Kentucky Sample Letter for Return of Overpayment to Client

Description

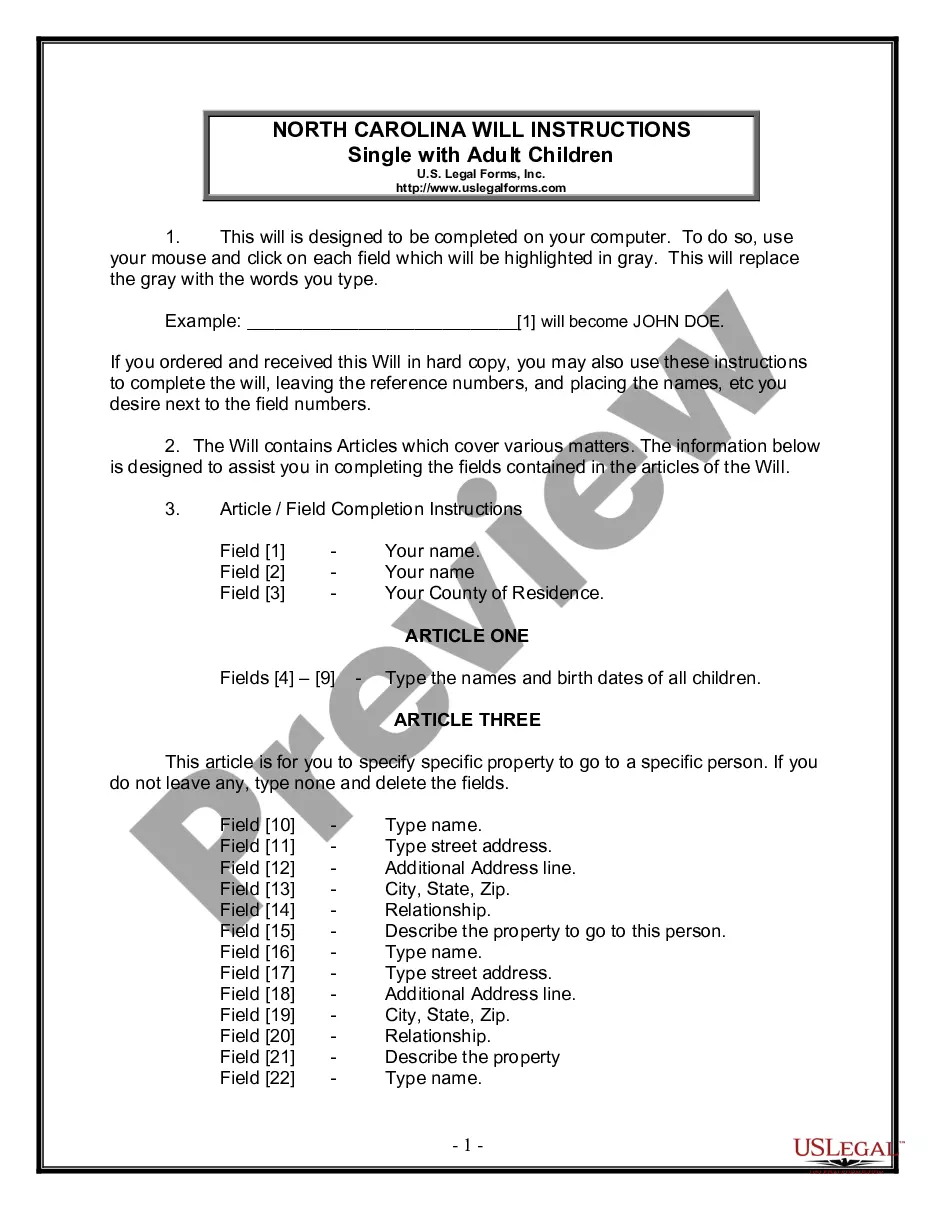

How to fill out Sample Letter For Return Of Overpayment To Client?

US Legal Forms - one of the greatest libraries of authorized forms in the USA - offers a wide range of authorized papers layouts you may down load or produce. Making use of the internet site, you will get 1000s of forms for enterprise and personal purposes, categorized by groups, claims, or search phrases.You will find the most recent variations of forms like the Kentucky Sample Letter for Return of Overpayment to Client within minutes.

If you have a monthly subscription, log in and down load Kentucky Sample Letter for Return of Overpayment to Client from the US Legal Forms local library. The Download button will show up on each kind you see. You have accessibility to all earlier acquired forms from the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, here are easy directions to get you started:

- Ensure you have selected the correct kind to your metropolis/county. Click the Preview button to check the form`s information. Read the kind information to actually have selected the proper kind.

- If the kind doesn`t suit your requirements, take advantage of the Search discipline towards the top of the display screen to obtain the one that does.

- When you are content with the form, confirm your option by clicking on the Buy now button. Then, pick the rates prepare you want and provide your qualifications to register for an accounts.

- Method the transaction. Make use of your credit card or PayPal accounts to complete the transaction.

- Find the structure and down load the form in your system.

- Make adjustments. Complete, modify and produce and indicator the acquired Kentucky Sample Letter for Return of Overpayment to Client.

Each design you included in your money does not have an expiry day which is your own for a long time. So, if you would like down load or produce yet another version, just proceed to the My Forms portion and click on about the kind you will need.

Obtain access to the Kentucky Sample Letter for Return of Overpayment to Client with US Legal Forms, one of the most extensive local library of authorized papers layouts. Use 1000s of professional and status-specific layouts that satisfy your business or personal requires and requirements.

Form popularity

FAQ

SUMMARY: This final rule requires providers and suppliers receiving funds under the Medicare program to report and return overpayments by the later of the date that is 60 days after the date on which the overpayment was identified; or the date any corresponding cost report is due, if applicable.

Communicate with the customer about the overpayment as soon as possible and confirm how they would like to proceed. Options for handling overpayments are to either refund the amount or establish a credit for it.

How to write this credit letter: Carefully explain how much the customer has overpaid. Inform the client how you plan to correct the error. Offer additional service.

A payment Medicare makes for services another payer may be responsible for. Medicare makes this conditional payment so you won't have to use your own money to pay the bill. The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later.

Request Immediate Recoupment: Occurs when Medicare recovers an overpayment by offsetting future payments. Recoupment may be partial (for example, a percentage of payments recouped) or complete. Upon your request, your MAC can begin recoupment immediately by following the demand letter instructions.

I acknowledge on [date] I received an over payment in the amount of $____________. I understand that [Company Name] will need to be reimbursed. I have selected the checked option below to repay the company. ? ____ Deduct the overpayment from my salary from next pay period.

If a customer pays you more than the amount required to pay a debt in full, you can mark the invoice as paid in full and write off the overpayment.

For Medicare overpayments, the federal government and its carriers and intermediaries have 3 calendar years from the date of issuance of payment to recoup overpayment. This statute of limitations begins to run from the date the reimbursement payment was made, not the date the service was actually performed.

I acknowledge on [date] I received an over payment in the amount of $____________. I understand that [Company Name] will need to be reimbursed. I have selected the checked option below to repay the company. ? ____ Deduct the overpayment from my salary from next pay period.

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan.