Utah Wage Withholding Authorization

Description

How to fill out Wage Withholding Authorization?

You can spend hours online searching for the legal document template that meets the state and federal standards you require.

US Legal Forms offers a vast array of legal documents that can be reviewed by professionals.

You can obtain or create the Utah Wage Withholding Authorization through the service.

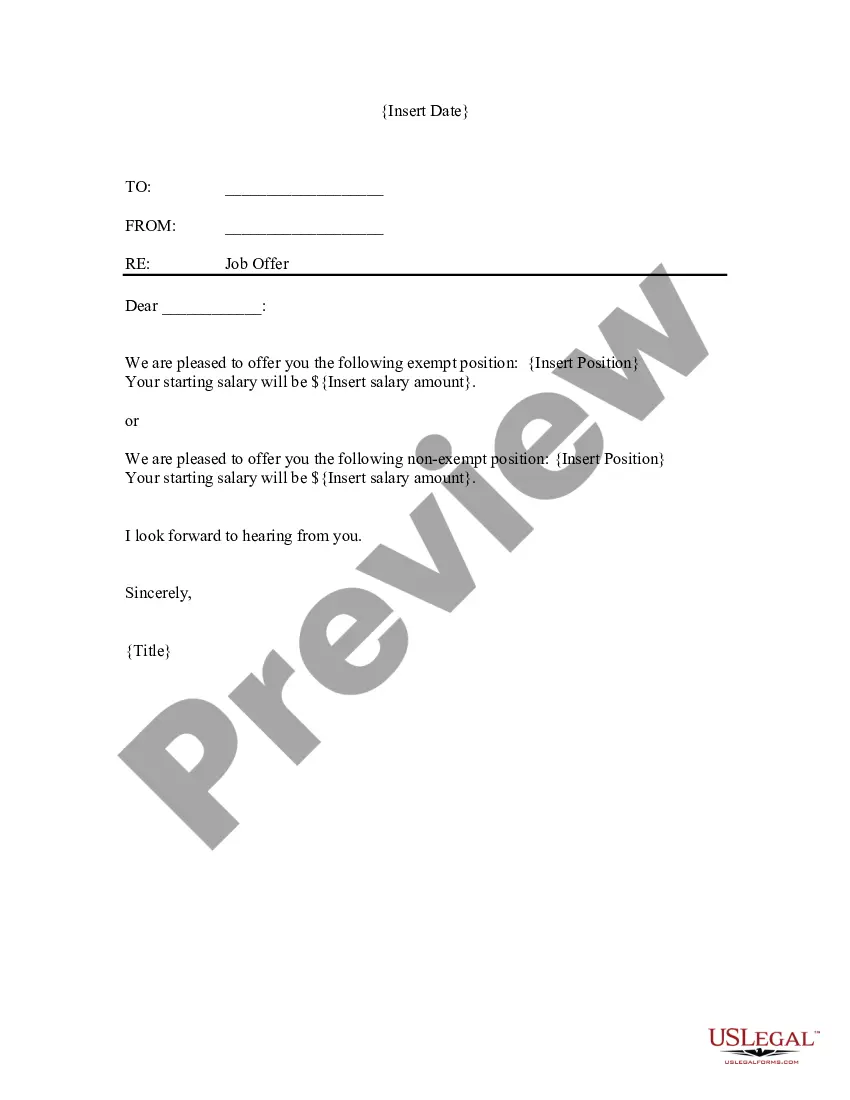

If available, use the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Utah Wage Withholding Authorization.

- Every legal document template you purchase is your property indefinitely.

- To get another copy of a purchased form, go to the My documents tab and select the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct document template for your county/area.

- Review the document description to ensure you’ve selected the right one.

Form popularity

FAQ

Forms You'll Need Employers must file online using form TC-941E.

Utah Withholding Account IDYou can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms.If you're unsure, contact the agency at (801) 297-2200.

TC-941PC, Payment Coupon for Utah Withholding Tax.

Utah Withholding Account ID You can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms. If you're unsure, contact the agency at (801) 297-2200.

Form 1099G is a record of the total taxable income the California Employment Development Department (EDD) issued you in a calendar year, and is reported to the IRS. You will receive a Form 1099G if you collected unemployment compensation from us and must report it on your federal tax return as income.

TC40 and SAFE reports are data generated by credit card issuers regarding cases where the cardholder claimed that they did not authorize the charges. These reports are sent to a merchant's acquirer, other issuing banks, and the relevant credit card network. In the case of the TC40, the reports are sent to Visa.

Form TC-941E is an Annual Employer Reconciliation report used to report wages and withholding tax returns for employees.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return. Keep all these forms with your tax records we may ask you to provide the documents at a later time.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return.

Form TC-40 is a Form used for the Tax Return and Tax Amendment. You can prepare a 2021 Utah Tax Amendment on eFile.com, however you can not submit it electronically. In comparison, the IRS requires a different Form - Form 1040X -to amend an IRS return (do not use Form 1040 for an IRS Amendment).