Utah Notice of Meeting of LLC Members To Consider Dissolution of the Company

Description

How to fill out Notice Of Meeting Of LLC Members To Consider Dissolution Of The Company?

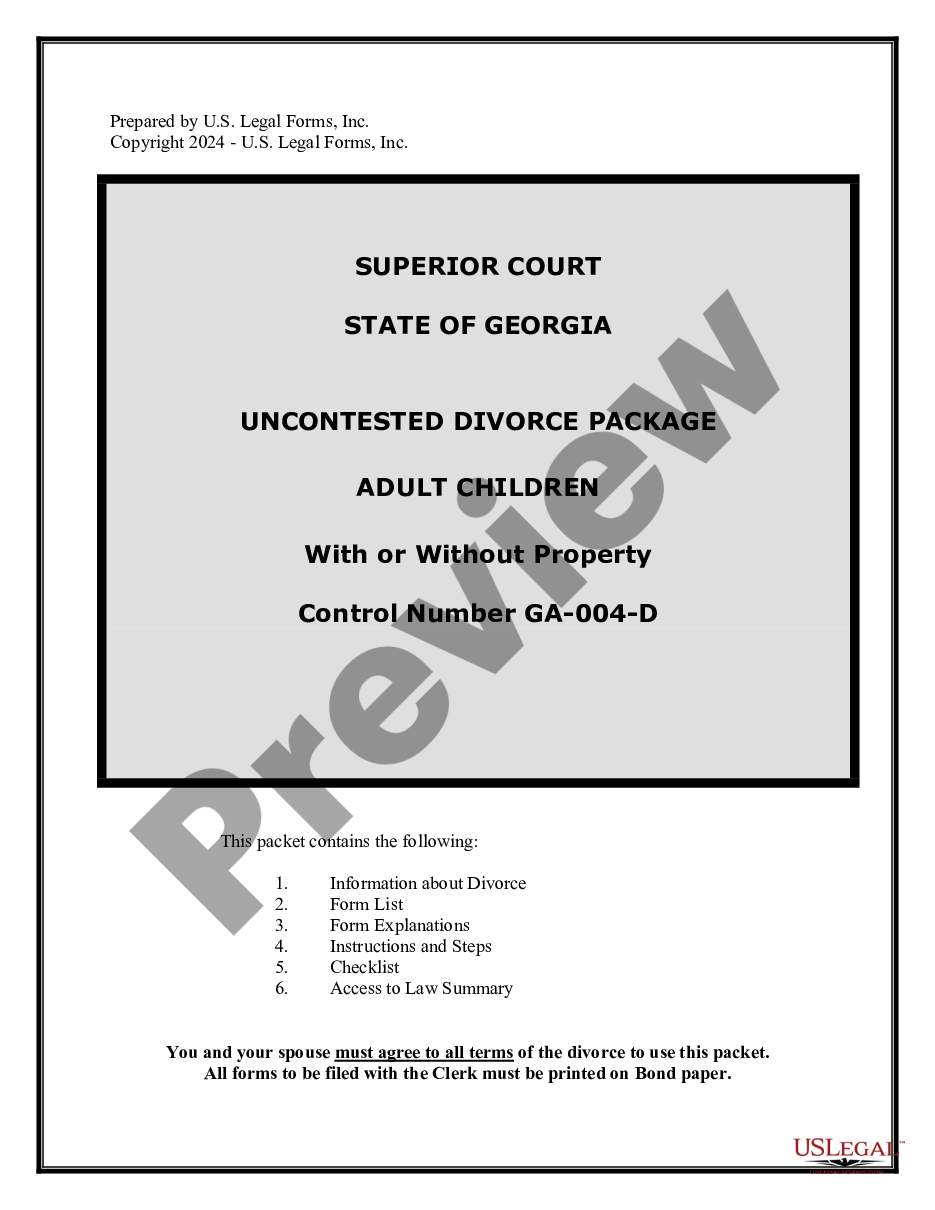

If you wish to full, acquire, or produce legitimate file web templates, use US Legal Forms, the most important variety of legitimate kinds, which can be found on the web. Utilize the site`s simple and convenient search to discover the paperwork you want. Different web templates for business and individual uses are sorted by types and says, or key phrases. Use US Legal Forms to discover the Utah Notice of Meeting of LLC Members To Consider Dissolution of the Company in a few mouse clicks.

In case you are presently a US Legal Forms buyer, log in in your account and then click the Obtain button to have the Utah Notice of Meeting of LLC Members To Consider Dissolution of the Company. You can also access kinds you formerly acquired from the My Forms tab of your account.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have selected the form for that correct town/country.

- Step 2. Use the Preview option to examine the form`s information. Never forget to read through the explanation.

- Step 3. In case you are unhappy with the develop, utilize the Look for industry near the top of the display to discover other variations of your legitimate develop design.

- Step 4. When you have found the form you want, go through the Acquire now button. Choose the rates plan you like and add your credentials to register for the account.

- Step 5. Method the transaction. You should use your charge card or PayPal account to complete the transaction.

- Step 6. Select the formatting of your legitimate develop and acquire it on your own system.

- Step 7. Complete, revise and produce or sign the Utah Notice of Meeting of LLC Members To Consider Dissolution of the Company.

Every single legitimate file design you purchase is your own forever. You may have acces to every develop you acquired with your acccount. Click the My Forms portion and pick a develop to produce or acquire yet again.

Be competitive and acquire, and produce the Utah Notice of Meeting of LLC Members To Consider Dissolution of the Company with US Legal Forms. There are thousands of skilled and express-certain kinds you can use for the business or individual requirements.

Form popularity

FAQ

'Administratively dissolved' in Utah signifies that your LLC has lost its legal status due to failure to meet state requirements, such as not filing annual reports or fees. This dissolution can occur without any active involvement from the members. To regain your LLC's standing, you'll need to address the issues that led to the administrative dissolution. Utilizing guidance like the Utah Notice of Meeting of LLC Members To Consider Dissolution of the Company is recommended to navigate this situation.

The only possible ways for a partnership or LLP to divorce a partner are through expulsion or de-listing. There is the option of resigning from the partnership, as described in the partnership agreement, and there is also the option of leaving voluntarily, as described in the partnership agreement.

How to Remove a Member from an LLCDetermine whether the LLC's governing documents set out formal procedures.Implement the formal procedure.Have the former member submit a written notice of withdrawal.File a petition for judicial dissolution.

Utah LLCs have to file a completed Articles of Amendment to Articles of Organization form with the Division of Corporations and Commercial Code. You can submit by fax, mail, or in person. If you choose to fax the document, you will need to attach a Fax Cover Letter. The filing of an amendment comes with a $37 fee.

Dissolution generally occurs when the business purpose of the LLC is completed or ceases to be economically viable. The members may also agree to dissolve the LLC if they are at an impasse regarding fundamental decisions concerning the LLC's business operations.

Reasons for Dissolution of partnershipAdmission of a new partner. Insolvency of an existing partner. Early retirement of a partner. Due to expiry of a partnership period after a certain time as mutually agreed upon by all partners.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence. What it does is change the purpose of its existence.

If a member requests removal, use the voting procedure if it is part of the LLC's terms. Write a resignation for the member. If the member does not wish to resign, consider offering a buyout. A court petition should be filed if the member refuses to resign from the business.

How to Dissolve a Limited Liability Company (LLC) in UtahHold a meeting of members and pass a resolution to dissolve the company.File the annual and other required reports with the state agency.Pay off all the outstanding business debts of the company.Pay all the outstanding taxes and fees owed by the company.More items...