is easy and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 13) within minutes:

- Make sure to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 13) in the format you need. If it’s your first experience with our service, click Buy now to proceed.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the Virginia Notice of Amendment to Debtor's Schedules of Creditors and/or Matrix (Chapter 13) you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

Debts not discharged in chapter 13 include certain long term obligations (such as a home mortgage), debts for alimony or child support, certain taxes, debts for most government funded or guaranteed educational loans or benefit overpayments, debts arising from death or personal injury caused by driving while intoxicated

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

The discharge releases the debtor from all debts provided for by the plan or disallowed (under section 502), with limited exceptions. Creditors provided for in full or in part under the chapter 13 plan may no longer initiate or continue any legal or other action against the debtor to collect the discharged obligations.

While Chapter 7 eliminates all your debt, Chapter 13 is a repayment plan. Once you file, you'll work with a trustee to come up with a court-approved payment plan. You pay the trustee, who then pays your creditors. No more creditors calling or sending intimidating letters.

A Chapter 13 case provides the opportunity to restructure debts through a payment plan which normally lasts three years. With court approval, a plan may last up to five years. The Chapter 13 Trustee receives all funds paid into the plan and pays creditors from these funds.

Although a Chapter 13 bankruptcy stays on your record for years, missed debt payments, defaults, repossessions, and lawsuits will also hurt your credit and may be more complicated to explain to a future lender than bankruptcy.

Unlike chapter 7, creditors do not have standing to object to the discharge of a chapter 12 or chapter 13 debtor. Creditors can object to confirmation of the repayment plan, but cannot object to the discharge if the debtor has completed making plan payments.

Chapter 13 and debt Firstly, all Chapter 13 payment plans must repay all priority claims and administrative expenses in full. These types of debts include taxes, child support, alimony, attorneys' fees and court costs.