Utah Social Worker Agreement - Self-Employed Independent Contractor

Description

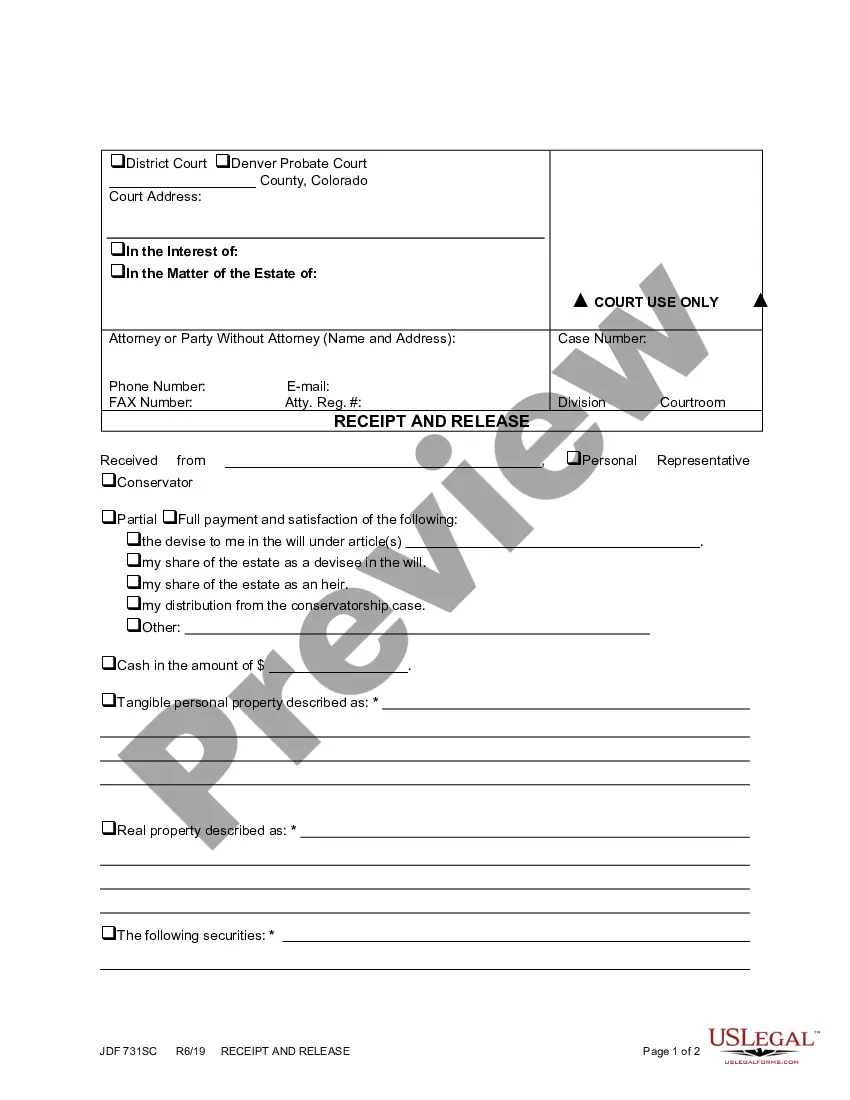

How to fill out Social Worker Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a broad selection of legal document templates that you can download or print.

Utilizing the site, you can discover numerous forms for business and personal use, organized by categories, states, or keywords.

You can quickly find the latest versions of forms such as the Utah Social Worker Agreement - Self-Employed Independent Contractor.

Review the form description to confirm that you have selected the correct form.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you already have an account, sign in to download the Utah Social Worker Agreement - Self-Employed Independent Contractor from the US Legal Forms library.

- The Download button will be visible on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you begin.

- Ensure you have selected the appropriate form for your city/state.

- Click the Review button to check the form’s contents.

Form popularity

FAQ

Creating an independent contractor agreement, like a Utah Social Worker Agreement - Self-Employed Independent Contractor, requires several key components. First, you should define the scope of work, including the specific services the contractor will provide. Next, detail the payment terms, such as rates and deadlines, to ensure clarity. Finally, consider using a platform like USLegalForms, which offers customizable templates to simplify the process and ensure you meet all legal requirements.

Creating an independent contractor agreement requires you to outline the work, payment structure, deadlines, and any legal obligations of both parties. Ensure it clearly states the contractor's independent status, which affects tax treatment. For a tailored Utah Social Worker Agreement - Self-Employed Independent Contractor, using a reliable platform like uslegalforms can simplify this process significantly.

To write a self-employment contract, start by detailing your services, payment terms, and any deadlines. Make sure to include clauses on termination and dispute resolution. A well-structured Utah Social Worker Agreement - Self-Employed Independent Contractor can help clarify these points and protect both parties in the agreement.

In Utah, the amount of work you can perform without a contractor license varies based on the project type. Generally, for projects under a certain dollar amount, you may not need a license. Always refer to the latest regulations for details, especially when drafting a Utah Social Worker Agreement - Self-Employed Independent Contractor, as compliance is essential.

