This document explains the different types of appraisals as defined by the business valuation standards of the American Society of Appraisers. It also includes a work list and a transmittal letter to accompany the work list.

Utah The Valuation Expert

Description

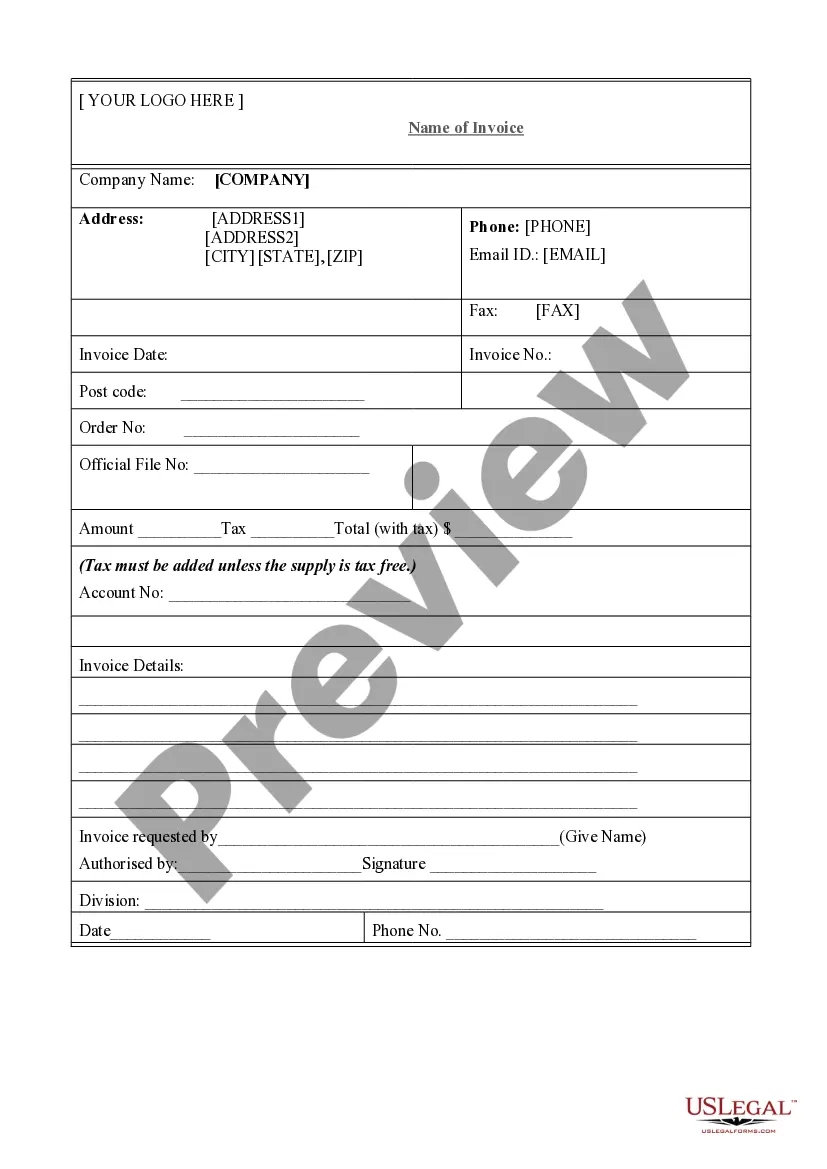

How to fill out The Valuation Expert?

Finding the right authorized file design might be a have a problem. Needless to say, there are tons of templates available on the net, but how would you discover the authorized kind you need? Use the US Legal Forms website. The assistance offers a large number of templates, including the Utah The Valuation Expert, which you can use for enterprise and private requires. Each of the varieties are inspected by professionals and fulfill federal and state specifications.

Should you be presently signed up, log in to your profile and then click the Acquire button to find the Utah The Valuation Expert. Make use of your profile to search from the authorized varieties you have ordered earlier. Check out the My Forms tab of your own profile and obtain one more duplicate from the file you need.

Should you be a fresh consumer of US Legal Forms, listed below are straightforward recommendations for you to comply with:

- First, make sure you have selected the right kind to your city/region. You are able to examine the form making use of the Review button and look at the form information to make certain it is the best for you.

- If the kind will not fulfill your requirements, take advantage of the Seach industry to get the right kind.

- Once you are certain that the form is acceptable, go through the Buy now button to find the kind.

- Pick the rates prepare you want and enter the needed information and facts. Build your profile and pay money for an order with your PayPal profile or credit card.

- Pick the file format and download the authorized file design to your gadget.

- Total, revise and print and sign the received Utah The Valuation Expert.

US Legal Forms will be the greatest local library of authorized varieties for which you can see various file templates. Use the service to download skillfully-created papers that comply with condition specifications.

Form popularity

FAQ

Solution: RCN = Cost × Index Factor (converted to decimal equivalent) Lesson 2 - Index Factors (Valuation of Personal Property and Fixtures) ca.gov ? info ? vppf ? lesson2 ca.gov ? info ? vppf ? lesson2

An accepted valuation approach in property tax environments across the country, RCN is the cost of replacing an existing property with one that is similar to it and is of equal utility. RCN Broadband Property Tax Valuation & Appraisal costquest.com ? uploads ? 2020/10 ? teleco... costquest.com ? uploads ? 2020/10 ? teleco...

Percent good, as a percentage, is the complement of depreciation; for example, if a property has depreciated 20 percent, it is 80 percent good.

Replacement Cost New As a widely accepted part of the valuation approach, Replacement Cost New (RCN) estimates the efficient cost of replacing an existing property with similar property with equal or greater functionality (or what is referred to as equal utility). National RCN & RCNLD Valuation Models - CostQuest Associates costquest.com ? resources ? articles ? nation... costquest.com ? resources ? articles ? nation...

Taxable Value Residential properties that serve as the primary residence of any household receive an exemption of 45% of fair market value. Therefore, the taxable value is only 55% of fair market value. Tax rates are applied to the taxable value to determine the property tax due.

Utah Property Taxes That exemption keeps property taxes for most homeowners quite low. In turn, Utah's average effective property tax rate is 0.5 8%, eventh11th-lowest in the U.S.

Utah Code in Title 59 requires the taxation of property for the funding of local government and Utah schools. Property tax is assessed on both real property and personal property. Generally, personal property used in business is subject to property taxes.