Utah Close Account Letter by Consumer

Description

How to fill out Close Account Letter By Consumer?

US Legal Forms - one of the largest libraries of legal templates in the United States - provides a broad selection of legal document types that you can download or print. By utilizing the site, you will find thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can quickly locate the latest templates, such as the Utah Close Account Letter by Consumer.

If you already possess a membership, Log In and download the Utah Close Account Letter by Consumer from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded templates in the My documents tab of your account.

If you are using US Legal Forms for the first time, here are some simple instructions to help you get started: Ensure you have selected the correct document for your city/state. Click the Review button to examine the document's content. Check the document details to confirm you have chosen the right one. If the document does not meet your requirements, use the Search area at the top of the screen to find one that does. If you are satisfied with the document, confirm your choice by clicking the Get now button. Then, select the pricing plan you want and provide your information to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the document to your device. Make edits. Fill out, modify, print, and sign the downloaded Utah Close Account Letter by Consumer. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the document you want.

- Access the Utah Close Account Letter by Consumer with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

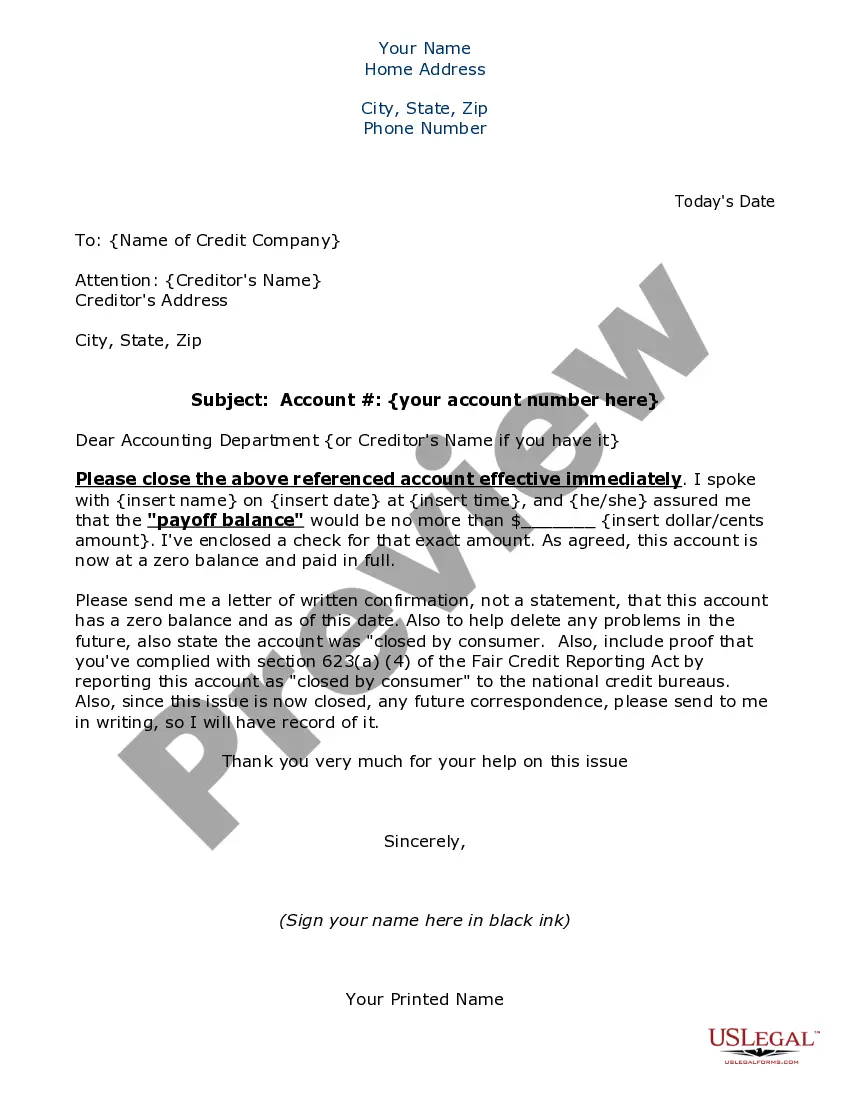

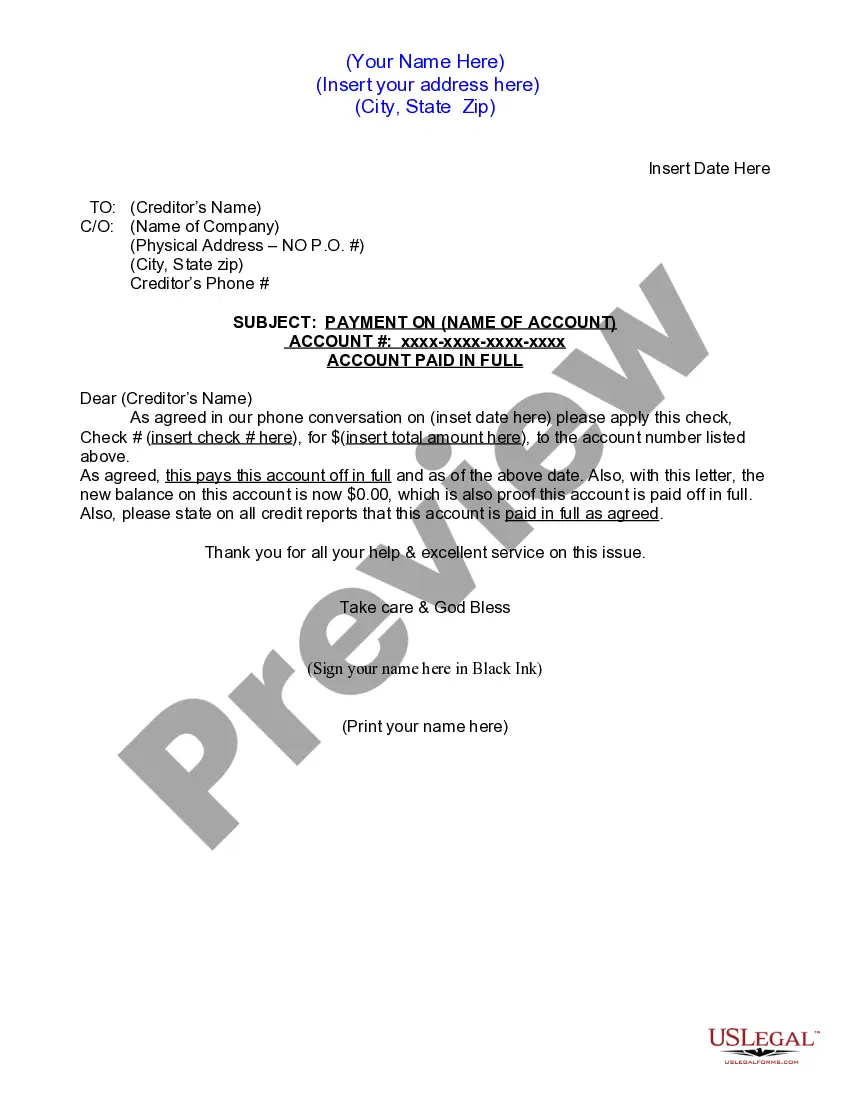

To write a letter for account closure, start with a clear statement of your intention to close the account. Include your account number, the date, and your contact details. A Utah Close Account Letter by Consumer can help you structure your letter correctly, ensuring you cover all vital information and maintain a professional tone throughout.

Filling out an account closing form typically requires you to provide personal information, including your account number and identification details. You should also specify the reason for closure and any final transactions. If you are unsure about the process, a Utah Close Account Letter by Consumer can guide you through the necessary steps, ensuring you complete the form accurately and efficiently.

An authorization letter to close a bank account grants permission for the bank to process your account closure request. This letter should clearly state your intention to close the account, your account number, and your signature. Utilizing a Utah Close Account Letter by Consumer can provide a structured format, making it easier for you to communicate your wishes effectively to the bank.

