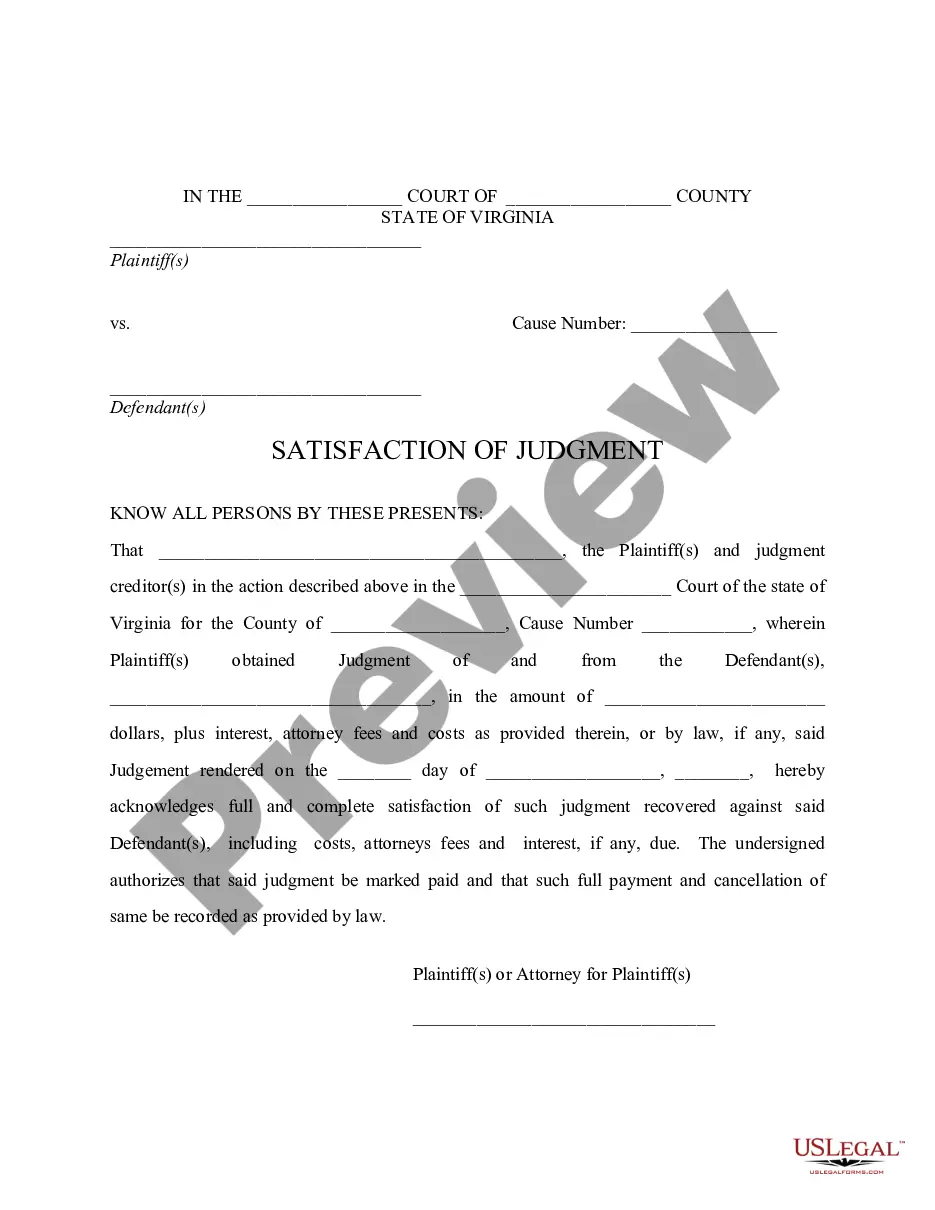

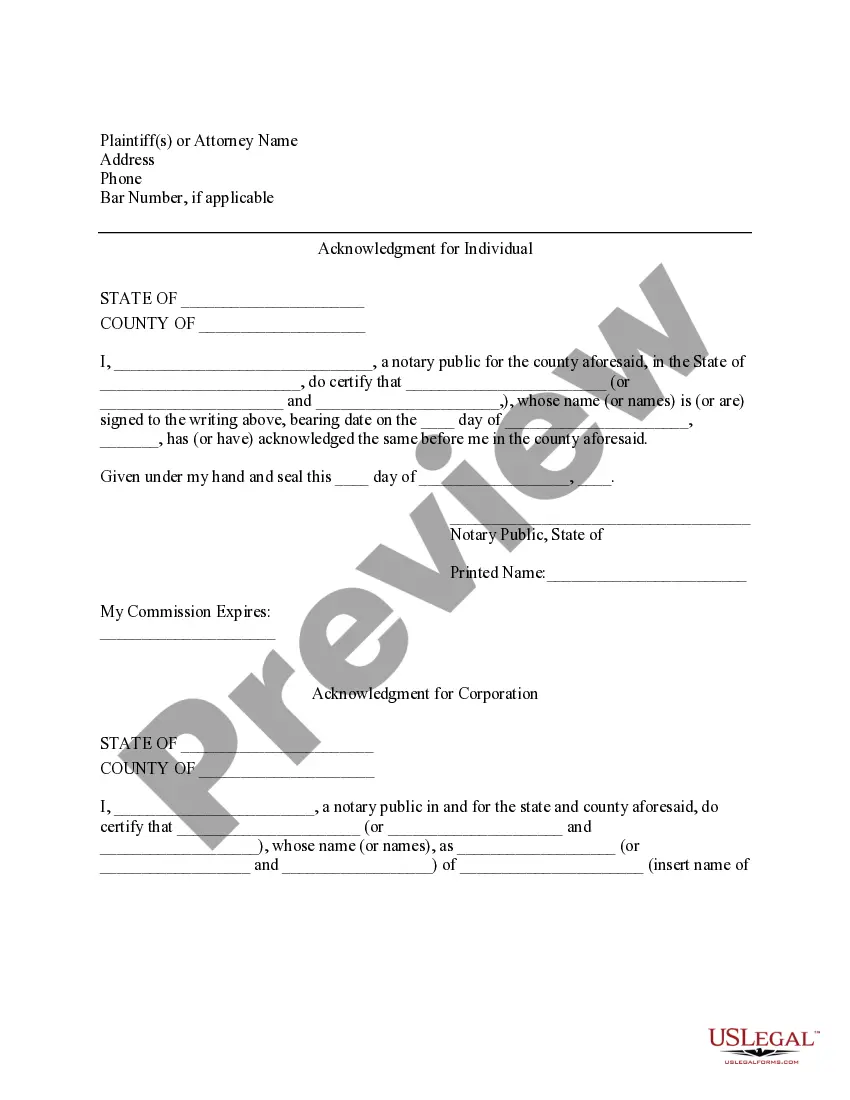

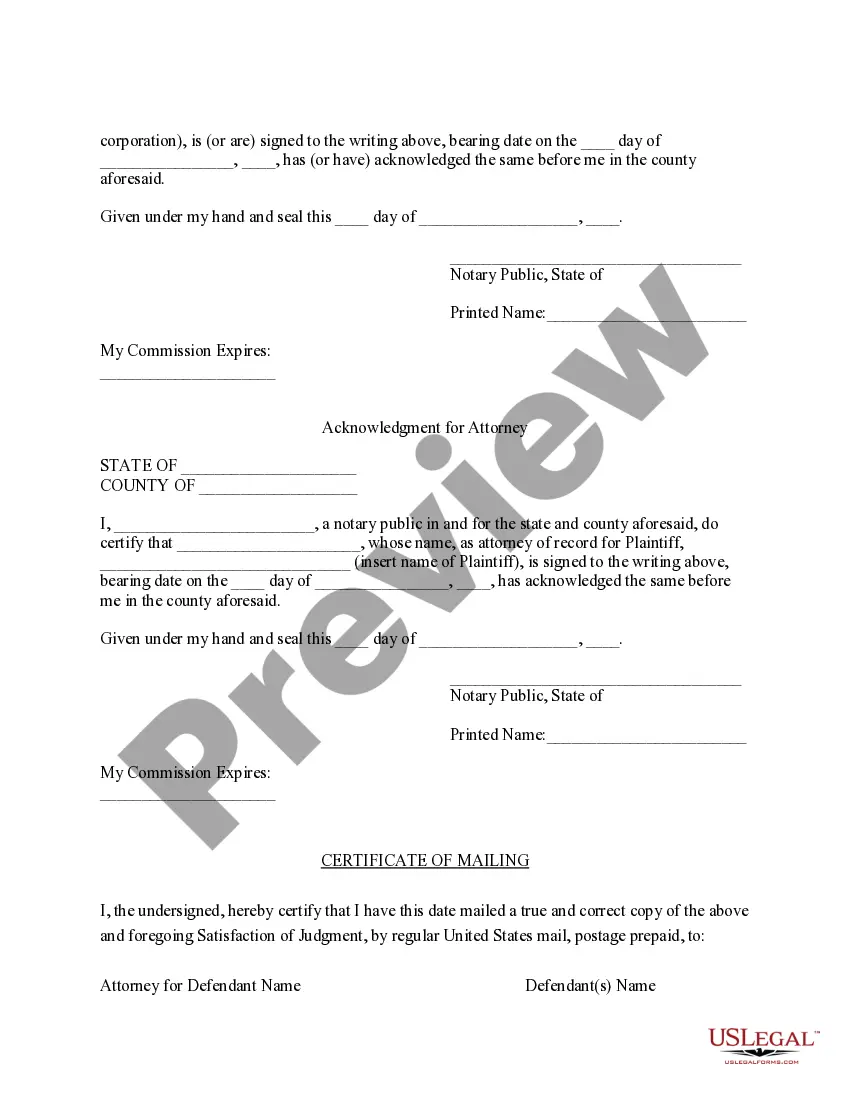

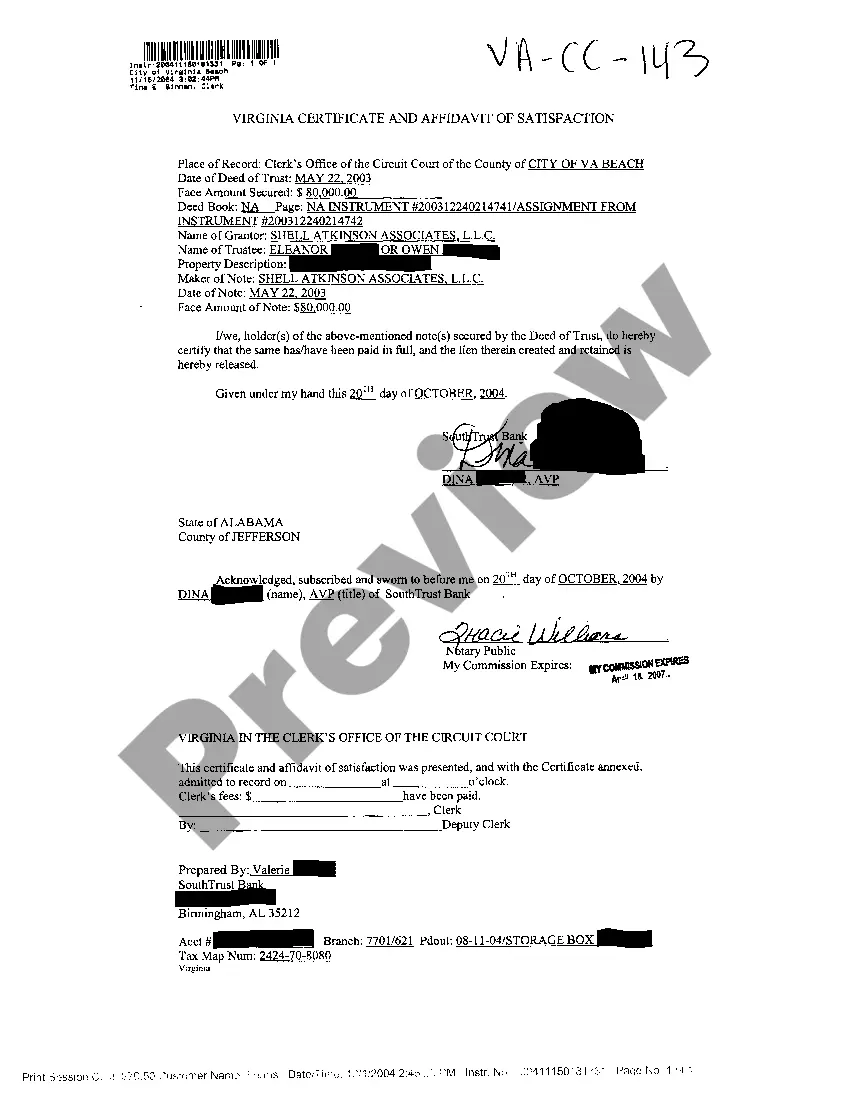

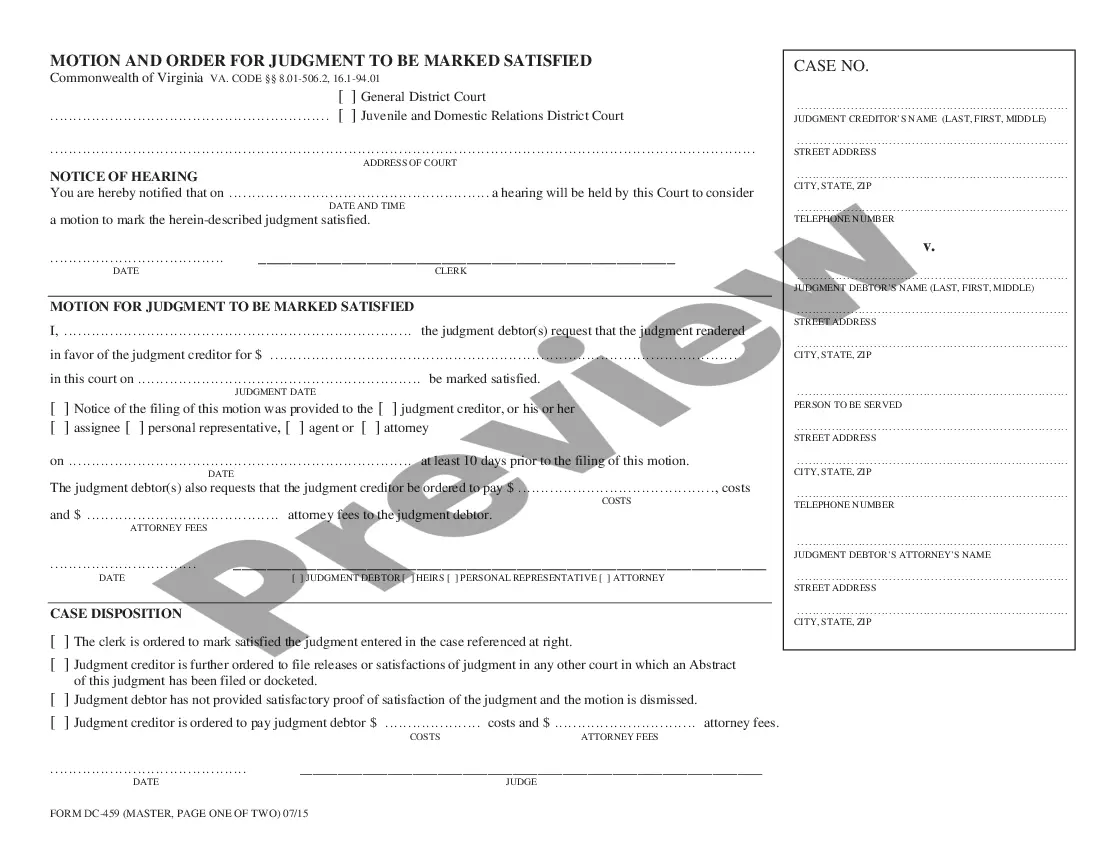

This is a satisfaction of judgment which indicates that a judgment has been paid in full, including all fees, costs and interest. It acknowledges full and complete satisfaction of the judgment and directs that the judgment be marked as paid in full.

Virginia Satisfaction of Judgment

Description

How to fill out Virginia Satisfaction Of Judgment?

Looking for a Virginia Satisfaction of Judgment online might be stressful. All too often, you see files that you think are alright to use, but discover later they are not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Have any document you are looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be added in to the My Forms section. In case you do not have an account, you need to register and pick a subscription plan first.

