Utah Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock

Description

How to fill out Articles Supplementary - Classifying Preferred Stock As Cumulative Convertible Preferred Stock?

You can devote hrs on the Internet trying to find the legitimate document format that fits the federal and state specifications you require. US Legal Forms gives thousands of legitimate varieties which can be reviewed by pros. It is possible to download or produce the Utah Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock from the service.

If you already possess a US Legal Forms bank account, you may log in and then click the Acquire key. Next, you may total, revise, produce, or indicator the Utah Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock. Each and every legitimate document format you buy is yours eternally. To acquire an additional duplicate for any obtained form, go to the My Forms tab and then click the related key.

If you are using the US Legal Forms web site the very first time, follow the easy recommendations under:

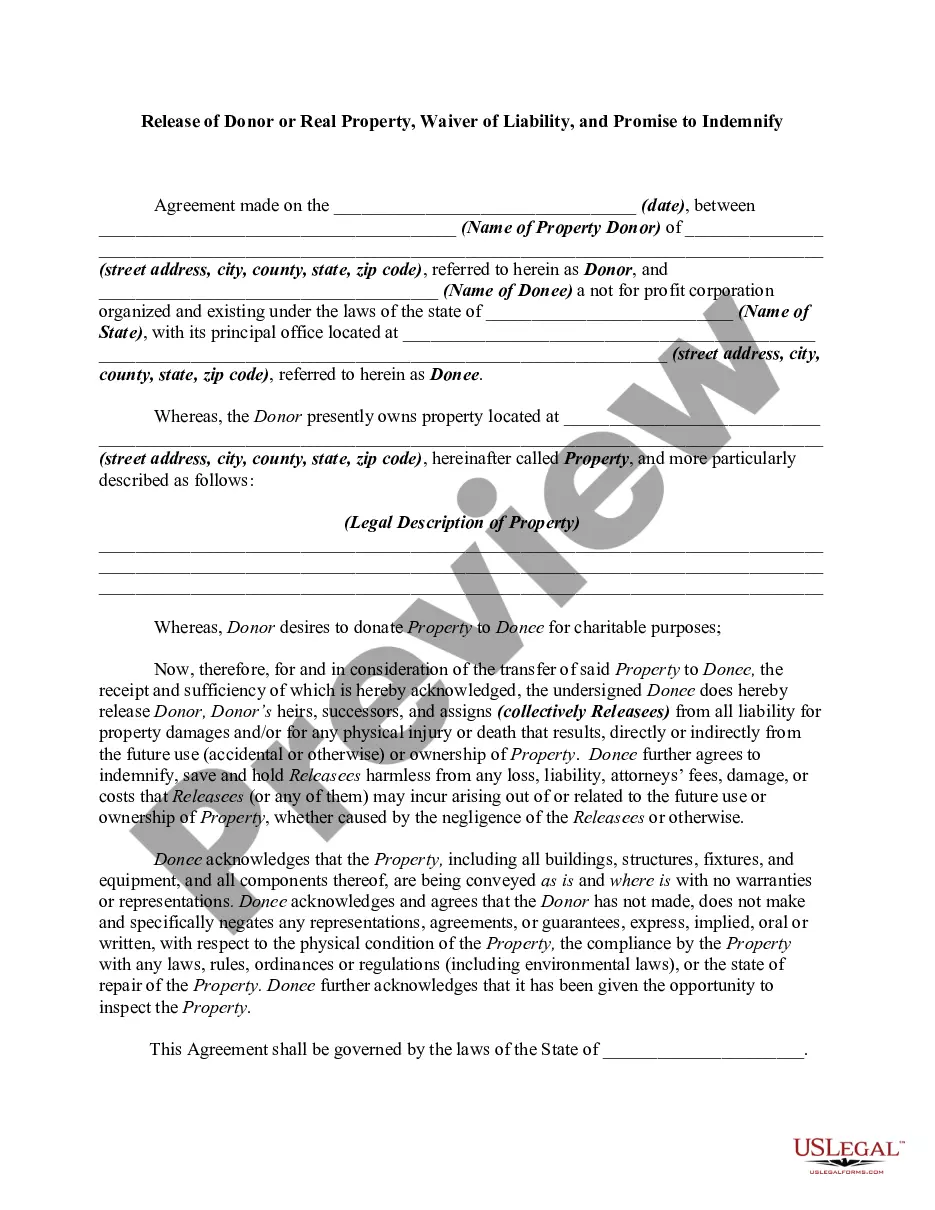

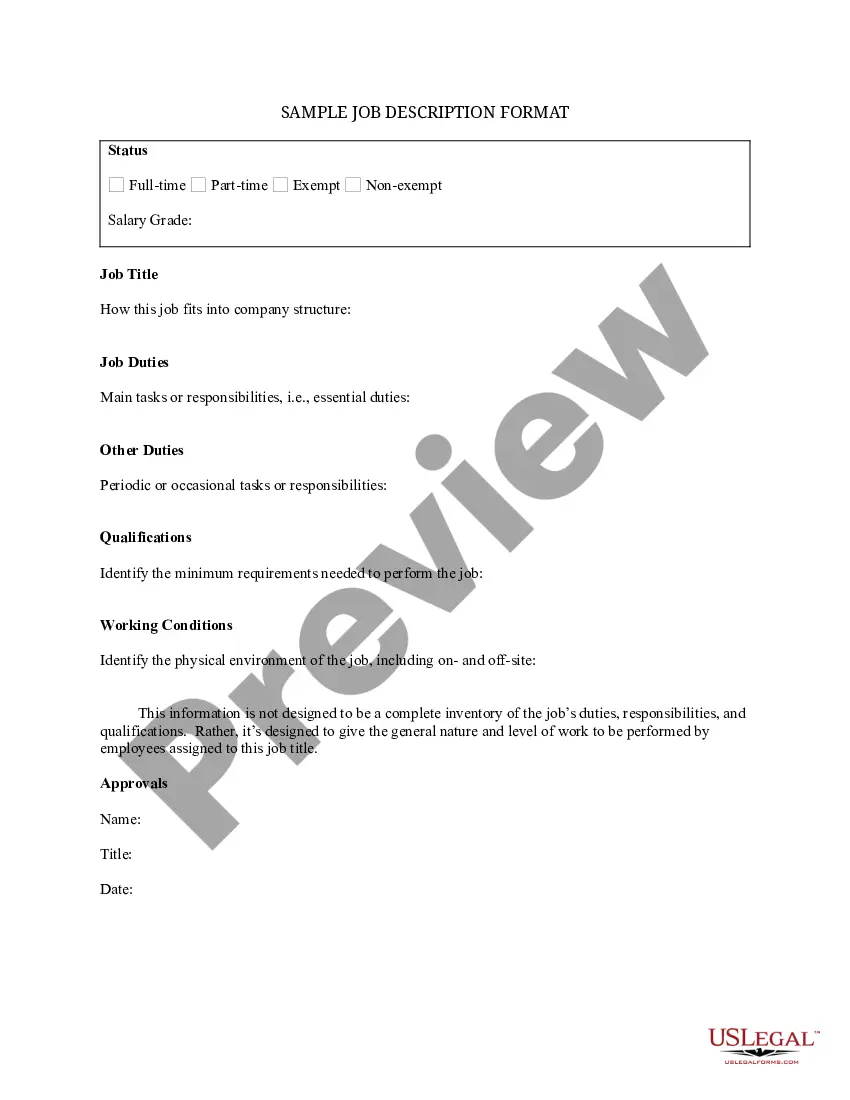

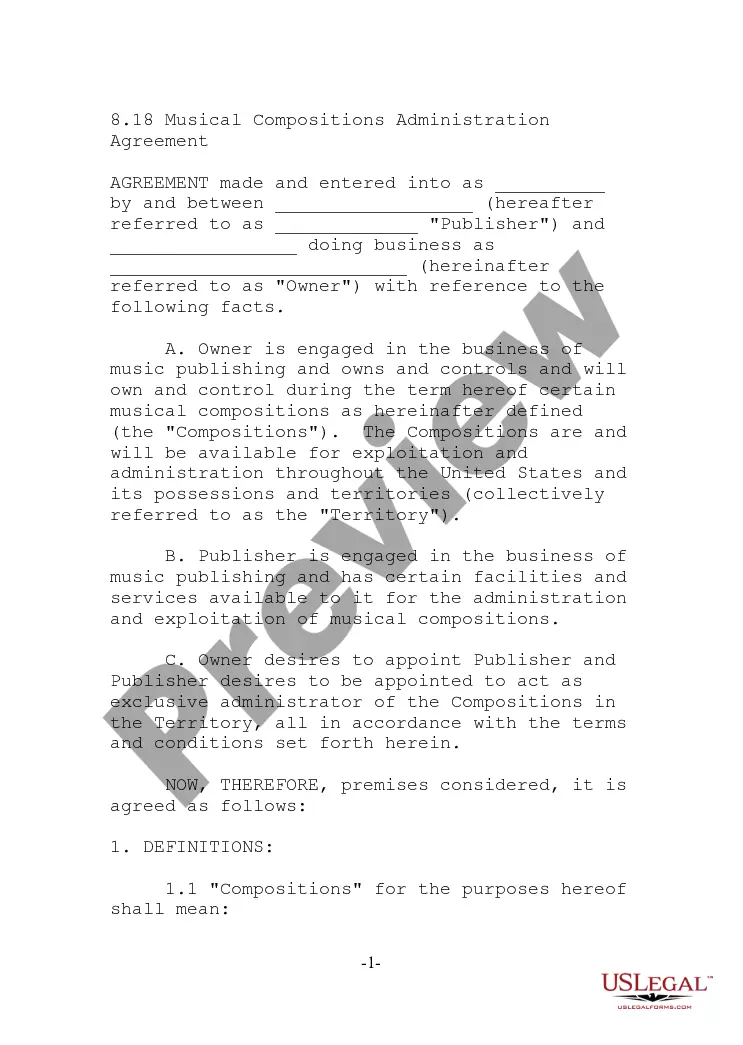

- Initial, make sure that you have selected the correct document format for that state/area of your choice. Look at the form description to make sure you have selected the correct form. If offered, take advantage of the Review key to look from the document format as well.

