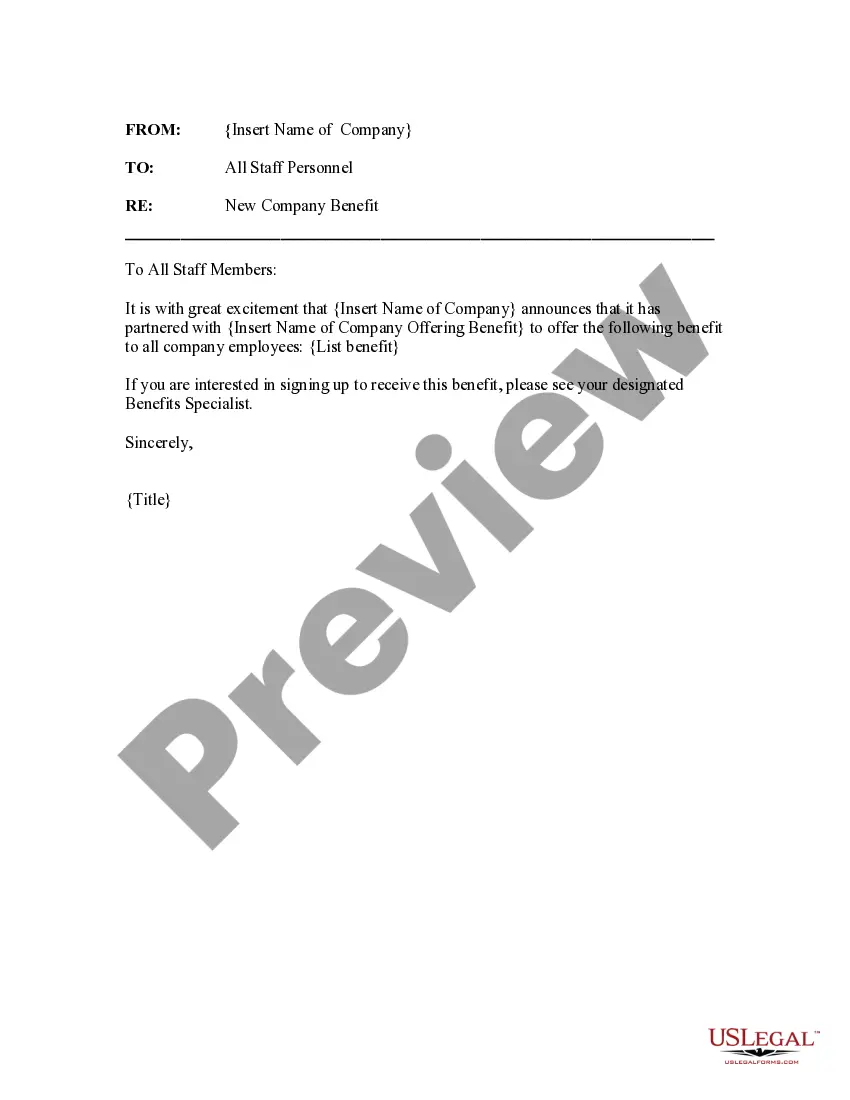

Utah New Company Benefit Notice

Description

How to fill out New Company Benefit Notice?

If you aim to compile, acquire, or print valid document templates, utilize US Legal Forms, the leading collection of legal forms, accessible online.

Employ the site's user-friendly and efficient search to find the documents you require.

Numerous templates for business and personal purposes are sorted by categories and jurisdictions, or keywords.

Every legal document template you purchase is yours permanently.

You will have access to every form you obtained within your account. Click on the My documents section and select a form to print or download again. Complete and obtain, and print the Utah New Company Benefit Notice with US Legal Forms. There are thousands of professional and state-specific forms available for your personal business or personal needs.

- Utilize US Legal Forms to locate the Utah New Company Benefit Notice within a few clicks.

- If you are already a US Legal Forms customer, Log Into your account and select the Download option to retrieve the Utah New Company Benefit Notice.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Take advantage of the Review option to examine the form's details. Don't forget to check the information.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the page to discover other versions of the legal form design.

- Step 4. Once you have located the desired form, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, revise, and print or sign the Utah New Company Benefit Notice.

Form popularity

FAQ

The Utah employer contribution rate is calculated annually by the Unemployment Insurance Division. In 2022, more than 67% of Utah's employers qualified for the minimum contribution rate of approximately $124 per employee per year.

Who is eligible for Utah Unemployment Insurance? To be eligible for this benefit program, you must a resident of Utah and meet all of the following: Unemployed, and. Worked in Utah during the past 12 months (this period may be longer in some cases), and.

Federal law requires employers to report basic information on new and rehired employees within 20 days of hire to the state where the new employees work. Some states require it sooner.

Employers pay all costs of the unemployment insurance program. Benefits are paid to eligible workers who (1) have sufficient wages during the base period, (2) are unemployed through no fault of their own, (3) are able to work full-time and (4) are available for and actively seeking full-time work.

Each new employee will need to fill out the I-9, Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

For questions about new hire reporting you can contact the Utah New Hire Registry by telephone between am and pm MST by dialing (801) 526-4361 or toll free at (800) 222-2857.

Utah's law calls for a benefit ratio to be determined for each qualifying employer. This means that unemployment insurance benefits paid to your former employees will be used as the primary factor in calculating your contribution rate. These payments are known as benefit costs.

Complete the combined withholding/employment registration form at the OneStop Online Business Registration portal to receive an Employer Registration Number, or apply separately at the UT Department of Workforce Services (DWS) portal. The number is issued immediately upon application completion in both cases.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.