Utah Mileage Reimbursement Form

Description

How to fill out Mileage Reimbursement Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal record templates that you can download or print.

While navigating the website, you can find thousands of forms for business and personal purposes, categorized by groups, states, or keywords. You can locate the latest versions of forms such as the Utah Mileage Reimbursement Form in moments.

If you currently hold a monthly subscription, Log In to access and download the Utah Mileage Reimbursement Form from the US Legal Forms collection. The Download button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Select the file type and download the form to your device.

Edit as needed. Fill out, modify, and print or sign the downloaded Utah Mileage Reimbursement Form. Each document added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Utah Mileage Reimbursement Form with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

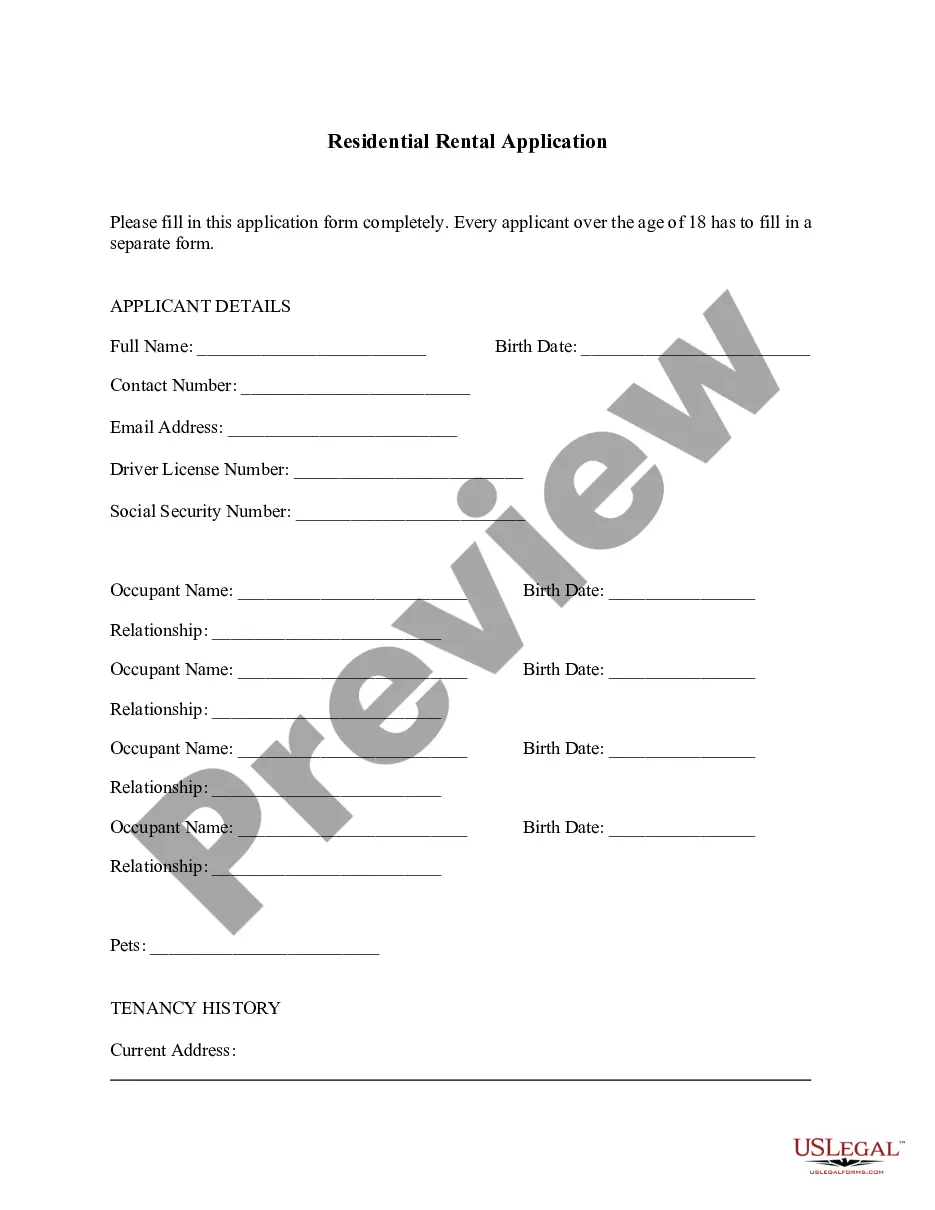

- Ensure you have selected the correct form for your city/state. Tap the Preview button to review the form's content.

- Examine the form details to confirm you have selected the right form.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your credentials to register for an account.

- Complete the transaction. Utilize your Visa or Mastercard or PayPal account to finalize the purchase.

Form popularity

FAQ

The Division of Finance promotes a culture of customer service, efficiency, and effectiveness. We also expect a high degree of fiscal accountability for the taxpayer resources entrusted to the State from the Utah Legislature and other stakeholders.

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and.

Mileage reimbursements are worth more to you than deducting a mileage allowance on your tax return. A reimbursement for mileage pays you 100 percent of the mileage allowance. A reimbursement of 55.5 cents per mile for 2,000 miles of work-related driving thus means you get $1,100, all of which is tax free.

Reimbursement rates cover all the costs related to driving for business. They are calculated to include gas, insurance, plus wear and tear on the vehicle. Employers who pay mileage reimbursement should not pay for gas and oil changes, as they're covered under the overall cost.

A Mileage Reimbursement Form is a document that is given to the accounting department for reimbursement of the traveling costs. Mileage reimbursements are usually done on a bi-monthly or a monthly basis.

The Utah Department of Administrative Services Division of Finance (Finance) manages the disbursement of vendor payments for most Utah state agencies. Disbursements are made at present using either warrants, ACH or US Bank's Payment Plus (a single use card system).

Mileage Reimbursement Law Requirements Governing the State of Utah (UT) When you work and must use your own car or vehicle for work-related use, then your employer should compensate you for the amount of miles that you put on your car.

A mileage reimbursement is not taxable as long as it does not exceed the IRS mileage rate (the 2022 rate is 58.5 cents per business mile). If the mileage rate exceeds the IRS rate, the difference is considered taxable income. This approach requires employees to record and report mileage.

The Division of Finance provides fiscal leadership and quality financial systems, processes, and information to state agencies and Utah residents.

On the federal level, there is no requirement for employers to reimburse employees for mileage when using personal vehicles for company purposes. However, all employers are federally required to reimburse employees for any work-related expense to a point.