Utah Private placement of Common Stock

Description

How to fill out Private Placement Of Common Stock?

US Legal Forms - among the most significant libraries of legal kinds in the USA - offers a wide range of legal papers themes you can download or print out. Utilizing the website, you may get thousands of kinds for enterprise and personal functions, sorted by categories, claims, or search phrases.You will find the most up-to-date types of kinds such as the Utah Private placement of Common Stock in seconds.

If you currently have a membership, log in and download Utah Private placement of Common Stock from your US Legal Forms local library. The Acquire switch can look on each and every develop you look at. You have accessibility to all previously saved kinds in the My Forms tab of your profile.

If you want to use US Legal Forms the first time, listed below are easy directions to obtain started out:

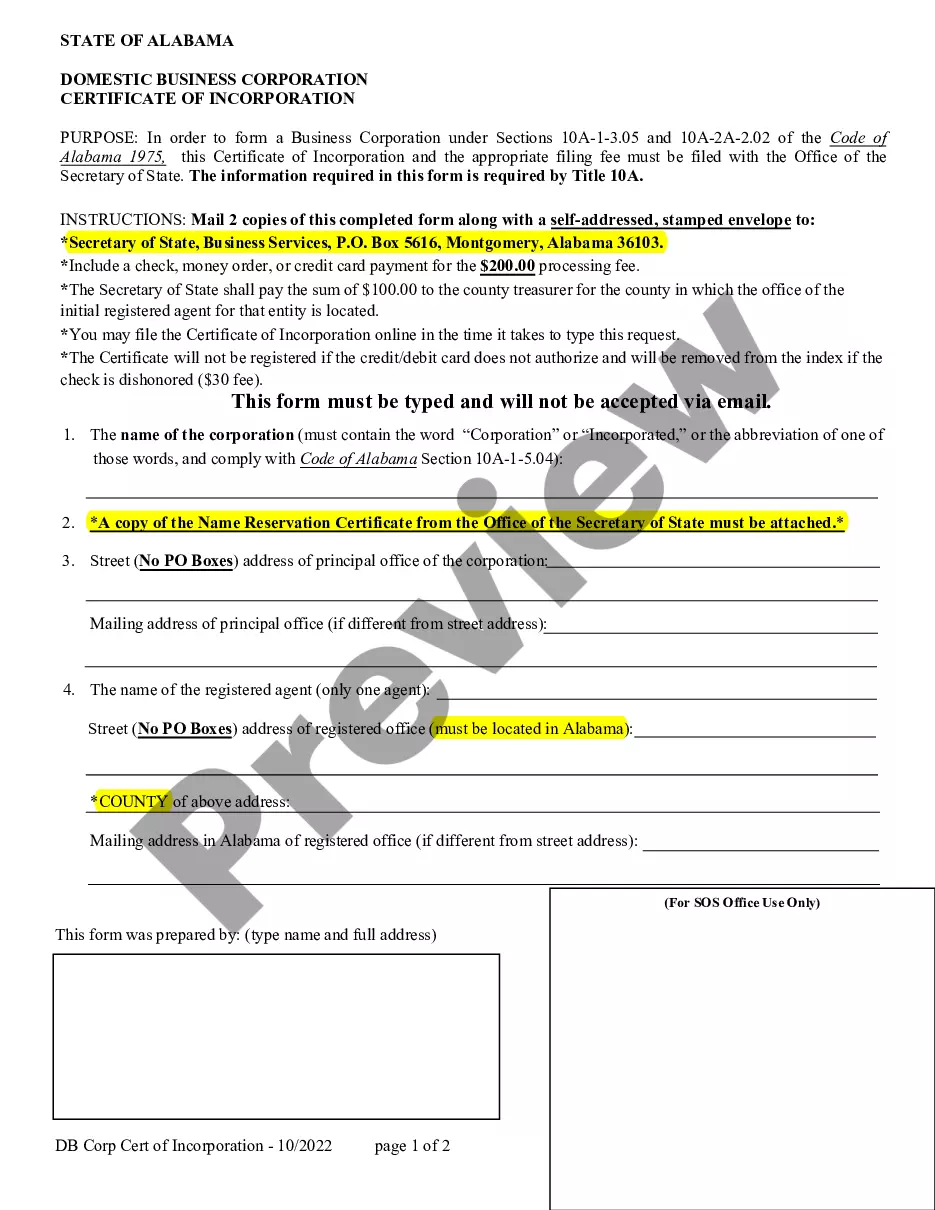

- Be sure you have chosen the best develop for your city/state. Click the Preview switch to examine the form`s content material. Look at the develop description to actually have selected the appropriate develop.

- If the develop does not fit your requirements, utilize the Research field on top of the display to get the the one that does.

- When you are pleased with the shape, confirm your choice by visiting the Get now switch. Then, pick the prices plan you prefer and give your references to sign up to have an profile.

- Process the deal. Utilize your credit card or PayPal profile to finish the deal.

- Choose the structure and download the shape on your system.

- Make adjustments. Load, change and print out and sign the saved Utah Private placement of Common Stock.

Each and every format you included in your money does not have an expiration day and it is the one you have permanently. So, if you would like download or print out an additional copy, just visit the My Forms section and click around the develop you require.

Gain access to the Utah Private placement of Common Stock with US Legal Forms, probably the most substantial local library of legal papers themes. Use thousands of professional and state-specific themes that satisfy your small business or personal needs and requirements.

Form popularity

FAQ

Private placements are regulated by the U.S. Securities and Exchange Commission under Regulation D. Investors invited to participate in private placement programs include wealthy individual investors, banks and other financial institutions, mutual funds, insurance companies, and pension funds.

There are two kinds of private placement?preferential allotment and qualified institutional placement. A listed company can issue securities to a select group of entities, such as institutions or promoters, at a particular price. This scenario is known as a preferential allotment.

FINRA Rule 5123 (Private Placements of Securities) requires firms to file with FINRA's Corporate Financing Department within 15 calendar days of the date of first sale of a private placement, a private placement memorandum, term sheet or other offering document, or indicate that no such offerings documents were used.

Regulation D is a provision that exempts some companies from the registration requirements associated with a public offering. It gives smaller companies access to investment capital by letting them offer specific types of private placements.

Consent of Shareholders, if general meeting called at shorter notice. Copy of Board Resolution for allotment of securities. Copy of Valuation Report. List of allottees. a complete record of private placement offers and acceptances in Form PAS-5 is required.

A private placement is an offering of unregistered securities to a limited pool of investors. In a private placement, a company sells shares of stock in the company or other interest in the company, such as warrants or bonds, in exchange for cash.

How to Complete a Private Placement Deal Launch. The first step, Deal Launch, initiates the window of time from which the issue is offered to investors, to when a decision must be made, typically 1-3 weeks. ... Negotiations. ... Information Gathering. ... Investment Risk Analysis. ... Pricing. ... Rate Lock. ... Closing.