Utah Personnel Status Change Worksheet

Description

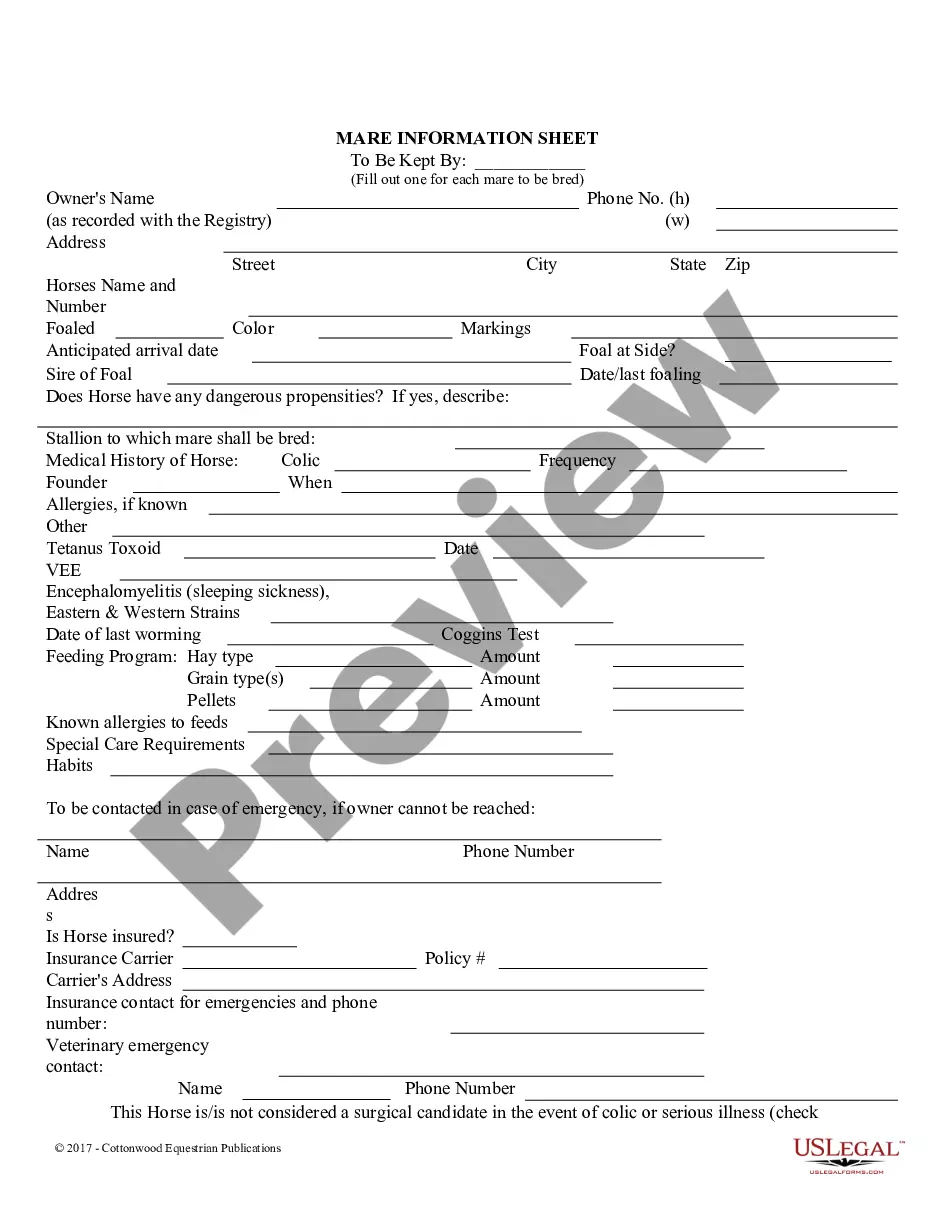

How to fill out Personnel Status Change Worksheet?

Selecting the correct legal document format can be quite challenging. Obviously, there are numerous templates accessible online, but how do you find the legal form you require? Utilize the US Legal Forms website. This service provides thousands of templates, including the Utah Employee Status Change Worksheet, which you can use for business and personal purposes. All the forms are reviewed by experts and comply with state and federal standards.

If you are already registered, Log In to your account and click the Download button to acquire the Utah Employee Status Change Worksheet. Use your account to browse through the legal forms you have purchased previously. Navigate to the My documents tab of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to ensure this is the right one for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- When you are confident that the form is suitable, click the Buy Now button to purchase the form.

- Select the pricing plan you need and enter the required information.

- Create your account and complete the purchase using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legal document template to your device.

- Complete, edit, print, and sign the acquired Utah Employee Status Change Worksheet.

- US Legal Forms is the largest collection of legal documents where you can find various document templates. Utilize the service to download professionally crafted documents that adhere to state regulations.

Form popularity

FAQ

9. Additional information. For questions about new hire reporting you can contact the Utah New Hire Registry by telephone between am and pm MST by dialing (801) 526-4361 or toll free at (800) 222-2857.

Form TC-941E is an Annual Employer Reconciliation report used to report wages and withholding tax returns for employees.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Utah Withholding Account IDYou can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms.If you're unsure, contact the agency at (801) 297-2200.

Rev. 12/09. Return ENTIRE form, coupon and payment to the Utah State Tax Commission. Payment Coupon for Utah Withholding Reconciliation, TC-941RPC.

TC-941PC, Payment Coupon for Utah Withholding Tax.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return. Keep all these forms with your tax records we may ask you to provide the documents at a later time.

You must file an annual reconciliation for each year (or partial year) you have a withholding tax account, even if you have no employees or withholding to report for the year. Whether you file quarterly or annually, you must file an annual reconciliation in addition to your withholding tax return(s).

Each new employee will need to fill out the I-9, Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

TC-941E, Utah Withholding Return for Employers, Template Instructions.