Utah Personal Guaranty - Guarantee of Lease to Corporation

Description

How to fill out Personal Guaranty - Guarantee Of Lease To Corporation?

If you need to be thorough, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search feature to find the documents you require.

An array of templates for business and personal use are categorized by regions and keywords.

Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to locate alternative variations of the legal form type.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your information to register for an account.

- Use US Legal Forms to obtain the Utah Personal Guaranty - Guarantee of Lease to Corporation with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to acquire the Utah Personal Guaranty - Guarantee of Lease to Corporation.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

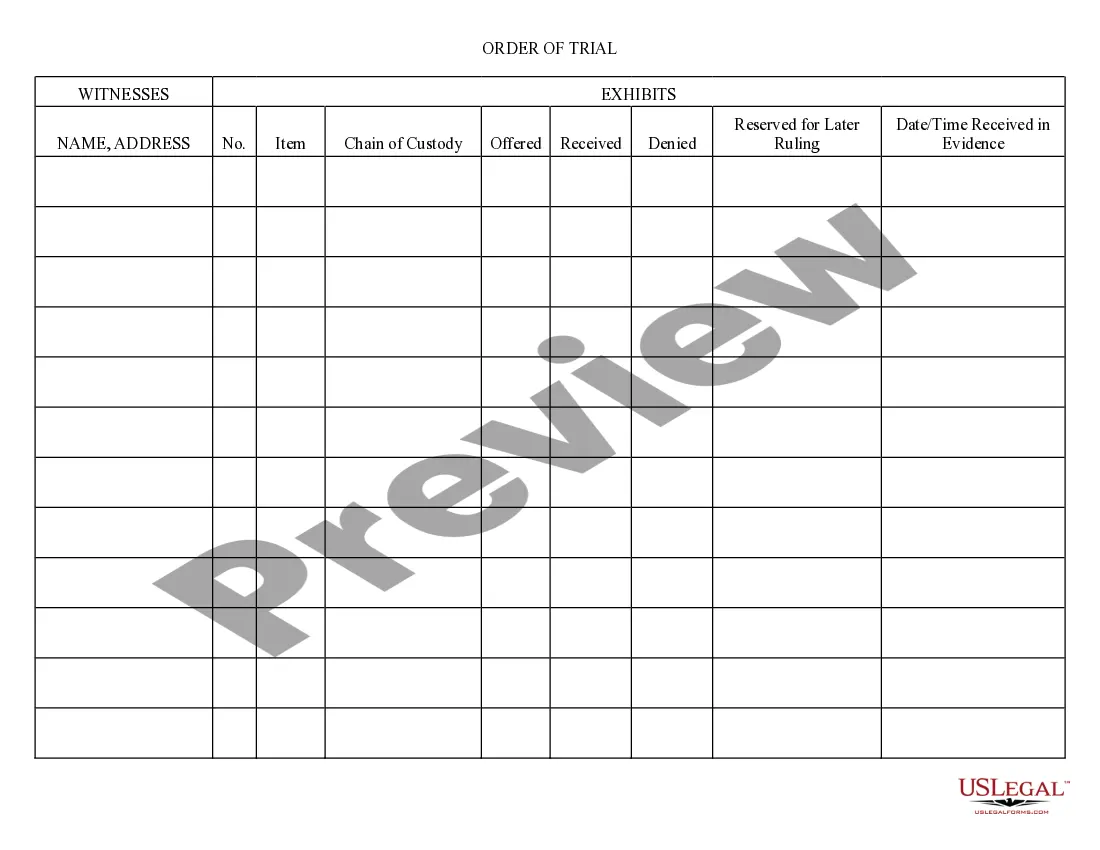

- Step 2. Use the Preview option to review the form’s content. Be sure to read the summary.

Form popularity

FAQ

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

A corporate guaranty is one usually signed by a parent or more developed affiliated company. It is a comfort to a landlord to have an extra set of assets to go after should its tenant default.

Unless a business is a sole proprietorship, personal guarantees can only be discharged by filing an individual bankruptcy. A business bankruptcy will not eliminate a personal guarantee. Likewise, the Chapter 13 co-debtor stay only applies to consumer debts and personal guarantees are usually considered business debts.

When a tenant violates to the terms or conditions of a lease agreement, enforcing the terms of the tenancy may be as simple as sending a letter to the tenant pointing out the lease violation and requesting tenant's compliance.

The difference between corporate and personal guarantors is quite simple: a personal guarantor is an individual who agrees to take on the obligations of a debt for a debtor, whereas a corporate guarantor is a corporation that takes on payment responsibilities.

A corporate guarantee is an agreement in which one party, called the guarantor, takes on the payments or responsibilities of a debt if the debtor defaults on the loan.

If you sign a personal guarantee, you are personally liable for the loan balance or a portion thereof. If your business later defaults on the loan, anyone who signed the personal guarantee can be held responsible for the remaining balance, even after the lender forecloses on the loan collateral.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

A personal guarantee is an agreement between a business owner and lender, stating that the individual who signs is responsible for paying back a loan should the business ever be unable to make payments.

A personal guaranty is not enforceable without consideration In fact, no contract is enforceable without consideration. A personal guaranty is a type of contract.