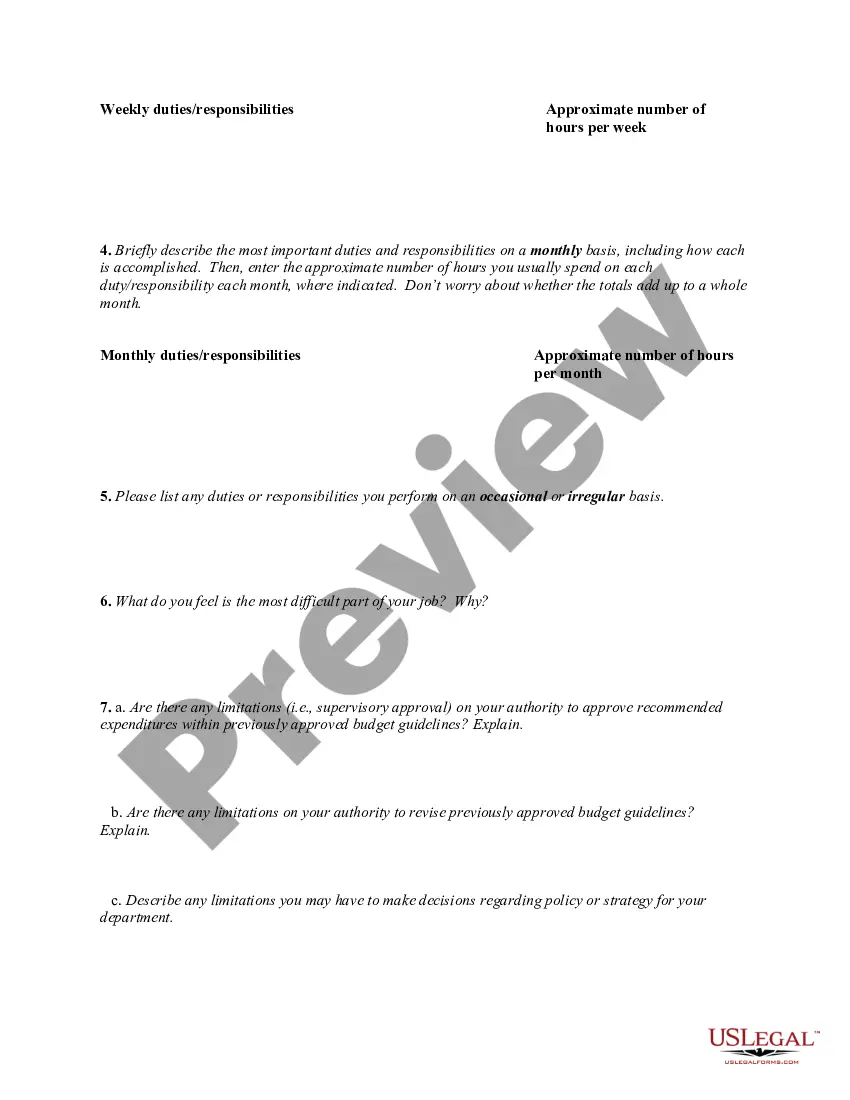

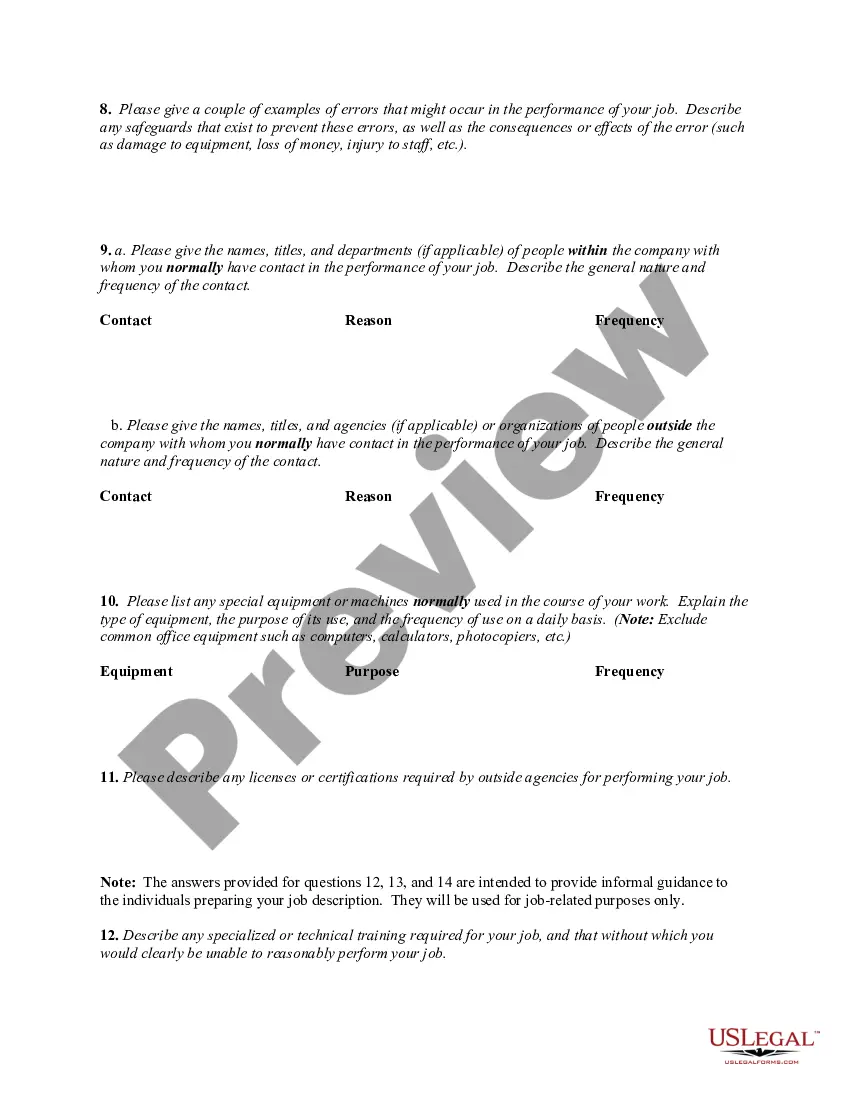

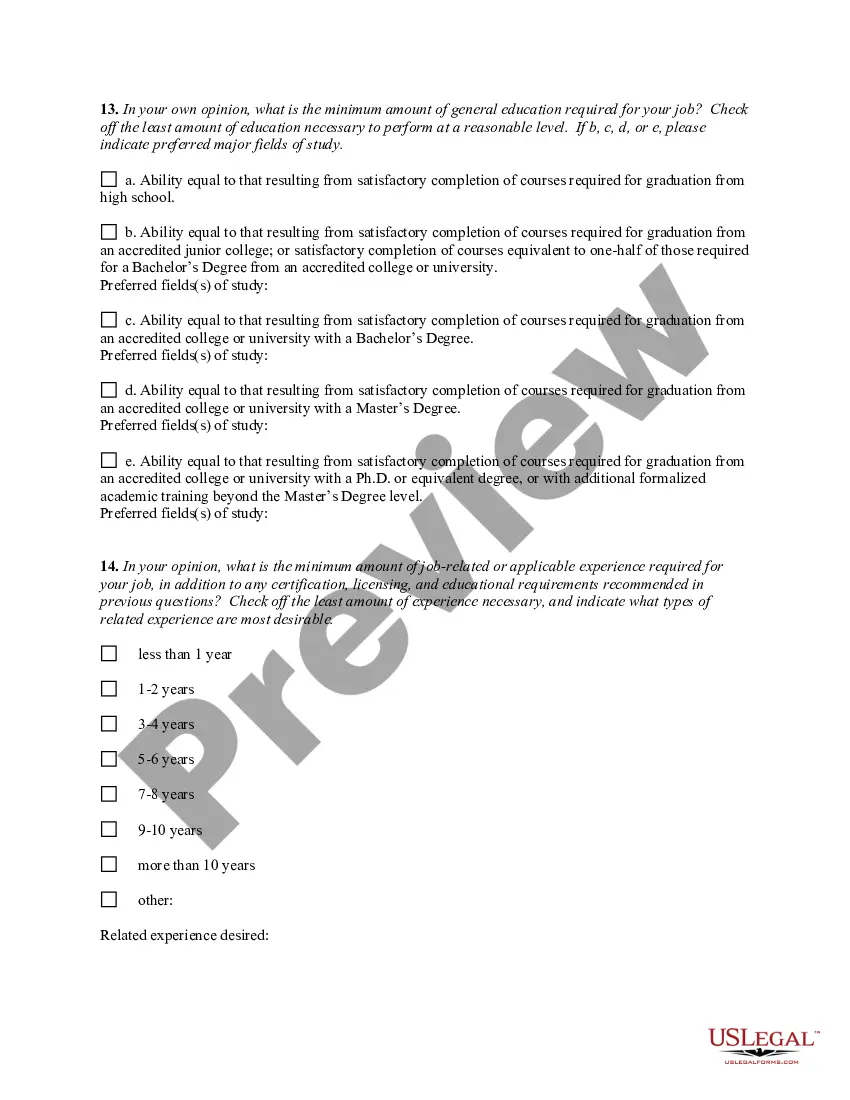

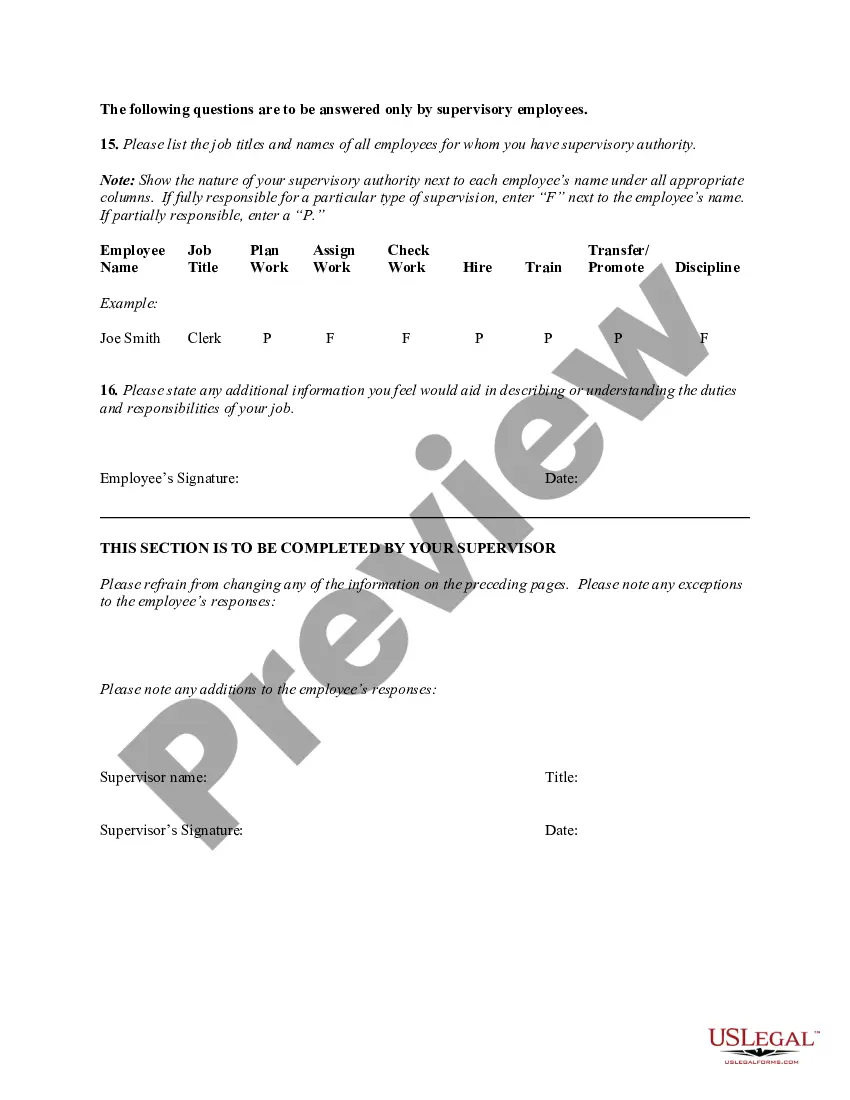

Utah Job Responsibilities Questionnaire

Description

How to fill out Job Responsibilities Questionnaire?

You can spend hours online searching for the legal document template that meets your state and federal requirements.

US Legal Forms provides thousands of legal forms that can be reviewed by experts.

You can download or print the Utah Job Responsibilities Questionnaire from our service.

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Get button.

- Then, you can complete, modify, print, or sign the Utah Job Responsibilities Questionnaire.

- Each legal document template you obtain is yours permanently.

- To get another copy of any downloaded form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple steps below.

- First, make sure you have selected the correct document template for the region/area you choose.

- Check the form description to ensure you have selected the correct form.

Form popularity

FAQ

When faced with the question, 'Do you have any questions about the role?', it’s a great opportunity to show your interest. Consider asking about specific job responsibilities listed in your Utah Job Responsibilities Questionnaire or how success is measured in the position. Thoughtful questions not only reflect your engagement but also help you assess if the role is a good fit.

