Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor

Description

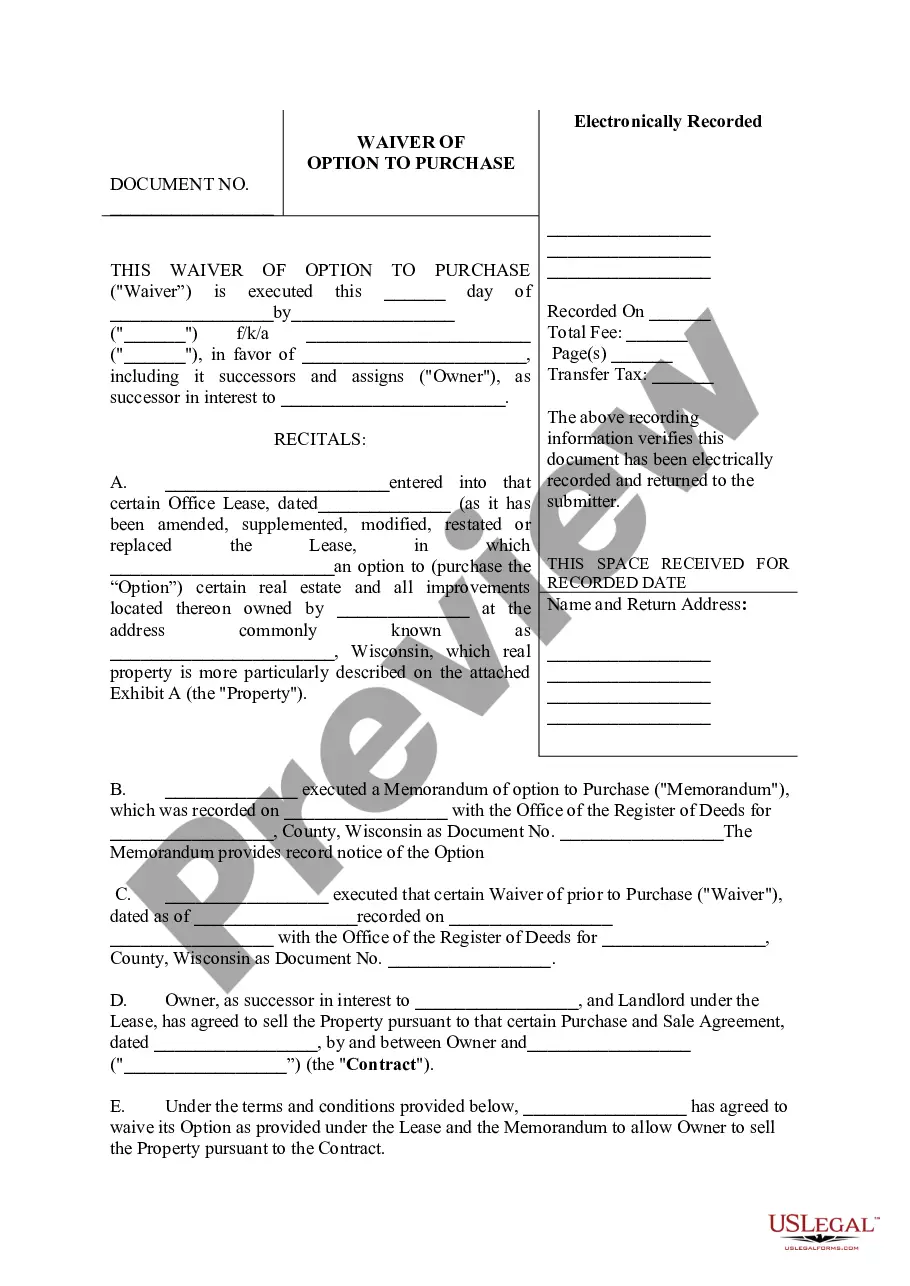

How to fill out Cable Disconnect Service Contract - Self-Employed Independent Contractor?

Selecting the appropriate official document format can be quite challenging.

Naturally, there are numerous templates accessible online, but how can you obtain the official form you desire.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor, which you can use for commercial and personal needs.

You can review the form using the Review option and check the form summary to ensure it is suitable for you.

- All of the documents are reviewed by professionals and comply with state and federal requirements.

- If you are already registered, Log In to your account and click on the Acquire button to locate the Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor.

- Use your account to search through the legal forms you may have previously purchased.

- Navigate to the My documents section of your account and acquire an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have chosen the correct form for your region/area.

Form popularity

FAQ

The new federal rule on independent contractors seeks to clarify the criteria for determining whether a worker is an independent contractor or an employee. This affects how the Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor should be drafted and understood. It is advisable to stay updated on these regulations, as they can impact your rights and obligations as a contractor.

Providing two weeks' notice as an independent contractor is generally considered good practice, although it is not legally required. Refer to your Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor for any specific notice requirements. Giving notice can foster positive relationships and demonstrate professionalism, which may benefit you in future projects.

To protect yourself as an independent contractor, ensure that you have a comprehensive Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor. This document should clearly outline payment terms, responsibilities, and termination conditions. Additionally, maintain accurate records of your work, communications, and financial transactions, which can serve as evidence if disputes arise.

To politely terminate a contract with a contractor, express appreciation for their services while stating your decision clearly. Refer to your Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor to ensure you're following agreed-upon termination procedures. Keep the communication respectful, as this approach can preserve relationships and open doors for future collaborations.

In Utah, whether an independent contractor needs a business license can depend on the nature of the work and the local jurisdiction. It's essential to consult the specific licensing requirements related to your Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor. Generally, certain professions may require licenses, while others might not, so thorough research is advised.

It is generally not illegal to terminate a 1099 contract, as long as you follow the terms laid out in the agreement. Your Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor should detail how to proceed with termination. However, consider that improper termination could lead to legal disputes, so clarify any potential consequences before taking action.

When terminating a contract with an independent contractor, begin by checking the specific provisions in your Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor. It's important to notify the contractor in writing, providing clear reasons for the termination. Be professional and respectful in your communication, as this maintains goodwill and can prevent potential disputes.

To terminate a contract with an independent contractor, you should first review the terms outlined in your Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor. Look for clauses specifying termination rights and notice requirements. After understanding these terms, communicate directly with the contractor to inform them of your decision. Keep records of all communications for reference.

To fill out an independent contractor agreement, begin with your contact information and the contractor's details. Clearly define the services to be provided in the context of the Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor. Include important clauses about payment, deadlines, and termination terms. Utilizing platforms like uslegalforms can further assist you in ensuring that all necessary sections are completed correctly and comprehensively.

Writing an independent contractor agreement involves outlining the scope of work you will perform under a Utah Cable Disconnect Service Contract - Self-Employed Independent Contractor setup. Start by detailing the services, payment terms, and project timelines. Be clear about each party's responsibilities to avoid confusion. You can simplify this process by using platforms like uslegalforms, which provide ready-made templates tailored for independent contractors.