- In order to find an additional variation from the form, take advantage of the Research discipline to find the format that meets your needs and specifications.

- Upon having discovered the format you desire, click Purchase now to move forward.

- Select the costs program you desire, enter your accreditations, and register for a merchant account on US Legal Forms.

- Total the transaction. You may use your bank card or PayPal bank account to purchase the legitimate form.

- Select the format from the document and download it in your device.

- Make alterations in your document if possible. You can total, revise and indicator and produce Utah Articles Supplementary - classifying Preferred Stock as Cumulative Convertible Preferred Stock.

Acquire and produce thousands of document themes using the US Legal Forms site, which offers the most important selection of legitimate varieties. Use specialist and condition-particular themes to tackle your organization or specific needs.

Form popularity

FAQ

What Is Convertible Preferred Stock? Convertible preferred stocks are preferred shares that include an option for the holder to convert them into a fixed number of common shares after a predetermined date.

CCPPO (Cumulative, Convertible, Participating, Preferred-dividend Ordinary) shares are a rare type of equity shares issued by a company, which contain multiple features, including cumulative dividends, participation, convertibility into common shares, and a preferred-dividend feature.

Noncumulative describes a type of preferred stock that does not entitle investors to reap any missed dividends. By contrast, "cumulative" indicates a class of preferred stock that indeed entitles an investor to dividends that were missed.

What Is Cumulative Preferred Stock? Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past, the dividends owed must be paid out to cumulative preferred shareholders first.

Cumulative preferred stock provides consistent income to shareholders. It ensures that if dividends are not paid in a particular period, they accumulate and must be paid in the future. This feature can attract risk-averse investors who seek reliable dividend payments and a degree of security.

Convertible preferred stock is a type of preferred share that pays a dividend and can be converted into common stock at a fixed conversion ratio after a specified date. Convertible preferred stock is a type of hybrid security with features of both debt and equity.