Utah Self-Employed Independent Contractor Questionnaire

Description

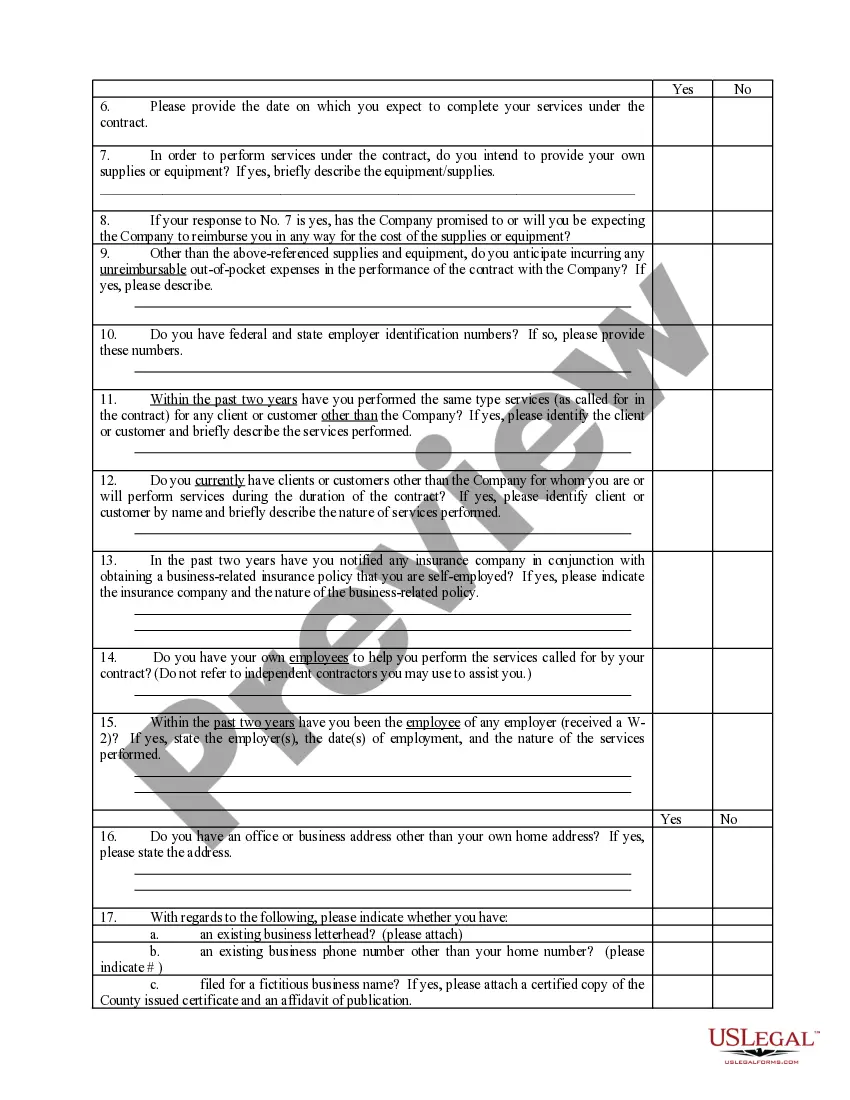

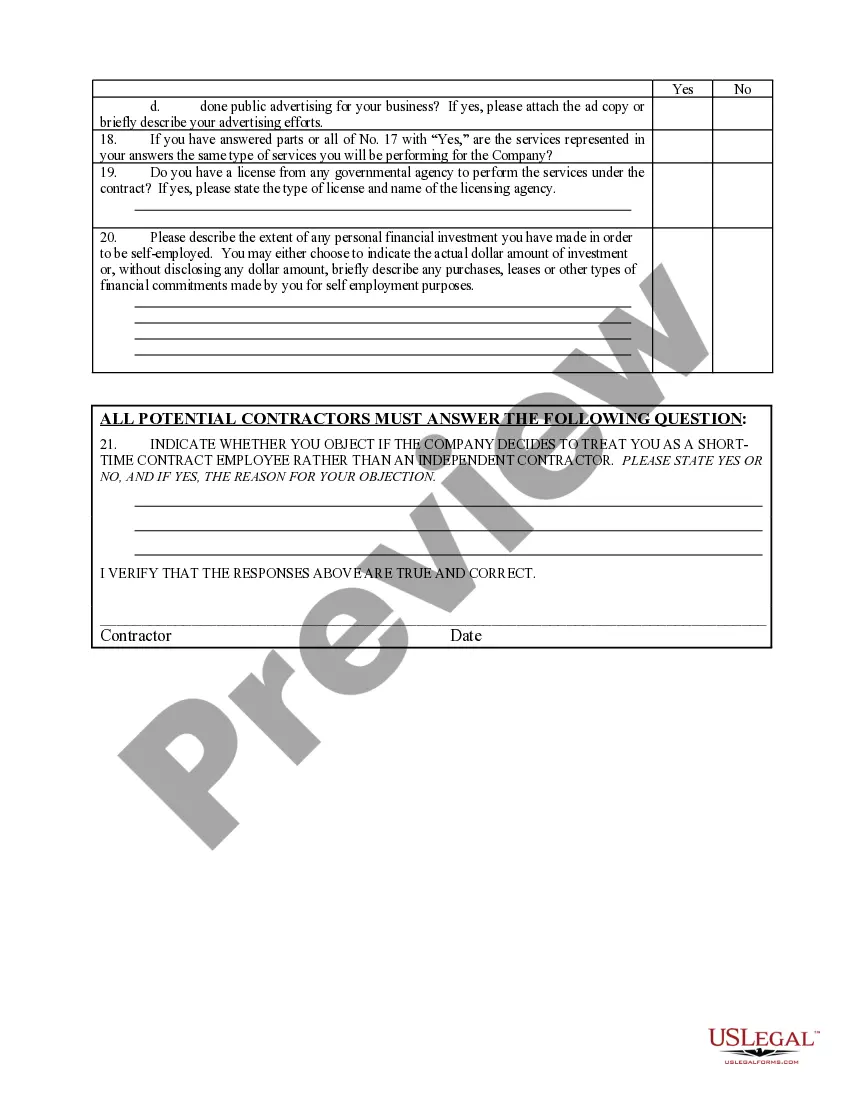

How to fill out Self-Employed Independent Contractor Questionnaire?

If you need to accumulate, obtain, or create legal documentation templates, utilize US Legal Forms, the most extensive collection of legal forms available on the web.

Employ the website's user-friendly and straightforward search function to locate the documents you require.

Various templates for commercial and personal purposes are categorized by type and jurisdiction, or keywords. Access US Legal Forms to quickly find the Utah Self-Employed Independent Contractor Questionnaire with just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access all forms you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Complete and download the Utah Self-Employed Independent Contractor Questionnaire with US Legal Forms. There are a variety of professional and state-specific templates available for your business or personal needs.

- If you are already a US Legal Forms member, sign in to your account and click the Purchase button to access the Utah Self-Employed Independent Contractor Questionnaire.

- You can also find templates you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the guidelines provided below.

- Step 1. Ensure you have selected the form pertinent to the right city/state.

