Utah Headhunter Agreement - Self-Employed Independent Contractor

Description

How to fill out Headhunter Agreement - Self-Employed Independent Contractor?

Have you ever been within a location where you require documentation for either professional or personal purposes nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of template documents, including the Utah Headhunter Agreement - Self-Employed Independent Contractor, which can be crafted to satisfy federal and state requirements.

Once you find the appropriate document, click Get now.

Select the pricing plan you desire, enter the required information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy. Access all of the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Utah Headhunter Agreement - Self-Employed Independent Contractor at any time if needed. Simply click the necessary document to download or print the template. Use US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service provides professionally crafted legal document templates that can be utilized for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Utah Headhunter Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the document you need and ensure it is for the correct city/county.

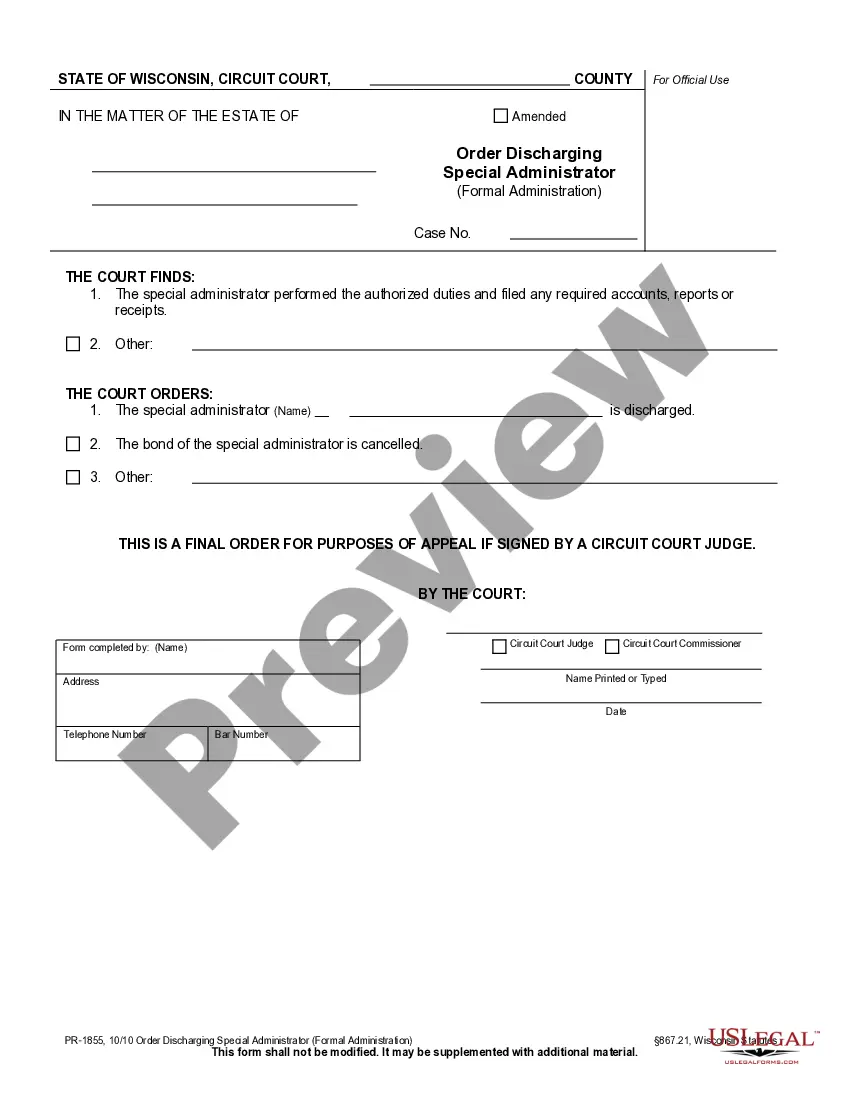

- Use the Review button to examine the form.

- Read the description to confirm that you have selected the correct document.

- If the document isn’t what you are looking for, utilize the Search field to locate the document that fulfills your requirements.

Form popularity

FAQ

To write an independent contractor agreement, start by defining the roles of both parties involved, including their legal names and contact information. Outline the specific services to be performed, payment amounts, and timelines to avoid misunderstandings. Utilizing the Utah Headhunter Agreement - Self-Employed Independent Contractor template on uslegalforms can streamline this process, ensuring you cover all essential elements.

The terms 'self-employed' and 'independent contractor' can often be used interchangeably, but there are subtle differences. 'Self-employed' generally refers to anyone who works for themselves, while 'independent contractor' specifically denotes a person who provides services under a contract. In the context of the Utah Headhunter Agreement - Self-Employed Independent Contractor, using either term is acceptable, but clarity in your role is key.

When filling out an independent contractor agreement, start by clearly stating the parties involved, including your name and the client's name. Specify the scope of work, payment structure, and deadlines to ensure both parties understand the terms. Consulting the Utah Headhunter Agreement - Self-Employed Independent Contractor can provide valuable guidance in creating a comprehensive agreement that meets your needs.

To fill out an independent contractor form, begin by entering your personal information, including your name, address, and contact details. Next, provide details about the project or services you will offer, highlighting the specific tasks and payment terms. Lastly, ensure you review the Utah Headhunter Agreement - Self-Employed Independent Contractor for accuracy and clarity, and submit it as required.

Non-compete agreements can be enforceable for independent contractors, but their validity often depends on the specifics of the contract and state laws. In a Utah Headhunter Agreement - Self-Employed Independent Contractor, ensure that the non-compete clause is reasonable in scope and duration to increase its enforceability. It is wise to consult legal counsel for tailored advice. Platforms like uslegalforms can provide resources to create effective agreements.

To protect yourself when hiring an independent contractor, it is essential to create a detailed contract, such as a Utah Headhunter Agreement - Self-Employed Independent Contractor. This agreement should outline the scope of work, payment terms, and confidentiality clauses. Additionally, consider including provisions for dispute resolution and ensure you verify the contractor's credentials. Utilizing uslegalforms can provide you with templates and guidance to craft a secure agreement.

Yes, you can operate as an independent contractor without a specific license in many cases, but it depends on your profession and local regulations. For instance, if you are entering into a Utah Headhunter Agreement - Self-Employed Independent Contractor, you may not need a business license unless your work requires it. Always check state and local laws to ensure compliance and avoid penalties. Using a platform like uslegalforms can help you understand your obligations.

Creating an independent contractor agreement involves outlining the terms of your working relationship, such as payment, scope of work, and deadlines. You can start with a template or consult legal resources to ensure you cover all essential elements. A Utah Headhunter Agreement - Self-Employed Independent Contractor can simplify this process by providing a clear structure. Platforms like uslegalforms offer customizable templates to assist you.

Yes, independent contractors in Utah often need a business license, particularly if they provide services that require special permits. Each city or county has its own regulations, so it's essential to verify the specific requirements that apply to your situation. Utilizing a Utah Headhunter Agreement - Self-Employed Independent Contractor can help ensure you meet all necessary legal obligations.

To provide proof of employment as an independent contractor, you can use documents such as contracts, invoices, or payment records. A Utah Headhunter Agreement - Self-Employed Independent Contractor serves as a formal record of your work arrangement. Additionally, keep a portfolio of your projects and client communications to further validate your employment status.