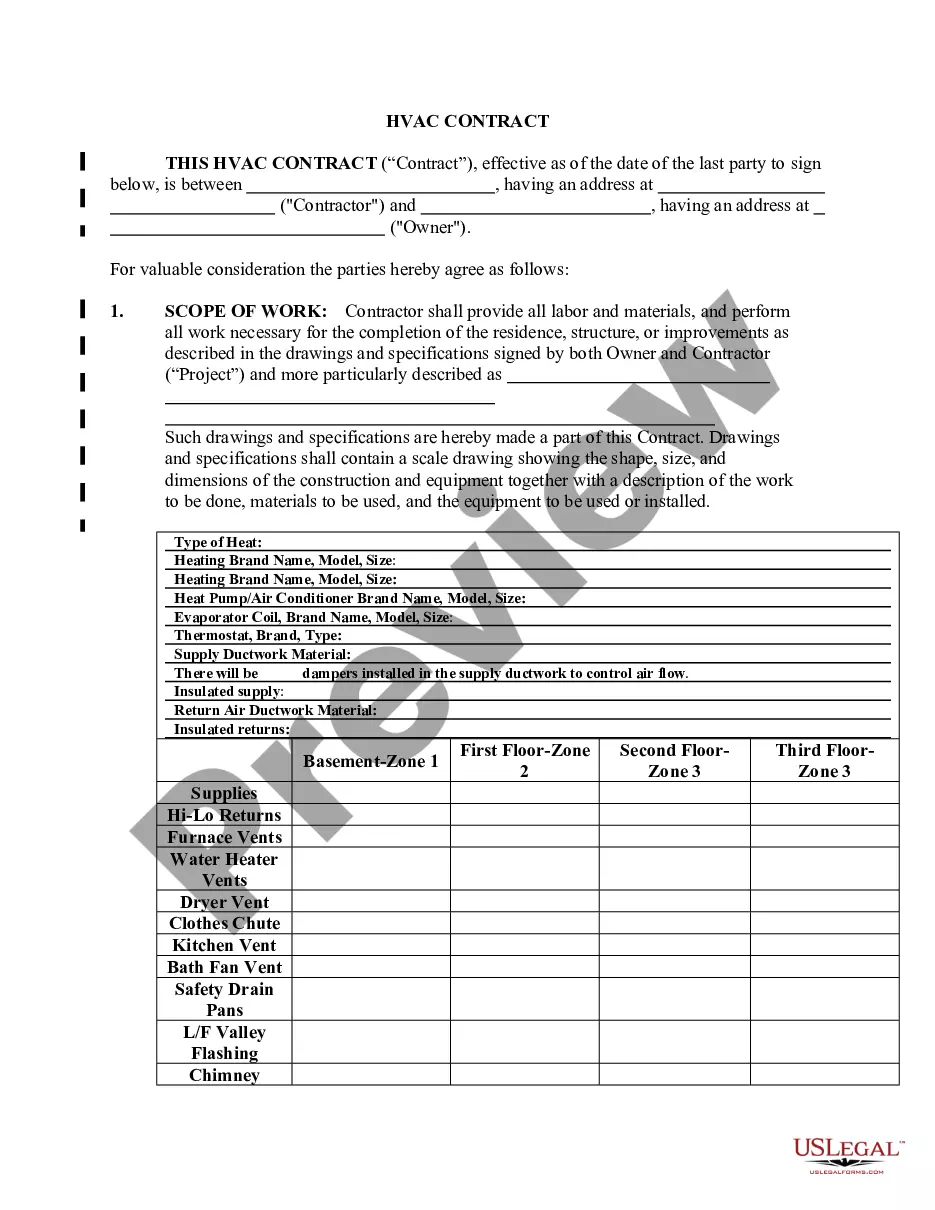

Utah Heating Contractor Agreement - Self-Employed

Description

How to fill out Heating Contractor Agreement - Self-Employed?

You can allocate time online searching for the legal document template that aligns with the federal and state requirements you will need.

US Legal Forms provides a vast array of legal templates that have been verified by experts.

You can conveniently download or print the Utah Heating Contractor Agreement - Self-Employed from my services.

If available, utilize the Preview button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the Utah Heating Contractor Agreement - Self-Employed.

- Each legal document template you purchase is yours indefinitely.

- To acquire another copy of any purchased form, navigate to the My documents tab and click the corresponding button.

- If it's your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Check the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Yes, independent contractors in Utah may need a business license, depending on their specific services and local regulations. It is advisable to check with the local city or county authority to ensure compliance. When establishing a Utah Heating Contractor Agreement - Self-Employed, being aware of licensing requirements helps prevent legal complications and fosters legitimate business operations.

employed individual typically operates under an independent contractor agreement. This type of contract delineates the terms of the freelance or contract work the individual will offer. For a solid foundation, review a Utah Heating Contractor Agreement SelfEmployed, which is designed to meet the specific needs of selfemployed heating contractors in Utah.

To write an independent contractor agreement, start by defining the services provided and the timeline for completion. Next, include payment details, responsibilities, and any applicable legal clauses. For a comprehensive Utah Heating Contractor Agreement - Self-Employed, consider using templates and legal solutions from uslegalforms, which offer user-friendly options tailored for contractors.

An employment contract must detail job duties, salary, and the duration of the employment. Additionally, it should include non-disclosure and non-compete clauses if necessary, as well as the process for termination. When crafting a Utah Heating Contractor Agreement - Self-Employed, ensure it aligns with state guidelines to protect both parties involved.

A 1099 contract should clearly outline the scope of work, payment terms, and the duration of the agreement. It must specify the responsibilities of both parties and include a clause on confidentiality, if applicable. For those utilizing a Utah Heating Contractor Agreement - Self-Employed, it is essential to define tax obligations, as independent contractors report income differently than employees.

Typically, the independent contractor agreement is drafted by the hiring party. In the case of a Utah Heating Contractor Agreement - Self-Employed, you should include specific terms that clarify the work scope, payment details, and any deadlines. Both parties can also seek legal advice to ensure that the agreement adheres to Utah state laws and adequately protects their interests. Using a platform like uslegalforms can simplify this process, providing templates tailored for Utah heating contractors.

Yes, a self-employed person can and should have a contract. A signed agreement protects both the contractor and the client by clearly laying out expectations and terms. It can cover payment details, project timelines, and other essential provisions. For those in the heating industry, a tailored Utah Heating Contractor Agreement - Self-Employed can provide a solid foundation for this contractual relationship.

To create an independent contractor agreement, start by defining the scope of work and the terms of payment. It is essential to outline the roles and responsibilities of both the contractor and the client clearly. Additionally, make sure to include relevant clauses regarding confidentiality, termination, and liability. Using a Utah Heating Contractor Agreement - Self-Employed template from ulegalforms can streamline this process and ensure that you cover all necessary legal aspects.

Yes, an independent contractor is indeed classified as self-employed. This classification applies to individuals who provide services independently without direct control from an employer. In the context of the Utah Heating Contractor Agreement - Self-Employed, understanding this distinction is essential for tax purposes and legal obligations. It reinforces the importance of properly drafting agreements to reflect this status.

To write an independent contractor agreement like the Utah Heating Contractor Agreement - Self-Employed, begin by defining the parties involved and outlining the scope of services. Next, specify payment amounts, schedules, and any additional terms such as confidentiality or liability. Incorporating clear and concise language is vital for effective communication. By following this structure, you create a legally sound document that protects both parties.