Utah Business Deductibility Checklist

Description

How to fill out Business Deductibility Checklist?

Are you presently in a position where you frequently require documents for either business or personal purposes.

There are numerous legal document templates accessible on the internet, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the Utah Business Deductibility Checklist, which can be tailored to meet federal and state requirements.

Once you discover the right form, click Get now.

Choose a preferred pricing plan, complete the necessary information to create your account, and process the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you may download the Utah Business Deductibility Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you require and ensure it is for the correct city/county.

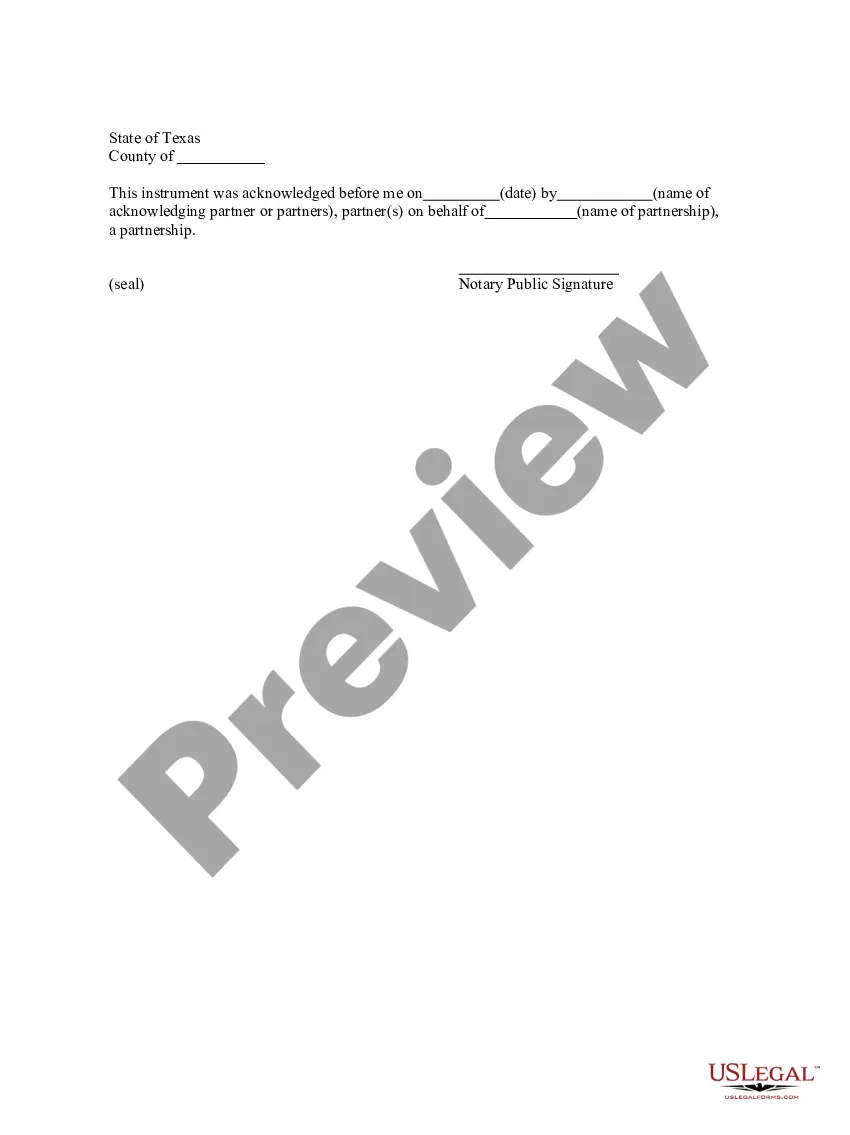

- Use the Preview button to examine the form.

- Check the details to confirm that you have selected the right form.

- If the form isn't what you are looking for, use the Search area to find the form that meets your needs and requirements.

Form popularity

FAQ

To claim business expenses as deductions under the Utah Business Deductibility Checklist, expenses must be ordinary and necessary for your business. This means they should be common in your industry and helpful for your business operations. Additionally, you should maintain proper documentation, such as receipts and invoices, to support your claims. Understanding these requisites can maximize your tax benefits.

In Utah, the corporate income tax generally is calculated at a flat 5% of Utah taxable income with a minimum tax of $100. If your LLC is taxed as a corporation you'll need to pay this tax. The state's corporate income tax return (Form TC-20) is filed with the Utah State Tax Commission (TC).

Utah Form TC-40 Personal Income Tax Return for Residents.

However, there are 12 states and Washington, D.C., that will allow you to itemize on your state tax return only if you itemize on your federal, said Rigney. Those 12 are Colorado, Georgia, Kansas, Maine, Maryland, Missouri, Nebraska, North Dakota, Oklahoma, South Carolina, Utah and Virginia, he said.

Utah does not have a standard deduction.

Corporate Income Tax Domestic and foreign corporations are required to pay a 5% state income or franchise tax on income earned in Utah. The minimum tax for state banks and corporations is $100.

Itemized deductions include expenses that are not otherwise deductible, including mortgage interest you paid on up to two homes, state and local income or sales taxes, property taxes, medical and dental expenses that exceed 7.5 percent of your adjusted gross income and any charitable donations you may make.

You can itemize or take the standard deduction on your Utah state taxes, but you must choose the same deduction method you used on your federal tax return. For 2019, the amount of your Utah standard deduction is the same as your federal standard deduction.

If you are thinking about starting a small business, it doesn't matter where your new business operates, it will need to pay certain state and local taxes, in addition to those required by the federal government.

Itemized deductions include amounts you paid for state and local income or sales taxes, real estate taxes, personal property taxes, mortgage interest, and disaster losses. You may also include gifts to charity and part of the amount you paid for medical and dental expenses.