Writing a simple employment contract includes stating the job title, responsibilities, compensation, and duration of employment. It's important to outline any benefits and confidentiality agreements if relevant. An effective Utah Social Worker Agreement - Self-Employed Independent Contractor can serve as a straightforward guide, ensuring you cover all vital aspects.

Yes, you can write your own legally binding contract as long as it follows legal principles including mutual agreement, consideration, and the capacity of parties to contract. Make sure to detail all necessary terms and ensure both parties sign the document. For ease, consider a Utah Social Worker Agreement - Self-Employed Independent Contractor template to ensure compliance with local laws.

To write a self-employed contract, start by defining the services you will provide and the compensation you will receive. Clarify any deadlines and specific expectations to avoid misunderstandings. Utilizing a Utah Social Worker Agreement - Self-Employed Independent Contractor can streamline this process, ensuring all essential terms are clear and legally binding.

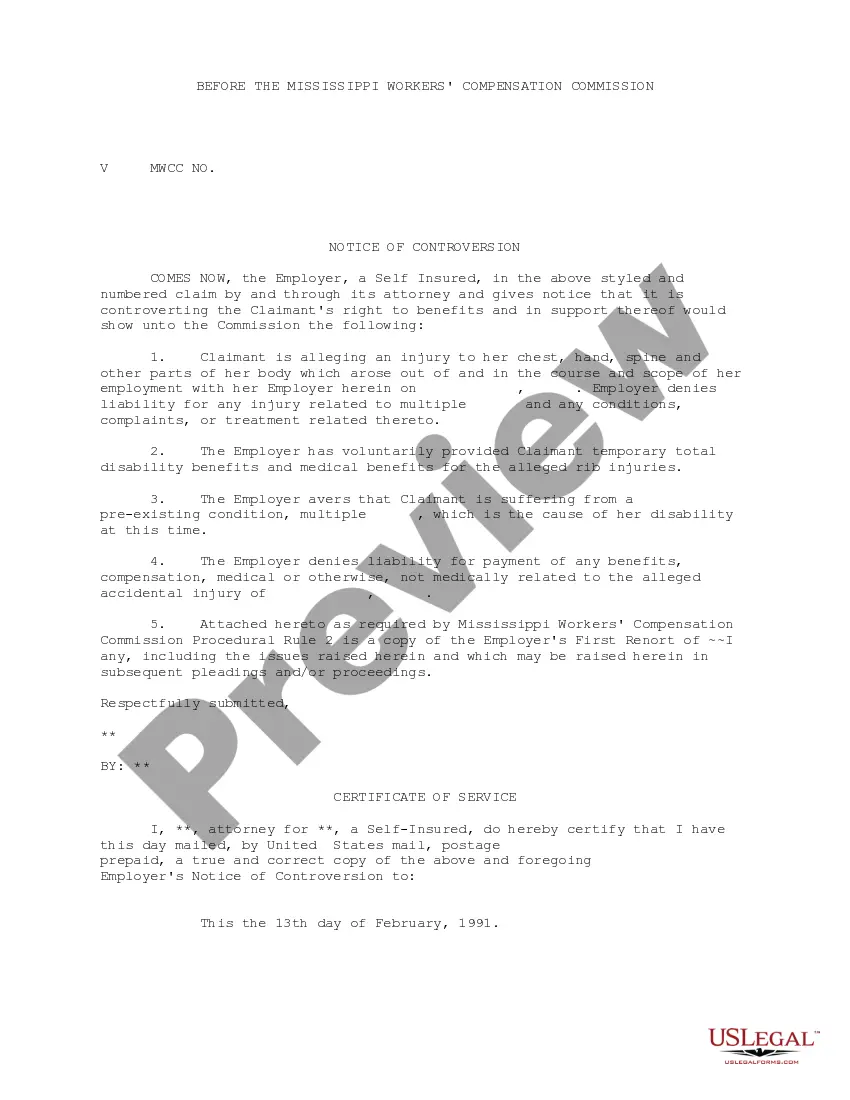

Writing a contract for a 1099 employee involves outlining the terms of the relationship, including payment details, work scope, and deadlines. It's essential to specify that the worker is an independent contractor, not an employee, which affects tax and legal obligations. For a detailed Utah Social Worker Agreement - Self-Employed Independent Contractor, consider including any applicable state regulations.

Yes, as an independent contractor in Utah, you generally need a business license to operate legally. This license demonstrates your compliance with local regulations and can enhance your professional image. If you are engaged in a Utah Social Worker Agreement - Self-Employed Independent Contractor, obtaining the appropriate license is an essential step. For additional guidance, consider using uslegalforms to simplify the licensing process.

Legal requirements for independent contractors include obtaining any necessary business licenses, following tax guidelines, and adhering to contractual agreements. Each state has different regulations, so familiarize yourself with Utah’s specific laws. When working under a Utah Social Worker Agreement - Self-Employed Independent Contractor, ensure that you understand these obligations to minimize legal risks. Uslegalforms offers resources to help navigate these requirements.