Utah Lien and Tax Search Checklist

Description

How to fill out Lien And Tax Search Checklist?

You are able to commit time online attempting to find the authorized papers web template which fits the federal and state needs you will need. US Legal Forms gives a large number of authorized kinds that are evaluated by experts. You can easily download or print out the Utah Lien and Tax Search Checklist from your support.

If you already possess a US Legal Forms bank account, you may log in and then click the Download button. After that, you may total, edit, print out, or sign the Utah Lien and Tax Search Checklist. Each and every authorized papers web template you purchase is your own eternally. To have one more duplicate of the obtained type, proceed to the My Forms tab and then click the corresponding button.

If you use the US Legal Forms internet site the first time, adhere to the easy guidelines below:

- Initially, be sure that you have chosen the best papers web template for your state/area of your liking. Look at the type outline to ensure you have chosen the appropriate type. If accessible, take advantage of the Review button to search from the papers web template also.

- In order to find one more version from the type, take advantage of the Research industry to find the web template that meets your requirements and needs.

- Upon having discovered the web template you would like, click on Get now to continue.

- Pick the prices strategy you would like, type in your credentials, and sign up for your account on US Legal Forms.

- Total the transaction. You can use your charge card or PayPal bank account to pay for the authorized type.

- Pick the formatting from the papers and download it in your gadget.

- Make changes in your papers if necessary. You are able to total, edit and sign and print out Utah Lien and Tax Search Checklist.

Download and print out a large number of papers themes while using US Legal Forms website, which provides the largest collection of authorized kinds. Use expert and state-certain themes to tackle your company or person requirements.

Form popularity

FAQ

Our mailing address is 160 East 300 South, P.O. Box 146705, Salt Lake City UT, 84114-6705. Our fax number is 801-530-6438.

Failure to file your returns or pay in a timely manner will result in a penalty of $20 or 10% of the total tax due, whichever is larger. If your bill remains unpaid after 90 days from the original due date, another $20 or 10% penalty will be added on.

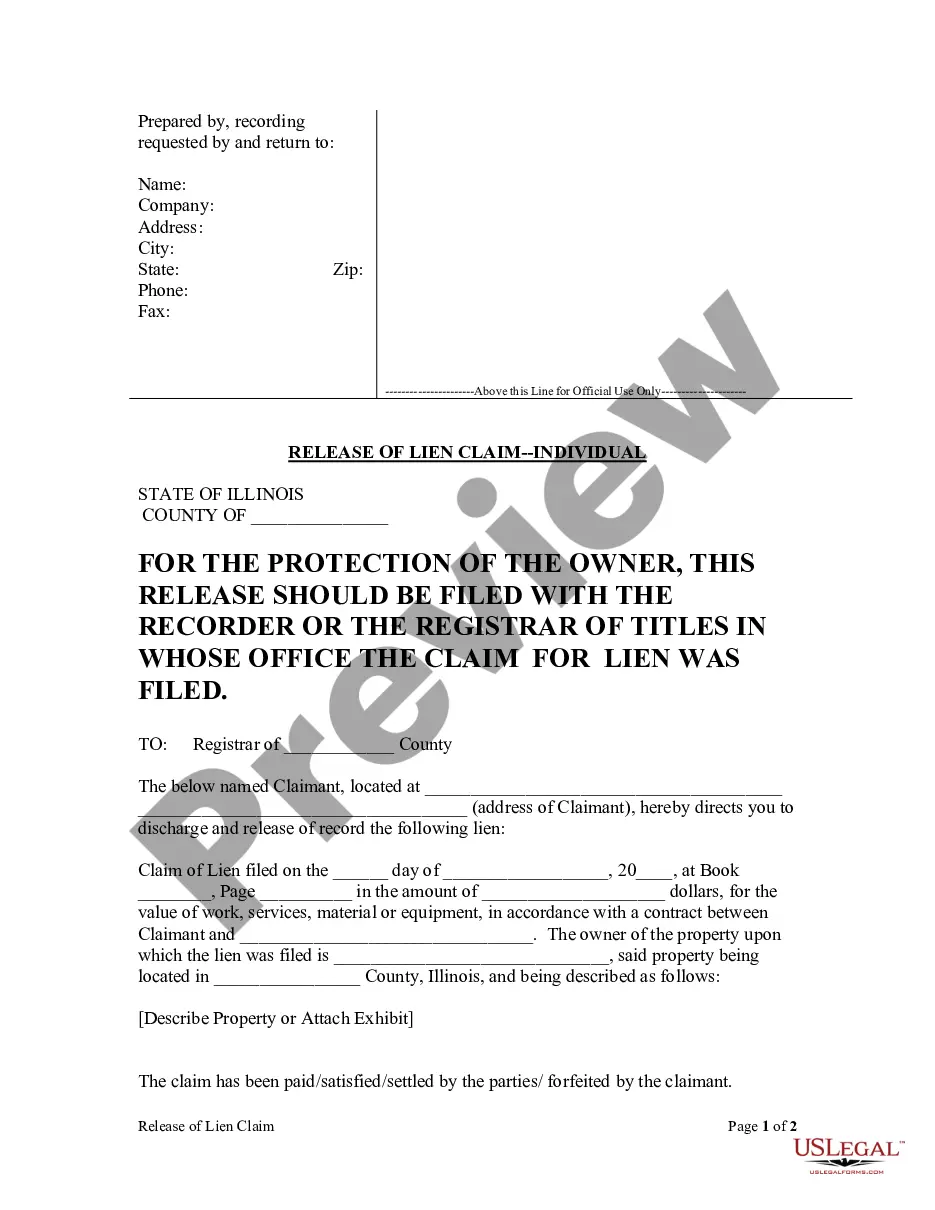

How can I find out what liens are on a property? You can do a title search on our website by Searching Utah County Records, or contact a title company to perform one for you.

Federal tax liens and releases or discharges of federal tax liens are recorded in the Recorder's Office. These documents can be requested by contacting the county recorder by phone at (435) 893-0410 or submitting a Document Request Form in person or via email at: 250 N.

This notice informs the taxpayer that if the amount due is not paid by the notice due date, the Tax Commission will file a lien with the courts and place it on the taxpayer's real and personal property.

Utah defines a lost or defective title as "insufficient evidence of ownership". If the value of the motor vehicle exceeds one thousand dollars ($1,000.00) then a surety bond will likely be required. Cars, trucks, motorcycles, ATVs, watercraft and trailers may be transferred by this bonded method through the Utah DMV.

The Tax Commission may use a lien to seize and sell a taxpayer's real and personal property, if necessary, to pay a tax balance. If a person or business has a payment agreement with the Tax Commission, we may file a lien to secure that debt. If the payments are made as agreed, we will not take action on the lien.