Utah Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005

Description

This form is data enabled to comply with CM/ECF electronic filing standards. This form is for post 2005 act cases.

How to fill out Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005?

It is possible to devote several hours on the Internet attempting to find the authorized record format that suits the state and federal requirements you require. US Legal Forms provides a large number of authorized forms which can be examined by specialists. You can easily acquire or printing the Utah Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005 from your service.

If you have a US Legal Forms accounts, you are able to log in and click on the Obtain button. Next, you are able to complete, change, printing, or indication the Utah Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005. Every single authorized record format you acquire is yours for a long time. To get yet another duplicate of any bought kind, check out the My Forms tab and click on the related button.

If you work with the US Legal Forms site initially, follow the easy instructions beneath:

- Initial, ensure that you have chosen the correct record format for the state/town of your liking. Browse the kind description to ensure you have chosen the right kind. If accessible, utilize the Preview button to appear from the record format also.

- If you want to find yet another variation of your kind, utilize the Search area to obtain the format that meets your needs and requirements.

- Upon having identified the format you would like, click Purchase now to continue.

- Pick the costs program you would like, enter your qualifications, and register for a free account on US Legal Forms.

- Total the transaction. You can use your credit card or PayPal accounts to cover the authorized kind.

- Pick the structure of your record and acquire it for your gadget.

- Make changes for your record if necessary. It is possible to complete, change and indication and printing Utah Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005.

Obtain and printing a large number of record templates making use of the US Legal Forms site, that offers the largest assortment of authorized forms. Use expert and condition-particular templates to tackle your business or personal demands.

Form popularity

FAQ

Assets are what a business owns, and liabilities are what a business owes. Both are listed on a company's balance sheet, a financial statement that shows a company's financial health. Assets minus liabilities equal equity?or the company's net worth. What Are Assets and Liabilities: A Primer for Small Businesses freshbooks.com ? hub ? accounting ? assets-... freshbooks.com ? hub ? accounting ? assets-...

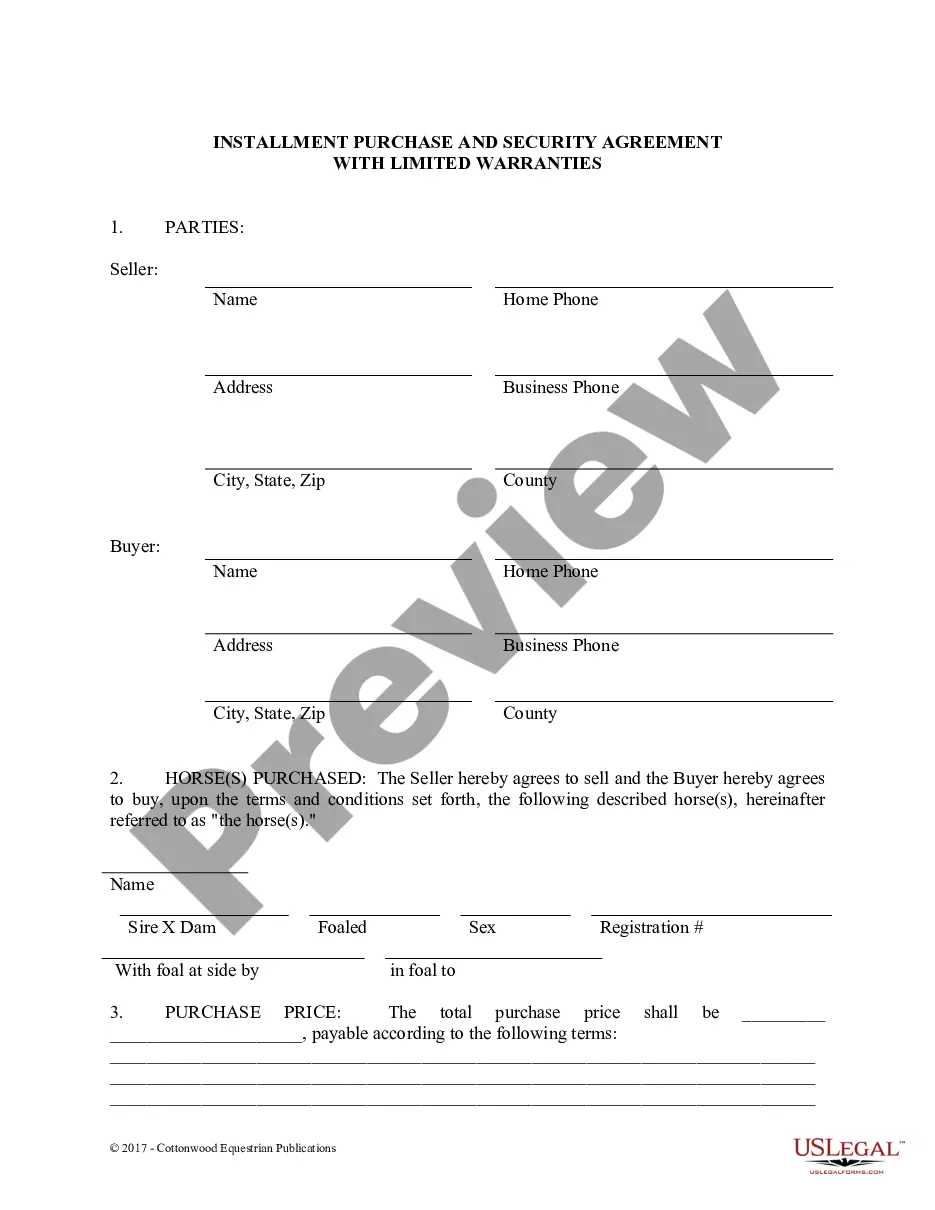

Schedule D is part of a series of documents a debtor files with the bankruptcy court. It is formally called "Official Bankruptcy Form 106D" or "Schedule D - Creditors Who Have Claims Secured by Property." Unlike unsecured debts like medical bills or credit cards, secured debts have collateral like cars and houses.

Official Form 106Sum. Summary of Your Assets and Liabilities and Certain Statistical Information. 12/15. Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for supplying correct information.

Unsecured Creditors, like credit card issuers, suppliers, and some cash advance companies (although this is changing), do not hold a lien on its debtor's property to assure payment of the debt if there is a default. The secured creditor holds priority on debt collection from the property on which it holds a lien.