Benefit Ratio - determined by dividing the total of all chargeable benefits paid to your former employees in the last four fiscal years (July 1 - June 30) by your taxable wages for the same time period. The benefit ratio portion of the overall tax rate is unique to each employer.

You must have earned at least $4500 during your Base Period. Your total Base Period earnings must be at least 1 ½ times the highest quarter of wages during your Base Period. If you do not qualify using earnings in your Base Period, you may qualify under the same conditions by using an Alternate Base Period.

If you work less than full-time and earn less than your weekly benefit amount during a given week, you may continue filing since you will be entitled to partial unemployment benefits if you are otherwise eligible. Workforce Services will apply a 30 percent earnings allowance to calculate your weekly benefit payment.

If your earnings equal or exceed your weekly benefit amount or you work 40 or more hours during the week, you will not receive any payment or waiting week credit for that week.

Utah's law calls for a benefit ratio to be determined for each qualifying employer. This means that unemployment insurance benefits paid to your former employees will be used as the primary factor in calculating your contribution rate. These payments are known as benefit costs.

There is no minimum amount of time or wages an employer has to meet in order to qualify under unemployment compensation. To qualify for UI in UT, you must have worked during a minimum of two quarters in the base period.

Assessment trainingDo assessment exercises. Components such as personality tests and interviews can also be practiced.Prepare interviews.Know your work values and motivation.Conduct a personal SWOT analysis.Do not make avoidable errors.Do not underestimate it.Know your rights and obligations.

You must report any gross earnings for the week the work is performed, regardless of when you are paid. You can earn up to 30% of your weekly benefit amount and still receive the full weekly benefit amount. If you earn over 30% of your weekly benefit amount then a dollar for dollar deduction will be taken.

How to respond to email messages that contain multiple questionsReply inline and separate your answers from each question with a blank line.Do not assume that the recipient will see any formatting.Simple but effective.