A closing account letter is a formal communication you send to your bank or financial institution to request the closure of your account. For instance, your letter should include your account number, the reason for closing the account, and your contact information. Using a Utah Close Account Letter by Consumer template can simplify this process, ensuring that you include all necessary details while maintaining professionalism.

The first step when filing a consumer complaint is to clearly define the issue at hand. Gather all necessary documentation, including a Utah Close Account Letter by Consumer, to support your claims. Next, identify the appropriate agency or organization to submit your complaint to, whether it's a state agency or consumer protection group. Taking these steps will ensure that your complaint is taken seriously and addressed promptly.

Deciding to go to consumer court depends on the specifics of your case. If you have a solid claim and sufficient evidence, such as a well-prepared Utah Close Account Letter by Consumer, pursuing legal action may be worthwhile. Consider the potential costs and benefits, as well as any alternative dispute resolution options available. Consulting with a legal professional can also help you make an informed decision.

When preparing your complaint, gather any evidence that supports your case, such as receipts, contracts, emails, and photographs. A Utah Close Account Letter by Consumer can help you articulate your issue clearly and formally. This documentation will strengthen your position and provide a clear timeline of events. Always ensure that your evidence is organized and easily accessible.

Filing a consumer complaint effectively begins with gathering all relevant documentation, including receipts and correspondence. You can use a Utah Close Account Letter by Consumer to clearly outline your concerns and experiences. Consider submitting your complaint to the Better Business Bureau or the Federal Trade Commission, which can provide guidance and support. Always keep copies of your complaint for your records.

In Utah, a debt collector can legally pursue old debt for up to six years. This time frame begins from the date of the last payment or acknowledgment of the debt. Understanding this statute is crucial, especially if you are considering a Utah Close Account Letter by Consumer, as it can affect your financial decisions moving forward.

The Utah State Tax Commission administers tax laws, collects state revenue, and ensures compliance with tax regulations. They handle various tax types, including income, sales, and property taxes. Knowing the role of the Tax Commission can help you navigate any related issues, especially when closing accounts that may involve tax implications.