Utah Issuance of Common Stock in Connection with Acquisition

Description

How to fill out Issuance Of Common Stock In Connection With Acquisition?

If you have to total, obtain, or print out lawful papers templates, use US Legal Forms, the greatest variety of lawful forms, that can be found on-line. Take advantage of the site`s easy and handy look for to get the files you require. Different templates for company and person purposes are categorized by categories and says, or keywords. Use US Legal Forms to get the Utah Issuance of Common Stock in Connection with Acquisition with a handful of click throughs.

In case you are previously a US Legal Forms customer, log in to the accounts and click the Down load button to obtain the Utah Issuance of Common Stock in Connection with Acquisition. You can even accessibility forms you formerly delivered electronically inside the My Forms tab of your accounts.

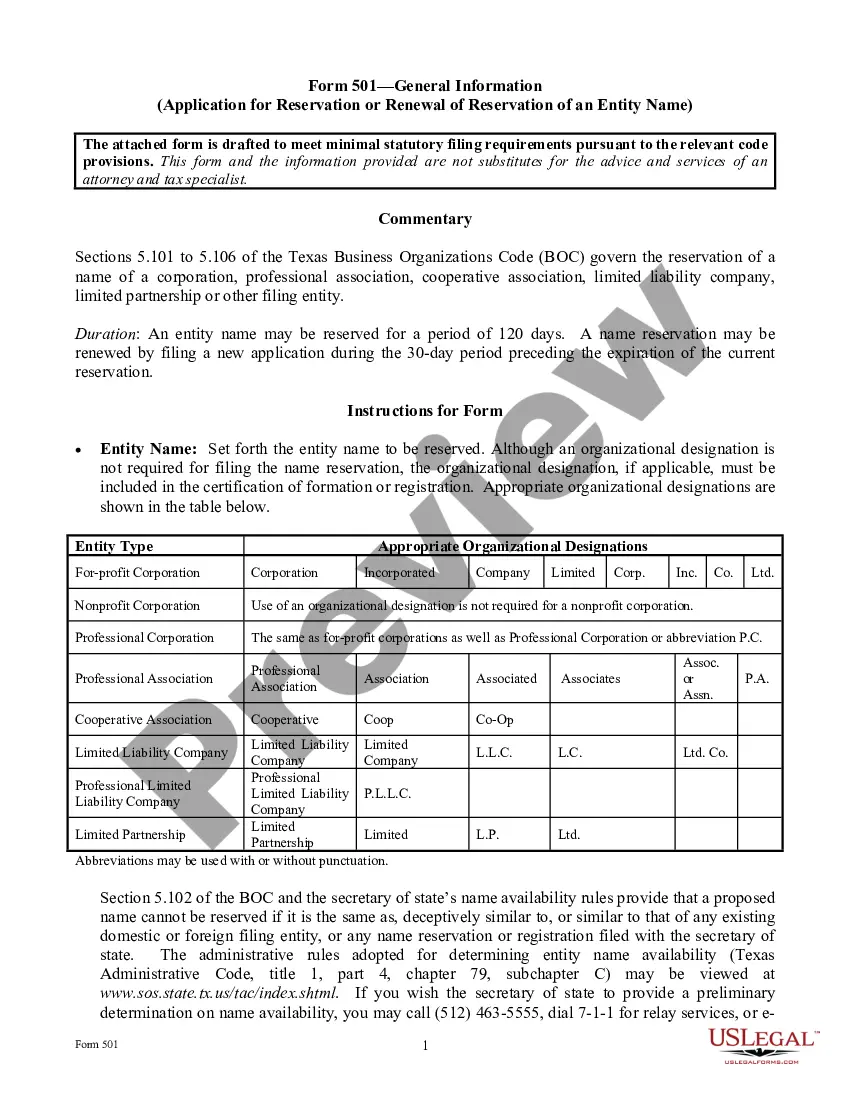

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for the right town/nation.

- Step 2. Make use of the Preview solution to examine the form`s content. Don`t forget about to learn the description.

- Step 3. In case you are not happy together with the develop, use the Research industry on top of the monitor to find other types of your lawful develop web template.

- Step 4. Upon having identified the shape you require, go through the Acquire now button. Choose the rates prepare you prefer and include your references to register on an accounts.

- Step 5. Approach the deal. You should use your charge card or PayPal accounts to finish the deal.

- Step 6. Choose the format of your lawful develop and obtain it on your own system.

- Step 7. Comprehensive, modify and print out or indicator the Utah Issuance of Common Stock in Connection with Acquisition.

Each lawful papers web template you buy is yours eternally. You have acces to every develop you delivered electronically in your acccount. Click on the My Forms area and pick a develop to print out or obtain once more.

Contend and obtain, and print out the Utah Issuance of Common Stock in Connection with Acquisition with US Legal Forms. There are many specialist and state-particular forms you can use for your personal company or person requirements.

Form popularity

FAQ

Liability of shareholders. A shareholder of a corporation, when acting solely in the capacity of a shareholder, has no fiduciary duty or other similar duty to any other shareholder of the corporation, including not having a duty of care, loyalty, or utmost good faith.

Depending on the specifics of the merger, investors may have their shares cashed-out, or exchanged for shares of the new company. Prices of stocks may increase or decrease, often depending on if they're shares of the target or acquiring company.

16-10a-601 Authorized shares. All shares of a class shall have preferences, limitations, and relative rights identical with those of other shares of the same class except to the extent otherwise permitted by this section and Section 16-10a-602.

Definition. "Oppressive conduct" means a continuing course of conduct, a significant action, or a series of actions that substantially interferes with the interests of a shareholder as a shareholder.

If a publicly traded company is acquired by a private company, its share prices will typically rise to the takeover price. When the deal is closed, existing shareholders will receive cash in return for their stock (i.e., their shares will be sold to the acquiring company).

A corporation shall keep as permanent records minutes of all meetings of its shareholders and board of directors, a record of all actions taken by the shareholders or board of directors without a meeting, and a record of all actions taken on behalf of the corporation by a committee of the board of directors in place of ...

16-10a-1501 Authority to transact business required. This applies to foreign corporations that conduct a business governed by other statutes of this state only to the extent this part is not inconsistent with those other statutes.

When A Company Is Bought, What Happens to the Stock? The stock of the company that has been bought tends to rise since the acquiring company has likely paid a premium on its shares as a way to entice stockholders. However, there are some instances when the newly acquired company sees its shares fall on the merger news.