This due diligence workform is used to review property information and title commitments and policies in business transactions.

Utah Fee Interest Workform

Description

How to fill out Fee Interest Workform?

You might invest hours online trying to locate the legal documents template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can actually obtain or print the Utah Fee Interest Workform from your service.

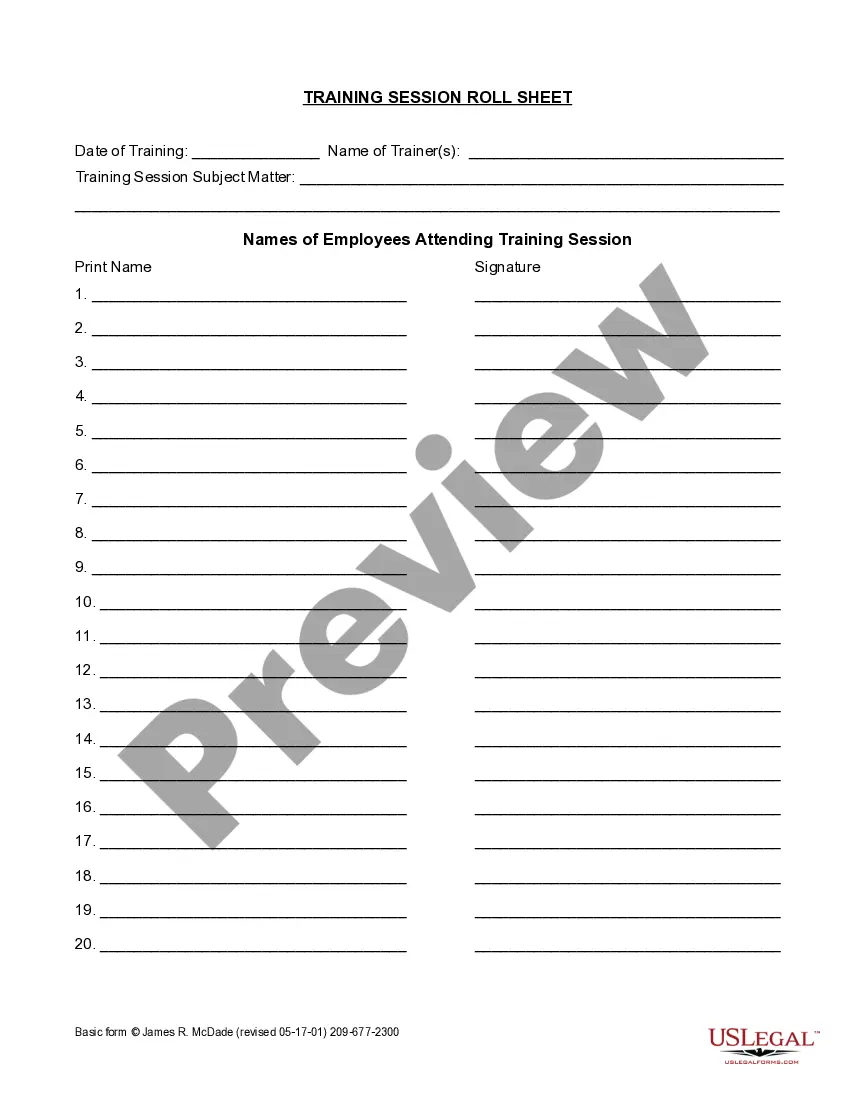

If available, use the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and then press the Acquire button.

- Then, you can fill out, modify, print, or sign the Utah Fee Interest Workform.

- Every legal document template you obtain is yours permanently.

- To get another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple steps outlined below.

- First, ensure you have chosen the correct document template for the area/city of your selection.

- Review the form details to confirm that you have selected the appropriate document.

Form popularity

FAQ

Yes, Utah provides a state withholding form specifically designed for this purpose. Employers must use this form to report and manage state income tax withholdings efficiently. By leveraging tools like the Utah Fee Interest Workform, you can ensure compliance while simplifying the documentation process for your employees.

Many people view Utah as a tax-friendly state due to its moderate income tax rates and various credits available to residents. The state offers several tax incentives for businesses and individuals, promoting a healthy economic environment. When planning your finances, consider how the Utah Fee Interest Workform can help you accurately report your income and deductions.

Yes, Utah is a mandatory withholding state. Employers must withhold state income tax from employee wages. This requirement is applicable to all employees regardless of their employment status. To manage this effectively, utilizing the Utah Fee Interest Workform can streamline the filing and withholding process.

In Utah, interest earned from municipal bonds is generally exempt from state income tax, which can be beneficial for investors. However, it is important to be aware of federal tax implications as well. Utilizing the Utah Fee Interest Workform can help you understand how to report these earnings appropriately and gain clarity on your overall tax situation.

The TC 40B form is a supplemental tax schedule that allows taxpayers to claim certain tax credits and adjustments. It provides additional details that supplement the primary TC-40 form. If you're seeking to maximize your deductions, the Utah Fee Interest Workform can guide you through the process of integrating this form into your tax filings.

The TC-40 tax form is Utah's individual income tax return, necessary for reporting personal income. This form allows individuals to calculate the taxes owed or refunds due for any taxable income earned in the state. Using the Utah Fee Interest Workform simplifies the process, enabling accurate completion and timely submission.

The TC 40 is the primary individual income tax return form used in Utah. Residents and non-residents who earn income in Utah utilize this form to report their earnings and calculate their state tax. By using the Utah Fee Interest Workform, individuals can accurately reflect their financial activities and ensure proper filing.

Any corporation that conducts business in Utah is required to file an Utah corporate tax return. This includes businesses registered in Utah and those operating in the state. The Utah Fee Interest Workform can help determine your tax obligations as a corporation, ensuring compliance with state regulations.

The TC-40 form is the primary individual income tax return form used in Utah. It is necessary for residents to report their income, deductions, and claim any credits. If you require assistance in filling out the form correctly, a Utah Fee Interest Workform can help streamline the process and ensure you do not miss any critical information.

The Utah state number, which is a unique 14-digit identifier for businesses, is assigned by the Utah Division of Corporations and Commercial Code. This number is essential for business operations including tax filings and permits. You can find your Utah state number on the state’s official business registration documents. Utilizing a Utah Fee Interest Workform can guide you through the process of obtaining this important identifier.