Utah Order for Relief in an Involuntary Case - B 253

Description

How to fill out Order For Relief In An Involuntary Case - B 253?

Choosing the best authorized file format can be quite a struggle. Obviously, there are a variety of templates available online, but how can you find the authorized kind you need? Make use of the US Legal Forms internet site. The assistance provides thousands of templates, such as the Utah Order for Relief in an Involuntary Case - B 253, which you can use for enterprise and private demands. All of the kinds are checked out by specialists and meet up with federal and state needs.

Should you be previously listed, log in for your account and click on the Down load option to get the Utah Order for Relief in an Involuntary Case - B 253. Make use of account to search from the authorized kinds you might have bought previously. Visit the My Forms tab of your respective account and get yet another copy of the file you need.

Should you be a whole new end user of US Legal Forms, listed here are easy guidelines that you should comply with:

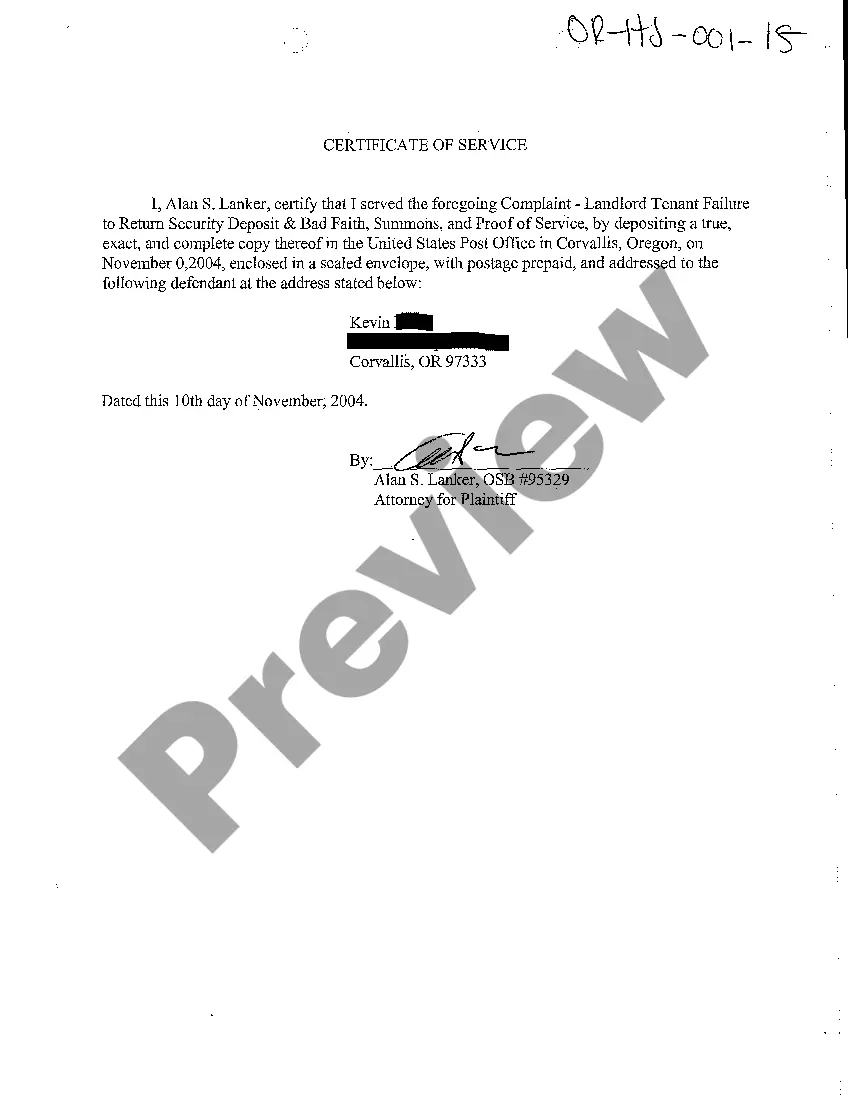

- Very first, ensure you have chosen the proper kind for your personal metropolis/region. You may examine the form making use of the Review option and study the form description to make certain it is the right one for you.

- In the event the kind is not going to meet up with your expectations, take advantage of the Seach field to find the correct kind.

- Once you are certain the form is acceptable, click on the Acquire now option to get the kind.

- Select the prices prepare you would like and enter the essential details. Make your account and pay for your order making use of your PayPal account or Visa or Mastercard.

- Opt for the file formatting and down load the authorized file format for your system.

- Comprehensive, edit and produce and signal the attained Utah Order for Relief in an Involuntary Case - B 253.

US Legal Forms may be the most significant catalogue of authorized kinds that you will find different file templates. Make use of the service to down load expertly-made papers that comply with express needs.

Form popularity

FAQ

Motion for Relief from the Automatic Stay is a request by a creditor to allow the creditor to take action against the debtor or the debtor's property that would otherwise be prohibited by the automatic stay.

An order for relief will be entered if the debtor does not contest the involuntary petition or, if the debtor contests the involuntary petition, an order for relief will be entered if (1) the court determines that the debtor is not paying its undisputed debts as they come due, or (2) a custodian (other than a trustee, ...

An involuntary case may be commenced only under chapter 7 or 11 of this title, and only against a person, except a farmer, family farmer, or a corporation that is not a moneyed, business, or commercial corporation, that may be a debtor under the chapter under which such case is commenced.

The most important thing the order for relief does for debtors is initiate the automatic stay. The automatic stay halts all actions by creditors to collect on debtors' debts or foreclose or repossess their assets. It's one of bankruptcy's biggest privileges to debtors.

An Involuntary Petition may be commenced only under chapters 7 or 11 of Title 11, and only against a person, except a farmer, family farmer, or a corporation that is not a moneyed, business, or commercial corporation, that may be a debtor under the chapter under which such case is commenced.

Debt relief order (DRO) This is a way of cancelling, or 'writing off' your debts. You will not have to deal with the people you owe money to, also called 'creditors'.