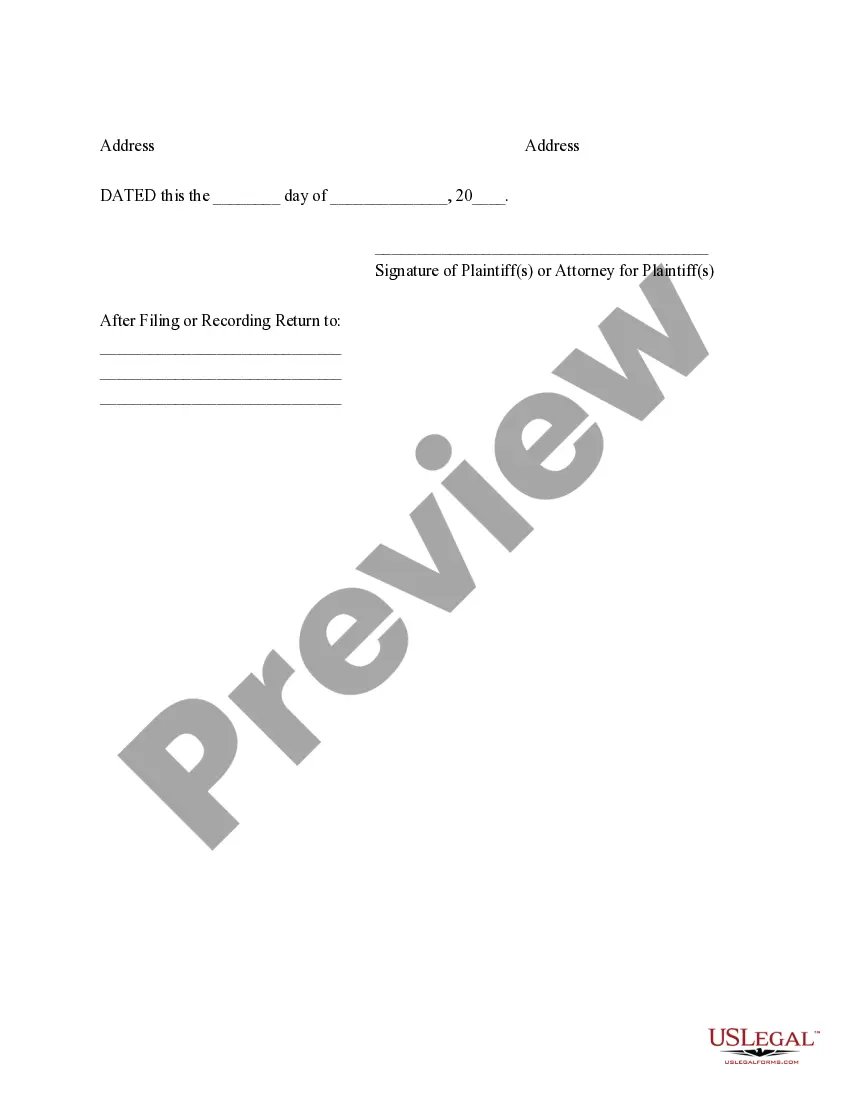

Follow the step-by-step guidelines listed below to download Virginia Satisfaction of Judgment from the website:

- See the document description and click Preview (if available) to verify if the form meets your expectations or not.

- If the form is not what you need, find others using the Search engine or the provided recommendations.

- If it is right, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- Right after downloading it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms library. Besides professionally drafted templates, users will also be supported with step-by-step guidelines regarding how to find, download, and complete templates.

Form popularity

FAQ

A Satisfaction of Judgment is a document signed by one party acknowledge receipt of the payment. The Satisfaction of Judgment is then filed with the court. This is beneficial to the paying party for multiple reasons. One, the court is put on notice that the debt has been satisfied.

The Satisfaction of Judgment form should be signed by the judgment creditor when the judgment is paid, and then filed with the court clerk. Don't forget to do this; otherwise, you may have to track down the other party later.

A court form that the judgment creditor must fill out, sign, and file with the court when the judgment is fully paid. If no liens exist, the back of the Notice of Entry of Judgment can be signed and filed with the court. (See judgment creditor, judgment .)

Judgments are no longer factored into credit scores, though they are still public record and can still impact your ability to qualify for credit or loans.If a civil judgment is still on your credit report, file a dispute with the appropriate credit reporting agencies to have it removed.

If the judgment creditor does not immediately file an Acknowledgement of Satisfaction of Judgment (EJ-100) when the judgment is satisfied, the judgment debtor may make a formal written demand for the creditor to do so. The judgment creditor has 15 days after receiving the debtor's request to serve the acknowledgement.

The general rule, as stated above, is that judgments last for 20 years from the date of the judgment once docketed in the Circuit Court records. However, the 20 years may be extended for an additional 20 years by filing the appropriate document.