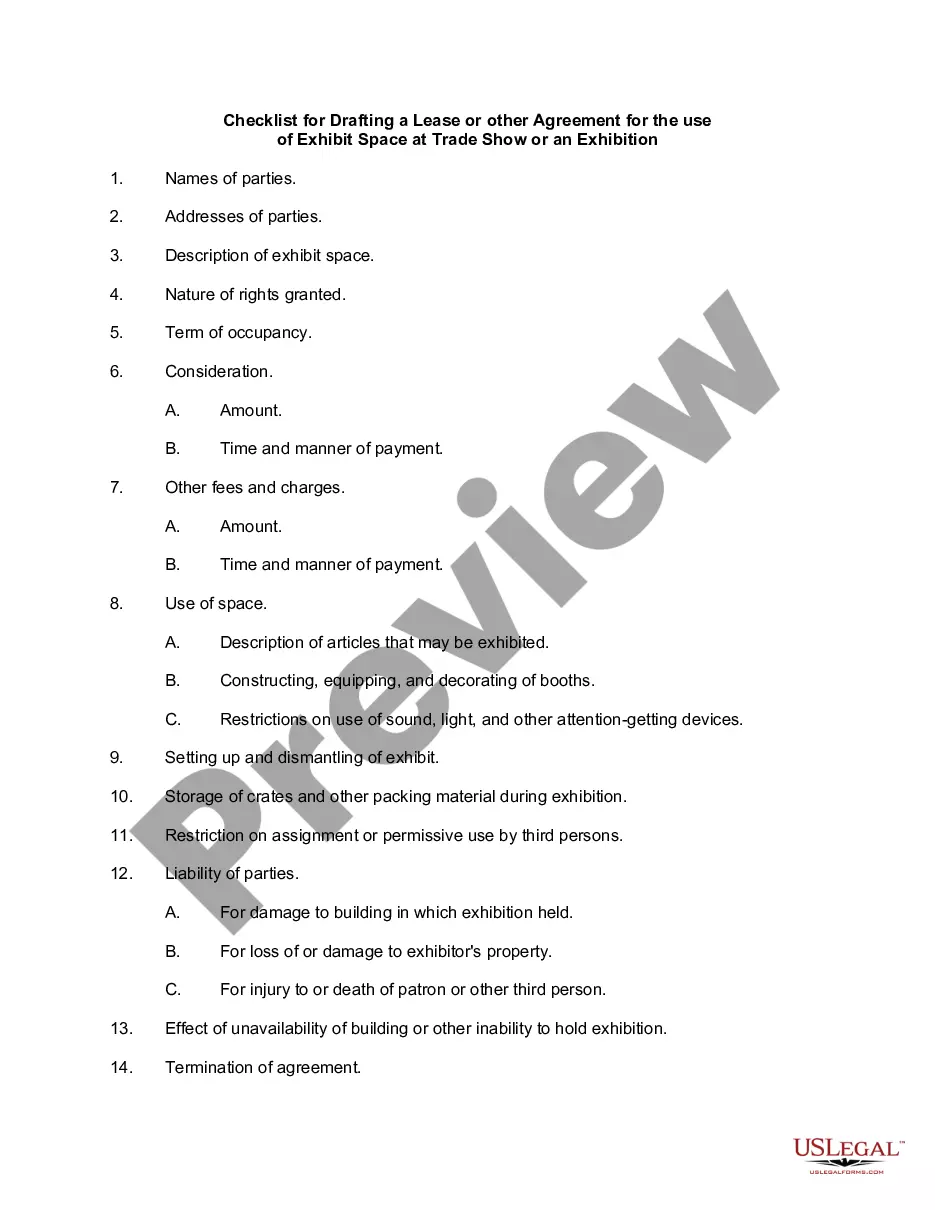

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to explore other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and provide your information to create an account.

- Step 5. Complete the transaction. You can use a credit card or PayPal account to finish the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Utah Self-Employed Independent Contractor Questionnaire.

Form popularity

FAQ

The HMRC recommends that you register your business as soon as it is possible for you to do so. However, there is a cut off involved with registering your business, and it is 5 October after the end of the tax year that you began your self-employment.

Yes! It's true that many self-employed individuals, especially those who work from home, never get a business license in Utah. But if your local government finds out that you're running an unlicensed business, you might be fined, or even be prevented from doing business until you obtain the license.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

All businesses in Utah are required by law to register with the Utah Department of Commerce either as a "DBA" (Doing Business As), corporation, limited liability company or limited partnership. Businesses are also required to obtain a business license from the city or county in which they are located.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

The Utah Workers' Compensation Act defines an independent contractor as "any person engaged in the performance of any work for another who, while so engaged, is (A) independent of the employer in all that pertains to the execution of the work; (B) not subject to the routine rule or control of the employer; (C) engaged

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...